|

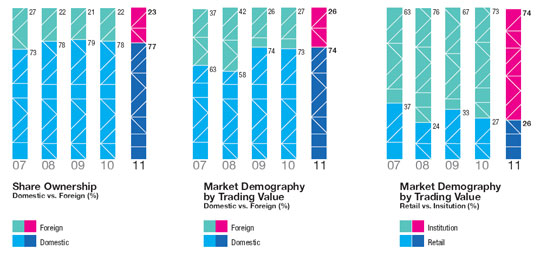

Market Highlights

|

| 31 DEC

2007 |

31 DEC

2008 |

31 DEC

2009 |

31 DEC

2010 |

31 DEC

2011 |

| Securities Market

| |

|

|

|

|

| KLCI/FBM KLCI

| 1,445.03 |

876.75 |

1,272.78 |

1,518.91 |

1,530.73 |

| Market Capitalisation (RM billion)

| 1,106 |

664 |

999 |

1275 |

1,285 |

| Velocity (%)

| 53 |

34 |

34 |

33 |

33 |

| Average Daily Volume – OMT & DBT (million shares)

| 1,548 |

631 |

1,000 |

1,021 |

1,344 |

| Average Daily Volume – OMT (million shares)

| 1,457 |

576 |

945 |

953 |

1,288 |

| Average Daily Value – OMT & DBT (RM million)

| 2,346 |

1,278 |

1,221 |

1,574 |

1,788 |

| Average Daily Value – OMT (RM million)

| 2,179 |

1,181 |

1,129 |

1,454 |

1,699 |

| Total Trading Volume – OMT & DBT (billion shares)

| 384 |

154 |

248 |

253 |

329 |

| Total Trading Value – OMT & DBT (RM billion)

| 582 |

313 |

303 |

390 |

438 |

| Total Funds Raised (RM billion)

| 10.6 |

6.1 |

27.8 |

33.0 |

15.0 |

| New Listings – IPOs (including REITs)

| 26 |

23 |

14 |

29 |

28 |

| New Listings – ETFs

| 1 |

1 |

0 |

2 |

0 |

| New Listings – Structured Warrants

| 154 |

81 |

124 |

204 |

363 |

| No. of ISS Instructions Cleared and Settled (’000)

| 444 |

389 |

326 |

369 |

493 |

| No. of PLCs

| 987 |

977 |

960 |

957 |

941 |

| No. of Listed REITs

| 13 |

13 |

12 |

14 |

15 |

| No. of Listed ETFs

| 2 |

3 |

3 |

5 |

5 |

| No. of Listed Structured Warrants

| 120 |

48 |

137 |

225 |

304 |

| No. of Rights & Bonus Issues

| 137 |

132 |

52 |

77 |

61 |

| No. of New CDS Accounts | 190,864 |

157,687 |

161,100 |

157,911 |

164,110 |

| Total CDS Accounts (million)

| 3.8 |

3.9 |

4.0 |

4.1 |

4.2 |

| No. of Trading Days

| 248 |

245 |

248 |

248 |

245 |

| No. of Participating Organisations of Bursa Malaysia Securities

| 34 |

34 |

34 |

35 |

35 |

| Derivatives Market

| |

|

|

|

|

| Open Interest

| 125,051 |

155,560 |

123,141 |

132,151 |

152,419 |

| No. of Contracts Traded:

| |

|

|

|

|

- Crude Palm Oil Futures (million)

| 2.8 |

3.0 |

4.0 |

4.1 |

5.9 |

|

| 3.2 |

2.9 |

2.0 |

2.0 |

2.5 |

|

| 239,314 |

195,193 |

126,690 |

95,477 |

92,775 |

| Daily Average No. of Contracts Traded

| 25,011 |

24,878 |

24,749 |

24,818 |

34,474 |

| Total Contracts Traded (million)

| 6.2 |

6.1 |

6.1 |

6.2 |

8.4 |

| No. of Trading Participants of Bursa Malaysia Derivatives

| 17 |

20 |

19 |

20 |

20 |

| Islamic Market

| |

|

|

|

|

| No. of Sukuk Listings on Bursa Malaysia Securities*

| - |

- |

12 |

19 |

19 |

| Value of Sukuk Listings (USD billion)

| - |

- |

17.6 |

27.7 |

28.5 |

| % of Shari’ah Compliant (by number of companies):

|

|

|

|

|

|

|

|

86 |

87 |

88 |

88 |

89 |

| % of Shari’ah Compliant

(by market capitalisation):

| |

|

|

|

|

|

| 64 |

64 |

64 |

63 |

63 |

|

| - |

49 |

56 |

51 |

40 |

|

| 26 |

30 |

35 |

22 |

18 |

| Bursa Suq Al-Sila’^:

| |

|

|

|

|

- Daily Average Value Commodity Traded (RM million)

| - |

- |

69.6 |

351.0 |

1,218.6 |

- Total Value Commodity Traded (RM million)

| - |

- |

6,472.3 |

90,219.0 |

298,551.0 |

- Total no. of Matched Contracts

| - |

- |

370 |

2,273 |

9,106 |

|

| - |

- |

93 |

257 |

245 |

- No. of Trading Participants

| - |

- |

16 |

33 |

55 |

|

| |

|

* Sukuk listing was introduced in December 2008

^ Bursa Suq Al-Sila' was launched in August 2009

|

Click on the image to view a larger version.

|

|

|

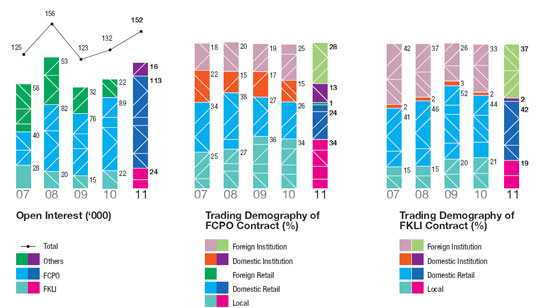

Derivatives Market

Click on the image to view a larger version.

|

|

|

|

|

|