Bursa Malaysia • Annual Report 2013

103

Financial Reports

2. Significant accounting policies (cont’d.)

2.2 Adoption of new and revised MFRSs and changes in accounting policies (cont’d.)

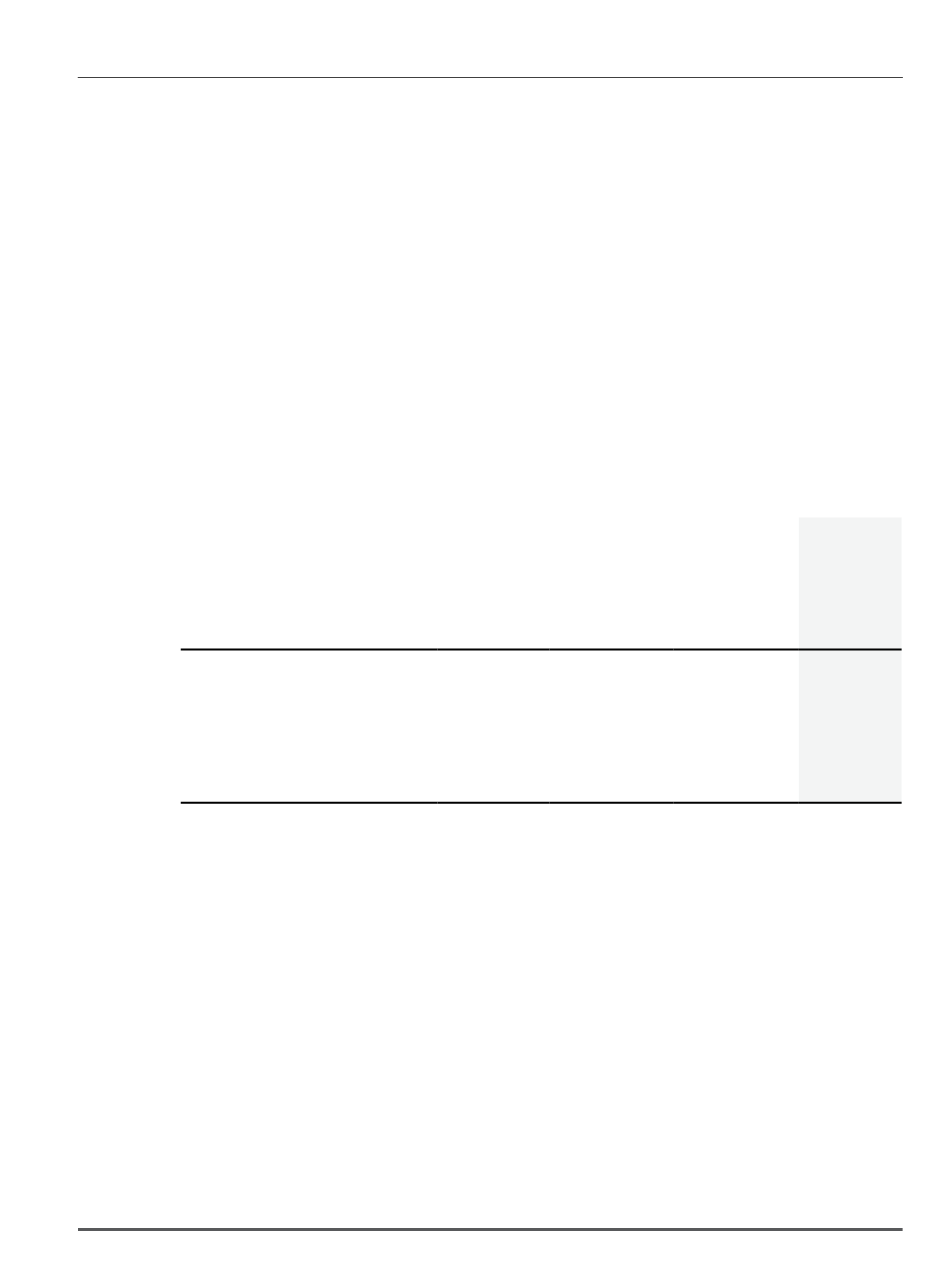

(c) Financial effects arising from the adoption of MFRS 119

Employee Benefits (revised)

and change in accounting policy on fines (cont’d.)

(iv) The following are reconciliations of statements of cash flows of the Group and of the Company for the financial year ended 31 December

2012:

As

previously

reported

Note 2.2(a)(i)

Effect of

adoption of

MFRS 119

Note 2.2(b)

Effect of change

in accounting

policy for fines

Restated

RM’000

RM’000

RM’000

RM’000

Group

Profit before tax

216,032

668

(1,361)

215,339

Retirement benefit obligations

2,574

(668)

-

1,906

Operating profit before working capital changes

230,113

-

(1,361)

228,752

Increase in payables

4,619

-

1,361

5,980

Company

Profit before tax

159,796

668

(113)

160,351

Retirement benefit obligations

2,574

(668)

-

1,906

Operating profit before working capital changes

17,332

-

(113)

17,219

Increase in payables

1,615

-

2,389

4,004

Changes in subsidiaries’ balance

(6,952)

-

(2,276)

(9,228)

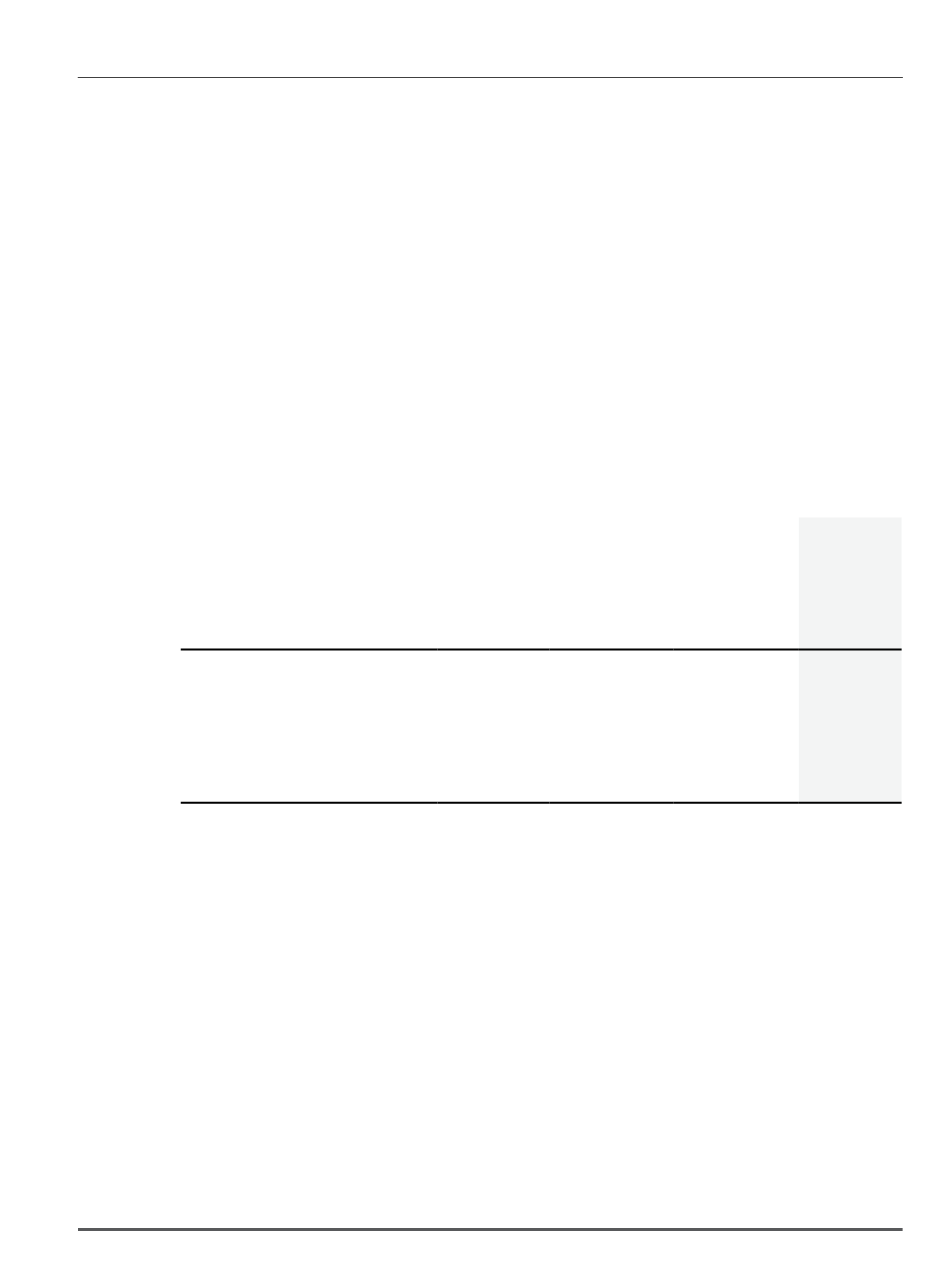

2.3 Standards issued but not yet effective

As at the date of authorisation of these financial statements, the following Amendments to Standards and IC Interpretations have been issued by

the Malaysian Accounting Standards Board (MASB) but are not yet effective and have not been adopted by the Group and the Company:

Effective for financial periods beginning on or after 1 January 2014

Amendments to MFRS 10

Consolidated Financial Statements: Investment Entities

Amendments to MFRS 12

Disclosure of Interests in Other Entities: Investment Entities

Amendments to MFRS 127

Consolidated and Separate Financial Statements: Investment Entities

Amendments to MFRS 132

Financial Instruments: Presentation - Offsetting Financial Assets and Financial Liabilities

Amendments to MFRS 136

Impairment of Assets - Recoverable Amount disclosures for Non-Financial Assets

Amendments to MFRS 139

Novation of Derivatives and Continuation of Hedge Accounting

IC Interpretation 21

Levies

Notes to the Financial Statements

31 December 2013