Bursa Malaysia • Annual Report 2013

5

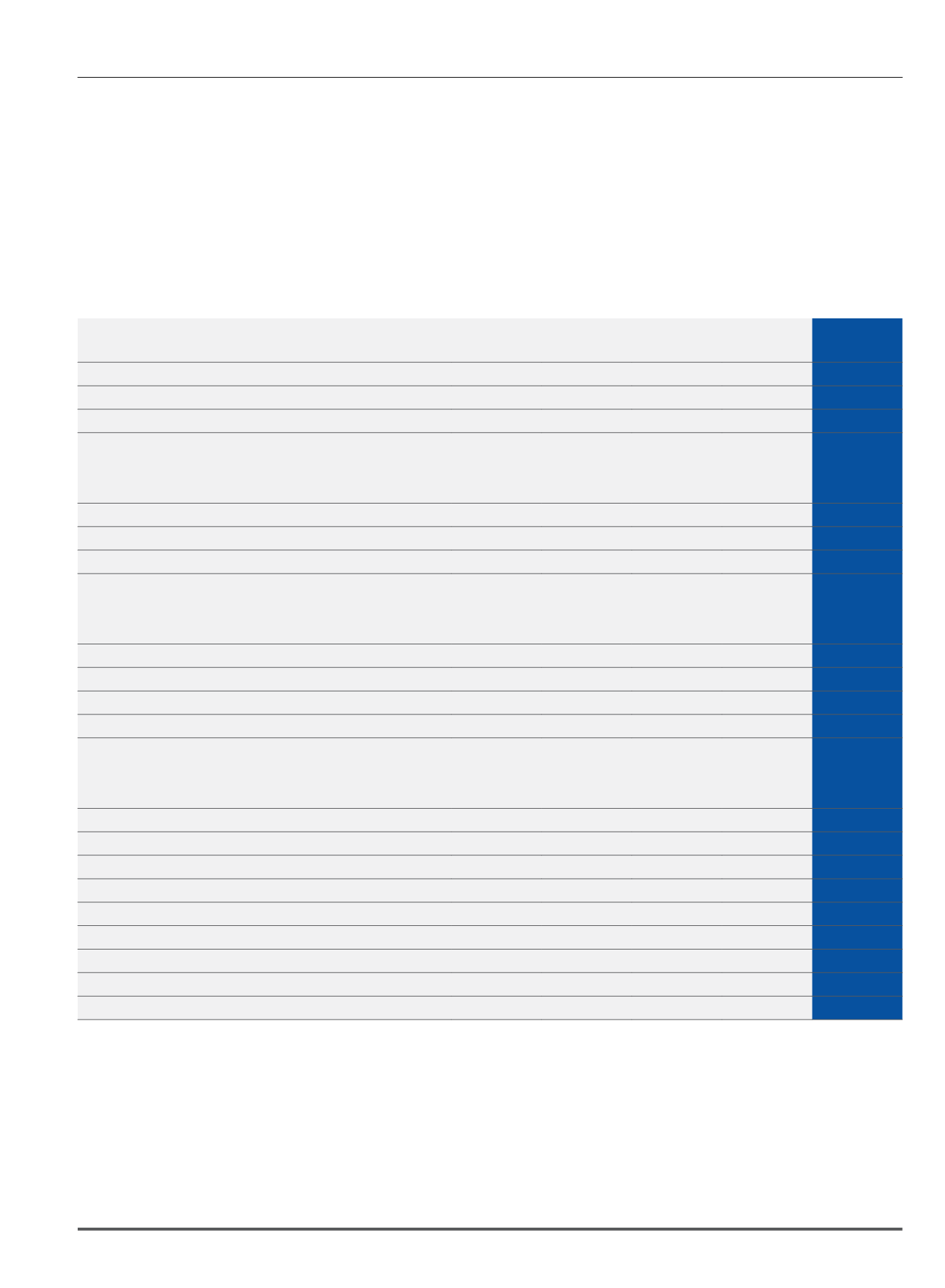

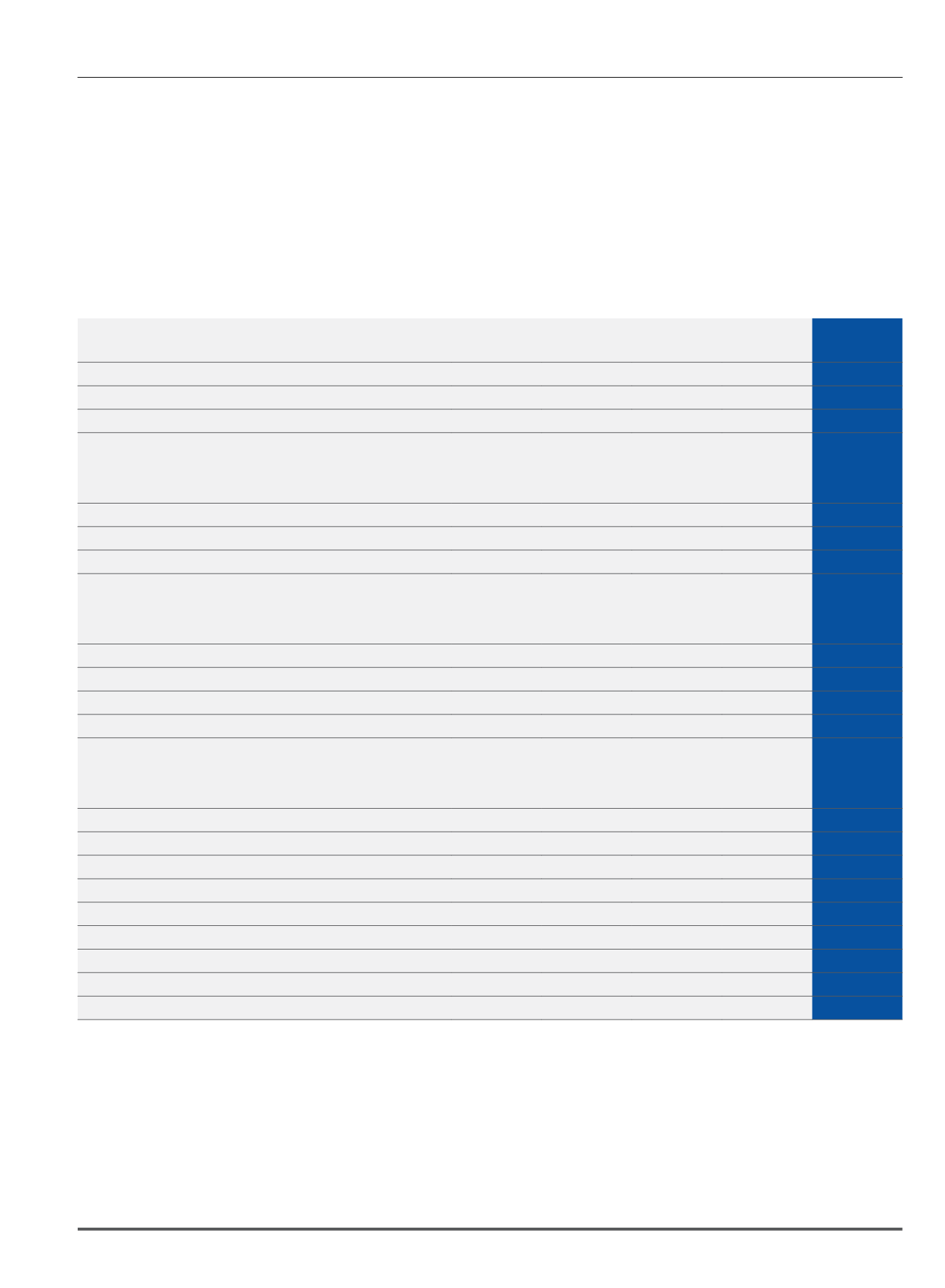

Our Performance

The Year in Brief

5-Year Highlights

31 DEC 2009 31 DEC 2010 31 DEC 2011 31 DEC 2012 31 DEC 2013

Key Operating Results (RM million)

Operating Revenue

297.8

331.3

381.5

388.5

439.8

Operating Expenses

1

181.9

196.6

212.0

209.2

229.4

Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA)

230.8

177.9

207.9

212.9

245.4

Profit after Tax and Minority Interest (PATAMI)

1

174.6

111.9

143.1

150.6

173.1

Other Key Data (RM million)

Total Assets

1,786.6

1,708.3

1,673.5

2,198.4

1,741.7

Total Liabilities

1

947.2

855.1

818.4

1,325.1

914.2

Shareholders' Equity

1

830.8

841.9

840.8

857.6

811.2

Capital Expenditure

22.1

21.9

13.6

26.7

33.3

Financial Ratios (%)

Operating Revenue Growth

(1.5)

11.2

15.2

1.8

13.2

Cost to Income Ratio

1

45.7

54.7

51.1

49.3

48.3

Net Profit Margin

1

43.9

31.9

35.7

36.9

37.8

PATAMI Growth

1

67.2

(35.9)

27.8

5.2

14.9

Return on Equity (ROE)

1

22.4

13.4

17.0

17.7

20.7

Share Information

Earnings per Share (EPS) (sen)

1

33.1

21.1

26.9

28.3

32.5

Net Dividend per Share (sen)

17.8

20.0

26.0

27.0

52.0

Dividend Yield (%)

2.4

2.6

3.9

4.3

6.3

Payout Ratio (%)

92.9

94.0

94.6

94.8

98.5

Net Assets per Share (RM)

1

1.57

1.58

1.58

1.61

1.52

Share Price - High (RM)

8.59

8.66

9.02

7.72

8.47

Share Price - Low (RM)

4.36

6.75

5.76

5.91

6.22

Share Price as at 31 December (RM)

7.99

7.80

6.70

6.22

8.23

Price Earnings Ratio (times)

1

24

37

25

22

25

Company Market Capitalisation (RM billion)

4.2

4.1

3.6

3.3

4.4

1 Comparative figures and ratios have been restated to take into account the effects of:

i.

Fines and related expenses no longer recognised in profit or loss following the setting up of Capital Market Education and Integrity Fund (CMEIF) on 1 January 2013.

ii.

Actuarial gains and losses recognised following the adoption of MFRS 119

Employee Benefits (revised)

on 1 January 2013.

2 The results and ratios for 2009 which exclude the gain on disposal of a subsidiary are as follows:

i.

EBITDA: RM154.8 million

ii.

PATAMI: RM98.6 million

iii.

Cost to Income Ratio: 56.5%

iv.

Net Profit Margin: 24.8%

v.

PATAMI Growth: (5.6%)

vi.

ROE: 12.7%

vii.

EPS: 18.7sen

3 PATAMI growth for 2010 which excludes the gain on disposal of a subsidiary in 2009 is 13.5%.

2

3