Notes to the financial statements

31 December 2014

Bursa Malaysia

•

Annual Report 2014

165

36. Financial risk management objectives and policies (cont’d.)

(e) Credit risk (cont’d.)

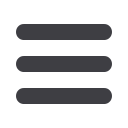

Receivables

The ageing analysis of the Group and the Company’s receivables are as follows:

Total Impaired

Neither

past

due nor

impaired

Past due not impaired

Total

past

due not

impaired

Note

< 30

days

31-60

days

61-90

days

91-180

days

>181

days

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

Group

At 31 December 2014

Staff loans receivable

17

6,671

-

6,671

-

-

-

-

-

-

Trade receivables

19

41,677

388

32,667

4,426

2,440

346

1,043

367

8,622

Other receivables which

are financial assets *

20

15,456

6,268

9,188

-

-

-

-

-

-

At 31 December 2013

Staff loans receivable

17

7,944

-

7,944

-

-

-

-

-

-

Trade receivables

19

33,234

501

26,388

3,394

1,167

380

480

924

6,345

Other receivables which

are financial assets *

20

16,694

7,004

9,690

-

-

-

-

-

-

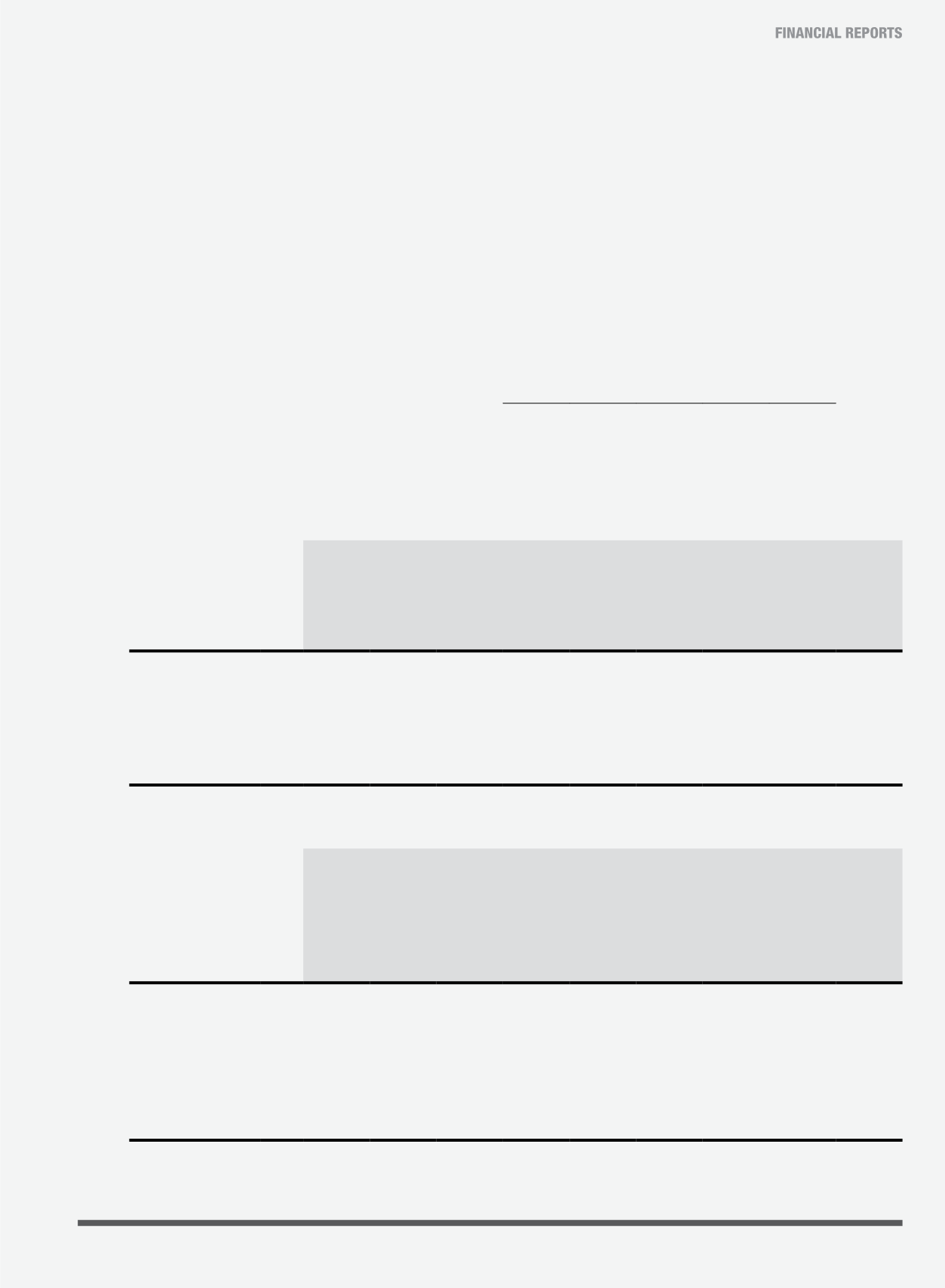

Company

At 31 December 2014

Staff loans receivable

17

6,078

-

6,078

-

-

-

-

-

-

Trade receivables

19

1,196

258

354

270

83

84

102

45

584

Other receivables which

are financial assets *

20

8,376

2,584

5,792

-

-

-

-

-

-

Due from subsidiaries

21

44,702

11,855

32,847

-

-

-

-

-

-

At 31 December 2013

Staff loans receivable

17

7,259

-

7,259

-

-

-

-

-

-

Trade receivables

19

1,480

194

498

506

63

56

54

109

788

Other receivables which

are financial assets *

20

8,883

2,675

6,208

-

-

-

-

-

-

Due from subsidiaries

21

42,533

11,851

30,682

-

-

-

-

-

-

* Other receivables which are financial assets include deposits, interest receivables and sundry receivables.