THE YEAR IN BRIEF

Bursa Malaysia

•

Annual Report 2014

16

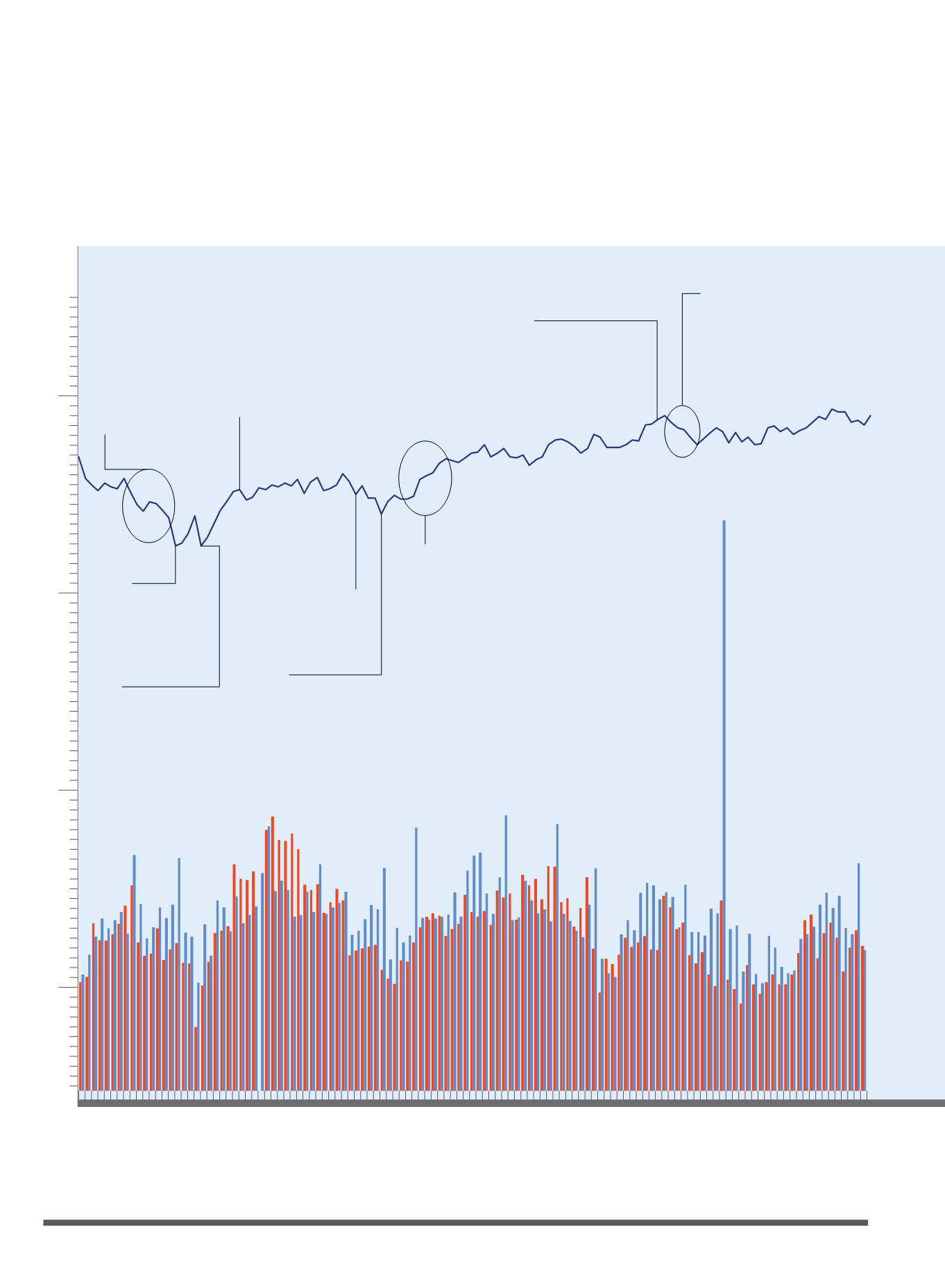

MARKET PERFORMANCE

2000

1800

1600

1400

1200

JAN

FEB

MAR

APR

MAY

JUN

FBM KLCI

(Points)

Jan 15 to 24:

Market sentiment dampens

following weak economic

data in China and the U.S.,

concerns over potential further

fund outflows from emerging

markets and political turmoil

in Thailand

Jan 27:

FBM KLCI falls by 1.31% on

fears over further reduction

of stimulus in the U.S. as

well as China’s slowing

economic growth

Feb 12:

Dovish comments from the new U.S. Federal

Reserve chairwoman, Janet Yellen, in her

maiden testimony to Congress and an

announcement on the extension of the U.S.

debt ceiling for another year boost sentiment

Bank Negara Malaysia (BNM) announces

that the Malaysian economy grew by 4.7% in

2013 compared to 5.6% in 2012

Feb 4:

FBM KLCI falls by 1.40% on

continued economic growth

concerns in China and the U.S.

Mar 8:

Malaysia Airlines Flight

MH370 bound for Beijing

from KL goes missing

Mar 14:

Rising geo-political tensions over

Russia’s plan to annex the Crimea

region of Ukraine and weaker-

than-expected economic data

from China dampen sentiment

Mar 20 to 28:

Sentiment improves after

a peaceful referendum by

Crimea to join Russia, tame

sanctions by the U.S. and

European Union on Russia and

improved U.S. trade data

May 16:

BNM announces that the

Malaysian economy expanded by

6.2% in the first quarter of 2014

May 30:

Daily trade value peaked at RM6.9 billion.

MSCI readjustment on 31 May 2014.

May 20 to 26 :

Concerns over potential

interest rate hike in the U.S.

and political unrest in Thailand

dampen sentiment

Note: Both Total Volume and Total Value include odd lot and direct business transactions