FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

Bursa Malaysia

•

Annual Report 2014

20

Meanwhile, Bursa Malaysia continues to build on its regulatory framework and approach to create an

orderly capital market. We are continuously looking at ways to develop greater transparency and efficiency

in dispensing our regulatory duties and in our corporate governance practices to create a level playing field

for all market participants.

We are also aware that the Exchange occupies a unique position among PLCs and therefore stands out as a

role model for others to emulate. We believe we must lead by example, and thus take special care to ensure

that we adhere to best corporate governance practices as much as possible. We are therefore heartened

to note that Malaysia retained its fourth place ranking in the Asian Corporate Governance Association’s

Corporate Governance Watch 2014 report.

In reflecting our position as the benchmark for other companies, we were the fastest PLC to issue our

FY2013 annual report in 2014, 58 days after the close of our books. With timely and accurate reporting

being a feature of good governance, we hope that the quick publication of our annual report will inspire

others to do the same.

BUILDING A MARKETPLACE FOR THE FUTURE

The formation of the ASEAN Economic Community (AEC) in 2015 represents both an opportunity and

a challenge for us. For Bursa Malaysia to effectively compete in the region, we must leverage on our

competitive advantage to demonstrate the value we can create for market participants within an integrated

environment.

To that end, we stepped up our outreach programmes in 2014 to engage a new generation of investors

from within and outside Malaysia. Our initiatives also leveraged on digital media to facilitate more effective

outreach to young investors.

Further to our efforts to engage the market, we also organised the inaugural Bursa Bull Charge on 21

October.Themed ‘The Day the Marketplace Runs for Others’, the aim of the event is to enhance sustainability

and inclusiveness through market collaboration. The Bursa Bull Charge registered 1,300 runners from over

130 organisations comprising PLCs, brokers, investment banks, ministries, regulators and the media, and

also saw a good turnout of young executives.

We also continued to fly the Malaysian flag at investor forums throughout the world to promote the merits

of the Malaysian exchange and our PLCs to raise awareness of the value we create for our stakeholders.

APPRECIATION

On behalf of the Board of Directors, I wish to take this opportunity to thank our shareholders for their

support of the Exchange. We also wish to express our gratitude to our financial regulators and policy

makers for their role in strengthening the Malaysian market.

My deepest thanks to my fellow Directors for their insights and help in ensuring that the Exchange stays

the course even in these times of volatility and, last but not least, we would like to thank our employees for

their loyalty, sacrifices and commitment to our vision which form the very basis of all our success.

DRIVING GOOD

SHAREHOLDERS

VALUE

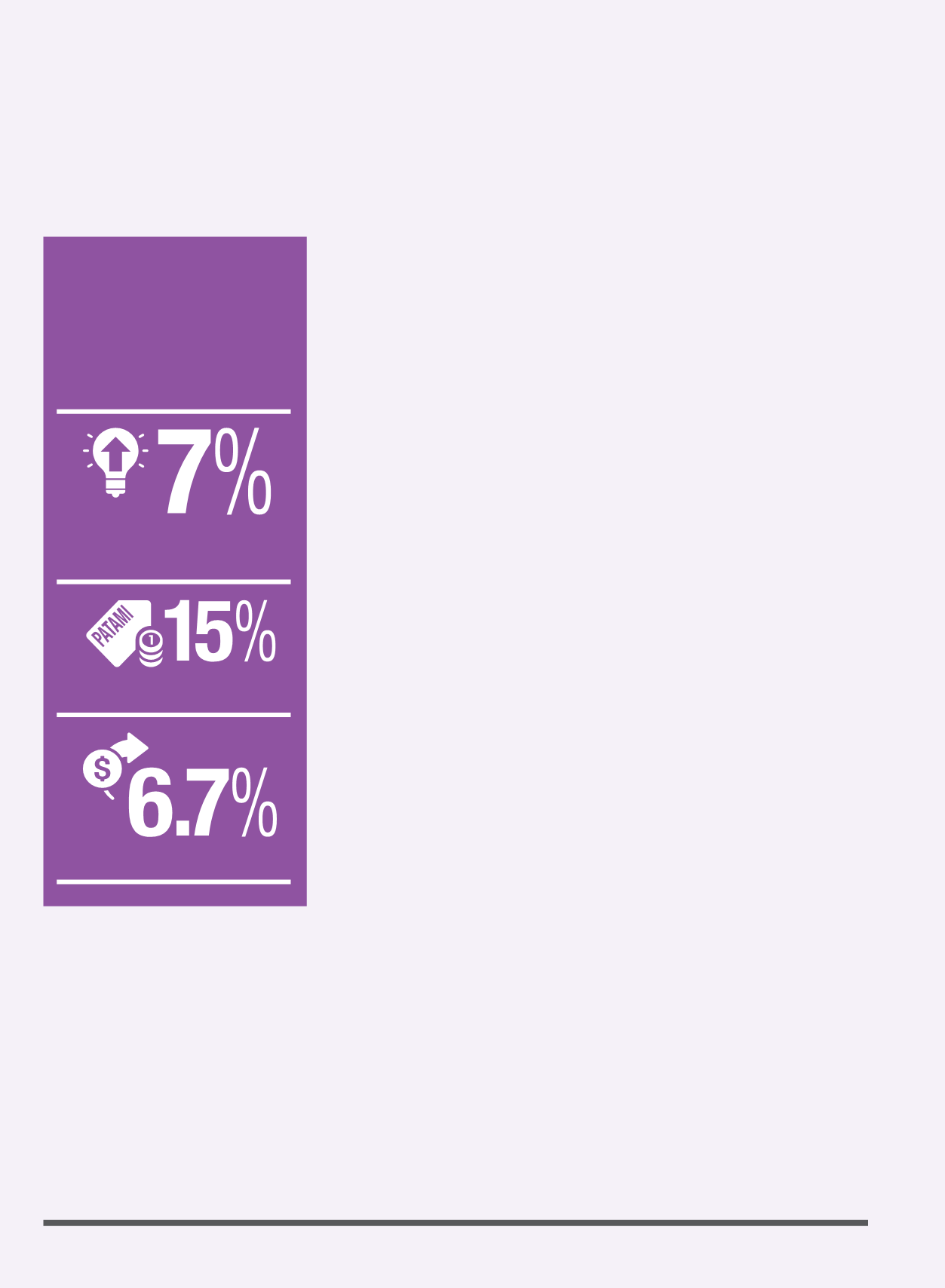

GROWTH IN

OPERATING REVENUE

GROWTH IN PATAMI

DIVIDEND YIELD

CHAIRMAN’S LETTER TO SHAREHOLDERS