|

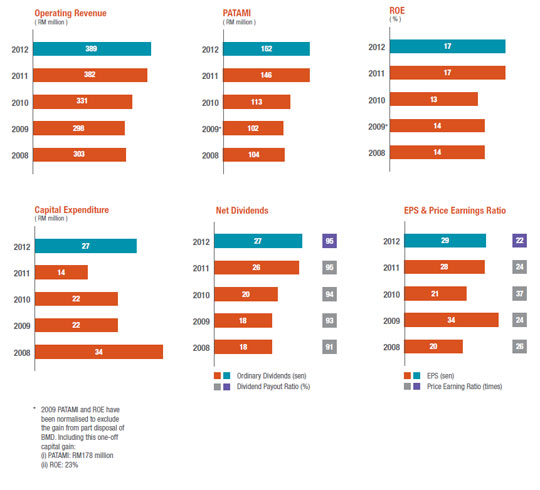

OUR PERFORMANCE

5 Year Highlights

|

| 31 DEC

2008 |

31 DEC

2009 |

31 DEC

2010 |

31 DEC

2011 |

31 DEC

2012 |

Key Results

(RM Million)

| |

|

|

|

|

| Operating Revenue1

| 302.5 |

297.8 |

331.3 |

381.3 |

388.5 |

| Operating Expenses2

| 186.0 |

183.2 |

197.3 |

214.0 |

211.1 |

| PATAMI

| 104.4 |

177.63 |

113.0 |

146.2 |

151.5 |

|

| |

|

|

|

|

Other Key Data

(RM Million)

| |

|

|

|

|

| Total Assets

| 1,729.9 |

1,786.6 |

1,708.3 |

1,673.5 |

2,198.4 |

| Total Liabilities

| 997.6 |

938.0 |

844.7 |

798.9 |

1,307.2 |

| Shareholders' Equity

| 732.3 |

840.0 |

852.3 |

860.4 |

875.5 |

| Capital Expenditure

| 34.0 |

22.1 |

21.9 |

13.6 |

26.7 |

|

| |

|

|

|

|

| Financial Ratios (%)

| |

|

|

|

|

| Operating Revenue Growth1

| (33.3) |

(1.5) |

11.2 |

15.1 |

1.8 |

| Cost to Income Ratio

| 56.1 |

45.53 |

54.6 |

50.9 |

49.4 |

| Net Profit Margin

| 31.5 |

44.13 |

32.0 |

36.0 |

36.9 |

| ROE

| 13.8 |

22.63 |

13.4 |

17.1 |

17.4 |

|

| |

|

|

|

|

| Share Information

| |

|

|

|

|

| Basic EPS (sen)

| 19.9 |

33.7 |

21.3 |

27.5 |

28.5 |

| Net Dividends per Share (sen)

| 18.1 |

17.8 |

20.0 |

26.0 |

27.0 |

| Payout Ratio (%)

| 90.9 |

92.9 |

94.0 |

94.6 |

94.8 |

| Net Assets per Share (sen)

| 1.39 |

1.59 |

1.60 |

1.62 |

1.65 |

| Share Price - High (RM)

| 16.30 |

8.59 |

8.66 |

9.02 |

7.72 |

| Share Price - Low (RM)

| 4.68 |

4.36 |

6.75 |

5.76 |

5.91 |

| Share Price as at 31 December (RM)

| 5.15 |

7.99 |

7.80 |

6.70 |

6.22 |

| Price Earnings Ratio (times)

| 26 |

24 |

37 |

24 |

22 |

| Company Market Capitalisation (RM billion)

| 2.7 |

4.2 |

4.1 |

3.6 |

3.3 |

|

| |

|

| |

1 Comparative figures have been restated to include administration fees and conference fees and exhibition related income.

2 Comparative figures have been restated to include commitment fees.

3 The results and ratios for 2009 which exclude the gain on disposal of a subsidiary are as follows:

| |

(i)

(ii)

(iii)

(iv) |

PATAMI: RM101.6 million

Cost to income ratio: 56.1%

Net profit margin: 31.1%

ROE: 13.6% |

|

| |

|

Click on the image to view a larger version.

|

|

|

| |

Quarterly Results

|

|

|

1st quarter |

2nd quarter |

3rd quarter |

4th quarter |

Full year |

| 2012 |

|

|

|

|

|

| Key Financials |

|

|

|

|

|

| Operating Revenue (RM million) |

100.5 |

96.8 |

96.7 |

94.5 |

388.5 |

| PATAMI (RM million) |

40.9 |

37.9 |

37.0 |

35.7 |

151.35 |

| ROE (%) |

18.4 |

17.0 |

17.2 |

16.6 |

17.4 |

| Cost to Income Ratio (%) |

47.7 |

49.3 |

48.7 |

52.1 |

49.4 |

| Earnings per Share (sen) |

7.7 |

7.1 |

7.0 |

6.7 |

28.5 |

| Dividend per Share (sen) |

- |

13.5 |

- |

13.5 |

27.0 |

| |

|

|

|

|

|

| Key Operating Drivers |

|

|

|

|

|

| ADV - OMT & DBT on Securities Market (RM million) |

1,973 |

1,517 |

1,684 |

1,509 |

1,666 |

| ADC on Derivatives Market |

31,015 |

40,367 |

42,234 |

43,555 |

39,387 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| 2011 |

|

|

|

|

|

| Key Financials |

|

|

|

|

|

| Operating Revenue (RM million) |

107.9 |

92.5 |

96.1 |

85.0 |

381.5 |

| PATAMI (RM million) |

40.5 |

35.8 |

38.6 |

31.3 |

146.2 |

| ROE (%) |

18.6 |

16.3 |

18.2 |

14.9 |

17.1 |

| Cost to Income Ratio (%) |

49.9 |

51.1 |

49.5 |

53.7 |

50.9 |

| Earnings per Share (sen) |

7.6 |

6.7 |

7.3 |

5.9 |

27.5 |

| Dividend per Share (sen) |

- |

13.0 |

– |

13.0 |

26.0 |

| |

|

|

|

|

|

| Key Operating Drivers |

|

|

|

|

|

| ADV - OMT & DBT on Securities Market (RM million) |

2,234 |

1,639 |

1,887 |

1,412 |

1,788 |

| ADC on Derivatives Market |

36,785 |

32,316 |

34,169 |

34,779 |

34,474 |

| |

|

|

|

|

|

|

|

|

|