Bursa Malaysia • Annual Report 2013

4

The Year in Brief

Cost to Income Ratio

48.3

%

ROE

20.7

%

(

improved

3percentage

points

)

2012: 17.7%

EPS

32.5

sen

(+15%)

2012: 28.3 sen

RM439.8

million

(+13%)

2012: RM388.5 million

Operating Revenue

RM173.1

million

(+15%)

2012: RM150.6 million

PATAMI

(

improved

1percentage

point

)

2012: 49.3%

Financial Highlights

* CAGR: Compounded Annual Growth Rate

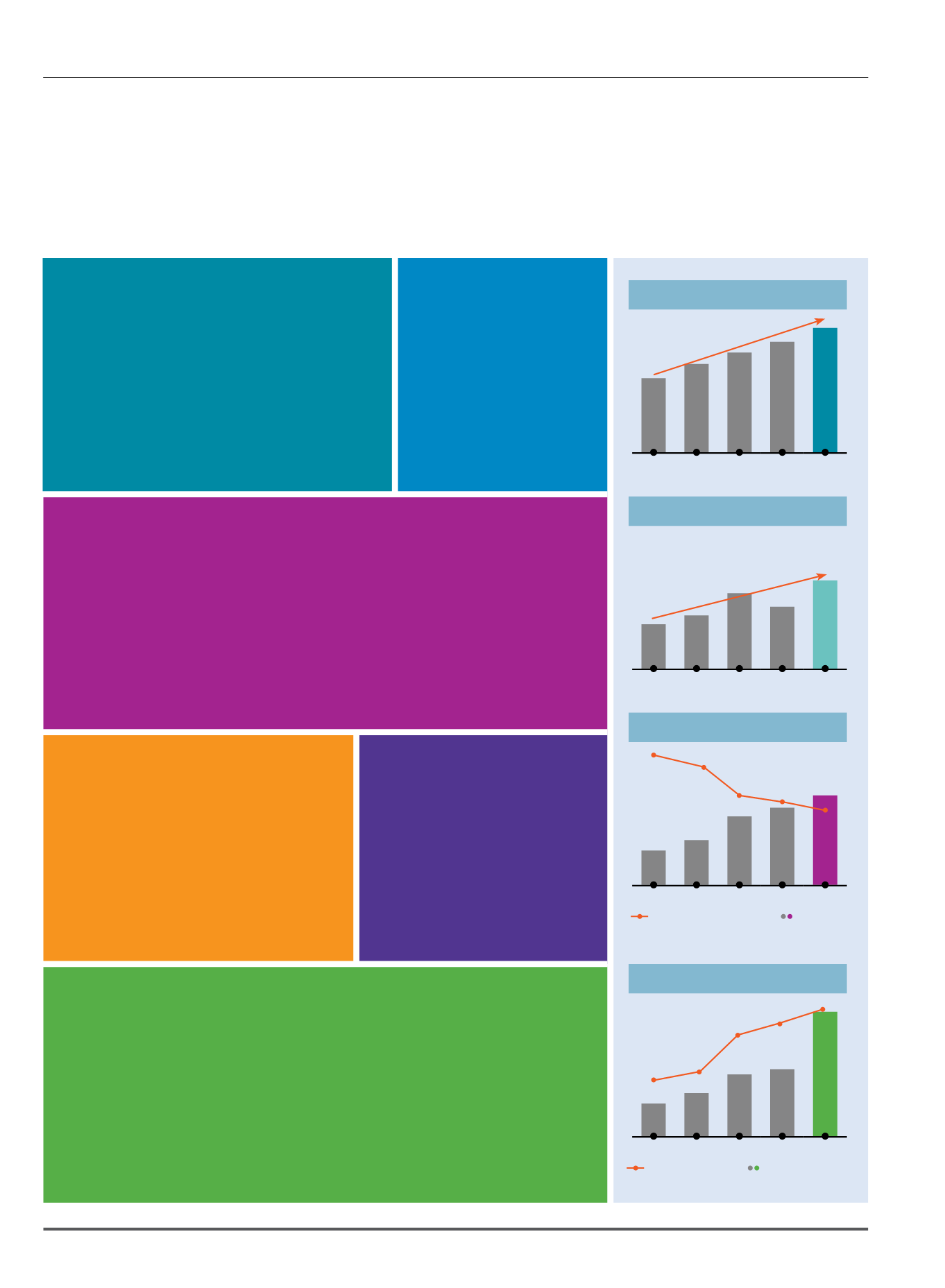

Operating Revenue (RMmillion)

2009 2010 2011 2012 2013

297.8

331.3

381.5

388.5

439.8

*CAGR: 10%

Operating Expenses (RMmillion)

2009 2010 2011 2012 2013

181.9

196.6

212.0

209.2

229.4

2.4 2.6

4.3

6.3

Net Dividend andDividendYield

2009 2010 2011 2012 2013

17.8

20.0

26.0

27.0

52.0

Dividend Yield (%)

Net Dividend (sen)

3.9

Net Dividend per Share

52

sen

(+93%)

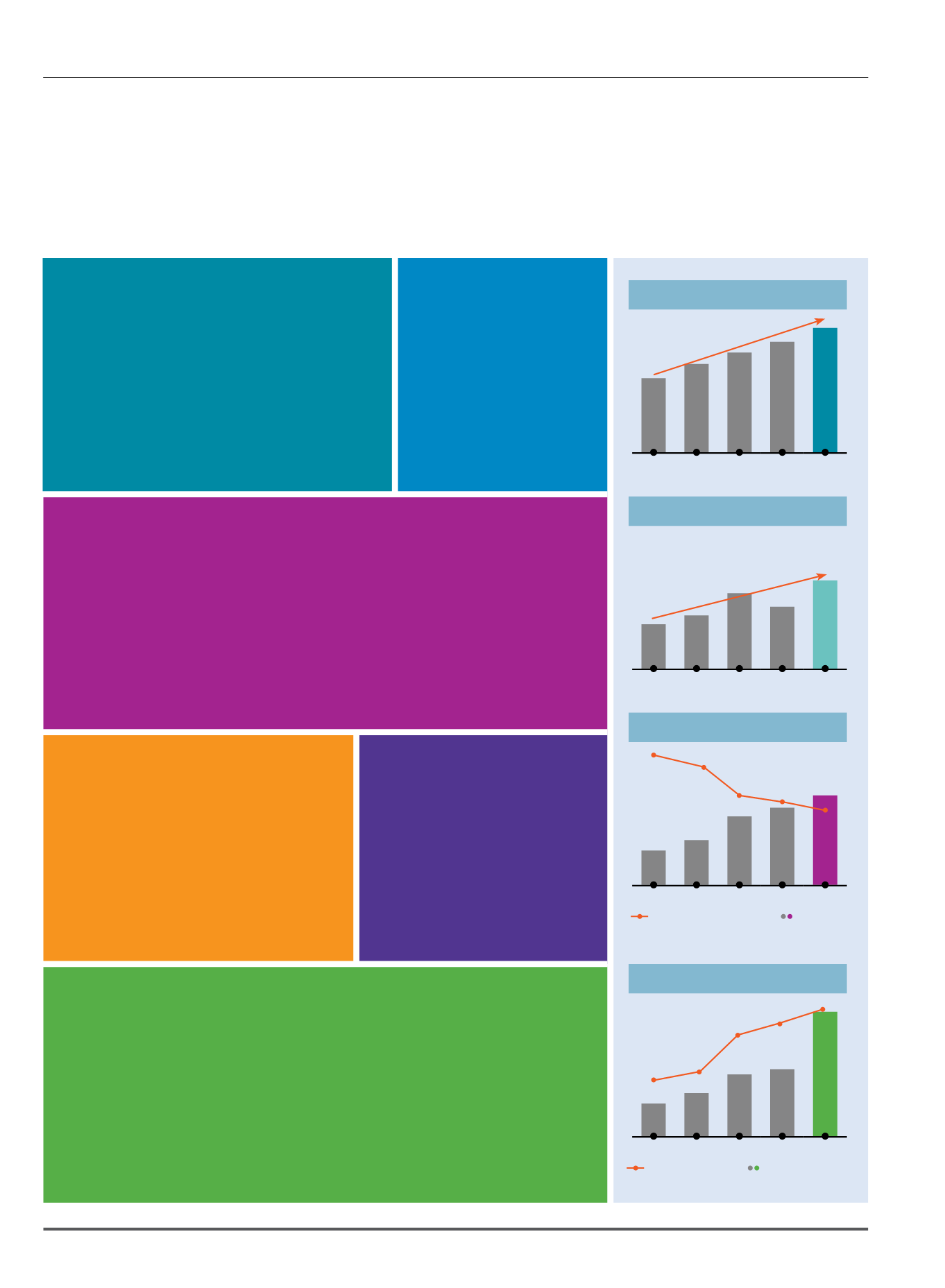

PATAMI and Cost to Income Ratio

2009

1

2010 2011 2012 2013

98.6

56.5

54.7

51.1

49.3 48.3

111.9

143.1

150.6

173.1

Cost to Income Ratio

(%)

PATAMI

(RM million)

1

Excludes gain from part disposal of

Bursa Malaysia Derivatives Berhad Group

*CAGR: 6%

2012: 27 sen