TO OUR SHAREHOLDERS

57

Bursa Malaysia •

Annual Report 2015

Since its inception, Bursa Malaysia’s circuit breaker has only been triggered

once in 2008. It is tested regularly as part of the Exchange’s Business

Continuity Test. The mechanism remains a relevant and effective control

measure for market integrity in Bursa Malaysia and contributes to the

resilience of our marketplace.

PRICE LIMITS MECHANISM

Bursa Malaysia has always enforced Static Price Limits as the market

safeguard. Static Price Limits prescribe the maximum fluctuation in price

for a trading day of a stock.

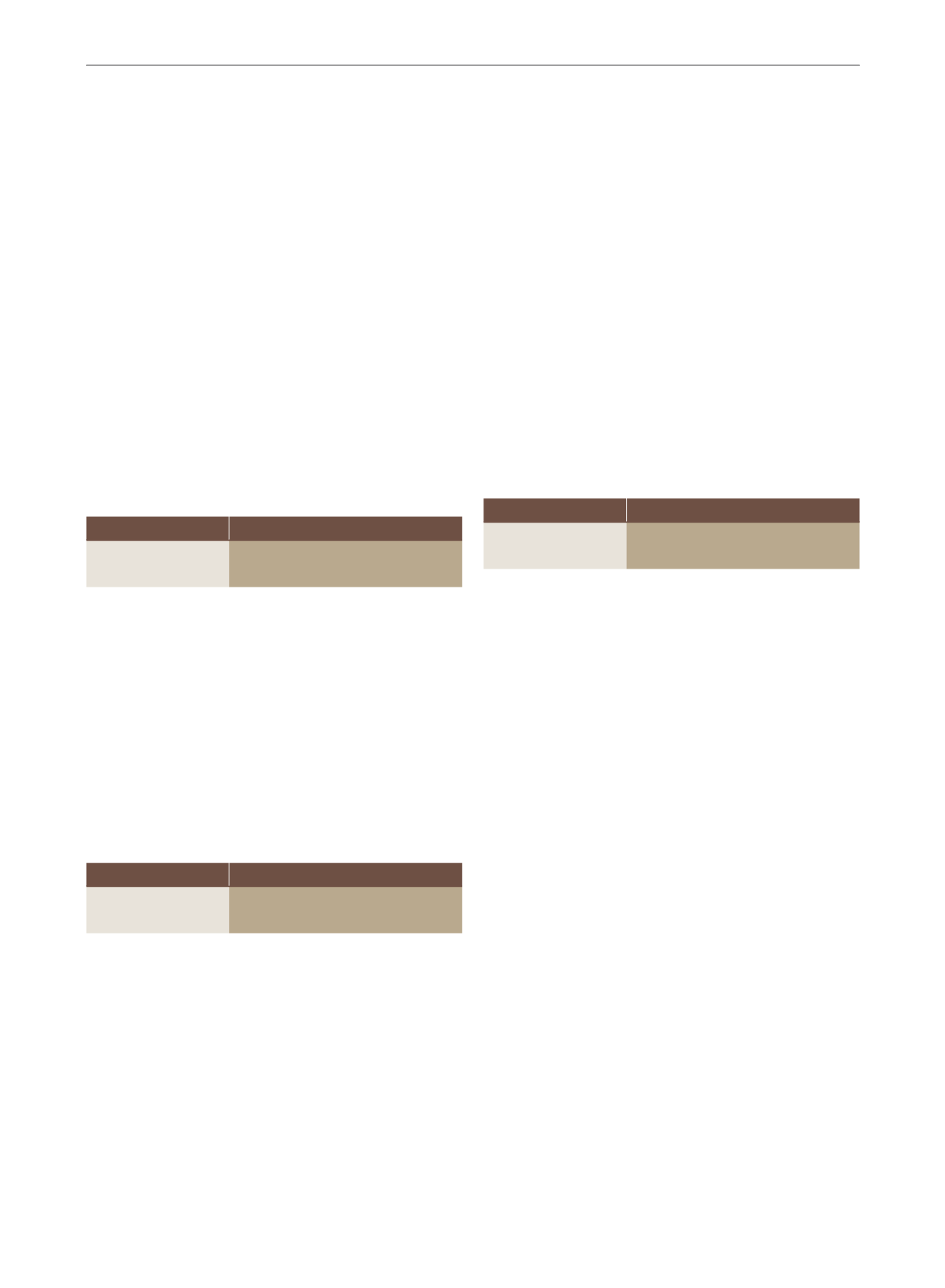

Static Price Limits Range

Reference Price

Static Price Limits Range

BELOW RM1.00

+/- RM0.30 FROM THE REFERENCE PRICE

RM1.00 AND ABOVE

+/- 30% FROM THE REFERENCE PRICE

This safeguard ensures a fair and orderly marketplace for the investors.

In addition to the wider Static Price Limits, Dynamic Price Limits (at stock

level) mechanismwas introduced in 2013 as an additional market safeguard.

This brings Bursa Malaysia in line with international best practice as it is

also being practiced by other exchanges such as in Australia, UK and US.

The Dynamic Price Limits provide upper and lower thresholds in percentage

or absolute terms that are actively updated in response to price changes.

This mechanism increases the sensitivity of the market safeguard to

respond to sudden price fluctuations, which may suggest disorderliness in

the trading of the stock.

Dynamic Price Limits Range

Last Done Price

Dynamic Price Limits Range

BELOW RM1.00

+/- RM0.08 FROM THE LAST DONE PRICE

RM1.00 AND ABOVE

+/- 8% FROM THE LAST DONE PRICE

The mechanism is designed to address potentially disruptive orders

without interrupting regular orders during trading. When an incoming order

attempts to match an existing order at a price outside the Dynamic Price

Limits range, the incoming order will be purged without disrupting the

matching of other regular orders.

The Dynamic Price Limits of the stock can be revoked and suspended for

10 minutes upon request in the event that an investor wishes to have the

orders matched at a price outside of the range. To ensure transparency, the

marketplace will be duly informed prior to the revocation.

In recognising the importance of closing price, the Exchange instituted

Last Price Limits in 2014. While Dynamic Price Limits are set to manage

erratic volatility in price during continuous trading phase, Last Price Limits

managed the closing price by regulating the theoretical closing price and

order entry during the pre-closing phase.

Last Price Limits Range

Last Done Price

Last Price Limits Range

BELOW RM 1.00

+/- RM0.08 FROM THE LAST DONE PRICE

RM1.00 AND ABOVE

+/- 8% FROM THE LAST DONE PRICE

In the absence of a current last done price, a reference price will be used

instead. All unmatched orders from the continuous trading phase will be

carried forward to the pre-closing phase. Any new orders during the pre-

closing phase is required to fall within the Last Price Limits range. This

mechanism will ensure that the closing price is determined in a fair and

orderly manner.

IMPROVING EFFICIENCY WITH TECHNOLOGY

The technological requirements of our marketplace have grown in tandem

with the expansion of our regional and global presence. Technology has

become indispensable in enabling market access, facilitating efficient

settlements and protecting the data and security of our market participants.

We are proud to report that we maintained a 100% uptime for all three

of our markets in 2015, while making upgrades that will ensure greater

efficiency and protection. These changes include:

• Replacing Bursa LINK

We replaced our existing Bursa Link infrastructure to increase efficiency

and provide enhanced functionalities to the listed issuers. The new

system optimises business processes with enhanced functionalities

for data submission through web browsers. The new system also

facilitates online listing applications to help Bursa Malaysia better

serve its clients. Arising from this, all paper based applications by

listed issuers have been replaced with online applications.

MARKETPLACE REPORT:

FAIR AND ORDERLY MARKET