Bursa Malaysia • Annual Report 2013

162

Financial Reports

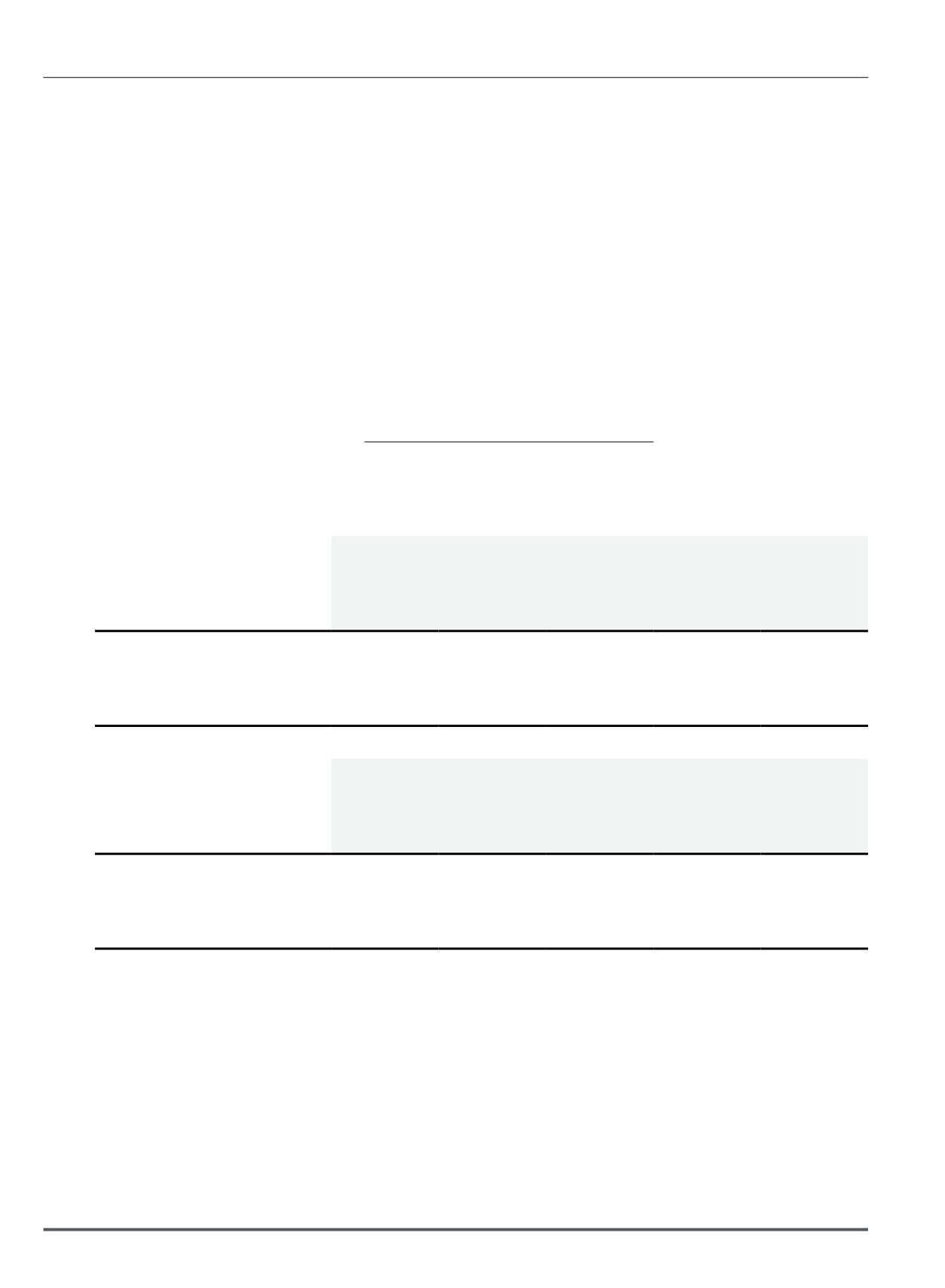

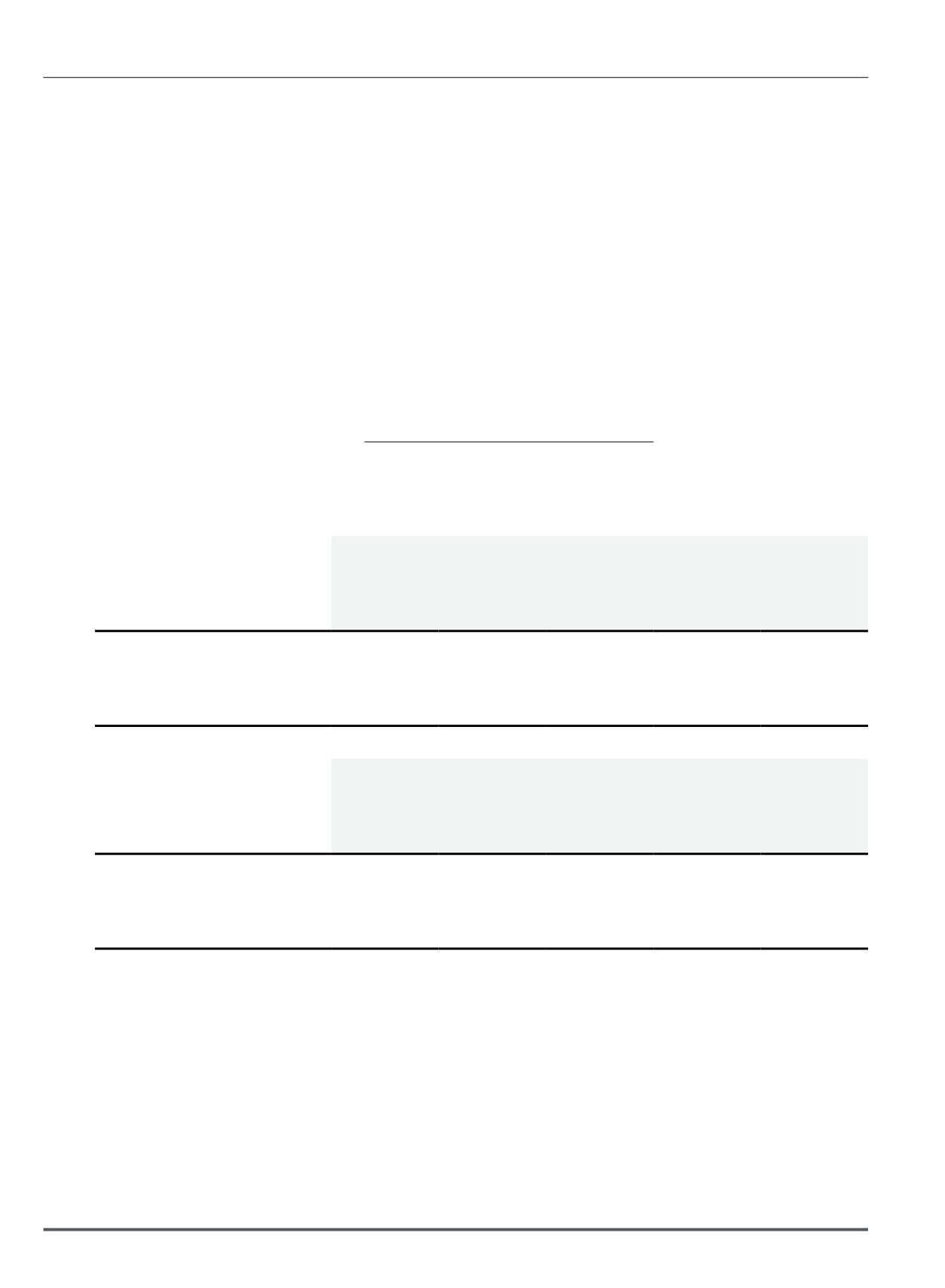

35. Financial risk management objectives and policies (cont’d.)

(b) Market risk: Interest rate risk (cont’d.)

Interest rate risk exposure

The following table analyses the Group and the Company’s interest rate risk exposure. The unquoted bonds, commercial papers and deposits with

licensed financial institutions are categorised by maturity dates.

Maturity

Total

Effective

interest

rate

Less than

one year

One to

five years

More than

five years

RM’000

RM’000

RM’000

RM’000

%

Group

At 31 December 2013

Investment securities

25,511

67,358

23,225

116,094

4.31

Deposits with licensed

financial institutions

379,067

-

-

379,067

3.36

At 31 December 2012

Investment securities

30,000

59,545

29,851

119,396

4.38

Deposits with licensed

financial institutions

466,631

-

-

466,631

3.34

Company

At 31 December 2013

Investment securities

10,596

12,391

13,281

36,268

4.34

Deposits with licensed

financial institutions

144,397

-

-

144,397

3.40

At 31 December 2012

Investment securities

20,029

10,312

14,624

44,965

4.41

Deposits with licensed

financial institutions

266,555

-

-

266,555

3.39

(c) Market risk: Foreign currency risk

Foreign currency risk is the risk that the value of a financial instrument will fluctuate because of changes in foreign exchange rates. The Group and the

Company are exposed to foreign currency risk primarily through the holding of CME Group shares which are denominated in United States Dollar (USD)

and transactions in USD.

Notes to the Financial Statements

31 December 2013