|

CORPORATE GOVERNANCE STATEMENT

|

The Board of Directors of Bursa Malaysia presents

this statement to provide an insight into the

Corporate Governance (CG) practices of the Company

under the leadership of the Board. In building a

sustainable business, and discharging its regulatory

role, the Board is mindful of its accountabilities to

the shareholders and various stakeholders. This

statement demonstrates the Board's commitment

in cultivating a responsible organisation by instilling

corporate conscience through excellence in CG

standards at all times. |

| |

- Establish clear roles and responsibilities

- Clear functions of the Board and Management

The Board is responsible for oversight and overall management

of the Company. To ensure the effective discharge of its

function and responsibilities, the Board established a

Governance Model for the Group delegating specific powers

of the Board to the relevant Board Committees 1 and the CEO.

The Governance Model is supported by the Authority Limits

Document (ALD), which clearly sets out relevant matters

reserved for the Board's approval, as well as those which the

Board may delegate to the Board Committees, the CEO and

Management. The Governance Model and ALD are reviewed

and amended as and when required, to ensure an optimum

structure for efficient and effective decision making in the

organisation.

1 The Board Committees comprise three Governance Committees and four Regulatory Committees as set out in the Governance Model of Bursa Malaysia of this Annual Report, which is also available at www.bursamalaysia.com, About Us-Corporate Governance section.

Key matters reserved for the Board's approval include the

annual business plan and budget, dividend policy, business

continuity plan, issuance of new securities, business

restructuring, expenditure above a certain limit, disposals

of significant fixed assets and the acquisition or disposal of

companies within the Group.

The Board Committees are entrusted with specific

responsibilities to oversee the Group's affairs, with authority to

act on behalf of the Board in accordance with their respective

Terms of Reference 2 (TOR). At each Board meeting, minutes of

Board Committee meetings are presented to keep the Board

informed. The Chairmen of the relevant Board Committees

also report to the Board on key issues deliberated by the

Board Committees at their respective meetings.

2 The TOR of each Board Committee together with the names of members of the Board Committees for the term of appointment from 12 May 2012 to 11 May 2013 are available at www.bursamalaysia.com, About Us-Corporate Governance section.

- Clear roles and responsibilities

The Board has discharged its responsibilities in the best

interests of the Company in pursuit of an integrated regulatory

and commercial objective. The following are among the key

responsibilities of the Board:

- Reviewing and adopting the Company's strategic plans

The Board plays an active role in the development

of the Company's strategy. It has in place a strategy

planning process, whereby the Management presents

to the Board its recommended strategy annually,

together with its proposed business and regulatory

plans for the ensuing year at a dedicated session,

for the Board's review and approval. At this session,

the Board deliberates both the Management's and its

own perspectives, and challenges the Management's

views and assumptions, to ensure the best outcome.

In conjunction with this, the Board also reviews and

approves the annual budget for the ensuing year, and

sets the Key Performance Indicators (KPIs) under the

Corporate Balanced Scorecard (CBS), ensuring that

the targets correspond to the Company's strategy

and business plan, reflect competitive industry trends

and internal capabilities as well as provide sufficient

stretch for the Management.

For 2012, the strategic planning process began at

an off-site Board meeting held in June 2011 where

the Management presented its proposals for the

Board's review. The Board subsequently approved the

Company's Strategy and 2012 Business and Regulatory

Plans (BRP).

A mid-year review of the 2012 BRP as well as the

Budget was conducted by the Board in July 2012, at

which the targets set by the Board were compared

against the actual performance year-to-date. The

Board also discussed strategy implementation

processes and requirements together with key

transformational initiatives undertaken in the first

half of the year to achieve the targets set out in the

2012 BRP. In this exercise, the Board took cognisance

of internal and external factors which had supported

various achievements as well as challenges facing

Management. The Board actively engaged with the

Management in monitoring the progress of initiatives

identified in the 2012 BRP and, where required, in

identifying alternative measures to be taken to ensure the successful realisation of the strategies.

As part of a Business Process Improvement initiative,

PricewaterhouseCoopers Advisory Services Sdn

Bhd was engaged to review Bursa Malaysia's 2012

CBS framework and enhance the effectiveness and

efficiency of internal processes, ensuring that they

were appropriately institutionalised. The review also

supported Bursa Malaysia's goals of becoming a high-performance

organisation. Findings from the review

and subsequent recommendations were tabled to the

Nomination and Remuneration Committee (NRC) and

the Board. The Board approved the revisions to the

2012 CBS and KPIs, which saw an increased focus

on improving internal processes and human capital

development.

In November 2012, the Management presented to

the Board the proposed 2013 BRP and Budget. The

Board reviewed the sustainability, effectiveness and

implementation of the strategic plans for 2012, and

provided its input to the Management. The 2013 BRP

and Budget for the Group was approved by the Board,

taking into consideration the need to continuously

invest, build and grow the three main markets of Bursa

Malaysia in line with the approved plans.

- Overseeing the conduct of the Company's business

The CEO3 is responsible for the day-to-day

management of the business and operations of the

Group in respect of both its regulatory and commercial

functions. He is supported by the Management

Committee4 and other committees established under

the Group's Management Governance Framework5.

The Management's performance, under the leadership

of the CEO, is assessed by the Board through a status

report which is tabled to the Board and which includes

a comprehensive summary of the Group's operating

drivers and its financial performance during each

reporting period. The Board is also kept informed of key

strategic initiatives and significant operational issues

and the Group's performance, based on the approved

KPIs in the CBS.

3 The CEO's job description was last reviewed and approved by the Board in September 2010.

4 The Management Committee members are as set out in the Management Committee/Senior Management of this Annual Report.

5 The Management Governance Framework, which takes effect from 25 May 2011, comprises two committees for governance function, and two committees for business operations functions. It is available at www.bursamalaysia.com, About Us-Corporate Governance section.

To ensure independence of the regulatory function,

the Chief Regulatory Officer (CRO) provides the Board

with a separate status report on a regular basis, to

inform the Board of actions taken by the Regulation

function and provide updates on regulatory initiatives.

The Management also presents to the Board in the first quarter of every year a report on Bursa Malaysia's

compliance with its regulatory duties and obligations

under the Capital Markets and Services Act 2007

(CMSA) during the preceding year. In March 2012, the

Board reviewed the Annual Regulatory Report 2011

prior to submission to the Securities Commission (SC)

in compliance with Section 16 of the CMSA.

In February 2012, the Board reviewed the results

of the 2011 employee engagement survey (EES) to

assess the level of employee satisfaction. The survey,

conducted by an external firm, aimed to ensure

continuous improvement in the operating environment

by maintaining areas of strength and improving areas

of opportunity for its internal stakeholders. Post EES,

intervention initiatives were taken to address those

areas below benchmark norms.

- Identifying principal risks and ensuring the

implementation of appropriate systems to manage

them

Through the Risk Management Committee (RMC),

the Board oversees the Enterprise Risk Management

(ERM) framework of the Group. The RMC advises

the Audit Committee (AC) and the Board on areas of

high risk faced by the Group and the adequacy of

compliance and control throughout the organisation.

The RMC reviews the risk management policies

formulated by Management and makes relevant

recommendations to the Board for approval. Details on

the RMC and the Company's ERM framework are set

out in this Corporate Governance Statement and Risk

Management Statement of this Annual Report.

-

Succession planning

The Board has entrusted the NRC with the responsibility

to review candidates for key management positions,

to determine compensation packages for these

appointments, and to formulate nomination, selection,

compensation and succession policies for the Group.

The Board is satisfied that the NRC, in its current form,

effectively and efficiently discharges its functions in

respect of nomination and remuneration matters listed

separately in its TOR for the purpose of clarity. As

such, there is no need to separate the nomination and

remuneration functions into discrete nomination and

remuneration committees.

In discharging its responsibility, the NRC reviews the

Group's human resources plan including the succession

management framework and activities, human

resources initiatives and the annual manpower budget.

In November 2012, the NRC reviewed Bursa Malaysia's

comprehensive succession management framework

which was subsequently approved by the Board in the

same month. The succession management framework

serves to ensure the smooth transition of key personnel

into critical positions and the development of human

capital within Bursa Malaysia.

The NRC undertakes yearly evaluation of the

performance of key management personnel whose

remunerations are directly linked to performance,

based on their scorecards. For this purpose, the 2011

CBS and KPI results of the CEO and relevant senior

management were reviewed by the NRC in February

2012. The assessment by the NRC however excludes

the Chief Internal Auditor (CIA). The CIA reports to the

AC, which evaluates and reviews his performance. The

CEO's compensation package is reviewed annually by

the NRC, after which it is put to the Board for decision.

- Overseeing the development and implementation of a

communication policy for the Company

Bursa Malaysia believes in building investor confidence

through good CG practices. The Company carried out

its Investor Relations (IR) activities in accordance with

its stated IR Policy, which is available on its website.

A report on IR activities is provided in the For the

Shareholders section of this Annual Report.

- Reviewing the adequacy and integrity of management

information and internal control system of the Company

The Board is ultimately responsible for the adequacy

and integrity of the Company's internal control system.

Details pertaining to the Company's internal control

system and the review of its effectiveness are set out in

the Internal Control Statement and Risk Management

Statement respectively of this Annual Report.

- Formalised ethical standards through Code of Ethics

The Company's Codes of Ethics for Directors and employees

continue to govern the standards of ethics and good conduct

expected of Directors and employees, respectively. The Code

of Ethics for Directors includes principles relating to theirduties, conflict of interest (COI) and dealings in securities.

For employees, the Code of Ethics covers all aspects of the

Company's business operations, such as confidentiality of

information, dealings in securities, COI, gifts, gratuities or

bribes, dishonest conduct and sexual harassment.

In addition, the Company's Whistleblower Policy and

Procedures (WPP) seek to foster an environment where

integrity and ethical behaviour are maintained and any

illegal or improper action and/or wrongdoing in the Company

may be exposed. The Board has overall responsibility to

oversee the implementation of the WPP for Directors, and

all whistle-blowing reports are addressed to the Non-

Executive Chairman of the Board or Senior Independent Non-

Executive Director (SID) of Bursa Malaysia 6. The AC has the

responsibility to oversee the implementation of the WPP for

the Group's employees. Duties in relation to the day-to-day

administration of the WPP are delegated to the CIA and/or

designated officer(s) of Group Internal Audit (GIA). The SID is

also responsible for receiving report(s) made by employees

or external parties for the purpose of whistle-blowing in the

form as prescribed under the WPP 7.

6 The contact details are set out under Corporate Information of this Annual Report. It is available at www.bursamalaysia.com, About Us-Other Corporate Information section.

7 The whistle-blowing report form is available at www.bursamalaysia.com, About Us-Corporate Governance section.

Bursa Malaysia on 17 December 2012, signed the Corporate

Integrity Pledge to create an effective system to increase

integrity through good governance, including anti-corruption

measures. This demonstrates the Board's commitment to

upholding anti-corruption principles in the conduct of the

Company's business, and to promoting integrity, transparency

and good governance in all aspects of operations.

- Strategies promoting sustainability

The Board promotes good CG in the application of sustainability

practices throughout Bursa Malaysia, the benefits of which

are believed to translate into better corporate performance.

A detailed report on sustainability activities, demonstrating

Bursa Malaysia's commitment to the global environmental,

social, governance and sustainability agenda, appears in the

Corporate Sustainability Statement of this Annual Report.

- Access to information and advice

The Directors have individual and independent access to

the advice and dedicated support services of the Company

Secretaries in ensuring the effective functioning of the Board.

The Directors may seek advice from the Management on

issues under their respective purview. The Directors may

also interact directly with the Management, or request further

explanation, information or updates on any aspect of the

Company's operations or business concerns from them.

In addition, the Board may seek independent professional

advice at the Company's expense on specific issues to

enable it to discharge its duties in relation to matters being

deliberated. Individual Directors may also obtain independent

professional or other advice in furtherance of their duties,

subject to the approval of the Chairman or the Board,

depending on the quantum of the fees involved.

- Qualified and competent Company Secretaries

The Board is satisfied with the performance and support

rendered by the Company Secretaries to the Board in the

discharge of its functions. The Company Secretaries play

an advisory role to the Board in relation to the Company's

constitution, Board's policies and procedures and compliance

with the relevant regulatory requirements, codes or guidance

and legislations. The Company Secretaries support the

Board in managing the Group Governance Model, ensuring

it is effective and relevant. The Company Secretaries also

ensure that deliberations at the Board and Board Committee

meetings are well captured and minuted, and subsequently

communicated to the relevant management for necessary

action. The Board is updated by the Company Secretaries

on the follow-up or implementation of its decisions/

recommendations by the Management till their closure.

The Company Secretaries keep abreast of the evolving capital

market environment, regulatory changes and developments

in CG through continuous training.

- Board Charter

The Board's Charter is embedded in the Governance

Model document of the Company which is available on the

corporate website. The document clearly sets out the roles

and responsibilities of the Board and Board Committees

and the processes and procedures for convening their

meetings. It serves as a reference and primary induction

literature providing prospective and existing Board members

and Management insight into the fiduciary and leadership

functions of the Directors of Bursa Malaysia.

The Board reviews its charter regularly, to keep it up to date

with changes in regulations and best practices and ensure its

effectiveness and relevance to the Board's objectives.

- Strengthen composition

- Nominating Committee

The TOR of the NRC provides that it shall comprise five Non-

Executive Directors (NEDs) of whom two are Public Interest

Directors (PIDs) and three are Independent NEDs. The NRC is

chaired by a PID.

The TOR of the NRC further provides that it shall have specific

responsibilities in relation to nomination and remuneration

matters. With respect to nomination matters, the specific

responsibilities of the NRC shall include:

-

Formulating the nomination, selection and succession

policies for members of the Board

- Making recommendations to the Board on new

candidates for appointment and the re-appointment/

re-election of Directors to the Board

- Reviewing the required mix of skills, experience and

other qualities of the Board annually

- Reviewing and recommending to the Board the

appointment of members of Board Committees

established by the Board annually

- Establishing a set of quantitative and qualitative

performance criteria to evaluate the performance

of each member of the Board, and reviewing the

performance of the members of the Board

- Ensuring that orientation and education programmes

are provided for new members of the Board, and

reviewing the Directors' continuing education

programmes

- Develop, maintain and review criteria for recruitment

and annual assessment of Directors

- Recruitment or Appointment of Directors

The policies and procedures for recruitment or

appointment (including re-election/re-appointment) of

Directors are detailed in the Protocol for Appointment of

Directors and Members of Board Committees of Bursa

Malaysia (the Protocol), which has been approved by the

Board. The NRC is guided in the nomination, selection

and appointment process by the Protocol, which also

sets out the requirements under the relevant laws and regulations. The Board has established a pool of

potential Directors of Bursa Malaysia for its reference

when considering new appointments, in line with the

sourcing process and criteria for candidates as set out

in the Protocol. The pool is refreshed from time to time,

to ensure the list of candidates available for the NRC/

Board's consideration remains relevant and offers the

talents/skills required.

In 2012, the Board composition was reviewed in

conjunction with implementation of the Board's nine-year

policy for Independent NEDs to ensure continued

effective functioning of the Board as well as to enable

its progressive refreshing. For this purpose, the NRC

reviewed the Board composition with the view to

identify and close any possible gap in the Board's

functional knowledge and competencies by bringing

in new experience, knowledge and expertise on the

Board, to meet the current and future needs of the

Company.

The NRC's review of the criteria for the appointment

process focused largely on creating a good mix of

skills, experience and strengths in areas relevant to

enable the Board to discharge its responsibilities in

an effective and competent manner. Other factors

considered include the candidates' ability to commit

sufficient time to Bursa Malaysia, their character

and level of independence (in line with the Main LR),

integrity and professionalism. The NRC also focused on

having a balanced mix of age and diversity in gender,

race, culture and nationality, to facilitate optimal

decision-making by harnessing different insights and

perspectives. Based on the review, the NRC submitted

to the Board its recommendation of suitable candidates

for appointment as Directors of the Company, to

replace those who will be retiring at the 36th Annual

General Meeting (AGM) in 2013. In November 2012, the

Board approved the NRC's recommendation.

Pursuant to Article 69 of the Articles of Association (AA)

of the Company, Directors (other than PIDs) are to be

elected at every AGM of the Company, when one-third

of the Directors longest in office should retire or, if

eligible, may offer themselves for re-election. The NRC

is responsible for recommending to the Board those

Directors who are eligible to stand for re-election/reappointment.

This recommendation is based on formal

reviews of the performance of the Directors, taking into

account the results of their latest Board Effectiveness Evaluation (BEE), contribution to the Board through

their skills, experience, strengths and qualities, level

of independence and ability to act in the best interest

of the Company in decision-making. The NRC also

takes into account the gradual implementation of the

nine-year policy for Independent NEDs based on the

schedule of retirement by rotation.

In 2012, the Board approved the recommendation of

the NRC for four Directors to retire at the 36th AGM

in accordance with Article 69 of the AA. Three of the

retiring Directors, namely Dato' Dr. Thillainathan a/l

Ramasamy, Encik Cheah Tek Kuang and Encik Izham

bin Yusoff, will not seek re-election in view of the nine-year

policy. The fourth Director, Dato' Wong Puan Wah

@ Wong Sulong, has expressed his intention not to

seek re-election. The Board also approved the NRC's

recommendation to support the re-appointment of Tun

Mohamed Dzaiddin bin Haji Abdullah and Tan Sri Datuk

Dr. Abdul Samad bin Haji Alias, both of whom are over

the age of 70 years and should retire at the 36th AGM,

in accordance with Section 129(2) of the Companies

Act 1965 (CA).

Section 10(1)(b) of the CMSA requires Bursa Malaysia,

as an exchange holding company, to obtain the SC's

concurrence on any proposed appointment/reappointment

of Directors (other than PIDs). Hence,

formal submissions were made in the last quarter of

2012, to seek the SC's concurrence on Bursa Malaysia's

proposed candidates and the re-appointment of

Director prior to seeking the shareholders' approval

at the 36th AGM. The SC subsequently carried out

a vetting exercise on each candidate and Director

seeking re-appointment to determine if he or she is a

person of integrity and is fit and proper to be a Director

of an exchange holding company.

The NRC also reviews the composition of the Board

Committees annually in accordance with the procedures

as set out in the Protocol. In determining candidates

for appointment to the Board Committees, various

factors are considered, including time commitment

of the Board Committee members in discharging their

roles and responsibilities through attendance at their

respective meetings. The NRC also refers to the results

of the Board Committee Effectiveness Assessment and

Board Committee members' Self and Peer Assessment

(SPA) under the BEE, to ensure the requirements of the

committees are addressed.

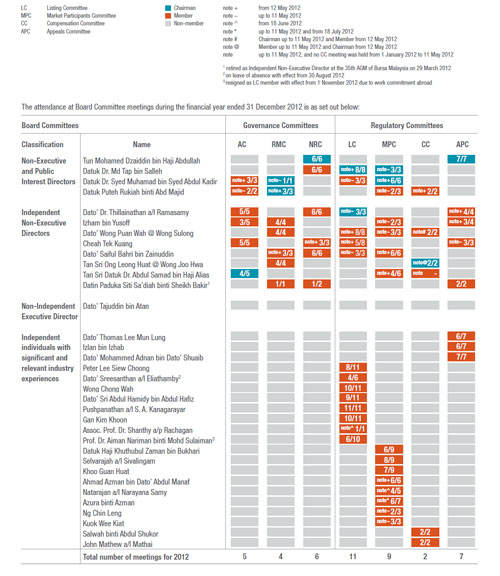

Click on the image to view a larger version.

-

Annual assessment

The NRC carries out the BEE exercise annually. For this

purpose, an external consultant is engaged every three

years to assist the NRC, the last time being in 2011. In

2012, the Company Secretaries facilitated the NRC in

carrying out the BEE exercise. The BEE is conducted

via questionnaires, comprising a Board and Board

Committee Effectiveness Assessment and a Directors'

and Board Committee members' SPA. The NRC

reviews the outcome of the BEE and recommends to

the Board for approval areas identified for continuous

improvement.

The Board's effectiveness is assessed in the areas

of composition, administration, accountability and

responsibility, conduct and the performance of

the Chairman and CEO. The Board, through the

Governance and Regulatory Committee Effectiveness

Assessment, examines the respective Governance

and Regulatory Committees, including their respective

Chairmen, to ascertain whether their functions and

duties are effectively discharged in accordance with

their respective TOR. The Director's SPA is intended

to ascertain the mix of skills, experience and other

relevant qualities the Directors bring to the Board,

and takes into account individual Directors' abilities

to exercise independent judgement at all times

and to contribute to the effective functioning of the

Board. The SPA process also examines the ability of

each Director or Committee member to give material

input at meetings and to demonstrate a high level of

professionalism and integrity in the decision-making

process. Results of the assessment form the basis of

the NRC's recommendation to the Board for the re-election

of Directors at the next AGM.

In November 2012, each Director and Board Committee

member was provided with individual results together

with a peer average rating on each area of assessment

for personal information and further development.

- Gender diversity policy

The Board has approved the establishment of a gender

diversity policy, and has set the target to have at

least two female Directors by 2013 and three female

Directors by 2016. The Company will endeavour

to achieve these targets through the progressive

refreshing of the Board as it implements the nine-year

policy for Independent NEDs.

- Appointment of SID

Prior to expiry of the term of appointment of the

second SID in December 2012, the NRC undertook

the nomination process in recommending a new SID

for 2013. In November 2012, the Board approved

the NRC's recommendation to appoint Tan Sri Ong

Leong Huat, who will carry out the responsibilities in

accordance with the TOR of the SID8 for a one-year

term commencing 1 January 2013.

8 The TOR of the SID is available at www.bursamalaysia.com, About Us-Corporate Governance section.

-

Remuneration policies

The specific responsibilities of the NRC in relation to

remuneration matters are set out under the TOR including:

- Formulating and reviewing the remuneration policies

and remuneration of members of the Board, Board

Committees and the CEO, and recommend the same to

the Board for approval; and

- Recommending the engagement of external

professional advisors to assist and/or advise the NRC

on remuneration matters, where necessary.

The Board is mindful that fair remuneration is critical to

attract, retain and motivate the Directors of the Company.

Hence, the Board has established formal and transparent

remuneration policies for the Board and Board Committees,

and the procedures for the policies. The NRC, in discharging

its responsibilities in the review of the remuneration policies,

considers various factors including the NEDs' fiduciary

duties, time commitments expected of them, the Company's

performance and market condition.

In 2012, the Board approved the NRC's recommendation to

maintain the remuneration policy of the NEDs, and a similar

quantum of Directors' fees for 2011 was approved by the

shareholders at the 35th AGM.

The current remuneration policy for the NEDs comprises the

following:

- Directors' Fees

The sum of RM90,000 per annum for the Chairman and

RM60,000 per annum for each NED of Bursa Malaysia

(as approved by the shareholders at the 33rd, 34th and

35th AGMs for 2009, 2010 and 2011 respectively).

In January 2013, the Board decided not to recommend

any increase in the Directors' fees of the Chairman

and NED in respect of 2012, for which shareholders'

approval will be sought at the forthcoming 36th AGM.

- Meeting allowance for each Board or Board Committee9

meeting attended by a NED

The Board had in 2012 approved the revision to the

meeting allowance for Board and Board Committee

meetings as follows:

| Meeting Allowance for |

Board of Director |

Board Committees |

|

|

2011 |

2012 |

2011 |

2012 |

|

| Chairman |

RM3,000 |

RM4,000 |

RM1,500 |

RM2,500 |

| Member |

RM1,500 |

RM2,000 |

RM1,000 |

RM1,500 |

The meeting allowance is also applicable to ad-hoc

Board Committees, Tender Evaluation Committee or

any management committee to which the NEDs are

invited to attend pursuant to the Company's policy and

procedures.

The Board is of the view that the current remuneration

level suffices to attract, retain and motivate qualified

Directors to serve on the Board.

9 Information on the composition, number of meetings held and attendance of meetings of all Board

Committees is set out in the Corporate Governance Statement of this Annual Report.

-

Benefits-in-kind and Emoluments

NEDs are not entitled to participate in the Share Grant

Plan (SGP) of Bursa Malaysia or any incentive plan for

Group employees. They are given other allowances,

such as travelling and mobile phone allowances,

comparable to other public listed companies (PLCs),

particularly those in the financial sector, government-linked

companies and selected stock exchanges.

The Chairman is also provided with a monthly fixed

allowance, revised to RM50,000 since 1 March 2010,

in view of his wide-ranging scope of responsibilities

and the fact that he does not serve on the boards of

any other PLC or market participant regulated by Bursa

Malaysia, to avoid conflict of interest.

The Executive Director/CEO is not entitled to the above

Director's fee nor is he entitled to receive any meeting

allowance for Board or Board Committee meetings

he attends. The CEO, who also serves as Chairman of Yayasan Bursa Malaysia, Bursa Malaysia Derivatives

Berhad and Bursa Malaysia Derivatives Clearing Berhad,

and as Director of all other subsidiary companies within

the Group, is also not entitled to Director's fees for

attending Board meetings for the time being.

The CEO's remuneration package comprises a fixed

component which includes a monthly salary and

benefits-in-kind/emoluments, such as gratuity, a

company car, driver and leave passage; and a variable

component which includes short-term incentives in the

form of a performance-based bonus and long-term

incentives in the form of shares under the Restricted

Share Plan and Performance Share Plan of the SGP

(Plan Shares), where applicable.

In addition to the above, the Directors have the benefit

of Directors and Officers (D&O) Insurance in respect

of any liabilities arising from acts committed in their

capacity as D&O of Bursa Malaysia. However, the

said insurance policy does not indemnify a Director or

principal officer if he or she is proven to have acted

negligently, fraudulently or dishonestly, or in breach

of his or her duty or trust. The Directors and principal

officers are required to contribute jointly towards the

premium of the said policy.

Disclosure of each Director's remuneration, including

that of the CEO, is set out in the Annual Audited

Financial Statements of this Annual Report.

- Reinforce Independence

- Annual Assessment of Independence

The Protocol also sets out policies and procedures to

ensure effectiveness of the Independent NEDs on the Board,

including new appointments. The Board, through the NRC,

assesses the independence of NEDs annually using the

Directors' SPA as part of the BEE, which takes into account

the individual Director's ability to exercise independent

judgement at all times and to contribute to the effective

functioning of the Board. Their SPA results demonstrate the

NEDs' independence of judgement and clarity of thought in

problem-solving.

Based on the above assessment in 2012, the Board is generally

satisfied with the level of independence demonstrated by all

the NEDs, and their ability to act in the best interest of the

Company.

With respect to the two NEDs who are seeking re-appointment

at the forthcoming 36th AGM, the NRC is satisfied that both,

Tun Mohamed Dzaiddin bin Haji Abdullah and Tan Sri Datuk Dr.

Abdul Samad bin Haji Alias, have satisfactorily demonstrated

that they are independent of management and free from any

business or other relationship which could interfere with the

exercise of independent judgment, objectivity or the ability to

act in the best interests of the Company. The Board, therefore,

recommends and supports their proposed re-appointment.

-

Tenure of Independent Directors

The Board has adopted a nine-year policy for Independent

NEDs, which is implemented on a gradual basis to ensure

the continued effective functioning of the Board as well as

to enable the progressive refreshing thereof, in line with best

CG practice. Dato' Dr. Thillainathan a/l Ramasamy, Encik

Cheah Tek Kuang and Encik Izham bin Yusoff are among the

first batch of Independent NEDs of the demutualised Bursa

Malaysia, who were appointed on 10 April 2004. They will

have served nine years as Independent NEDs by 9 April 2013,

and will be retiring at the 36th AGM.

- Shareholders' approval for the re-appointment of Non-

Executive Directors

Tun Mohamed Dzaiddin bin Haji Abdullah, 75, was appointed

on 1 March 2004 as a PID and Chairman of Bursa Malaysia

by the MOF in consultation with the SC pursuant to Section

10(1)(a) and (3) of the CMSA. He has offered himself for re-appointment

as Director of the Company at the 36th AGM, in

accordance with Section 129(6) of the CA.

The Board is satisfied with the skills, contribution and

independent judgment that Tun Mohamed Dzaiddin bin Haji

Abdullah brings to the Board. In view thereof, the Board

recommends and supports his re-appointment as NED of the

Company which is tabled for shareholders' approval at the

forthcoming 36th AGM of the Company.

Shareholders' approval will not be sought to retain Tun

Mohamed Dzaiddin bin Haji Abdullah as an Independent NED

in accordance with Recommendation 3.3 of the Malaysian

Code on CG 2012 in view of the statutory nature of his

appointment as a PID and Chairman of an exchange holding

company by the MOF pursuant to Section 10(1)(a) and (3) of

the CMSA.

- Separation of positions of the Chairman and CEO

The Chairman, who is a PID, leads the Board with a keen focus

on governance and compliance. In turn, the Board monitors

the functions of the Board Committees in accordance with

their respective TOR to ensure its own effectiveness. The

positions of Chairman and CEO are held by two different

individuals. The CEO is a Non-Independent Executive

Director, who manages the business and operations of the

Company and implements the Board's decisions. The distinct

and separate roles of the Chairman and CEO, with a clear

division of responsibilities, ensure a balance of power and

authority, such that no one individual has unfettered powers

of decision-making.

-

Composition of the Board

The Board of Bursa Malaysia, chaired by a PID, comprises

12 Directors of whom four are PIDs, seven are Independent

NEDs and one is an Executive Director who is also the CEO.

The four PIDs, including the Chairman, are appointed by the

MOF in line with requirements of the CMSA for the Company

to act in the public interest, having particular regard to the

need for the protection of investors in performing its duties

as an exchange holding company.

The Independent NEDs account for more than 50% of the

Board. The Directors play an active role in the Board's

decision-making process bringing with them vast experience

and knowledge as well as independence and objectivity in

their views, acting in the best interest of Bursa Malaysia and

at the same time safeguarding public interest.

- Foster Commitment

- Time commitment

The Board is satisfied with the level of time commitment

given by the Directors towards fulfilling their roles and

responsibilities as Directors of Bursa Malaysia. This is

evidenced by the attendance record of the Directors at Board

meetings, as set out in the table.

| Name of Director |

Attendance |

|

| Tun Mohamed Dzaiddin bin Haji Abdullah

(Chairman and PID) | 10/10 |

|

Datuk Dr. Md Tap bin Salleh (PID) | 10/10 |

|

Datuk Dr. Syed Muhamad bin

Syed Abdul Kadir (PID) | 10/10 |

|

Datuk Puteh Rukiah binti Abd Majid (PID) | 7/10 |

|

Dato' Dr. Thillainathan a/l Ramasamy | 9/10 |

|

Izham bin Yusoff | 8/10 | |

Dato' Wong Puan Wah @ Wong Sulong | 10/10 |

|

Cheah Tek Kuang | 9/10 | |

Dato' Saiful Bahri bin Zainuddin | 9/10 |

|

Tan Sri Ong Leong Huat @ Wong Joo Hwa | 9/10 |

|

Tan Sri Datuk Dr. Abdul Samad bin Haji Alias | 10/10 |

|

Dato' Tajuddin bin Atan (CEO) | 10/10 |

|

Datin Paduka Siti Sa'diah binti Sheikh Bakir10 | 1/2 |

10 Retired as Director at the 35th AGM held on 29 March 2012.

To ensure that the Directors have the time to focus and fulfil

their roles and responsibilities effectively, one criterion as

agreed by the Board for determining candidates for the pool

of potential Directors is that they must not hold directorships

at more than five PLCs and must be able to commit sufficient

time to Bursa Malaysia.

The Directors are required to submit an update on their other

directorships and shareholdings in Bursa Malaysia every

quarter. Such information is used to monitor the number

of directorships held by the Directors of Bursa Malaysia,

including those on PLCs, and to notify the Companies

Commission of Malaysia accordingly.

To facilitate the Directors' time planning, an annual meeting

calendar is prepared and circulated to them before the

beginning of every year. It provides the scheduled dates

for meetings of the Board and Board Committees, the AGM,

major conferences hosted by the Company, as well as the

closed periods for dealings in securities by Directors based

on the targeted dates of announcements of the Group's

quarterly results.

-

Training

The Board emphasises the importance of continuing

education for its Directors to ensure they are equipped with

the necessary skills and knowledge to meet the challenges

of the Board. A budget for Directors' continuing education

is therefore provided each year by the Company. The Board

also has a policy requiring each Director to attend at least

three training sessions on capital market developments each

year to keep abreast of industry developments and trends.

In addition, each Director determines the areas of training

that he or she may require for personal development as a

Director or as a member of a Board Committee. The Company

Secretaries arrange for the Directors' attendance at these

training programmes, which are conducted either in-house

or by external service providers.

The Company Secretaries also assist the NRC in arranging

induction programmes for newly appointed Directors to

familiarise themselves with the operations of the Group

through briefings by the relevant management teams.

In 2012, all Directors of Bursa Malaysia attended at least

six training programmes. At least three of the same were on

capital market development. The development programmes

included Corporate Governance, Risk Management and Audit,

Leadership, Legal and Business Management, and Financial

and Capital Markets. The Directors were also invited to attend

a series of talks organised by Bursa Malaysia together with

various professional associations and regulatory bodies.

Several Directors attended conferences and seminars as

guest speakers, panelists or moderators. The Directors further

attended the two main conferences in the capital market

organised by the Company, namely Invest Malaysia 2012

held on 29-30 May 2012 and the 23rd Palm & Lauric Oils

Conference held on 6 March 2012. The following additional

in-house development programmes were organised for the

Directors in 2012:

| Directors' Duties, Defences, Bursa Malaysia

and Judicial Review | 15 July 2012 |

| Competition Law: How It May Impact the

Way We Do Business | 15 July 2012 |

Besides the above, the Directors attended various external

programmes in 2012, which included the following:

Corporate Governance

- Malaysian Code on CG 2012, 10 & 16 May 2012 /

21 November 2012 (Attended by Tan Sri Ong Leong

Huat / Dato' Wong Puan Wah @ Wong Sulong)

- CG Today and the Directors Moving Forward, 14 June

2012 (Attended by Datuk Dr. Syed Muhamad bin Syed

Abdul Kadir)

- CG Blueprint and Malaysian Code on CG 2012, 18 June

2012 (Attended by Datuk Dr. Md Tap bin Salleh, Datuk

Puteh Rukiah binti Abd Majid and Encik Izham bin

Yusoff)

- Malaysian Code on CG 2012: The Implication and

Challenges to PLCs, 3 July 2012 (Attended by Datuk Dr.

Md Tap bin Salleh, Datuk Puteh Rukiah binti Abd Majid

and Dato' Saiful Bahri bin Zainuddin)

- CG and Whistleblowing, 9 August 2012 (Attended by

Encik Izham bin Yusoff)

Risk Management and Audit

- Board Audit Committee Forum, 2-4 March 2012

(Attended by Dato' Dr. Thillainathan a/l Ramasamy)

- Role of the Audit Committee in Assuring Audit Quality,

22 May 2012 (Attended by Datuk Puteh Rukiah binti

Abd Majid and Tan Sri Datuk Dr. Abdul Samad bin Haji

Alias)

- Governance, Risk Management and Compliance: What

Directors Should Know, 8 August 2012 (Attended by

Dato' Wong Puan Wah @ Wong Sulong)

- The Key Components of Establishing and Maintaining

World-Class Audit Committee (AC) Reporting

Capabilities, 3 October 2012 (Attended by Dato' Dr.

Thillainathan a/l Ramasamy, Encik Izham bin Yusoff

and Tan Sri Datuk Dr. Abdul Samad bin Haji Alias)

- What Keeps an AC up at Night, 3 October 2012

(Attended by Dato' Dr. Thillainathan a/l Ramasamy,

Encik Izham bin Yusoff and Tan Sri Datuk Dr. Abdul

Samad bin Haji Alias)

Leadership, Legal and Business Management

- IDEAS Conference: The Role of the Judiciary as a Key

Check and Balance in Malaysia, 11 February 2012

(Attended by Tun Mohamed Dzaiddin bin Haji Abdullah)

- International Police Conference on Principled Policing:

Rule of Law, Public Order and Sustainable Development,

13 February 2012 (Attended by Tun Mohamed Dzaiddin

bin Haji Abdullah)

- Briefing on Goods and Services Tax, 22 March 2012

(Attended by Dato' Dr. Thillainathan a/l Ramasamy)

- Briefing on Personal Data Protection Act 2010,

15 March 2012 / 9 August 2012 (Attended by Tan Sri

Ong Leong Huat / Dato' Saiful Bahri bin Zainuddin)

- Briefing on Competition Act 2010, 7 May 2012 /

16 August 2012 (Attended by Tan Sri Ong Leong Huat /

Dato' Saiful Bahri bin Zainuddin)

- International Directors Summit 2012: Awakening the

Corporate Entrepreneurship for High Income Economy,

21-22 May 2012 (Attended by Tan Sri Datuk Dr. Abdul

Samad bin Haji Alias)

- Harvard Business School Management Development

Programme, 4 & 7 July 2012 (Attended by Tan Sri

Datuk Dr. Abdul Samad bin Haji Alias)

- Human Capital Management in the Boardroom,

14 August 2012 (Attended by Tan Sri Ong Leong Huat)

- Growth Through Innovation, 23 August 2012 (Attended

by Datuk Dr. Syed Muhamad bin Syed Abdul Kadir)

- Professionalism in Directorship Programme: What

Does It Take to be an Effective Corporate Director?

26-27 September 2012 (Attended by Datuk Puteh

Rukiah binti Abd Majid)

- International Malaysia Law Conference 2012: Asian

Perspectives, Global Viewpoints, 26-28 September

2012 (Attended by Encik Cheah Tek Kuang)

- Khazanah Megatrends Forum 2012: The Big Shift

– Traversing the Complexities of a New World,

1-2 October 2012 (Attended by Datuk Dr. Syed

Muhamad bin Syed Abdul Kadir and Tan Sri Datuk Dr.

Abdul Samad bin Haji Alias)

- Khazanah Global Lectures: Institutionalising Knowledge

to Build Malaysia's Human Capital, 29 November 2012

(Attended by Datuk Dr. Syed Muhamad bin Syed Abdul Kadir)

Financial and Capital Markets

- Bank Negara Malaysia (BNM)'s Annual Report 2011:

Financial Stability and Payment Systems Report

Briefing, 21 March 2012 (Attended by Datuk Dr. Syed

Muhamad bin Syed Abdul Kadir)

- International Financial Reporting Standards Conference,

28 March 2012 (Attended by Encik Izham bin Yusoff)

- Pillar 3 Disclosure on Basel II, 23 April 2012 (Attended

by Datuk Dr. Syed Muhamad bin Syed Abdul Kadir)

- BNM Requirements for the Internal Capital Adequacy

Assessment Process (ICAAP), 30 April 2012 (Attended

by Datuk Dr. Syed Muhamad bin Syed Abdul Kadir)

- Understanding BNM's New Liquidity Framework,

9 June 2012 (Attended by Tan Sri Ong Leong Huat)

- Financial Institutions Directors Education (FIDE) Forum,

12 June 2012 (Attended by Tun Mohamed Dzaiddin bin

Haji Abdullah and Tan Sri Ong Leong Huat)

- Rating Agency of Malaysia (RAM) Annual Bond Market

Conference: Making the Asian Bond Market a Reality,

12 July 2012 (Attended by Dato' Dr. Thillainathan a/l

Ramasamy)

- Anti-Money Laundering Act: Financial Crime Risk –

CIMB Perspective, 10 September 2012 (Attended by

Datuk Dr. Syed Muhamad bin Syed Abdul Kadir)

- Briefing on ICAAP, 20 September 2012 & 11 December

2012 (Attended by Tan Sri Ong Leong Huat)

- 52nd General Assembly of the World Federation of

Exchanges, 14-17 October 2012 (Attended by Tun

Mohamed Dzaiddin bin Haji Abdullah and Dato'

Tajuddin bin Atan)

- 17th Malaysian Capital Market Summit: Malaysia the

Rising Star – Geared for Growth, 29 October 2012

(Attended by Datuk Dr. Md Tap bin Salleh)

- 7th China International Oils & Oilseeds Conference,

6 November 2012 (Attended by Dato' Tajuddin bin Atan)

- Global Financial Leadership Conference,

12-14 November 2012 (Attended by Tun Mohamed

Dzaiddin bin Haji Abdullah and Dato' Tajuddin bin Atan)

- 8th Asia-Pacific New Markets Forum: Enhancing

the Quality of Emerging Markets in the Asia-Pacific

Region, 29-30 November 2012 and 1 December 2012

(Attended by Dato' Tajuddin bin Atan)

- Application of Equity Valuation Methods, 8 December

2012 (Attended by Tan Sri Ong Leong Huat)

An off-site development session was held on 29 September

2012 for the Market Participants Committee to update on

Bursa Malaysia's supervision approach and observations, the

common areas of breach, proposed enforcement actions and

policies, as well as related issues and challenges. The Listing

Committee, meanwhile, held an off-site development session

on 31 October 2012 to deliberate on its enforcement policies,

enforcement impact with regard to key breaches, as well as

related issues and challenges.

- Uphold integrity in financial reporting

- Compliance with applicable financial reporting standards

The Board ensures that shareholders are provided with

a balanced and meaningful evaluation of the Company's

financial performance, its position and future prospects,

through the issuance of Annual Audited Financial Statements

(AAFS) and quarterly financial reports, and corporate

announcements on significant developments affecting the

Company in accordance with the Main LR.

The AC Chairman Tan Sri Datuk Dr. Abdul Samad bin Haji

Alias 11, who is a member of three professional accounting

organisations, together with all AC members who have vast

accounting and/or financial related experience, meets on a

quarterly basis, to review the integrity and reliability of the

Group's financial statements in the presence of both external

and internal auditors, prior to recommending them for the

Board's approval and issuance to stakeholders.

As part of the governance process in reviewing the quarterly

and yearly financial statements by the AC, the CFO provided

assurance to the AC that adequate processes and controls

are in place for an effective and efficient financial statement

close process, that appropriate accounting policies had

been adopted and applied consistently and that the relevant

financial statements gave a true and fair view of the state

of affairs of the Group in compliance with the Malaysian

Financial Reporting Standards, International Financial

Reporting Standards and the requirements of the CA.

In addition to the above, the CIA also undertook an

independent assessment of the internal control system on a

quarterly basis and assured the AC that no material issue or

major deficiency had been detected which posed a high risk

to the overall internal control under review.

11 Tan Sri Datuk Dr. Abdul Samad bin Haji Alias' profile is set out in the Board of Directors' Profiles of this AnnualReport.

- Assessment of suitability and independence of external

auditors

The AC undertakes an annual assessment of the suitability

and independence of the external auditors in accordance with

the Board's Auditor Independence Policy which was adopted

in 2006. Having satisfied itself with their performance and

fulfilment of criteria as set out in the policy, the AC will

recommend their re-appointment to the Board, upon which

the shareholders' approval will be sought at the AGM.

In this regard, the AC had in February 2012, assessed the

independence of Messrs Ernst & Young (EY) as external

auditors of the Company as well as reviewed the level of

non-audit services to be rendered by EY to the Company for

FY2012. The AC was satisfied with EY's technical competency

and audit independence.

- Recognise and manage risks

- Sound framework to manage risks

The RMC oversees the ERM framework of the Group, reviews

the risk management policies formulated by Management and

makes relevant recommendations to the Board for approval.

The Company continues to maintain and review its internal

control procedures to ensure, as far as possible, the

protection of its assets and its shareholders' investments.

- Internal audit function

The Board has established an internal audit function within

the Company, which is led by the CIA who reports directly to

the AC.

Details of the Company's internal control system and

framework are set out in the Internal Control Statement

together with the Risk Management Statement and AC

Report of this Annual Report respectively.

- Ensure timely and high quality disclosure

- Corporate Disclosure Policy

The Company has in place a Policies and Procedures for

Compliance with the Listing Requirements, a document

which sets the policies and standard operating procedures

for employees (including the CEO) to facilitate and ensure

compliance by Bursa Malaysia as a PLC. It also serves as a

guide to enhance awareness among employees of corporate

disclosure requirements. Clear roles and responsibilities of

Directors, management and employees are provided together

with levels of authority, to be accorded to 'designated

person(s)' 12, spokespersons and committees in the handling

and disclosure of material information. Persons responsible

for preparing the disclosure will conduct due diligence

and proper verification, as well as coordinate the efficient

disclosure of material information to the investing public.

The Company has put in place an internal control policy

on confidentiality to ensure that confidential information is

handled properly by Directors, employees and relevant parties

to avoid leakage and improper use of such information. The

Board is mindful that information which is expected to be

material must be announced immediately.

12 The name(s) and contact information are available on Bursa Malaysia's website.

- Leverage on information technology for effective

dissemination of information

Bursa Malaysia's website incorporates a Corporate section

which provides all relevant information on Bursa Malaysia

and is accessible by the public. This Corporate section

enhances the Investor Relations (IR) function by including

share price information, all announcements made by Bursa

Malaysia, annual reports as well as the corporate and

governance structure of Bursa Malaysia. Notice of general

meetings, minutes of general meetings together with slide

presentations made at such meetings and webcasts are also

made available on the website for the benefit of shareholders

who are not able to attend meetings.

The Company has leveraged on information technology for

broader and effective dissemination of information with

regard to the dates scheduled to release its quarterly results.

After the end of every quarter, the Company Secretary will

announce these dates in advance via Bursa LINK.

The announcement of the quarterly financial results is also

made via Bursa LINK immediately after the Board's approval

between 12.30 p.m. and 1.30 p.m., following which a press

release is issued. This is important in ensuring equal and fair

access to information by the investing public.

- Strengthen relationship between Company and shareholders

- Encourage shareholder participation at general meetings

Bursa Malaysia dispatches its notice of AGM to shareholders

at least 28 days before the AGM, well in advance of the 21-

day requirement under the CA and Main LR. The additional

time given to shareholders allows them to make necessary

arrangements to attend and participate either in person, by

corporate representative, by proxy or by attorney.

Bursa Malaysia encloses the Administrative Guide together

with the notice of AGM, which provides information to the

shareholders with regard to, amongst others, details of the

AGM, their entitlement to attend the AGM, the right to appoint

a proxy and also the qualifications of a proxy. The Company

allows a member to appoint a proxy who may be a member

of the Company. If the proxy is not a member of the Company,

he/she need not be an advocate, an approved company

auditor or a person approved by the Registrar of Companies.

Commencing with the 35th AGM held on 29 March 2012,

Bursa Malaysia removed the limit on the number of proxies

to be appointed by an exempt authorised nominee with

shares in the Company for multiple beneficial owners in one

securities account to allow greater participation of beneficial

owners of shares at general meetings of the Company. The

AA of the Company further entitles a member to vote in

person, by corporate representative, by proxy or by attorney.

Essentially, a corporate representative, proxy or attorney is

entitled to vote both on a show of hands and on a poll as if

they were a member of the Company.

To further promote participation of members through

proxy(ies), which is in line with the insertion of Paragraph

7.21A(2) of the Main LR, the Company will be seeking

shareholders' approval to amend its AA to include explicitly the

right of proxies to speak at general meetings. Shareholders'

approval is being sought under Special Resolution as set out

in the Notice of the 36th AGM.

The Board will consider adopting electronic voting to facilitate

greater shareholder participation at general meetings, and to

ensure accurate and efficient outcomes of the voting process.

- Encourage poll voting

At the 35th AGM of the Company held on 29 March 2012,

no substantive resolutions were put forth for shareholders'

approval, other than resolutions pertaining to the adoption

of AAFS for the year ended 31 December 2011, payment of

final dividend, re-appointment/re-election of retiring NEDs,

payment of Directors' fees and re-appointment of external

auditors. As such, the resolutions put forth for shareholders'

approval at the 35th AGM were voted on by a show of hands.

- Effective communication and proactive engagement

At the 35th AGM, a total of 12 out of 13 Directors were present

in person to engage directly with, and be accountable to the

shareholders for their stewardship of the Company. The

proceedings of the 35th AGM included the CEO's presentation

of the Company's operating and financial performance for

2011, the presentation of the external auditors' unqualified

report to the shareholders, and a Q&A session during

which the Chairman invited shareholders to raise questions

pertaining to the Company's accounts and other items

for adoption at the meeting, before putting a resolution to

vote. The Directors, CEO/Management and external auditors

were in attendance to respond to the shareholders' queries.

The CEO also shared with the shareholders the Company's

responses to questions submitted in advance of the AGM by

the Minority Shareholder Watchdog Group.

Shareholders were also invited to submit any additional

questions they might have had via an enquiry box placed at

the venue of the 35th AGM so that these could be responded

to in writing after the meeting. Officers of the Company

were present to handle other face-to-face enquiries from

shareholders.

|

COMPLIANCE STATEMENT

The Board is satisfied that in 2012, the Company fully complied with the

principles and recommendations of the Malaysian Code on CG 2012.

This Statement is made in accordance with the resolution of the Board

dated 31 January 2013. |

| |

|

|