|

Chief Executive Officer's Message

To the outside observer, a year of headline activity is often followed by one of apparent quiet. The reality is usually different. Much hard work is needed to embed change, nurture new developments to reach their potential and refine the strategies to secure our future. 2010 was just such a year for Bursa Malaysia, and we made considerable progress.

The sustainability theme was featured when, on 23 November 2010, the Honourable Prime Minister

launched a Bursa Malaysia programme to encourage all PLCs to focus on sustainability as a key business driver for the future. This programme is supportive of the Government's plans to transform the nation into a high income economy, based on the principles of inclusiveness and sustainability.

Dato' Yusli Bin Mohamed Yusoff Chief Executive Officer |

| |

|

In the Budget for 2010, the Government focused its attention on four areas: re-invigorating private investment, intensifying human capital development, enhancing the quality of life and strengthening public sector delivery. Coupled with its own programme of fiscal prudence and value-for-money spending, these measures are expected to help sustain relatively good GDP growth into 2011, despite the progressive removal of subsidies on various commodities. A recovery in global trade is already benefitting the manufacturing sector, and a continuing current account surplus backed by a well-capitalised and resilient banking sector, plus strong domestic demand, is setting the stage for improved FDI flows. An accommodative monetary policy and reasonably well contained inflation are additional catalysts for sustaining the positive sentiment which has returned to the capital markets. All this augers well for Bursa Malaysia, especially as the private sector is expected to lead future economic growth and our markets stand to be beneficiaries.

|

| |

|

| |

Several events took place in 2010 which helped enhance liquidity and efficiency in the capital market and positioned us to take advantage of the improving investment climate.

Our international profile was enhanced when, in September, Malaysia was upgraded by FTSE to 'Advanced Emerging Market' status in the FTSE Global Equity Index Series. This will take effect from June 2011, and is another step on the journey to developed market status, putting us on the radar screen of a wider audience of sophisticated international institutional investors.

In June, China recognised Malaysia as an approved investment destination under China's QDII scheme administered by the CBRC. This has positive implications for inflows of Chinese funds into the Malaysian capital market and was followed by other changes which will encourage greater foreign participation.

Also in June, further recognition of the capability of our markets and participants came with the US CFTC approval for Malaysian futures brokers to deal directly with US customers. This should expose our local brokers to the demands of an international clientele and help raise standards to the benefit of all concerned. Another positive development was the September decision by the US Securities and Exchange Commission to recognise Bursa Malaysia as a 'Designated Offshore Securities Market', which makes it easier for US investors to trade in Malaysian listed securities and shelf listed bonds.

International recognition needs to be accompanied by global access, and a significant step in that direction was taken in September 2010 as a positive consequence of our relationship with CME. Our derivative products were successfully migrated onto the CME Globex® electronic trading platform. This will progressively broaden the market for these products globally, especially the global benchmarked FCPO contract.

This was the canvas that provided the backdrop for our markets in 2010.

|

How Our Markets Performed

|

- Securities Market

-

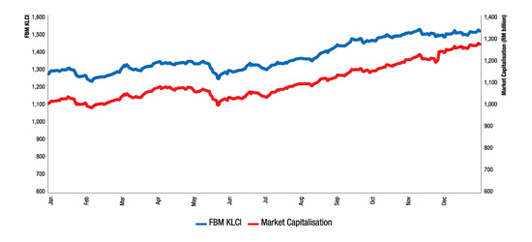

Our securities markets progressed steadily throughout 2010. The benchmark FBM KLCI opened 2010 at 1,272.78 points and advanced by 19% to close the year at 1,518.91 points, having hit an all time high of 1,528.01 points on 10 November 2010. The FBM Top 100 and the FBM EMAS indices performed in a similar manner, with both hitting all time highs on 22 November 2010, but the FBM ACE index (formerly known as the FBM MESDAQ) finished the year up by only 1% at 4,347.56 points.

On the back of strong final quarter performance, the specialist palm oil indices introduced in 2009 did well. The FBM Palm Oil Plantation index ended the year up by 33% at 21,537.66 points, with the regional USD and Malaysian Ringgit denominated FBM Asian Palm Oil Plantation indices up by 28% at 21,587.57 points and 15% at 23,128.52 points respectively.

Interest in the Shari'ah indices, FBM Hijrah Shariah and FBM EMAS Shariah, was sustained, but at a marginally lower level than the

overall market.

Index Movement Table

| |

As at

31 Dec 2009 |

As at

31 Dec 2010 |

Movement

(%) |

| FTSE Bursa Malaysia KLCI |

1,272.78 |

1,518.91 |

19 |

| FTSE Bursa Malaysia Top 100 |

8,308.89 |

10,116.56 |

22 |

| FTSE Bursa Malaysia Small Cap |

10,165.81 |

12,625.36 |

24 |

| FTSE Bursa Malaysia EMAS |

8,507.61 |

10,374.98 |

22 |

| FTSE Bursa Malaysia ACE |

4,299.58 |

4,347.56 |

1 |

| FTSE Bursa Malaysia Palm Oil Plantation |

11,615.60 |

15,481.09 |

33 |

| FTSE Bursa Malaysia Asian Palm Oil Plantation (USD) |

16,931.27 |

21,587.57 |

28 |

| FTSE Bursa Malaysia Asian Palm Oil Plantation (MYR) |

20,141.01 |

23,128.52 |

15 |

| FTSE Bursa Malaysia Hijrah Shariah |

9,312.02 |

10,456.86 |

12 |

| FTSE Bursa Malaysia EMAS Shariah |

8,509.52 |

10,058.15 |

18 |

-

Market capitalisation advanced strongly, crossing the RM1 trillion threshold on the first trading day of 2010, and rounded off the year by growing by some 28% over the year. IPO activity contributed to a strong year-end boost in overall market values.

Click on the image to view a larger version.

Compared with 2009, average daily trading values increased by 29% to reach RM1.6 billion even though the average daily trading volume only increased by 2% in 2010. With market capitalisation growing at a faster pace than the growth of value traded, there was a statistical decline in overall market velocity to 33%.

Securities Market Performance Table

| |

2009 |

2010 |

Movement (%) |

| Daily Average Trading Value (OMT & DBT) (RM billion) |

1.22 |

1.57 |

28.7 |

| Total Trading Value (OMT & DBT) (RM billion) |

303 |

390 |

28.7 |

| Market Capitalisation (RM billion) |

999 |

1,275 |

27.6 |

Total Funds Raised (RM billion)

- IPOs

- Other corporate actions |

27.75

12.04

15.71 |

32.97

19.87

13.10 |

18.8

65.0

(16.6) |

| Velocity (%) |

34.0 |

33.0 |

(2.9) |

-

New issue excitement returned to our markets in 2010, in line with the stronger economy and generally improved sentiment. There

were 29 IPOs, including two REITs in 2010, compared with 14 in 2009. Secondary issues also gathered pace, with a total of 77 rights and bonus exercises being conducted during the year, compared with 52 in 2009.

In terms of market demographics, foreign investors remained more or less constant at 22% by value of shareholding, while trading

participation stood at 27%. Institutional funds dominated the market with a 73% share compared with 27% for retail investors.

- Derivatives Market

-

Our derivatives markets operated at lower activity levels in the first

nine months of 2010. This was largely a result of the relatively narrow

spread between the futures and physical markets which applied for

much of the period. However, with a return of volatility and better

spreads, activity levels picked up noticeably in the final quarter of

the year.

In the month of November, FCPO contracts recorded an all time high

of 451,843 contracts traded, passing the previous record of 442,220

contracts in April 2009. Daily contract volume touched a record high

of 41,879 contracts on 18 November, surpassing the previous record

of 37,231 recorded on 13 June 2007.

Overall, the total number of contracts for 2010 grew marginally by 0.3%

from 6.14 million in 2009 to 6.15 million in 2010. Average daily volume

increased correspondingly from 24,749 contracts in 2009 to 24,818

contracts in 2010. Open positions improved 7.3% from approximately

123,000 contracts in 2009 to 132,000 contracts in 2010.

Total annual volume traded for FCPO contracts was 4.1 million

contracts, slightly higher compared to the previous year of

4.0 million contracts, or the equivalent of just above 100 million

metric tons of CPO. The daily average number of FCPO contracts

increased marginally from 16,165 contracts in 2009 to 16,389

contracts in 2010, primarily as a result of the narrower trading

range for CPO for the first 9 months of the year between RM2,270

to RM2,755 or a range of RM485 per metric ton. The prices of CPO

started to pick up from October onwards, in line with other global

commodities, trading from RM2,653 to a high of RM3,792 or a price

range of RM1,139 per metric ton.

FKLI futures activity in 2010 was similar to 2009, with 2.0 million

contracts traded and the daily average number of contracts was

approximately 8,000. There was reduced volatility in the underlying

index for the first seven months of the year ranging from 1,220 to

1,364 points, after which it started trending upwards from August

onwards from 1,364 to a high of 1,546 points.

KLIBOR futures traded a total of 95,477 contracts in 2010 as

compared with126,690 contracts in 2009, which was lower by 25%.

From a market demography perspective, the participation of foreign

players, both individuals and institutions, has improved markedly.

For FCPO contracts, foreign participation grew from 19% to 25%

over the year, while for FKLI contracts there was an increase from

26% to 33%. This is a positive signal and provides early signs of

validation for the globalisation path Bursa Malaysia has chosen for

its derivatives business.

Derivatives Market Performance Table

| |

2009 |

2010 |

Movement (%) |

| Open Positions |

123,141 |

132,151 |

7.3 |

| Daily Average

Open Positions |

145,017 |

123,937 |

(14.5) |

| Total Contracts Traded

(million) |

6.14 |

6.15 |

0.3 |

Daily Average

No. of Contracts

- FCPO

- FKLI

- 3-month

KLIBOR Futures |

16,165

8,056

511 |

16,389

8,044

385 |

1.4

(0.2)

(24.7) |

| Daily Average

No. of All Contracts |

24,749 |

24,818 |

0.3 |

- Islamic Markets

-

The capital market plays a significant role as a source for fund raising

by all companies, including those that follow Islamic principles.

Bursa Malaysia currently hosts 842 Shari'ah compliant securities

representing 88% of total listed securities, with market capitalisation

amounting to RM800 billion at the end of 2010. In terms of trading

volume, Shari'ah compliant securities accounted for 160.74 billion

units or 64% of total units traded in 2010.

Islamic Markets Performance Table

| |

2009 |

2010 |

Movement (%) |

| No. of Sukuk Listings on

Bursa Malaysia Securities |

12 |

19 |

58.3 |

| Value of Sukuk Listings

(USD bil) |

17.6 |

27.7 |

57.4 |

% of Shari'ah Compliant

- PLCs

- ETFs

- REITs

- Market Capitalisation

|

88.0

55.7

34.7

63.8 |

87.8

50.2

22.3

62.8 |

-

(9.9)

(35.7)

(1.6) |

-

In line with the national aspiration to establish Malaysia as a

pre-eminent international Islamic financial centre, we launched

initiatives to promote the listing of sukuk in both Malaysian Ringgit

and foreign currencies on Bursa Malaysia, and the establishment of

a Shari'ah compliant commodity trading platform. Along with several

other initiatives, these measures are already proving to be a new and

reliable contributor to our primary income streams at Bursa Malaysia,

and will continue to increase in importance in the years ahead.

Following our maiden sukuk listing in August 2009, I am glad to

report that we remain the top sukuk listing destination in the world,

with a total of USD27.7 billion of sukuk programmes listed. Even

more pleasing is the fact that we have managed both to create

greater visibility for domestic sukuk issuers, as well as enhance our

international appeal, with several foreign sukuk issuers seeking to

list on our main market. The largest foreign issue to date was the

November 2010 listing of the Islamic Development Bank's USD3.5

billion sukuk programme, which capped a year that saw seven new

sukuk issues from seven issuers, raising a total of some USD9 billion.

In addition to the sukuk market, I am pleased to report further

developments in our Islamic commodity trading platform, Bursa Suq

Al-Sila'. We now have 33 members trading through this platform

encompassing both domestic and foreign financial institutions

(including those domiciled in the GCC), along with commodity

suppliers. The establishment of Bursa Suq Al-Sila' represented an

entirely new business for any exchange, and the fact that others are

now attempting to emulate our success is a compliment.

- The Labuan International Financial Exchange

-

LFX recorded six new listings in 2010, bringing the total number

of listed instruments to 28. The most significant listing was the

USD1.25 billion '1Malaysia Sukuk' issued by the Malaysian

Government, which was listed on 8 June 2010. The market

capitalisation of the LFX stands at USD19.2 billion at year end 2010.

| LFX |

2009 |

2010 |

Movement (%) |

| Market Capitalisation |

18.1 |

19.2 |

6.1 |

| No. of Listed Instrument |

28 |

28 |

- |

-

In a move to boost market activity on LFX, a revision was made in

November of the entry level for a licensed Listing Sponsor from the

previous Minimum Net Assets requirement of USD2 million to a lower

threshold of USD100,000. The revision is designed to attract greater

participation by issuers on LFX and will encourage more entities

to apply for a Listing Sponsor license. As a measure to enhance

efficiency, the LFX has also undertaken to improve the turnaround

time for approval of listing applications to two market days, from the

previous seven days.

|

Financial Review

|

We recorded a higher profit of RM113 million for the financial year 2010,

which is in effect an 11% increase from our normalised profit of RM102

million in 2009. Normalised profit for 2009 excludes the RM76 million

gain made from the disposal of a 25% equity interest in Bursa Malaysia

Derivatives in that year. The improvement in current year profit was

backed by activity on our securities market, which was relatively stable

despite the global volatility seen throughout 2010.

|

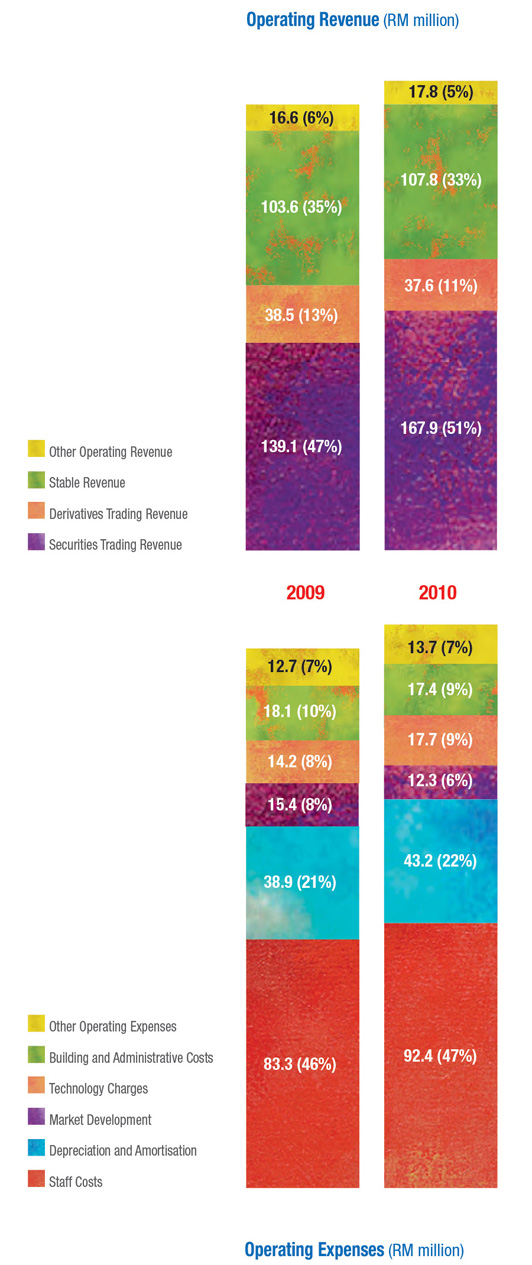

- Operating Revenue

- RM331 million; +11%

-

Operating revenue comprises trading revenue from the securities

and derivatives markets, stable revenue and other operating

revenue.

Trading revenue from the securities market grew by 21% to

RM168 million in 2010. Trading activity improved from a daily

average value of RM1.22 billion per day in 2009 to RM1.57 billion

per day in 2010. The growth in trading revenue was offset to some

extent by the lower effective clearing fee rate of 2.38 basis points

in 2010 compared with 2.51 basis points in 2009.

Trading revenue from the derivatives market was fairly stable at

RM38 million. The marginal increase in contracts traded in 2010

(2010: 6.15 million vs. 2009: 6.14 million) brought about a 0.6%

increase in trading and clearing fees. Guarantee fees however

declined by RM1 million as a result of lower average daily open

positions in 2010.

Stable revenue increased by 4% to RM108 million in 2010. This is

attributed to the higher number of IPOs, structured warrant listings

and secondary issues in 2010 compared with 2009.

Other operating revenue increased by 7% to RM18 million in 2010.

This is mainly due to processing fees derived from the transfer of

certain functions from the SC to Bursa Malaysia in the second half

of 2009.

- Operating Expenses

- RM197 million; +8%

-

Higher expenses in 2010 were largely due to our efforts to recruit

and retain talent, and the migration of our derivatives products

from BTD onto CME Globex® on 20 September 2010. Moving

towards the migration date, we shortened the useful life of BTD

and, thus, accelerated depreciation of the system. We now pay a

license fee for the trades done on CME Globex®.

Click on the image to view a larger version.

- Capital Expenditure

- RM22 million; unchanged

-

We spent RM22 million in 2010 mainly for system and infrastructure

development. We started the year by focusing on developing the

derivatives infrastructure which would link our brokers to CME

Globex®. We then moved to revamping our derivatives clearing

system towards the end of the year. The work on this is still ongoing.

In addition, we worked on streamlining our internal infrastructure to

create greater value and efficiency.

- Cash flows

- Net increase in cash RM114 million

| RM million |

2009 |

2010 |

| Cash generated from operating activities |

131.8 |

153.9 |

| Cash generated from/(used in)

investing activities |

(7.8) |

46.7 |

| Cash used in financing activities |

(69.8) |

(86.8) |

| Net increase in cash |

54.2 |

113.8 |

-

The higher cash flows from operating activities were in line with

higher operating profits generated in 2010. During the year, we also

converted more of our short term investments into cash, resulting

in a net increase in cash from investing activities. Cash used in our

financing activities was higher following the greater quantum of

dividends paid in the year.

- Rewarding Shareholders

- Total dividend of 20 sen per share

-

This year, we paid an interim dividend of 9.5 sen per share and

propose 10.5 sen per share as our final dividend. This will bring total

dividends to 20 sen per share for the year, representing a payout of

94% of our FY2010 profits to our shareholders.

|

Our Strategic Initiatives In 2010:

Building a Sustainable, Quality Market

|

|

Growing our core businesses in the securities and derivatives markets

remained our principal focus in 2010. At the same time, we made strides

in establishing our principal differentiator - our strengths in commodities

and Islamic offerings. Further emphasis will be given to this important

segment going forward.

|

Securities Market Progress

|

Let me take you through some of the more notable developments in 2010.

|

- New Issue Activity

-

Although recovery of the global economy remained sluggish, the

combined effects of relatively robust domestic economic growth

and the Government's stimulus packages proved to be a catalyst for

greater IPO activity in 2010 from a variety of sectors. For the year,

there were 29 IPOs, up 107% from 2009. Our IPOs raised a total of

RM20 billion compared with RM12 billion in 2009, an increase of

65%. With the new listing framework, we also saw more ACE Market

listings compared with 2009, with the number of ACE Market IPOs

increasing from 2 to 6.

The most notable new listing was by PETRONAS Chemicals Group

Berhad, which successfully raised some RM13 billion, and was the

largest issue in South East Asia. In line with current investor demands

for high-yielding lower risk assets, we saw the listings of two REITs,

namely Sunway Real Estate Investment Trust, our largest REIT todate,

and CapitaMalls Malaysia Trust.

Although the number of secondary capital issues increased, the

amount of capital raised declined marginally from RM16 billion in

2009 to RM13 billion in 2010.

Funds raised by our PLCs continued its momentum as the equity

capital market remained a viable source of funding. There were also

a total of 204 newly listed structured warrants in 2010 compared

with 124 in 2009.

- New ETFs

-

The Malaysian ETF market achieved another milestone with the listing

of two ETFs in July 2010, namely the CIMBA40 and the CIMBC25.

Both issues were firsts for Bursa Malaysia, with the CIMBA40 being

the first cross-listing ETF with SGX, and the CIMBC25 ETF the first

foreign ETF. These funds provide choice for investors who have a

lower risk appetite but wish to increase their exposure to ASEAN and

Chinese markets and tap into some of the strongest assets in China

and in the region.

Our efforts to educate and raise awareness of the benefits of ETFs

will continue as we push to attract foreign denominated ETFs to be

listed on the Main Market. The listing of foreign denominated ETFs

will leverage on the multi-currency platform we introduced last

year to enable investors to create better diversification as well as

providing an element of hedging into their portfolios.

- Promoting Research for Listed Companies

-

CBRS embarked on its third phase in October 2010 after a successful

run since its inception five years ago. CBRS is open to participation by

all companies listed on Bursa Malaysia, and is aimed at generating

investor interest in under-researched stocks by providing regular

research reports on the counters that are covered by the scheme.

This ultimately supports the Exchange's continuous call to facilitate

informed investing via wider research coverage.

Over the years, CBRS has assisted listed companies understand

the importance of profiling and being transparent if they are to

generate greater investor awareness as well as manage investors

expectations. Investors, particularly retail investors, are now savvier

and more discerning, and rely on independent analysis. This is

evidenced by the number of CBRS reports downloaded, which has

steadily increased to some 64,000 reports per month. Through

CBRS, investors can gain free access to in-depth information on the

company's potential, progress and updates that allow them to make

better informed investment decisions.

Bursa Malaysia is committed to providing support to all issuers,

particularly those with smaller capitalisation, so that they can gain

investor attention and eventually create liquidity in their securities.

The cost of coverage for participating companies is partially

subsidised by the CMDF.

- New Structured Warrant Product - Callable Bull Bear Certificate

-

As part of Bursa Malaysia's on-going efforts to raise the attractiveness

of the Structured Warrant segment, the LR were amended in May

2010 to allow for CBBCs.

CBBC is a type of structured warrant issued either as Bull or Bear

certificate, with a fixed expiry date. On Bursa Malaysia, CBBCs

may have a tenor ranging from three months to five years. CBBCs

let investors take bullish or bearish positions on an underlying

instrument. They track the performance of the underlying instrument

without requiring investors to pay the full price required to own the

actual instrument. A smaller capital outlay and lower transaction

costs and commissions make CBBCs an interesting new alternative

for investors.

The first four CBBCs were listed in July 2010 and, at end-December

2010, a total of 19 CBBCs had been listed on Bursa Malaysia. From

July to end December 2010, trading in CBBCs accounted for 8%

(RM1.1 million) in average daily turnover value of the Structured

Warrant segment on Bursa Malaysia.

- Enhancing Efficiency through Electronic Services

-

Bursa Malaysia has an on-going programme to introduce

leading edge electronic efficiencies for the benefit of investors

and market participants. In 2009, the Prime Minister announced

the introduction of e-Dividend to promote payment efficiency,

and I am pleased to report that e-Dividend was successfully

implemented in September 2010. Shareholders can now

benefit from the timely receipt of dividends directly into their

bank accounts, with the convenience of not having to wait

for dividend cheques and the hassle of physically paying into

their bank accounts. The new system also offers far greater

security. Since the commencement of e-Dividend registration

in April 2010, a total of 735,628 account holders representing

38% of total CDS accounts had registered for e-Dividend by end

December 2010.

From 1 September 2010 onwards, all PLCs that announce

their book closure dates are required to effect cash dividend

payments via e-Dividend to shareholders who have registered.

As at end 2010, a total of 152 companies have already

implemented e-Dividend.

Bursa Malaysia Depository offers two services related to

e-Dividend. We are the central depository of bank account

information provided by CDS account holders and the service

provider to listed companies in facilitating the payment of cash

dividends directly into their shareholders' bank accounts.

In August, the Electronic Share Payment facility for share

transactions, or e-Share, was introduced by the SC, BNM and

Bursa Malaysia. This facility promotes the use of e-payments

in the stock market and enhances efficiency in the market's

payment and settlement systems. E-Share gives investors

faster access to their funds by allowing share sales proceeds

to be paid on the same day directly into their bank accounts.

- ASEAN Trading Link

-

A Memorandum of Understanding has been signed between the

six established ASEAN Exchanges, including Bursa Malaysia,

in which we agreed to cooperate in working towards the

establishment of the ASEAN Link. All the exchanges involved

meet regularly to discuss the details of implementation. The aim

is to promote ASEAN as an asset class to investors globally.

|

Derivatives Market Progress

|

Following on from the partnership we entered with CME in September

2009, in which CME took a 25% equity stake in BMD, BMD underwent

a major re-organisation. A shift in business structure was necessary to

ensure there was a dedicated team in place, focusing exclusively on

the derivatives business whilst the supporting functions continued to be

outsourced to the holding company.

|

- Our Unique Partnership with CME

-

Our partnership with CME is unique and very different from that of

a vendor relationship. Ours is a stakeholder relationship. CME has

demonstrated strong commitment and dedication towards this

venture, and our joint search for new businesses and markets has

been at the forefront of our discussions and activities. There has been

an efficient transfer of knowledge and skill sets to our team members

and, for its part, CME has gained a better understanding and deeper

appreciation of the local culture and business environment.

- Migration to Globex®

-

On 20 September 2010, we successfully migrated all our derivatives

products comprising commodity, financial and equity futures onto

the CME Globex® electronic trading platform, thereby making our

derivatives markets truly international.

The listing of our derivative products on CME Globex®, the leading

electronic trading platform for derivatives in the world, has added

great value to our markets as a whole. We now have unparalleled

global distribution for our derivatives products, particularly our star

product FCPO contract which is the global price benchmark for the

CPO market. International customers who might otherwise never

have thought of investing in Malaysian derivative products now have

efficient access to our markets.

Meanwhile, BMD continues to operate and regulate its market.

The trading hours for the Malaysian derivatives market remain

unchanged, and all our derivatives contracts traded on CME Globex®

continue to be cleared by Bursa Malaysia Derivatives Clearing, a

subsidiary of BMD. Changes have been effected to the rules of BMD

to reflect the trading features and functionalities on CME Globex®,

and are now benchmarked against international best practices.

- Our Trading Participants

-

The year started well with the introduction of LT International

Futures as a new TP in December 2009. In May 2010, Interactive

Futures became our 20th TP, and we aim to build on this pipeline of

intermediaries, crucial to developing the critical mass and market

liquidity we need. Certain TPs already have an international presence

and we believe the time is opportune to further leverage on these

global linkages.

- Building Blocks: Internationalising Our Derivatives Market and

Growing Average Daily Volume

-

The focus for 2010 has mostly been on putting the building blocks

in place to internationalise our market and grow the average daily

volumes traded. To compete internationally, we can no longer rely

on organic growth. The only way to make that quantum leap is to go

global, and we have made many of the key infrastructure changes in

the form of technological enhancement, rule changes and securing

trade reliefs.

- Technological Infrastructure

-

In 2010, our first task was to develop the technological infrastructure

for our market. Historically, there has been a low take-up rate for

infrastructure by the industry, and it serves as a barrier to entry. To

ensure that all TPs are able to subscribe to a reliable system, Bursa

Malaysia took the initiative to host a CME-certified broker front end

system, better known as OMS. The aim was to provide the industry

with early system readiness to immediately trade on CME Globex®.

CMDF was instrumental in supporting our OMS initiative and has

since funded the one-time software licensing fee for OMS.

In October 2010, one month after the migration to CME Globex®,

we introduced internet trading for derivatives. Internet facilities are

essential to tap into the growing presence of sophisticated traders

and allow for trading by local investors through Malaysian TPs

electronically. Both the OMS and internet trading model are regarded

as necessary catalysts to improve distribution channels.

CME's own telecommunication hub in Kuala Lumpur was launched in

May 2010, and complements our infrastructure. The CME Malaysian

hub will act as an international gateway for greater accessibility by

both local and international traders and connects our market to the

rest of the world.

- Launch of CUPO

-

As means to strengthen Malaysia's position as the global price

benchmark for crude palm oil, BMD licensed CME the right to use the

settlement prices for its RM-denominated FCPO. In May 2010, CME

launched the USD-denominated futures contracts in Crude Palm

Oil, or CUPO. CUPO provides industry players with more arbitrage

opportunities; international players have greater choices for hedging

in dollars to mitigate currency risks.

- Removing Regulatory Barriers to Entry and Securing

Trade Reliefs

-

In April 2010, we received BNM approval for the relaxation of the

Foreign Exchange Administration Rules. Resident futures brokers

are now allowed to make payments, on behalf of residents, to

non-residents for foreign currency-denominated derivatives

(excluding currency contracts) transacted on specified overseas

exchanges. This was greeted favourably by brokers and helps greatly

in the management of risk.

The Derivatives Clearing House has also extended its acceptance on

foreign currency collateral for margin coverage from December 2010

onwards to include Renminbi and Hong Kong dollars in addition to the

current US dollars, Japanese yen and Singapore dollars, to appeal to

a broader investor base.

In June 2010, another milestone was secured with the granting of

trade relief for our TPs. The US CFTC now permits TPs to solicit and

accept orders and customer funds directly from US customers for

trading on the Exchange, without having to register with the CFTC

as Futures Commission Merchants. A TP must make a filing with the

National Futures Association of the US to avail itself of the relief, but

this opens up new market possibilities for TPs. Nine TPs have since

filed with the National Futures Association and avail themselves on

the said relief.

- Market Readiness for Brokers

-

We realised that meaningful market engagement and education were

key. Broker engagement was at the highest levels ever. Together with

our CME partners, "onboarding" and one to one sessions were held

at brokers' premises to ensure that they were ready to migrate to

CME Globex®, both from a technological and market readiness view

point. Vigorous training and education sessions continued for our

internal users, TPs and regulators to familiarise them with OMS, CME

Globex® and its functionalities.

- Increasing Our Sales Force

-

We recognise the need for a continuous supply of sales personnel

to market derivatives products. To this end, we are working closely

with our regulators to see how certain participant requirements

can be liberalised in light of the current business environment,

whilst working on our recruitment campaigns for Locals and FBRs.

We are also exploring with universities how we can build a meaningful

collaboration to encourage the younger generation to venture into the

derivatives market as a career, whether with the Exchange or the

TPs. Over time, we hope to build a sustainable resource model to

continuously replenish this vital support group.

|

Educating Investors and The Market

|

Markets are vibrant, constantly changing places. Staying abreast of

change is a challenge for us, but it is essential if we are to sustain

our relevance and attractiveness. Linked to this is a responsibility to

raise awareness of our offerings and those features which make us

attractive, which means that considerable effort goes into educating

all those who use our markets, or may consider doing so.

|

- Retail Investor Engagements

-

Retail investors have always been a crucial investor segment

for us, and Bursa Malaysia is committed to retaining, developing

and engaging with this segment. Significant effort is put into

understanding, educating and inspiring retail investors. Our

various in-house programmes and collaborative projects with

our partners have a common purpose - we want to develop

a sustainable and diversified investor base, both locally and

internationally.

At the beginning of the year, Bursa Malaysia organised an

industry leadership forum called 'Rethink Retail'. Attended by

various captains of industries, the highlight of this forum was

the sharing of insights into Malaysian attitudes to investing. The

forum's objective was to initiate a mindset change and promote

planning collaboration amongst key stakeholders and partners.

It was also the starting point for various activities designed to

create a more vibrant retail market, by reaching out to young

retail investors and overcoming misconceptions through

education and information.

a. Young Investors

-

Interaction with young Malaysians is a feature of many of

our investor development efforts. Talks were held at Bursa

Malaysia throughout the year for visiting students from

local and foreign universities. Topics covered included an

overview of the capital market and the basic understanding

of investment. We also worked with youth bodies such

as the YCM. Bursa Malaysia sponsored the 1st Annual

Young Corporate Malaysians Summit (Reinventing and

Liberalising Malaysia's Economy) in December 2009, and

I was a participant in the 25th YCM CEO Series in July 2010.

The event was attended by professionals between 21 and

35 years old.

There was also a series of advertorial articles published

in the media, aimed at changing perceptions about

investing in shares and other capital market instruments

as an option to savings, unit trust and investment-linked

insurance.

b. Taking the Word to the Market

-

In line with Bursa Malaysia's retail strategy of sustaining and

engaging existing investors, we continued with our annual

nationwide engagement programme called 'Market Chat'.

Market Chat remains an integral part of Bursa Malaysia's Retail

Investor Engagement Programme and is now in its fourth year

with the launch of the 2010/11 series in October 2010. In total,

there were 58 Market Chat roadshows in 2010. This year, 79

more roadshows will be held at various locations, with a special

focus on the East Coast of Peninsular Malaysia, Sabah and

Sarawak. The latest series is conducted in conjunction with

eight broker partners, and will concentrate on raising the profile

of alternative investment products (CBBCs, ETFs and REITs).

The events will also help create greater awareness of the valueadded

services Bursa Malaysia provides for retail investors,

such as internet trading and e-Dividend.

In June and July 2010, Bursa Malaysia and a local investment

bank jointly organised two retail investment seminars for

high-net-worth individuals. The talks showcased top financial

experts and offered the audience practical strategies and ideas

on surviving and thriving in a climate of global volatility.

We also participated in several retail investor conferences

during the year such as Minggu Saham Amanah Malaysia

2010, Minggu Kesedaran Kewangan 2010 and Asia Trader and

Investor Convention (Singapore and Kuala Lumpur).

c. Awareness of Derivatives

-

In the derivatives area as well, education is a prerequisite if we

are to encourage greater retail participation. During the year,

we jointly hosted educational road-shows, called 'Talk Futures',

with TPs across Malaysia to cater to retailers and FBRs. We have

since seen a gradual growth in the number of futures accounts

maintained. These retail road shows will continue next year as

we aim to bring new, younger players into our market. In 2010,

we successfully conducted 61 Talk Futures roadshows.

Going forward, Bursa Malaysia will continue with its investor

education and retail engagement initiatives. It is our hope that

these efforts will solidify our market position as a primary

catalyst in building an informed investment community

in Malaysia, in line with the country's quest to develop a

knowledge-based economy.

- Institutional Investor Engagements

-

a. Promoting our Securities Market

-

Our annual Invest Malaysia conference has become a

permanent date in the calendars of many institutional investors

from home and abroad. The sixth Invest Malaysia conference

was held in March 2010 and continued to attract local and

foreign institutional investors. IM 2010 was a national effort as

it showcased portfolio and direct investment under one roof.

Invest Malaysia has evolved into a communication platform as

well as a springboard for action. It provides a sounding board

for policy makers who can engage with market participants,

as well as a channel to communicate the Malaysia Story.

The success of these conferences demonstrates that we have

achieved a fine, productive balance between the national

agenda and business agenda.

As a follow-through of IM 2010, an Invest Malaysia road-show

was held in Europe in late June/early July 2010. Meetings

were arranged with targeted new investors as well as opinion

leaders in Paris, London and Edinburgh. Media roundtables

and interviews were also organised as part of the process of

moving towards the upgrade of Malaysia by FTSE to Advanced

Emerging Market status.

More Invest Malaysia roadshows were held in Hong Kong,

Beijing and Tokyo, in October and November 2010. The focus

for Hong Kong and Beijing was mid-tier funds and QDII funds

respectively.

The two over-arching strategic objectives of Invest Malaysia

are business development (diversifying and broadening our

investor base) and communicating the Malaysia Story, as well

as managing external perceptions of our capital market.

b. Profiling our Derivatives Market

-

Institutions are also important players in the derivatives area,

and we organised and participated in various events, together

with our CME partners and third parties. These events were

designed to profile our derivatives market, the partnership with

CME and the products we offer.

Our well known annual POC conference provided a local

platform in March 2010. The third party events included FIA

Chicago, FOW and the FIA Singapore, CIOC China and Globoil

India. Brokers were supportive of our efforts and aggressive in

their own marketing.

In the 'Euromoney' event in Hong Kong, our BMD team joined

forces with BNM and SC officials to conduct several education

and awareness dialogues, designed to dispel myths about

Malaysia's foreign exchange controls through 'Perception vs.

Reality' sessions. The crux of the message was that there are no

restrictions on the trading of derivatives by foreigners in Malaysia

or the repatriating of funds arising from such trading activities.

|

Our Principal Strategic Risks

|

Exchanges do not just serve a domestic investor community; they are

part of a global financial market place. Our environment is extremely

competitive. Issuers, capital and investors have become increasingly

international in their outlook and adept at identifying the best available

option for their needs. To remain relevant in a global context, Bursa

Malaysia must address a wide variety of risks, and I think it is important to

share with you the three which we think outweigh all others:

- Erosion of our competitive position, with Bursa Malaysia regressing

and being marginalised, resulting in our losing ground to other

regional/global markets, with an inability to attract investors and

quality companies to list on Bursa Malaysia.

- Our business strategy does not deliver on its objectives and targets,

with the consequential undermining of confidence in Bursa Malaysia

both as an exchange and as a listed enterprise.

- Ineffective management of talent within the organisation, leading to

loss of key personnel to competitor exchanges or to issuers.

These are not unusual risks, but that does not mean we should give them

less than full attention. It will also be apparent that these are risks that

cannot easily be targeted with specific remedial actions. They affect the

entire enterprise and are to be found in most of our different activities

to some extent or another. The only way to address these issues is by

working with policy makers, coupled with a holistic approach woven to

our plans and strategies. In the following section I will talk more about

the plans we have in our primary markets which are designed to keep us

competitive and emphasise our differentiated value proposition.

On the human capital front, there is a special section in this

Annual Report which describes our concerted efforts to attract,

grow and retain the talent that is so essential for us to thrive in a

competitive world.

|

Technology & Systems

|

Most of our innovations and new strategies require essential support

in the form of technology and systems for them to be effective.

On the derivatives front, this has certainly been true as we have

developed our partnership with CME. As mentioned earlier, electronic

access to BMDs' products for both local and international traders is

provided through the CME Globex® electronic trading platform. This

is complemented by multiple access points through international

telecommunications hubs. The next step will be to implement a

new Derivatives Clearing and Settlement system, which will provide

higher capacity and functionality to further improve our market and

services.

In the securities markets, our recently introduced e-services were

built to deliver speed and convenience, while providing better account

management and greater security for investors. In the coming year,

we plan to develop a more robust and agile infrastructure. We aim

to demarcate the trading and non-trading functions, so that less

customisation is needed on the trading system and there is minimal

interdependency between these systems.

As part of our efforts to improve overall technology efficiency and

capability, we have implemented an enterprise-wide customer

service system which caters to all our internal and external

customers. This facility provides a single point of contact through

which all customers can channel their requests and issues.

Internally, a common storage infrastructure has been established

to provide a centralised automated backup infrastructure for all

systems in Bursa Malaysia. This helps minimise operational costs

through effective automation and systems management.

|

Our Regulatory Role

|

A well regulated market place will remain an important focus area

for Bursa Malaysia. We seek to ensure that our market is conducive

for both capital raising and investment by practicising sound

regulatory principles and in doing so we are guided by the following

core objectives:

- protection of investors;

- ensuring that markets are fair, efficient and transparent; and

- reduction of systemic risk.

For this purpose we have a robust framework in place for regulating the

market guided by our philosophy of being balanced and outcome based.

The framework encompasses our regulatory goals, action plans and

strategies for regulating the market. Our key areas of focus in achieving

our regulatory goals are as follows:

- raising the standard of CG by PLCs;

- improving the quality and timeliness of disclosures to the market;

- raising the standards of business conduct by market participants;

- increasing the effectiveness of our enforcement activities; and

- elevating the level of education and awareness-raising activities for

the industry.

We continuously improve on our regulatory effectiveness by, amongst

others, assessing the outcomes that we achieve, reviewing and

keeping abreast with developments in other markets and best practices

recommended by the relevant industry organisations. This enables us to

further improve and refine our regulatory approaches.

Together with this, we are also constantly reviewing our processes to

ensure that we remain efficient and optimum in utilisation of resources to

meet our deliverables and time to market for regulatory approvals sought

by industry from the Exchange.

A more detailed commentary on our regulatory functions appears on

page 50 to 53 of this annual report.

|

Today and Tomorrow

|

In 2010, we worked at bringing new listings to the market, addressing

some of our macro structural issues and realising value propositions,

especially from our CME partnership and the building of our Islamic

market presence. It is these factors which set Bursa Malaysia apart and

will drive us forward as a unique international exchange.

Our medium term targets remain in place. In terms of velocity in

the securities market, our focus will be to achieve a 60% level. In the

derivatives market, especially with the benefit of our relationship with

CME, our target is to double the volume of contracts.

Moving into 2011 and beyond, we continue to be committed to ensuring

the market is sustainable, attractive and vibrant. Our efforts will intensify

to increase market competitiveness as well as to develop the robustness

and resilience of our market.

Our broad strategic plan revolves around five strategic thrusts which we

regard as key to ensuring our sustainability, relevancy and vibrancy of our

markets:

-

Revitalising the Market

- Make the process of trading easier, reduce the friction of

transacting on our markets and adapt to new requirements;

- These will be manifested by strengthened liquidity, improved

trading velocity and increased vibrancy of the market.

-

Developing World Class Capability and Capacity

- Develop well-versed, highly skilled and committed manpower

to drive a thriving, innovative and efficient capital market;

- Through thought-leadership, Bursa Malaysia aims to be at the

forefront of the industry.

-

Improving the 'Eco-System'

- Promote further liberalisation of the market by working closely

with relevant policy makers;

- Encourage greater participation from PLCs and market

intermediaries to increase market competitiveness.

-

Improving Efficiency and Productivity

- Review our market structure as well as simplify rules and

processes to make it more efficient and cost effective;

- Continuously upgrade our infrastructure.

-

Internationalising the Market

- Extend our global appeal and facilitate foreign access to our

markets by foreign investors and issuers;

- Expand the range of international products.

- Securities Market

-

A vibrant market is essential if Bursa Malaysia is to continue to be

attractive to investors and issuers. We will step up efforts, together

with other industry stakeholders, to attract more large capitalisation

issuers, with sizeable free floats. Other action plans include

introducing intra-day shorting, increasing the number of PDTs and

improving overall trading liquidity. Efforts will also be put in ensuring

ease of trading, a transparent and readily understood regulatory

environment and improved market infrastructure.

We will continue to promote intra-ASEAN trading to diversify and

expand financial choices available to investors, and improve the

efficiency of delivery of financial products and services. We are

also putting together an international board which will bring foreign

securities closer to our investors, create a more diverse investor base,

and further internationalise our markets. As for the bond market, we

are currently working on guidelines and a framework which will

allow for direct retail participation in listed corporate bonds, making

this important segment available to a far wider investment audience

than before.

- Derivatives Market

-

From a technological perspective, our work is never finished. In 2011,

we will see a period of post-stabilisation following our migration

to CME Globex®. We will also undertake a major technological

enhancement by developing a new Derivatives Clearing System. This

agile system will be multi functional and possess multi currency,

multi asset class and multi time-zone capabilities needs.

To further broaden our market horizon, we will widen our distribution

channels, increase our sales force and provide greater accessibility

to our products. The volume growth coupled with improved

participation from foreign players post CME Globex®, are early

indicators of validation of the globalisation path that Bursa Malaysia

has taken for the derivatives business segment. 2011 will certainly

see a continuation of the process of internationalisation and growth.

- Islamic Market

-

The global market for Islamic financial products has grown at an

average rate of 20% over the last five years. Malaysia's position at

the forefront of this development is largely attributable to the MIFC

initiatives, to which Bursa Malaysia is a key contributor. We are proud

that Bursa Malaysia is the only market in the world with an Islamic

Capital Markets regulatory framework. We are pleased, also, to be

one of very few exchanges offering a range of Shari'ah compliant

products in the securities markets.

The resilience of the Islamic banks in the recent global financial

crisis proved that Shari'ah compliant finance is a viable alternative to

conventional markets as it is disengaged from speculative financial

products which do not have an underlying asset base. These

products are often cited as a primary cause of the "credit crunch",

the excesses which led to the near collapse of financial markets, and

the global economic recession which followed. As a result, the appeal

of the Islamic investment products has been enhanced as investors

seek to diversify risk in their portfolios. At Bursa Malaysia, we have a

range of Shari'ah compliant products encompassing listed equities,

ETFs and REITs.

Not surprisingly, Islamic markets and Islamic products feature large

in Bursa Malaysia's development plans. They are an aspect of our

exchange which differentiates us from our competitors, and they are

a key element in our initiatives to internationalise our markets. We

are committed to remain a thought leader and a pioneer in innovation

as the development of Islamic financial products transforms Islamic

finance into a global industry.

|

The Bigger Picture

|

Bursa Malaysia is a key element of the national financial infrastructure,

and we expect to accommodate changes as policy makers push ahead

with their agenda and introduce new measures that include:

- Liberalising equity holding requirements and investment limits,

such as allowing GLICs increase investment in overseas markets to

explore opportunities for better returns;

- Further divestment by GLICs, which will increase the free float in the

market, potentially triggering significant increases in stock turnover,

benefitting larger players in particular;

- Issue of new stock-broking licenses to eligible local, foreign or

joint-venture companies to increase retail market participation;

- Relaxing some of the processes and procedures for the listing of

companies and products; and

- Enhancing cooperation with regional and, possibly, other foreign

bourses.

It is expected the BRICs as well as selected ASEAN markets will

grow faster than other markets, while traditional financial centres

will see declines in terms of market capitalisation and market share.

Positioning Bursa Malaysia to take advantage of this trend in its

broader businesses as well as its specialisations will present many

demands. Our special niches in commodities and Islamic offerings

will be a particular focus, while efforts to boost our broader securities

and derivatives presence will continue.

I am confident we have the building blocks and capabilities to

promote the success of Bursa Malaysia as a regional leader.

|

In Appreciation

|

As always, there are many who have contributed to the year just

passed. What has been gratifying is the willingness of so many

market participants to add their weight to our efforts, and my thanks

go to all of you.

The policy-makers and regulators have shown an ability to take

bold steps to help develop our markets and our products, and are

set to continue doing so. Our business partners and the investment

community at large have been generous with their support and

comments, all of which helped us improve.

Our directors have provided guidance and encouragement, and had

a positive impact in terms of improving our governance and business

processes.

Underpinning it all is that special group we sometimes call 'Warga

Bursa' (the Bursa Family). They have helped us shape our values and

drive the changes that are needed for us to remain relevant and create a

genuine value proposition for all who use the exchange. They are an

exceptional bunch.

Finally, the support of our shareholders is paramount as we address

the challenges that face us in such a competitive sphere as ours.

Your continued interest in our endeavours is reflected not only in the

support of our share price, but also in the variety and frequency of the

feedback we receive from our electronic and other communication

channels. We are most grateful, and our efforts to deliver superior

returns to our shareholders will continue.

|

|