Notes to the financial statements

31 December 2014

Bursa Malaysia

•

Annual Report 2014

171

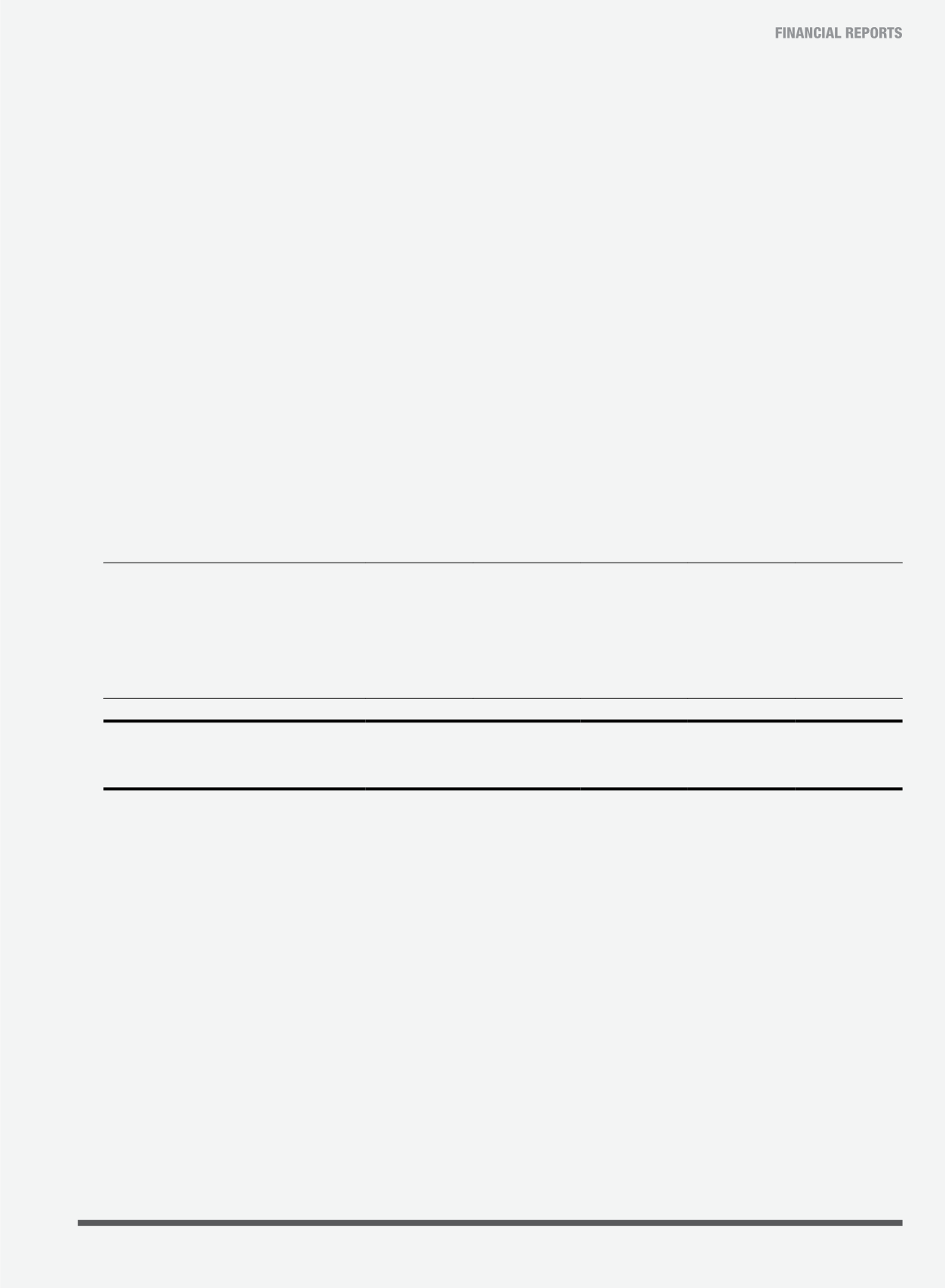

37. Classification of financial instruments (cont’d.)

AFS

HTM

Loans and

receivables

Financial

liabilities at

amortised cost

Total

RM’000

RM’000

RM’000

RM’000

RM’000

Company

At 31 December 2013

Assets

Investment securities

- Shares (quoted equity)

98,584

-

-

-

98,584

- Bonds

26,545

-

-

-

26,545

- Commercial papers

-

9,723

-

-

9,723

125,129

9,723

-

-

134,852

Staff loans receivable

-

-

7,259

-

7,259

Trade receivables

-

-

1,286

-

1,286

Other receivables which are financial assets *

-

-

6,208

-

6,208

Due from subsidiaries

-

-

30,682

-

30,682

Cash and bank balances

-

-

144,759

-

144,759

Total financial assets

125,129

9,723

190,194

-

325,046

Liability

Other payables which are financial liabilities **

-

-

-

7,403

7,403

*

Other receivables which are financial assets include deposits, interest receivables, sundry receivables and allowance for impairment as disclosed in Note 20.

** Other payables which are financial liabilities include sundry payables as disclosed in Note 30.

38. Fair value

(a) Financial instruments that are carried at fair value

AFS financial assets are measured at fair value at different measurement hierarchies (i.e. Level 1, 2 and 3). The hierarchies reflect the level of objectiveness

of inputs used when measuring the fair values.

(i) Level 1: Quoted prices (unadjusted) in active markets for identical assets.

Quoted equity is measured at Level 1. The fair value of quoted equity is determined directly by reference to its published market bid price at the

financial year end.

(ii) Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset, either directly (i.e. prices) or indirectly (i.e. derived

from prices).

Unquoted bonds are measured at Level 2. The fair value of unquoted bonds is determined by reference to the published market bid price of unquoted

fixed income securities based on information provided by Bond Pricing Agency Malaysia Sdn Bhd.