Bursa Malaysia • Annual Report 2013

170

Financial Reports

35. Financial risk management objectives and policies (cont’d.)

(e) Credit risk (cont’d.)

(ii) Receivables that are impaired (cont’d.)

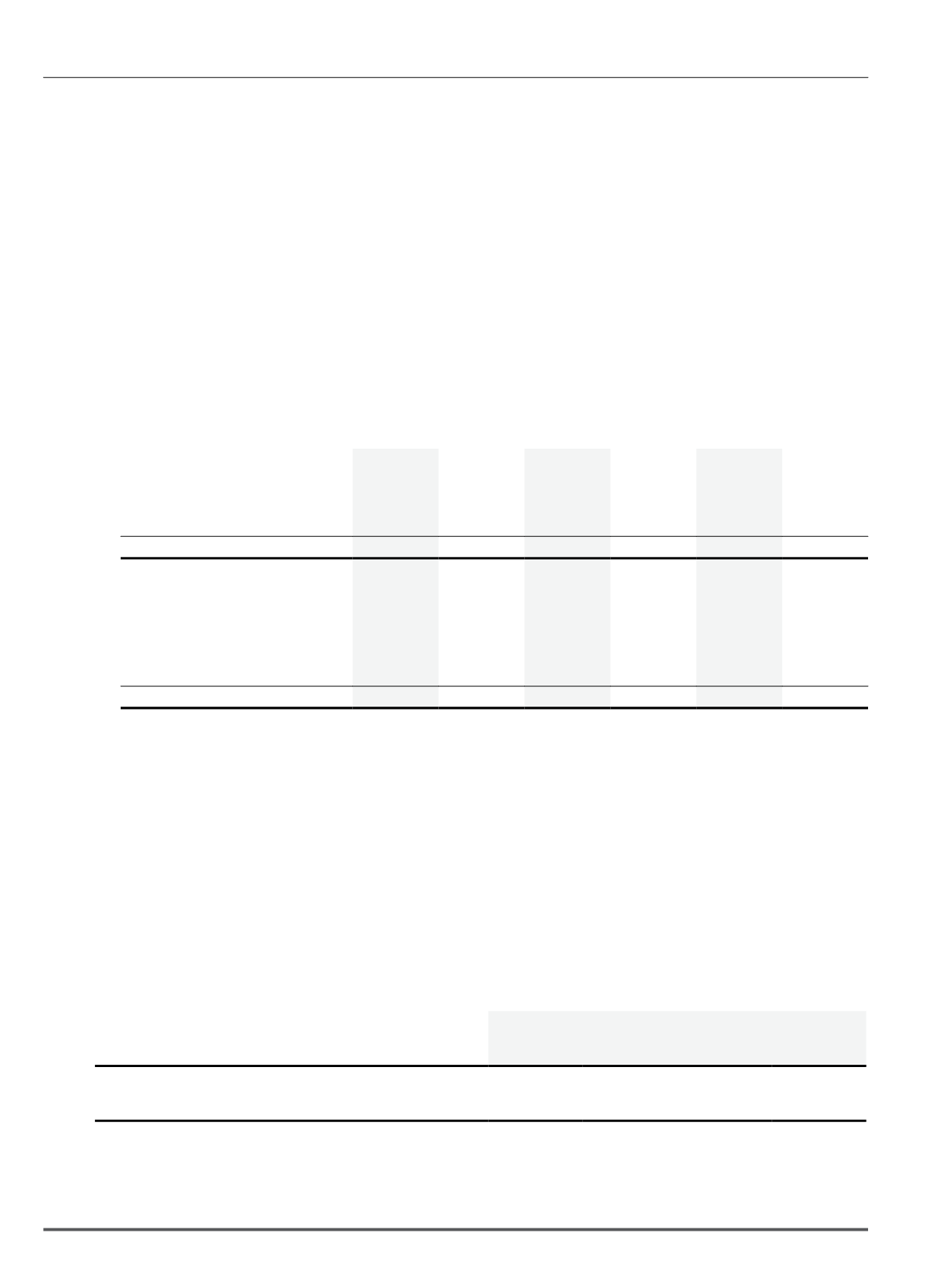

Trade

receivables

Other

receivables

Due from

subsidiaries

2013

2012

2013

2012

2013

2012

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

Company

At nominal amounts

194

276

2,675

2,695

11,851

11,851

Less: Allowance for impairment

(194)

(206)

(2,675)

(2,695)

(11,851)

(11,851)

-

70

-

-

-

-

Movement in allowance accounts:

At 1 January

206

238

2,695

1,647

11,851

8,527

(Reversal)/charge of impairment

loss for the year

(12)

(5)

(20)

1,048

-

3,324

Written off

-

(27)

-

-

-

-

At 31 December

194

206

2,675

2,695

11,851

11,851

Receivables that are individually determined to be impaired at the financial year end relate to debtors that are in significant financial difficulties

and have defaulted on payments.

Receivables are not secured by any collateral or credit enhancements other than as disclosed in Note 22.

36. Fair value of financial instruments

(a) Fair value of financial instruments by classes that are not carried at fair value and whose carrying amounts are not reasonable approximations

of fair value

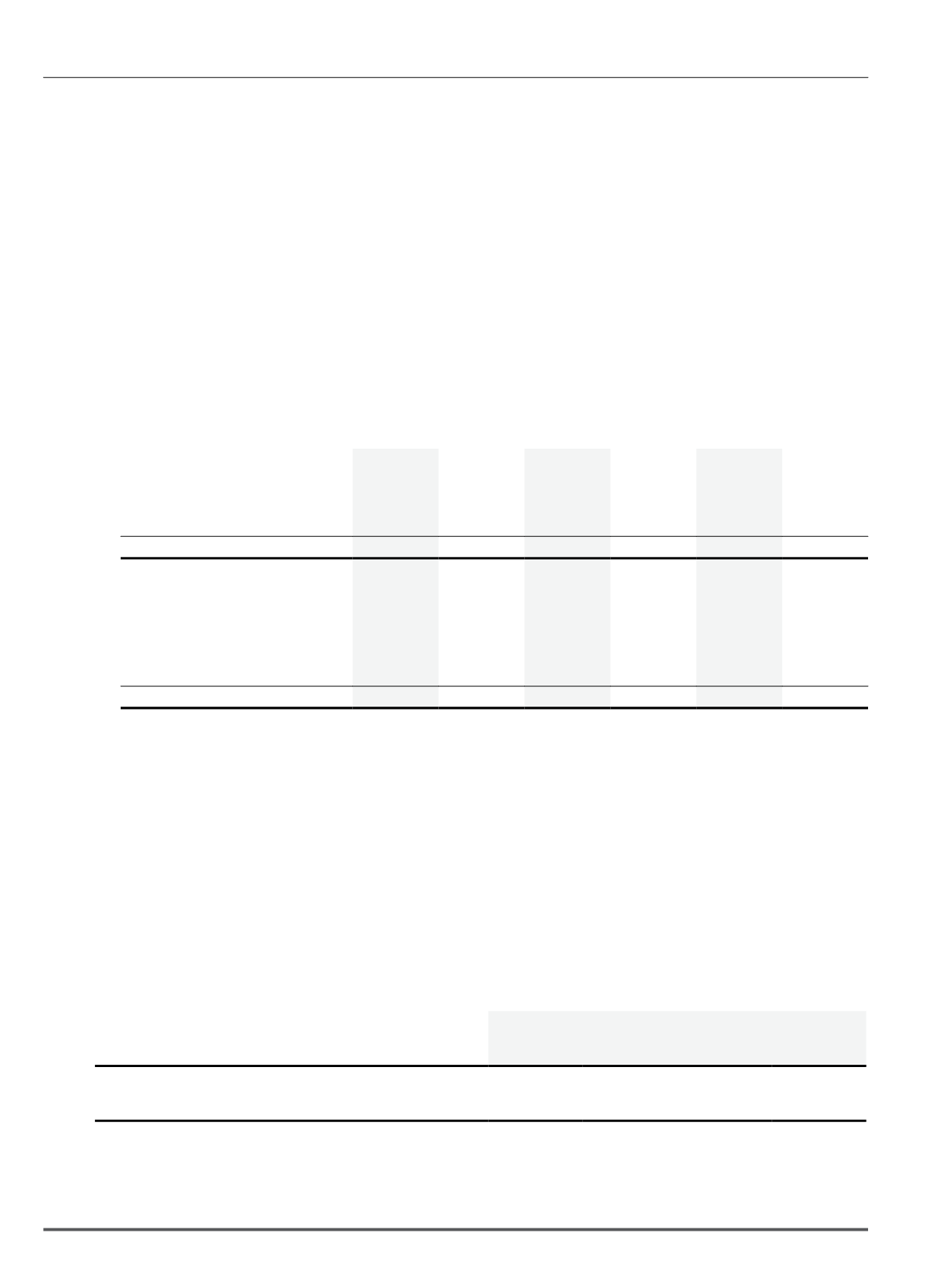

Group

Company

Carrying

amount

Fair

value

Carrying

amount

Fair

value

RM’000

RM’000

RM’000

RM’000

At 31 December 2013

Staff loans receivable (Note 17)

7,944

5,974

7,259

5,449

At 31 December 2012

Staff loans receivable (Note 17)

10,030

7,163

9,289

6,606

Notes to the Financial Statements

31 December 2013