Notes to the financial statements

31 December 2014

Bursa Malaysia

•

Annual Report 2014

161

36. Financial risk management objectives and policies (cont’d.)

(c) Market risk: Foreign currency risk (cont’d.)

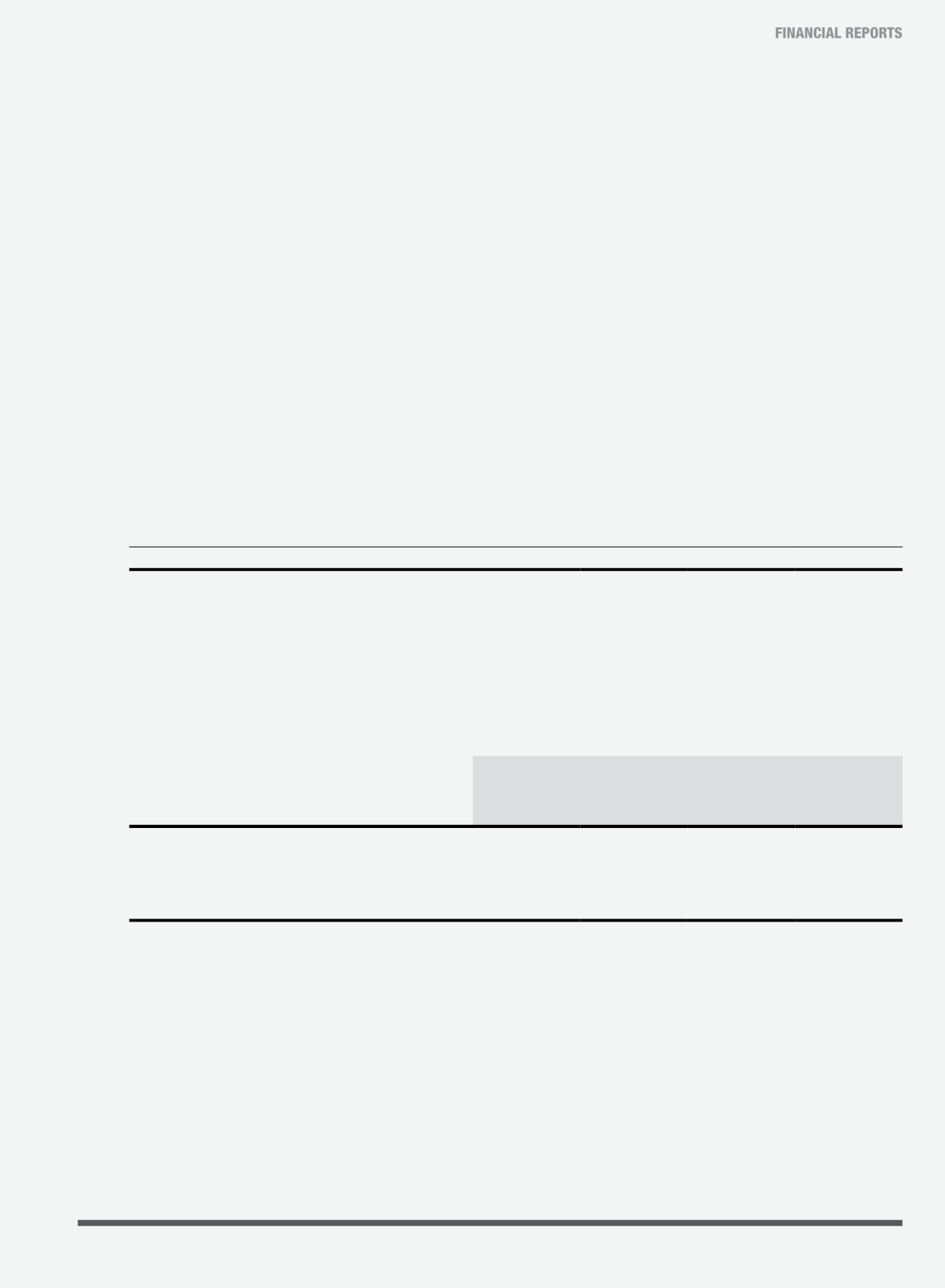

USD

SGD

Total

RM’000

RM’000

RM’000

Group

At 31 December 2013

Financial assets

Cash for trading margins and security deposits

275,500

1,045

276,545

Financial liabilities

Trade payables

(275,500)

(1,045)

(276,545)

-

-

-

The following table demonstrates the sensitivity of the Group and of the Company’s profit after tax and equity to a reasonably possible change in the

exchange rates against the respective functional currencies of the Group’s entities, with all other variables held constant.

Group

Company

Profit

after tax

Equity

Profit

after tax

Equity

RM’000

RM’000

RM’000

RM’000

At 31 December 2014

USD - strengthen by 5% against RM

(157)

5,932

-

5,932

SGD - strengthen by 5% against RM

(2)

(2)

(2)

(2)

At 31 December 2013

USD - strengthen by 5% against RM

(98)

4,927

(3)

4,927

SGD - strengthen by 5% against RM

(2)

(2)

(2)

(2)

An equivalent weakening of the foreign currency as shown above would have resulted in an equivalent, but opposite, impact.

(d) Liquidity risk

Liquidity risk is the risk that an entity will encounter difficulty in meeting its financial obligations due to a shortage of funds.

(i) Liabilities related risk

The Group and the Company maintain sufficient levels of cash and cash equivalents to meet working capital requirements. The Group and the

Company also maintain a reasonable level of banking facilities for contingency operational requirements.