Bursa Malaysia • Annual Report 2013

168

Financial Reports

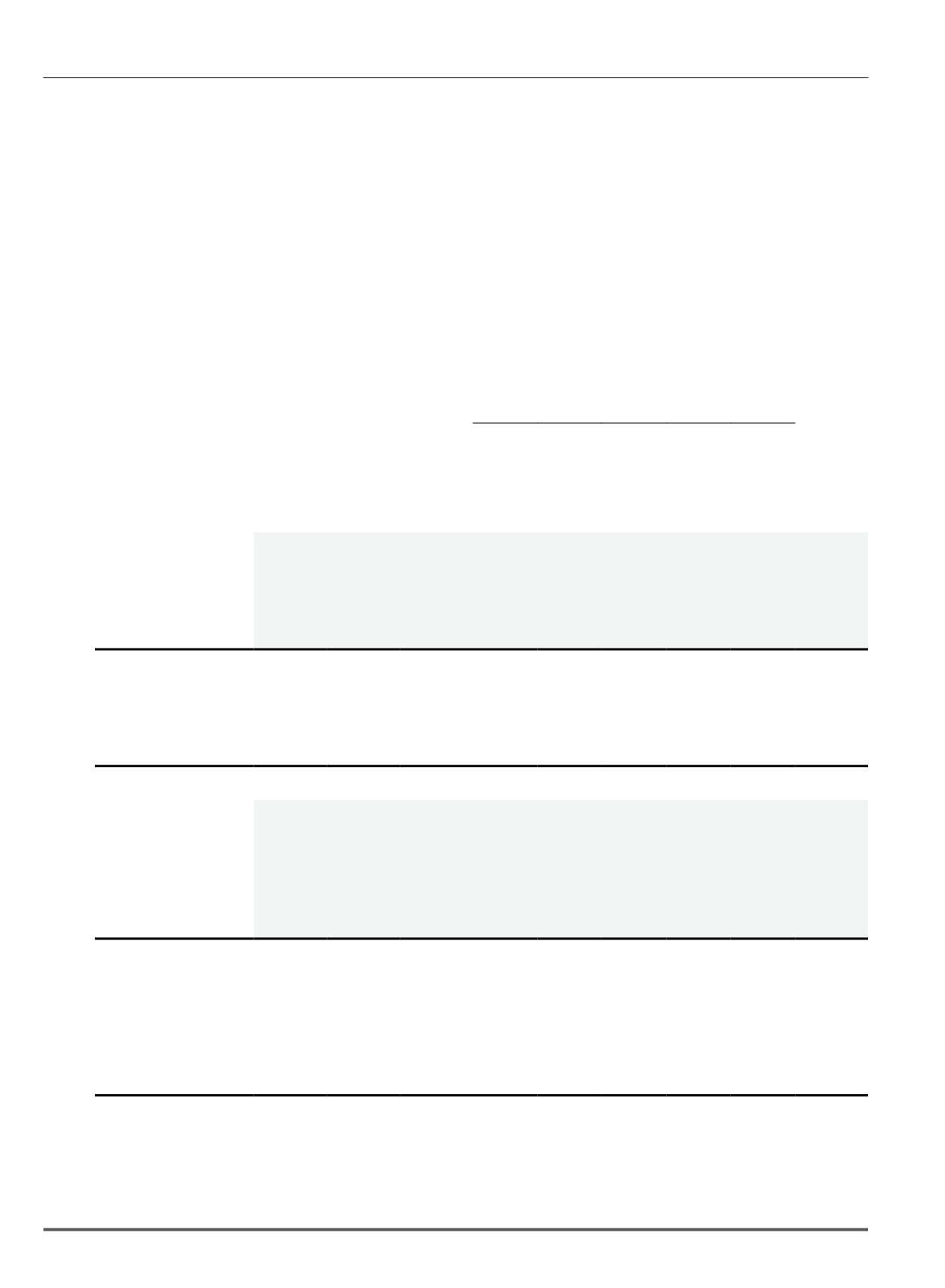

Company

At 31 December 2013

Staff loans receivable

7,259

-

7,259

-

-

-

-

-

-

Trade receivables

1,480

194

498

506

63

56

54

109

788

Other receivables which are

financial assets

8,883

2,675

6,208

-

-

-

-

-

-

Due from subsidiaries

42,533

11,851

30,682

-

-

-

-

-

-

At 31 December 2012

(Restated)

Staff loans receivable

9,289

-

9,289

-

-

-

-

-

-

Trade receivables

1,581

206

568

546

-

94

61

106

807

Other receivables which are

financial assets

8,729

2,695

6,034

-

-

-

-

-

-

Due from subsidiaries

55,887

11,851

44,036

-

-

-

-

-

-

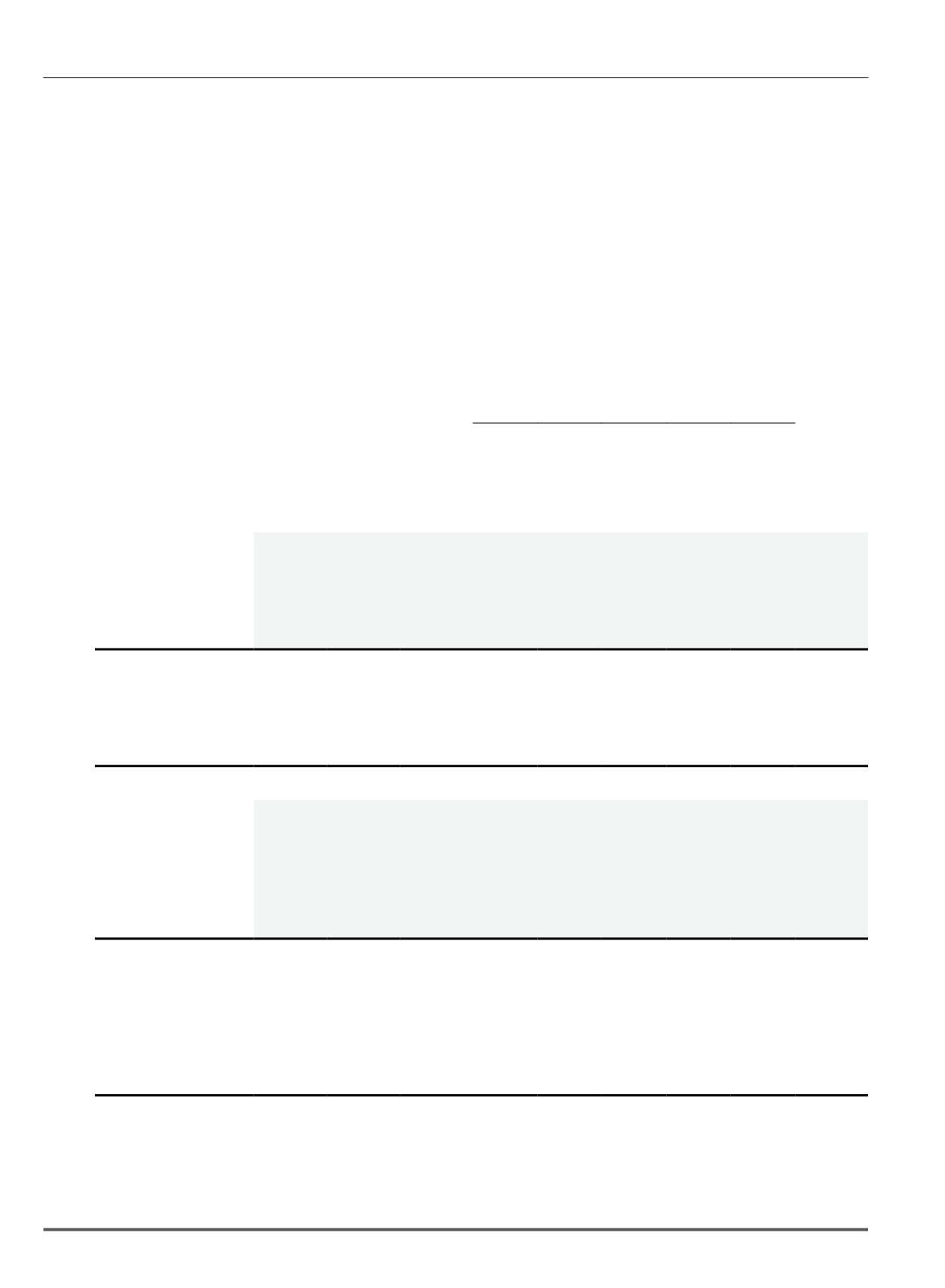

35. Financial risk management objectives and policies (cont’d.)

(e) Credit risk (cont’d.)

Receivables

The ageing analysis of the Group and the Company’s receivables are as follows:

Total

Impaired

Neither

past

due nor

impaired

Past due not impaired

Total

past

due not

impaired

< 30

days

31-60

days

61-90

days

91-180

days

>181

days

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Group

At 31 December 2013

Staff loans receivable

7,944

-

7,944

-

-

-

-

-

-

Trade receivables

33,234

501

26,388

3,394

1,167

380

480

924

6,345

Other receivables which are

financial assets

16,694

7,004

9,690

-

-

-

-

-

-

At 31 December 2012

Staff loans receivable

10,030

-

10,030

-

-

-

-

-

-

Trade receivables

28,920

458

22,075

3,166

1,103

590

365

1,163

6,387

Other receivables which are

financial assets

18,488

7,024

11,464

-

-

-

-

-

-

Notes to the Financial Statements

31 December 2013