|

CHIEF EXECUTIVE OFFICER'S MESSAGE

|

|

|

|

While Bursa Malaysia was placed in the global

spotlight with the unfolding of three of the

world's biggest IPOs, our real deliveries in 2012

ran far deeper, and were less discernible to the

outsider's eye. The year was exciting for the

main reason that we successfully implemented

numerous projects and initiatives that have

strengthened Bursa Malaysia at a fundamental

level. Yet, like all far-reaching changes, these

have gestation periods and their full effects will

materialise only in the years to come. So, just

as 2012 was a year in which we made a mark

internationally, internally we feel confident of

being in a better shape to capitalise on future

opportunities.

Dato' Tajuddin Bin Atan Chief Executive Officer |

| |

|

| |

"The fact is, the industry is changing in unprecedented ways and has now

entered a 'New Norm'. Trading is becoming increasingly borderless as

markets liberalise, while an increasing number of companies, Malaysian

organisations included, are going multinational. To establish a strong

presence in this highly competitive environment, we are revitalising our

systems and processes to create a more facilitative exchange, and are

bringing in more talent with the right skill sets to tap into current and

future opportunities. Meanwhile, we continue to engage actively with our

various stakeholders to ensure a fair and orderly market.

Despite a challenging global economy, ASEAN markets in general were

robust, boosted by strong internal demand. As the three mega IPOs

indicate, our top PLCs were able to shine in a domestic environment that

stood to benefit from initiatives such as the Government Transformation

Programme (GTP) and Economic Transformation Programme (ETP). Given

their performance, our market capitalisation grew 14% to reach RM1.47

trillion, a new record. On the derivatives front, too, we achieved a new

record in terms of open interest for all products.

In short, I am pleased with the progress we made during the year. Not

only have we put in place the building blocks to leverage on growth of the

ASEAN marketplace, but we have also produced commendable financial

results, which I have great pleasure in sharing with you." |

| |

FINANCIAL PERFORMANCE

Bursa Malaysia pulled in a positive performance for the financial year

ended 31 December 2012, registering profit after tax and minority

interest (PATAMI) of RM151.5 million. This 4% increase from our PATAMI

of RM146.2 million in 2011 was due principally to improvements in our

stable revenue and derivatives trading revenue.

Stable revenue increased by 13% to RM127.4 million from RM112.8

million in 2011 due to a combination of factors. The listing of the three

mega IPOs in 2012 contributed significantly to the increase in the

revenue from depository services. The substantial growth in the number

of structured warrants listed to 551 from 363 in 2011 resulted in higher

listing fees. Additionally, the higher stable revenue was also boosted by

the increase in sales of information.

As we had expected, our derivatives market continued along its

expansionary journey following migration onto the Globex trading

platform, and was even described by the editor of Futures and Options

World (FOW) as "one of the most exciting derivative markets globally".

This was substantiated by a 9% increase in revenue from RM51.2 million

to RM56.0 million, as the volume of derivatives traded grew 14% from

8.4 million contracts to 9.6 million contracts.

While bolstering our revenue by growing our stable income and derivatives

business, we have also ensured fiscal responsibility. This is evident in the

figures: over the last four years, we achieved 30% revenue growth while

expenses grew by only 15%.

During a year in which global trading value was down 22%, trading on

Bursa Malaysia dipped only by 7%, translated to a drop in daily trading

value in securities from RM1.79 billion to RM1.67 billion. As a result,

our trading revenue decreased from RM193.0 million to RM178.3 million.

More positively, the successful mega IPOs of Felda Global Ventures

Holdings Berhad, IHH Healthcare Berhad and Astro Malaysia Holdings

Berhad contributed to an expansion of our market capitalisation to

RM1.47 trillion from RM1.29 trillion.

Bursa Malaysia also reaffirmed our prominence as the world's leading

sukuk listing destination with an 18% increase in the value of programmes

listed from USD28.5 billion in 2011 to USD33.7 billion in 2012. At the

same time, Bursa Suq Al-Sila' (BSAS) recorded an impressive 89%

increase in its average daily trading value to RM2.3 billion from RM1.2

billion, following growing acceptance among global market participants.

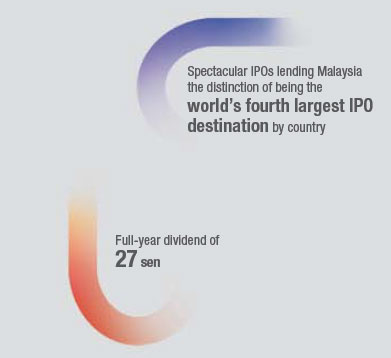

Given our financial performance, we are proposing a final dividend of

13.5 sen which, combined with the 13.5 sen interim dividend paid in

August, totals to a full-year dividend of 27 sen. This represents a payout

of 95% of our net profit, and means that we are once again looking to

reward our shareholders beyond our dividend promise of 75% minimum

payout.

MARKET HIGHLIGHT

A definite highlight of the year was hosting the three earlier-mentioned

mega IPOs, which earned Bursa Malaysia a spot on the international

capital market space. These listings were indicative of investor confidence

in our top-performing PLCs, which was further reflected in the FBM KLCI

hitting a number of new highs from July onwards and closing the year

at 1,688.95 points, a significant 158.22 points higher than the previous

year-end's 1,530.73 points.

Another highlight was being able to step up our linkages within the

regional market when, together with the Singapore Exchange (SGX) and,

later, The Stock Exchange of Thailand (SET), we connected our trading

platforms via the ASEAN Trading Link. Our grouping brings together

2,250 listed companies with a market capitalisation of USD1.6 trillion,

representing approximately 70% of the total market capitalisation of

ASEAN.

Ahead of the launch of the ASEAN Trading Link, IHH Healthcare Berhad

opted to enhance its profiling by dual listing on the Main Boards of Bursa

Malaysia and SGX on 25 July 2012. The listing is fully fungible, allowing

shareholders to transfer their shares between both Exchanges via a

standard cross transfer mechanism. This marked an exciting milestone

for us as it was the first simultaneous dual listing to be conducted on our

Exchange.

It was also a memorable year for our derivatives market, which truly rode

on a high. Other than its impressive open interest record, it continued

to attract more foreign participants via the Globex trading platform as

well as bring us greater recognition. During the financial year, Futures

& Options World presented our derivatives segment the Best Technology

Innovation by an Asian Exchange award while naming it a runner-up for

the Asian Derivatives Exchange of the Year. The publication cited easy

accessibility and global connectivity of the Malaysian derivatives market

as key factors that led to these wins.

Our Islamic markets continued to hold their own, further reinforcing Bursa

Malaysia as an integrated exchange offering both conventional and niche

products. Thanks to the continuous efforts of our team, we retained our

leadership position as the premier sukuk listing destination for the fourth

consecutive year, with 20 programmes undertaken by 17 issuers.

CREATING A VIBRANT MARKETPLACE

We are fully cognisant of the challenges of the brave new globalised and

digitalised world, in which traditional protective barriers are no longer

recognised, and only the fittest can survive. We are therefore building

on our foundations to enter this uncompromising realm. As we boost

our ecosystem and create a more dynamic exchange, we are better

positioned to catalyse further growth of corporate Malaysia.

Our vision is to serve not just as an effective Malaysian bourse, but as

the preferred ASEAN multinational marketplace. To achieve this vision,

we recognise the need to embody all the virtues of a high-performance

organisation. In 2012, therefore, we developed four Strategic Intents to

build on our inherent strengths and take us forward. These are:

- to create a more facilitative trading environment;

- to facilitate more tradable alternatives;

- to reshape the market structure and framework; and

- to become a regional marketplace with global access.

Towards creating a facilitative trading environment, we have invested in

various technologies to improve the exchange ecosystem in a holistic

manner, initiating domino-effect change from the front end to the back

room and vice versa, thus enhancing the entire value chain of trading,

clearing, settlement and depository.

In the securities market, we introduced new order and validity types

which enable participants to execute a greater variety of trading and

risk management strategies. When keying in orders now, for example, brokers can use Market to Limit order, Fill and Kill, and minimum quantity. Other innovations included introducing CDS Straight Through Processing

and extending our eCash payments framework. To further expand our

accessibility and reach, we have also revamped our website to be more

user-friendly.

The derivatives space was enhanced by the implementation of a new

clearing system which has greater capacity for trade volume and for

handling more complex products. This system also incorporates better

risk management capabilities to protect investors.

In terms of new products, we further entrenched our leadership position in

the palm oil market with the launch of Options on Crude Palm Oil futures

(OCPO), the first commodity options in Asia. The derivatives market was

also enriched by the re-launch of options on FKLI (OKLI). Meanwhile, BSAS

saw the addition of RBD Palm Olein as one of its commodity offerings.

As our marketplace evolves with the addition of more products of greater

complexity, we acknowledge the need for a more sophisticated system

to protect our market integrity and our investors. Hence on 31 December

2012, we introduced a new Surveillance System which helps to improve

the quality of both our securities and derivatives markets.

Our efforts to reshape the market structure and framework are geared

towards removing barriers in order to create greater activity and

liquidity. Towards this end, we introduced referral agent activities and

a dual licencing fast-track programme; eased the entry requirements

for derivatives trading; and are now allowing futures brokers to set up

branches and kiosks to expand their reach.

To profile our PLCs and elevate the Malaysian capital market

internationally, we have been conducting the successful Invest Malaysia

programme, in Kuala Lumpur and Hong Kong, every year. At the 2012

events, we positioned Bursa Malaysia as a key driver of the ASEAN

market. ASEAN, with a population of 600 million, is one of the world's

most vibrant economic regions, with projected GDP growth of 5.5%

through to 2017 according to the Organisation for Economic Co-operation

and Development (OECD). We intend to leverage on this growth to create

greater visibility on the international front.

We have already made headway in this regard in both the derivatives and

Islamic markets, where we are gaining recognition for offering quality

products and services.

Derivatives trade by foreign institutions increased from 31% in 2011 to

36%, and we are hopeful of further boosting this figure upon clearance

from the Commodity Futures Trading Commission (CFTC) for US traders to

have direct market access to the Globex trading platform. In our Islamic

markets, no less than a quarter of the trading participants are foreign,

and trade by foreign participants on BSAS increased from 21% in 2011

to 30%. Our credentials as a sukuk listing destination, meanwhile, are

second to none as we uphold our status as the premier sukuk listing

destination for the fourth consecutive year.

PROTECTING THE INTEGRITY OF OUR MARKETPLACE

As a regulator, we serve to ensure a high level of integrity in the

marketplace in order to protect our investors. In carrying out this function,

we constantly update our regulatory framework so that it remains

relevant to support developments taking place regionally.

In advance of launching the Exchange Traded Bonds and Sukuk (ETBS) in

February 2013, we changed our Listing Requirements to permit the listing

of bonds and sukuk by a larger base of issuers that includes non-listed

companies. We further amended the Listing Requirements to support

the Securities Commission's Corporate Governance Blueprint 2011 and

Malaysian Code on Corporate Governance 2012 by strengthening board

quality and enhancing transparency in listed companies' governance

practices. To accommodate the new products launched on our derivatives

market, we also made relevant changes to the Bursa Derivatives Rules.

PROSPECTS FOR 2013 AND BEYOND

The overall outlook for Malaysia is anticipated to be marginally better in

2013 than it was in 2012 given the country's economic prospects and

business fundamentals, despite on-going global uncertainties. Malaysia's

strong domestic demand will continue to drive growth, supported by

catalytic initiatives under the GTP and ETP.

These will cushion the global impact on our securities market, which

we will continue to build by further enhancing our infrastructure and

introducing new asset classes. The year has already begun on a high

note with the listing on 8 February of our first ETBS, issued by DanaInfra

Nasional Berhad. With the Guidelines issued on Business Trust late 2012,

we can look forward to additional options for fund raising exercises and

investments.

We also aim to expand our retail reach via the Internet, and build a strong

cadre of investors by targeting those who have just entered the workforce

as well as the current population who are not active investors. The idea

is to reach out to potential investors and keep them informed of the wide

range of investment opportunities, products and services that Bursa

Malaysia has to offer.

While our derivatives market has been growing from strength to strength

over the last few years, we will continue to develop it by further widening

our distribution channels and increasing the breadth and depth of our

product offerings. As an example, we plan to leverage on our entrenched

position in palm oil trading by creating new tradable options such as

futures in refined palm oil.

A major challenge in the Islamic markets is acceptance of our products

internationally. To overcome this, we intensify our product innovations

and offerings to meet the international Shari'ah standards through

continuous consultation and engagement with industry players. This is

also supported by more focused marketing and educational efforts.

We recognise that our onward journey will be challenging yet, having

implemented several mission-critical projects in 2012, we are confident

of our potential once the market picks up. In 2012, we made a good start

towards becoming an exchange to be reckoned with, and are determined

to continue to push the envelope to serve not just Malaysian issuers and

investors, but also those from the region and beyond so as to establish

ourselves as ASEAN's leading marketplace. |

| |

Dato’ Tajuddin bin Atan

Chief Executive Officer |

|

|