Bursa Malaysia • Annual Report 2013

167

Financial Reports

35. Financial risk management objectives and policies (cont’d.)

(e) Credit risk (cont’d.)

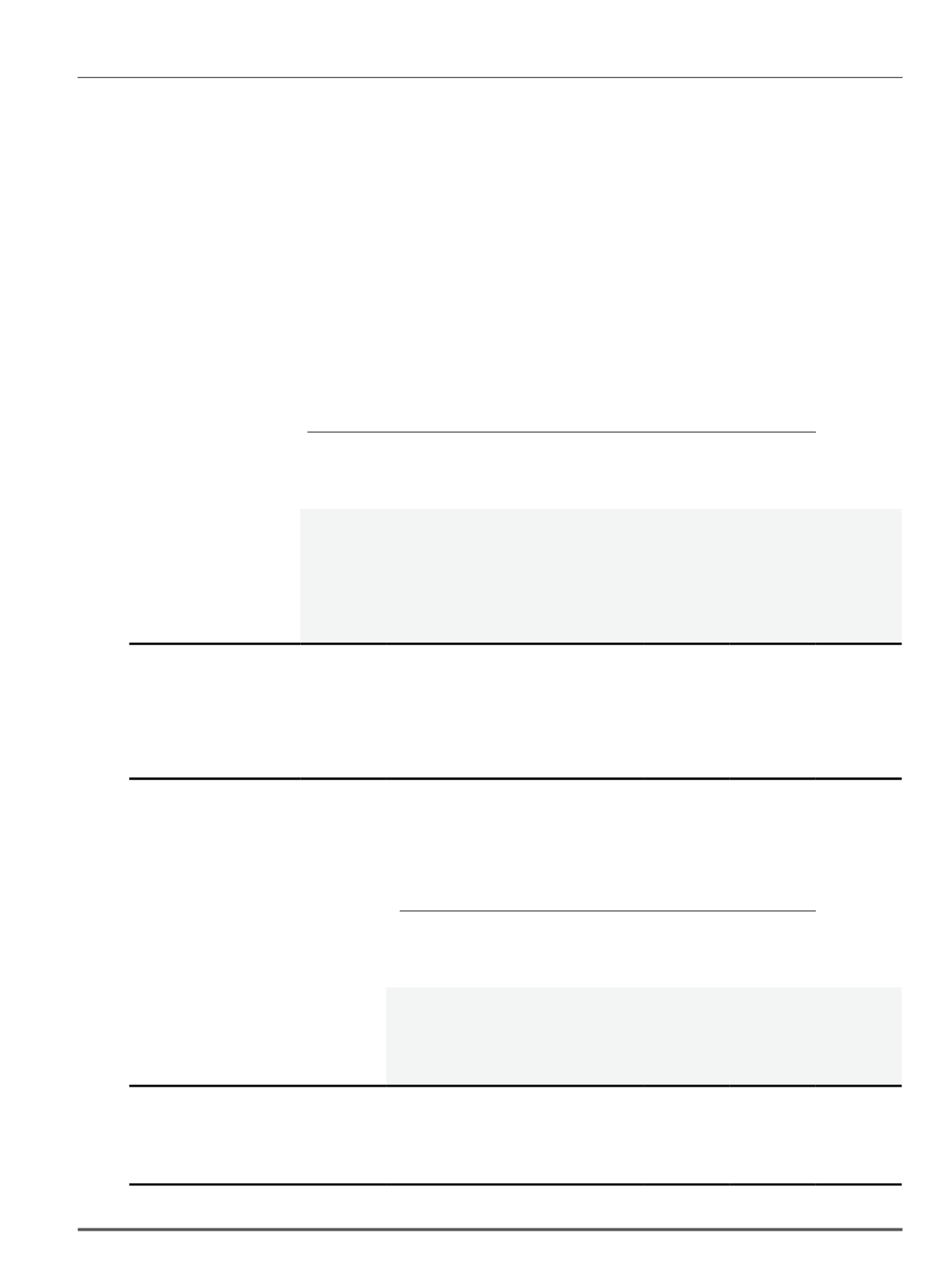

Investment securities and cash and bank balances

The counterparty risk rating of the Group and of the Company’s investment securities and cash and bank balances with financial institutions at

the financial year end are as follows:

Counterparty risk ratings

GG

P1

AAA

AA

A

BB

Total

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

Group

At 31 December 2013

Cash and bank balances

-

-

710,502

388,697

53,160

-

1,152,359

AFS financial assets

- unquoted bonds

1,939

-

26,840

72,683

-

-

101,462

HTM investment

- commercial papers

-

14,632

-

-

-

-

14,632

At 31 December 2012

Cash and bank balances

-

-

848,475

673,201

124,827

-

1,646,503

AFS financial assets

- unquoted bonds

496

-

17,366

73,292

4,586

3,858

99,598

HTM investment

- commercial papers

-

19,798

-

-

-

-

19,798

Note a

Note a

The risk rating of this AFS unquoted bond was downgraded from AA to BBB in 2010 and subsequently to BB in 2011. This bond was disposed off

during the financial year.

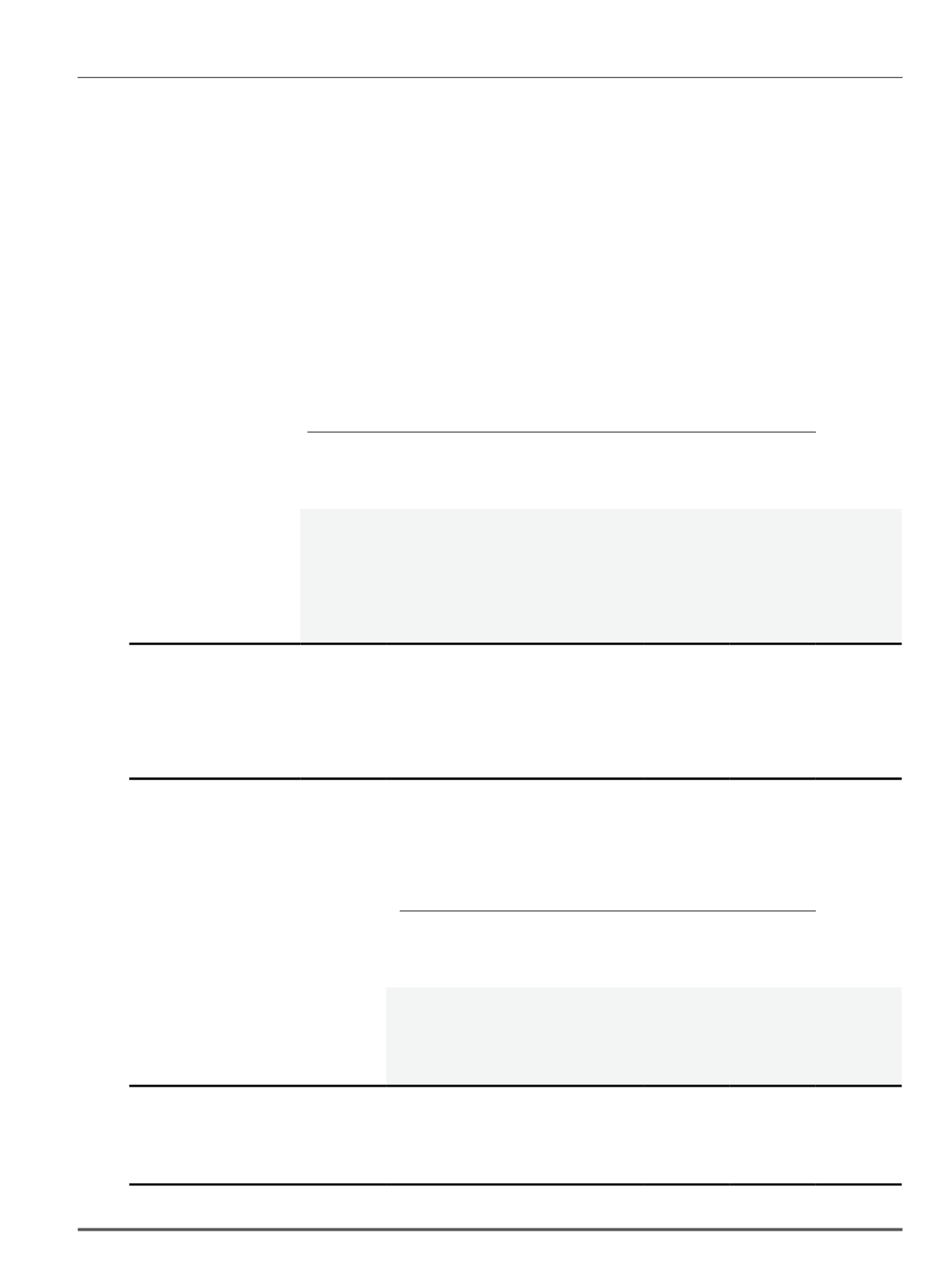

Counterparty risk ratings

GG

P1

AAA

AA

A

Total

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

Company

At 31 December 2013

Cash and bank balances

-

-

42,506

81,973

20,280

144,759

AFS financial assets - unquoted bonds

1,939

-

6,861

17,745

-

26,545

HTM investment - commercial papers

-

9,723

-

-

-

9,723

At 31 December 2012

Cash and bank balances

-

-

130,698

83,963

53,714

268,375

AFS financial assets - unquoted bonds

496

-

7,229

17,814

4,586

30,125

HTM investment - commercial papers

-

14,840

-

-

-

14,840

Notes to the Financial Statements

31 December 2013