Bursa Malaysia • Annual Report 2013

174

Financial Reports

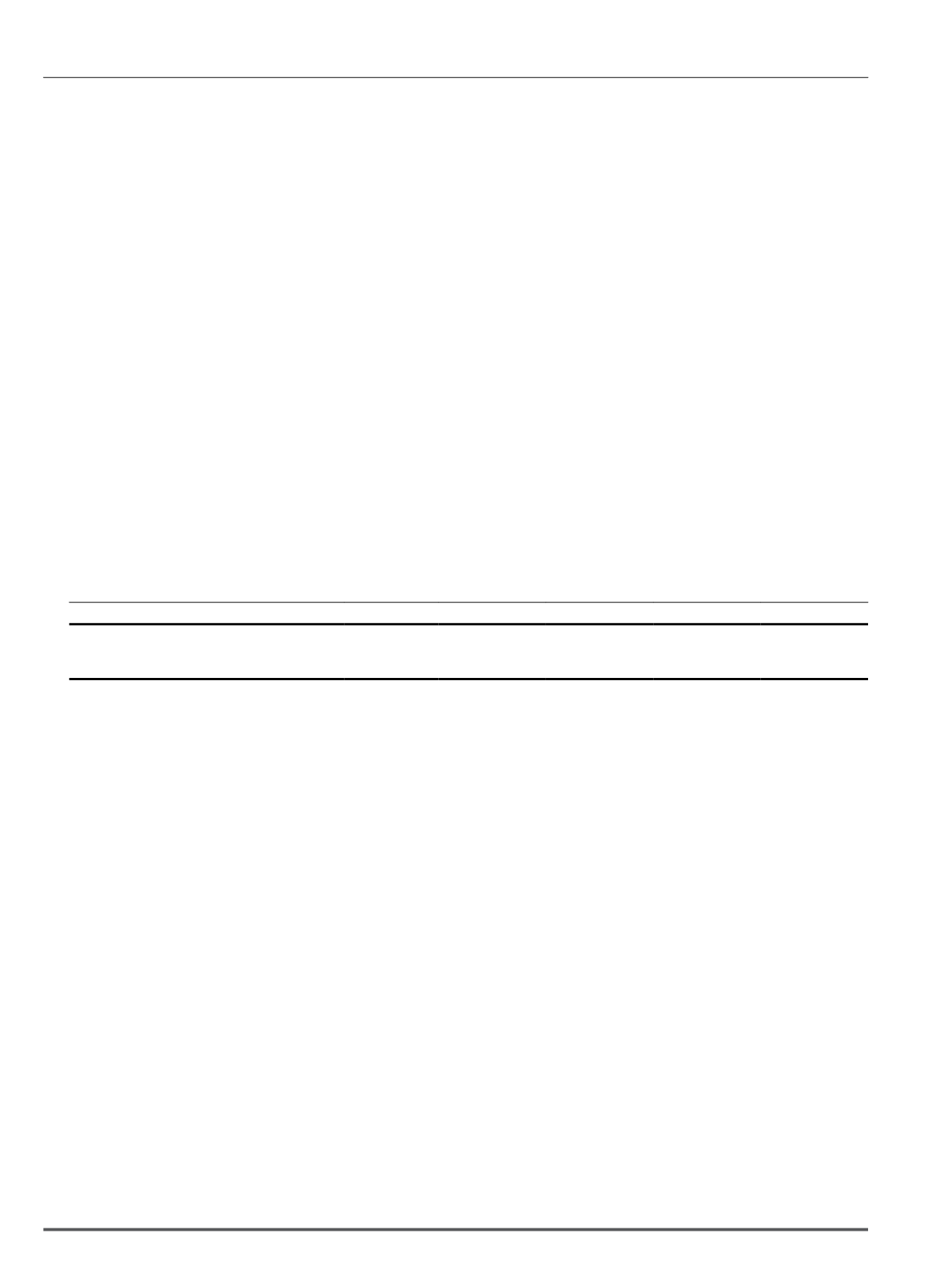

37. Classification of financial instruments (cont’d.)

AFS

HTM

Loans and

receivables

Financial

liabilities at

amortised cost

Total

RM’000

RM’000

RM’000

RM’000

RM’000

Company

At 31 December 2012 (Restated)

Assets

Investment securities

89,447

14,840

-

-

104,287

Staff loans receivable

-

-

9,289

-

9,289

Trade receivables

-

-

1,375

-

1,375

Other receivables which are financial assets

-

-

6,034

-

6,034

Due from subsidiaries

-

-

44,036

-

44,036

Cash and bank balances

-

-

268,375

-

268,375

Total financial assets

89,447

14,840

329,109

-

433,396

Liabilities

Other payables which are financial liabilities

-

-

-

8,674

8,674

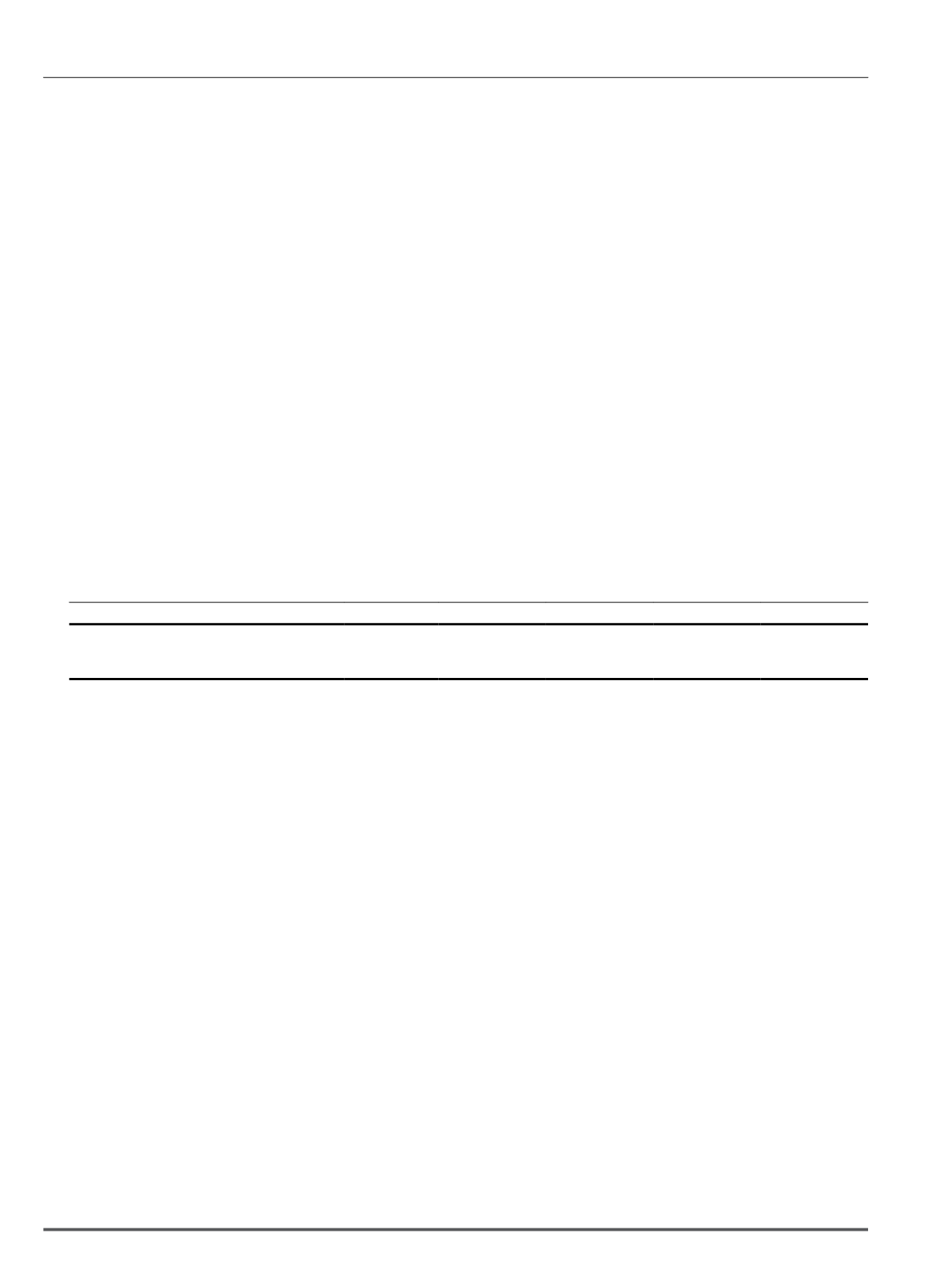

38. Fair value hierarchies of financial instruments

The fair value measurement hierarchies used to measure financial assets carried at fair value in the statements of financial position are as follows:

(a) Level 1 : Quoted prices (unadjusted) in active markets for identical assets or liabilities.

(b) Level 2 : Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. prices) or indirectly

(i.e. derived from prices).

(c) Level 3 : Inputs for the asset or liability that are not based on observable market data (unobservable inputs).

Notes to the Financial Statements

31 December 2013