Bursa Malaysia • Annual Report 2013

163

Financial Reports

35. Financial risk management objectives and policies (cont’d.)

(c) Market risk: Foreign currency risk (cont’d.)

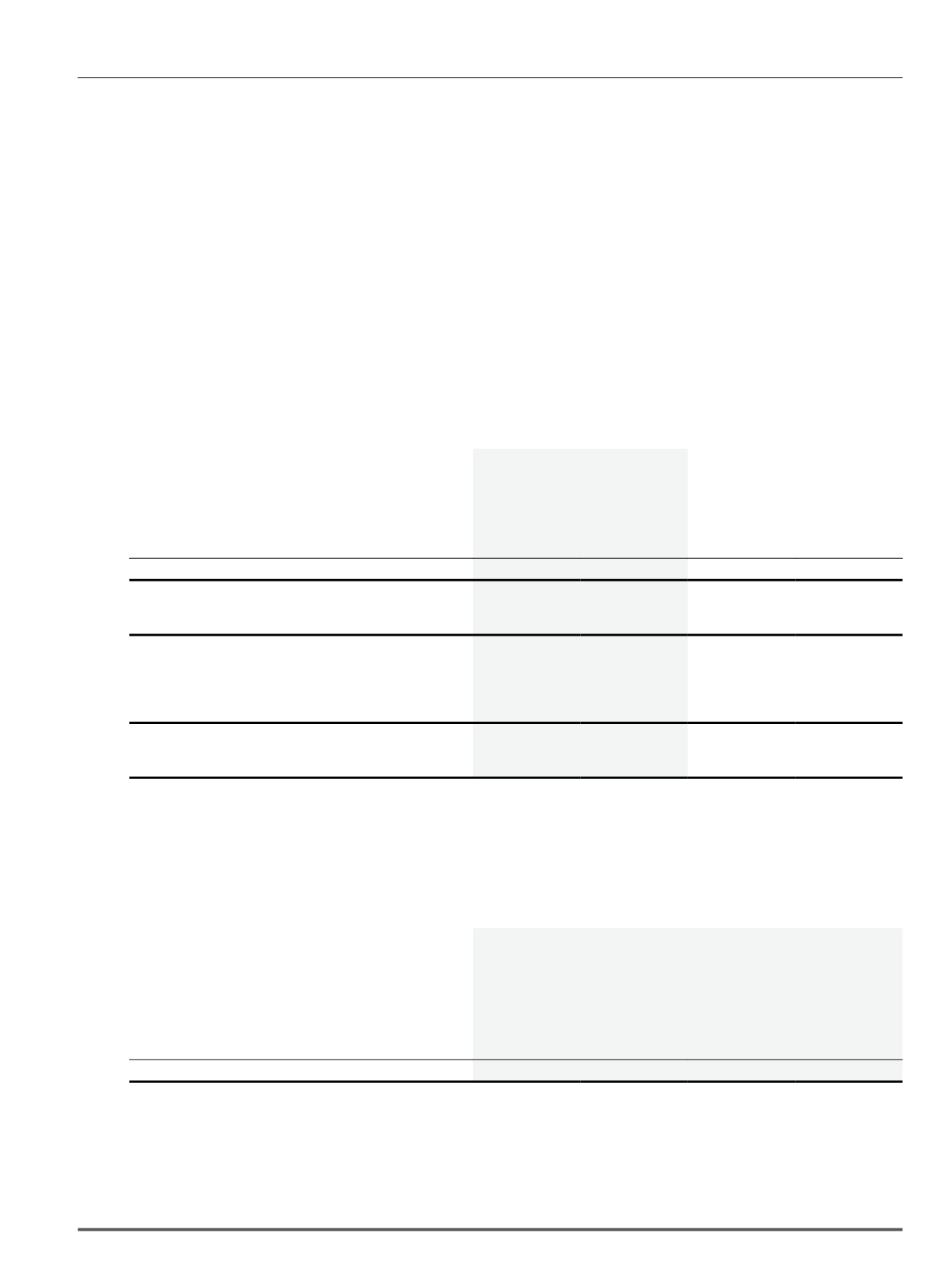

The Group and the Company do not hedge their currency exposures. The following table shows the accumulated amount of material financial assets

and liabilities which are unhedged:

2013

2012

USD

SGD

USD

EUR

RM’000

RM’000

RM’000

RM’000

Group

Financial assets

Investment securities - shares quoted outside Malaysia

98,584

-

59,322

-

Trade receivables

1,063

-

573

-

99,647

-

59,895

-

Financial liabilities

Other payables

3,662

54

3,957

87

Company

Financial assets

Investment securities - shares quoted outside Malaysia

98,584

-

59,322

-

Financial liabilities

Other payables

66

54

256

87

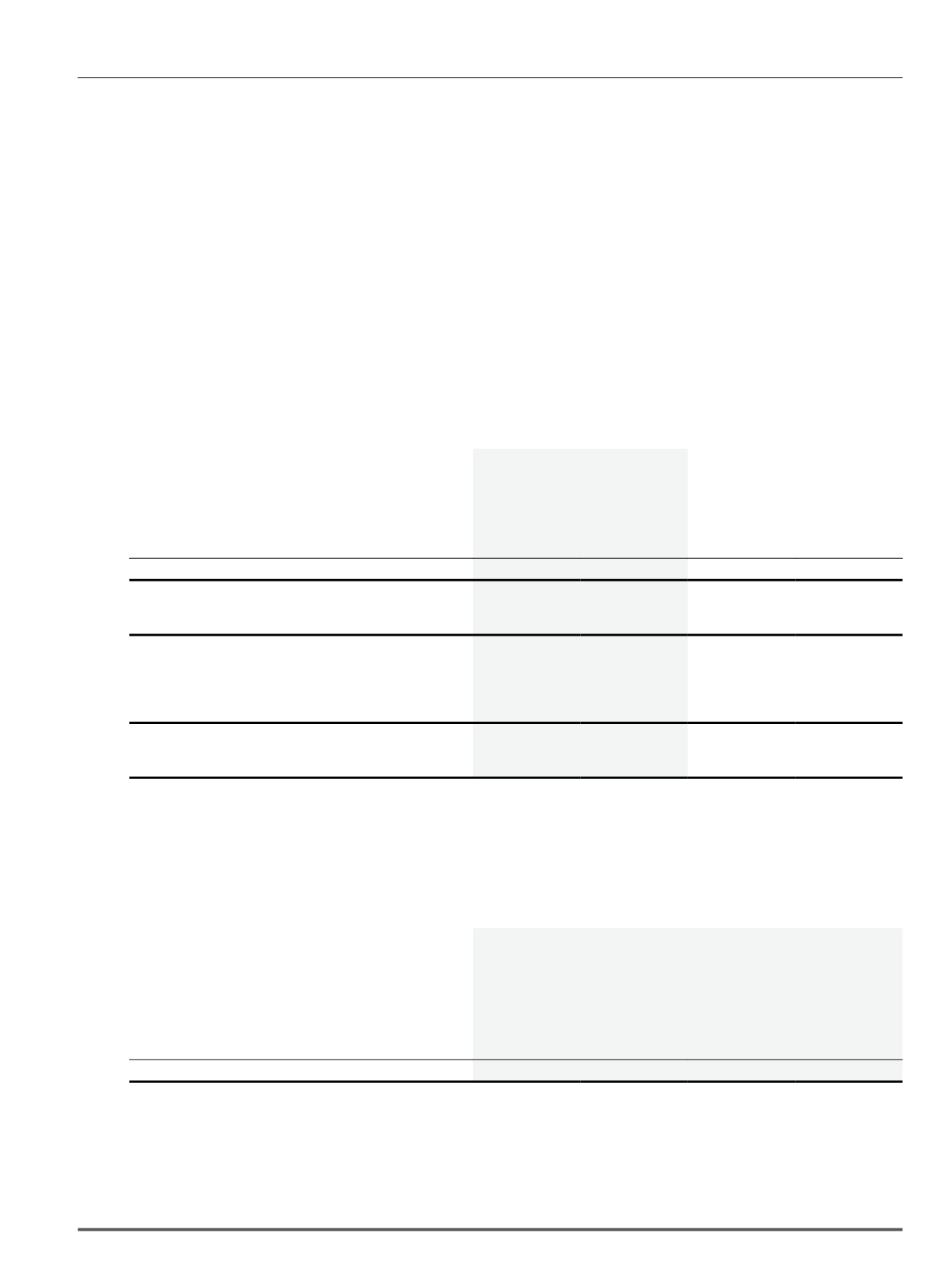

The Group is not exposed to foreign currency risk from the holding of margins and collaterals as the risks are borne by the participants. The following

table depicts this through the netting off of monies held as margins and collaterals against the corresponding liability.

USD

SGD

JPY

Total

RM’000

RM’000

RM’000

RM’000

Group

At 31 December 2013

Financial assets

Cash and bank balances

275,500

1,045

-

276,545

Financial liabilities

Trade payables

(275,500)

(1,045)

-

(276,545)

-

-

-

-

Notes to the Financial Statements

31 December 2013