THE YEAR IN BRIEF

Bursa Malaysia

•

Annual Report 2014

5

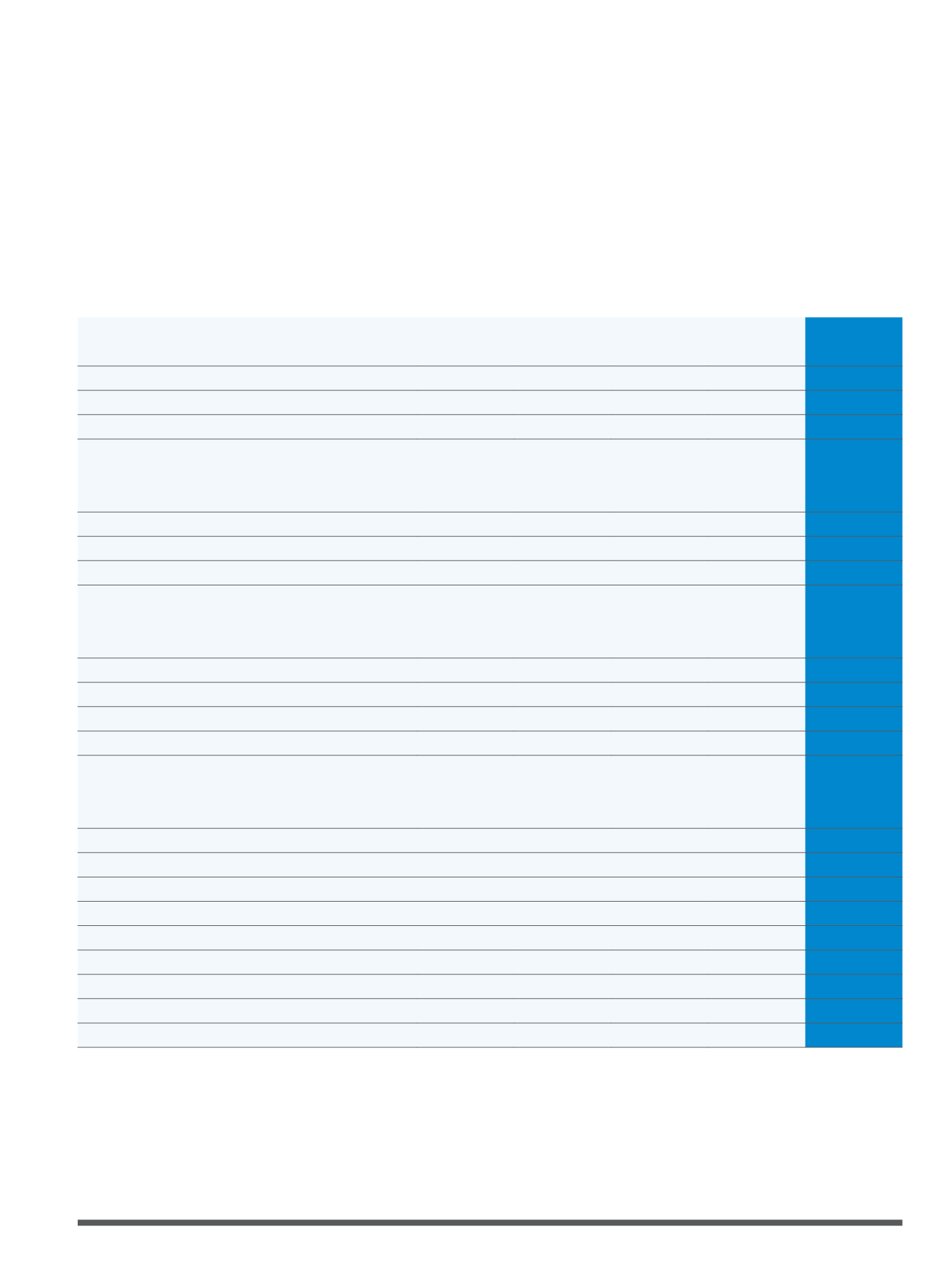

OUR PERFORMANCE

5-Year Highlights

31 DEC 2010

1, 2

31 DEC 2011

1

31 DEC 2012

1

31 DEC 2013 31 DEC 2014

Key Operating Results (RM million)

Operating Revenue

331.3

381.5

388.5

439.8

471.3

Operating Expenses

196.6

212.0

209.2

229.4

232.0

Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA)

177.9

207.9

212.9

245.4

264.6

Profit after Tax and Minority Interest (PATAMI)

111.9

143.1

150.6

173.1

198.2

Other Key Data (RM million)

Total Assets

1,708.3

1,673.5

2,198.4

1,741.7

1,656.5

Total Liabilities

855.1

818.4

1,325.1

914.2

893.8

Shareholders’ Equity

841.9

840.8

857.6

811.2

748.7

Capital Expenditure

21.9

13.6

26.7

33.3

11.9

Financial Ratios (%)

Operating Revenue Growth

11.2

15.2

1.8

13.2

7.1

Cost to Income Ratio

54.7

51.1

49.3

48.3

46.1

Net Profit Margin

31.9

35.7

36.9

37.8

40.5

PATAMI Growth

(35.9)

27.8

5.2

14.9

14.5

Return on Equity (ROE)

13.4

17.0

17.7

20.7

25.4

Share Information

Earnings per Share (EPS) (sen)

21.1

26.9

28.3

32.5

37.2

Net Dividends per Share (sen)

20.0

26.0

27.0

52.0

54.0

Dividend Yield (%)

2.6

3.9

4.3

6.3

6.7

Payout Ratio (%)

94.0

94.6

94.8

98.5

91.5

Net Assets per Share (RM)

1.58

1.58

1.61

1.52

1.40

Share Price - High (RM)

8.66

9.02

7.72

8.47

8.32

Share Price - Low (RM)

6.75

5.76

5.91

6.22

7.40

Share Price as at 31 December (RM)

7.80

6.70

6.22

8.23

8.10

Price Earnings Ratio (times)

37

25

22

25

22

Company Market Capitalisation (RM billion)

4.1

3.6

3.3

4.4

4.3

1 Comparative figures and ratios have been restated to take into account the effects of:

i.

Fines and related expenses no longer recognised in profit or loss following the setting up of Capital Market Education and Integrity Fund (CMEIF) on 1 January 2013.

ii.

Actuarial gains and losses recognised following the adoption of MFRS 119

Employee Benefits (revised)

on 1 January 2013.

2 The PATAMI growth for 2010 which excludes the gain on disposal of a subsidiary in 2009 is 13.5%.