Bursa Malaysia's share price took off at the start of the year in line with strong performance of

Asian shares and other regional exchanges. In May, however, regional exchanges and indices

were affected by negative news flow, in particular that surrounding European sovereign debt

issues. During that same period, Bursa Malaysia was removed from the MSCI Emerging

Markets Index, and transferred from the MSCI Malaysia Standard Index to the MSCI Malaysia

Small Cap Index at MSCI's semi-annual index review on 15 May. The reclassification by MSCI

resulted in a drop in share price over the month, culminating in a large sell down as funds

tracking the index sold out. Foreign shareholding in Bursa Malaysia fell from 17% at end

April to 10% at end May. The movement of our share price is reflected below. |

|

In 2012, our share price dropped by 7% from RM6.70 to RM6.22 mainly

due to the removal from the MSCI index. This, in effect, has made our

share more attractive than other exchanges in the region. As at 31

December 2012, Bursa Malaysia's forward PE ratio stood at 21.7x, in

comparison to Hong Kong Exchanges and Clearing Ltd (32.2x), Singapore

Exchange (23.8x) and Australian Securities Exchange (15.9x) [Source:

Bloomberg]. Despite the downward movement of our share price, mainly

due to the MSCI announcement, Bursa Malaysia's fundamentals remain

strong and unaffected.

IMPROVEMENT AND RECOGNITION

As an exchange and a proxy to the market, maintaining best practice

in corporate governance is given top priority at Bursa Malaysia and

we remain committed to strengthening the investment community's

confidence in the Company. In the year under review, Bursa Malaysia

was proud to be included as one of the Top 50 Corporate Governance

Ranked Mid/Small Caps in Asia Pacific by the Asian Corporate Governance

Association. This recognition elevated our standing, and attracted the

interest of foreign institutional funds that had never previously invested

in the Exchange.

As part of our continuous effort to forge a stronger relationship with

our investors, we launched our new and easier-to-navigate website in

early July. Its new features include more user-friendly search functions

for stock prices, all-in-one listed company profile pages and improved

classification of information. In order to provide clear segregation of the

dual role played by Bursa Malaysia as a listed company and an exchange

marketplace, the website has also been divided into two broad sections

– the Corporate and Market sections.

We encourage investors to follow our progress and explore our new

Investor Relations portal located in the Corporate Section of the website.

We continue to make available the webcast of our Annual General

Meetings (AGMs) and our CEO's video on our IR Portal.

OUR COMMITMENT

Access to timely information is vital to our investors. In this regard, we use

an array of media channels to disseminate material and price-sensitive

information to our investors for them to make informed decisions. We

continue to keep our investors engaged through roadshows, meetings,

briefings, announcements and our Annual General Meetings.

As part of our continuous efforts to reach out to our stakeholders,

Bursa Malaysia engaged with investors in Kuala Lumpur, Singapore,

Hong Kong and the United States this year. We have 20 analysts from

local and foreign houses providing coverage for Bursa Malaysia. As at

31 December 2012, Bursa Malaysia had 57% of its call ratings as Buy,

Outperform or Overweight, 36% as Hold, Neutral or Market Perform and

7% as Sell.

DIVIDEND POLICY

We remain committed to rewarding our shareholders. Our policy is to pay

out no less than 75% of our net profit subject to other considerations,

such as the level of available cash and cash equivalent, return on equity

and retained earnings, our projected level of capital expenditure and

other investment plans.

We have constantly rewarded our shareholders above the minimum 75%

of our net profit. In the last five years, we have paid out more than 90%

of our net profit, as reflected in the table below:

| Financial Year |

Dividend Payment |

(sen/net) |

% of Dividend Payout |

|

| 2012 |

• Interim Dividend |

13.5 |

95% |

| |

• Final Dividend |

13.5 |

|

|

| 2011 |

• Interim Dividend |

13.0 |

95% |

| |

• Final Dividend |

13.0 |

|

|

| 2010 |

• Interim Dividend |

9.5 |

94% |

| |

• Final Dividend |

10.5 |

|

|

| 2009 |

• Interim Dividend |

8.8 |

93% |

| |

• Final Dividend |

9.0 |

|

|

| 2008 |

• Interim Dividend |

12.2 |

91% |

| |

• Final Dividend |

5.9 |

|

|

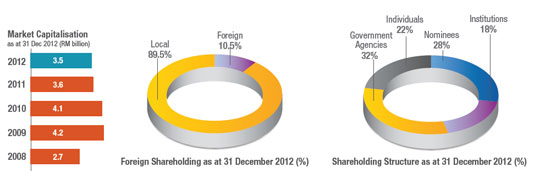

FOREIGN SHAREHOLDING AND MARKET CAPITALISATION

Our public shareholding of 65.2% provides a fair free float for Bursa Malaysia's shares and a good level of liquidity.

We had a total shareholder count of 26,976 as at end 2012. Our market capitalisation, meanwhile, declined from RM3.6 billion in 2011 to RM3.5 billion.

Click on the image to view a larger version.

Investor Relations Contact

All investors are welcome to contact the IR team directly at ir@bursamalaysia.com or visit the Investor Relations section on our website, where they can

subscribe to regular updates on Bursa Malaysia via email alerts and access our quarterly newsletter.

|