Notes to the financial statements

31 December 2014

Bursa Malaysia

•

Annual Report 2014

122

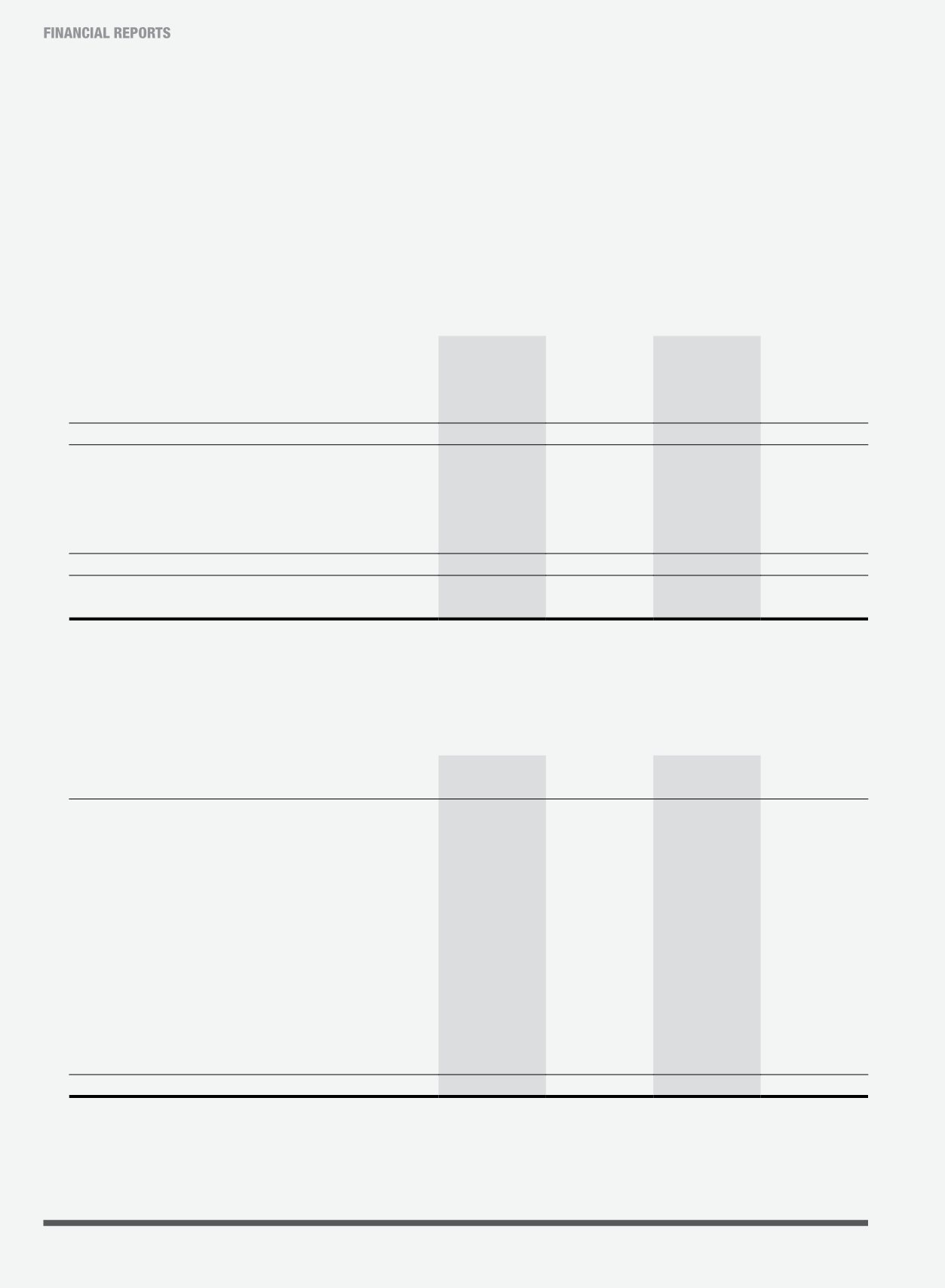

9. Income tax expense

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Income tax:

Current year provision

74,844

68,602

327

1,810

Under/(over) provision of tax in prior years

70

(7,434)

72

(2,132)

74,914

61,168

399

(322)

Deferred tax (Note 18):

Relating to origination and reversal of temporary differences

(5,258)

(2,288)

(2,741)

(1,504)

Relating to reduction in Malaysian income tax rate

(918)

-

(820)

-

(Over)/under provision of tax in prior years

(1,001)

7,315

(1,001)

7,192

(7,177)

5,027

(4,562)

5,688

Total income tax expense

67,737

66,195

(4,163)

5,366

The reconciliation between tax expense and the product of accounting profit multiplied by the applicable corporate tax rate for the years ended 31 December

2014 and 31 December 2013 is as follows:

Group

Company

2014

2013

2014

2013

RM’000

RM’000

RM’000

RM’000

Accounting profit before tax

271,759

245,580

170,473

126,369

Taxation at Malaysian statutory tax rate of 25%

67,940

61,395

42,618

31,592

Deferred tax not recognised in respect of current year’s tax losses

1

89

-

-

Effect of tax rate of 3% on profit before tax for

subsidiary incorporated in Labuan

(55)

(35)

-

-

Effect of expenses not deductible for tax purposes

5,670

5,981

4,949

5,181

Effect of reduction in Malaysian income tax rate

(918)

-

(820)

-

Effect of income not subject to tax

(1,637)

(911)

(49,981)

(36,262)

Recognition of previously unrecognised deferred tax assets

(1,586)

-

-

-

Utilisation of previously unrecognised tax losses by a subsidiary

(747)

-

-

-

Utilisation of subsidiaries losses under group relief

-

(205)

-

(205)

Under/(over) provision of income tax in prior years

70

(7,434)

72

(2,132)

(Over)/under provision of deferred tax in prior years

(1,001)

7,315

(1,001)

7,192

Tax expense for the year

67,737

66,195

(4,163)

5,366

In the previous financial year, the Group and the Company’s tax charge was reduced by RM205,000 as unutilised tax losses of certain subsidiaries were offset

against its taxable income. No payments were made by the Company to its subsidiaries for the surrendering of these tax losses.

The Malaysian statutory tax rate will be reduced to 24% from the current year’s rate of 25%, effective year of assessment 2016.