|

Investor Relations

|

| Effective communication and regular engagement with investors are important to the Investor Relations function at Bursa Malaysia, in accordance with the expectations of the Malaysian Code of Corporate Governance. Being at the centre of changes in the global capital market environment, and undergoing a period of transformation ourselves, Bursa Malaysia is committed to engaging with the investment community to keep the latter fully informed of our business operations and activities under all conditions and environments. |

| |

OUR COMMITMENT

While Bursa Malaysia may be viewed as a regulator, we remain aware of our roles and responsibilities as a listed entity, which means that we must exercise good corporate governance even more diligently to ensure we set a good example to other issuers. Recognising that access to timely information is vital to our investors, we use an array of channels through which we disseminate current, material and price-sensitive information to enable our investors to make informed decisions. We continue to keep our investors and other stakeholders engaged regularly through a series of roadshows, meetings, briefings, and announcements, culminating in the Annual General Meeting.

As part of the continuing effort to stay in touch with our stakeholders, Bursa Malaysia has in the year under review engaged with more than 139 investors in Kuala Lumpur, Singapore, Hong Kong and the United States.There are 19 analysts from local and foreign houses providing coverage for Bursa Malaysia. As at 31 December 2011, Bursa Malaysia had 32% of its call ratings as Buy, Outperform or Overweight; 47% as Hold, Neutral or Market Perform; and 21% as Sell. Analysts have an average target price of RM7.00 on our stock.

IMPROVEMENTS AND RECOGNITION

We strive to be among the best in our class and constantly benchmark ourselves against our local, regional and global peers. One of the ways in which we do this is to participate in the IR Global Rankings, an annual ranking system for investor relations websites, online annual reports, corporate governance practices and financial disclosure procedures. In the year under review, we were pleased to have secured three awards for the Asia Pacific Region for Best Online Annual Report, a bronze award in the Investor Relations Website category, and another award for Outstanding Corporate Governance.

Maintaining a fast, efficient and content-rich website is crucial to successful communication today and we continued to make improvements to ours. In addition to the many enhancements to our Bursa Malaysia website this past year, we improved the content and features of our IR portal, striving always to provide a more user-friendly and interactive experience wherever possible. For our Annual General Meeting this year, we made available a webcast viewable on our IR Portal, in addition to webcasts for our half-year and full-year results briefings. Investors are encouraged to visit the Company's IR portal for easy access to the online Annual Report, Q&A library, and complete series of historical financial results data as well as copies of presentations given to shareholders and analysts.

BURSA’S PERFORMANCE ON THE CAPITAL MARKET

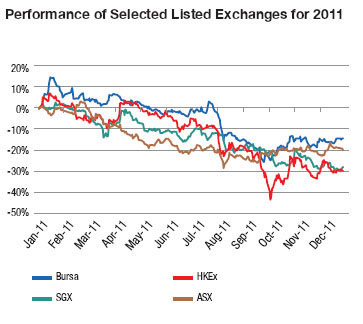

The Company’s share price as at 31 December 2011 was RM6.70, representing a 14% decline over the year. The beginning of 2011 witnessed an exuberant start with market average daily trading value (ADV) averaging RM2.6 billion in the month of January, where Bursa Malaysia’s share price hit a 52-week high of RM9.02 on 17 January 2011. The following months saw volumes taper and decline, reflecting global and regional sentiments.

On 5 August 2011, global markets suffered a shock as the United States experienced its first downgrade in history after Standard and Poor’s cut its credit rating from AAA to AA+. Global markets were sent into a tailspin and the share price of Bursa Malaysia and other regional exchanges was impacted negatively. Whilst ADV recovered to RM2.0 billion in August after the sell-off, weak sentiment over concerns of global recovery as well as European sovereign debt continued to plague the markets, resulting in weakened volumes in the month of September and Bursa Malaysia’s share price hit a 52-week low of RM5.76 on 26 September 2011.

In spite of the weak sentiment, Bursa Malaysia managed to post stronger results in October for its third quarter, due to higher ADV. This helped the share price to recover from its low of RM5.76 to reach RM6.70 at the end of the year.

As at 31 December 2011, Bursa Malaysia’s forward Price Earnings Ratio stood at 24.8x1, in comparison to Hong Kong Exchanges and Clearing Ltd (26.0x), Singapore Exchange (20.4x) and Australian Securities Exchange (14.4x).

DIVIDEND POLICY

Bursa Malaysia remains committed to giving good investment returns to our shareholders. Our policy is to pay out not less than 75% of PAT, subject to certain considerations, such as the level of available cash and cash equivalents, return on equity and retained earnings, and the projected level of capital expenditure and investment commitments.

Historically, Bursa Malaysia has enjoyed a dividend payout ratio of 90% or better.

Financial

Year |

Historical Dividend

Payment (sen/net) |

|

% of Dividend Payout

(excludes special dividend) |

| 2011 |

- Interim Dividend

- Final Dividend

|

13.0

13.0 |

95% |

| 2010 |

- Interim Dividend

- Final Dividend

|

9.5

10.5 |

94% |

| 2009 |

- Interim Dividend

- Final Dividend

|

8.8

9.0 |

93% |

| 2008 |

- Interim Dividend

- Final Dividend

|

12.2

5.9 |

91% |

| 2007 |

- Interim Dividend

- Final Dividend

- Special Dividend

|

23.4

18.5

20.4 |

91% |

Note:

Under Section 25 of the Capital Markets and Services Act 2007, no person can acquire 5% or more of the issued and paid-up share capital of the Company without first gaining approval from the Ministry of Finance.

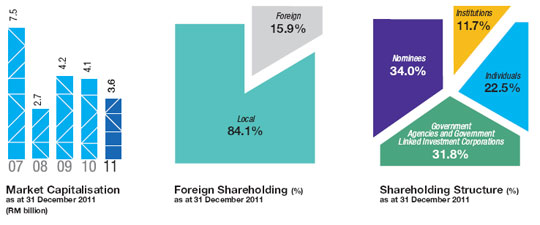

FOREIGN SHAREHOLDING AND MARKET CAPITALISATION

Our public shareholding of 64.93% provides a fair free float for Bursa Malaysia's shares and a good level of liquidity.

The number of depositors on the register of Bursa Malaysia was 28,273 at the end of 2011. Foreign shareholding as at 31 December 2011 stood at 15.9%, while market capitalisation declined from RM4.1 billion in 2010 to RM3.6 billion during the year.

KEY SHARE INFORMATION

| |

31 Dec 07 |

31 Dec 08 |

31 Dec 09 |

31 Dec 10 |

31 Dec 11 |

| Basic Earnings Per Share (sen) |

46.1 |

19.9 |

33.7 |

21.3 |

27.5 |

| Net Dividends Per Share (sen) |

62.3 |

18.1 |

17.8 |

20.0 |

26.0 |

| Net Assets Per Share (RM) |

1.49 |

1.39 |

1.59 |

1.60 |

1.62 |

| Share Price – High (RM) |

16.90 |

16.30 |

8.59 |

8.66 |

9.02 |

| Share Price – Low (RM) |

8.00 |

4.68 |

4.36 |

6.75 |

5.76 |

| Share Price As At 31 December (RM) |

14.30 |

5.15 |

7.99 |

7.80 |

6.70 |

| Price Earnings Ratio (times) |

31 |

26 |

24 |

37 |

24 |

| Company Market Capitalisation (RM billion) |

7.5 |

2.7 |

4.2 |

4.1 |

3.6 |

INVESTOR RELATIONS CONTACT

Bursa Malaysia adopts an open-door policy to its stakeholders. All investors are welcome to contact the IR team directly at ir@bursamalaysia.com or visit

the IR section of our website, where they can subscribe for regular updates on Bursa Malaysia via email alerts and also access the quarterly newsletter. |

| |

|