FINANCIAL REPORTS

177

Bursa Malaysia •

Annual Report 2015

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2015

36. Financial risk management objectives and policies (cont’d.)

(b) Market risk: Interest rate risk (cont’d.)

Interest rate risk exposure (cont’d.)

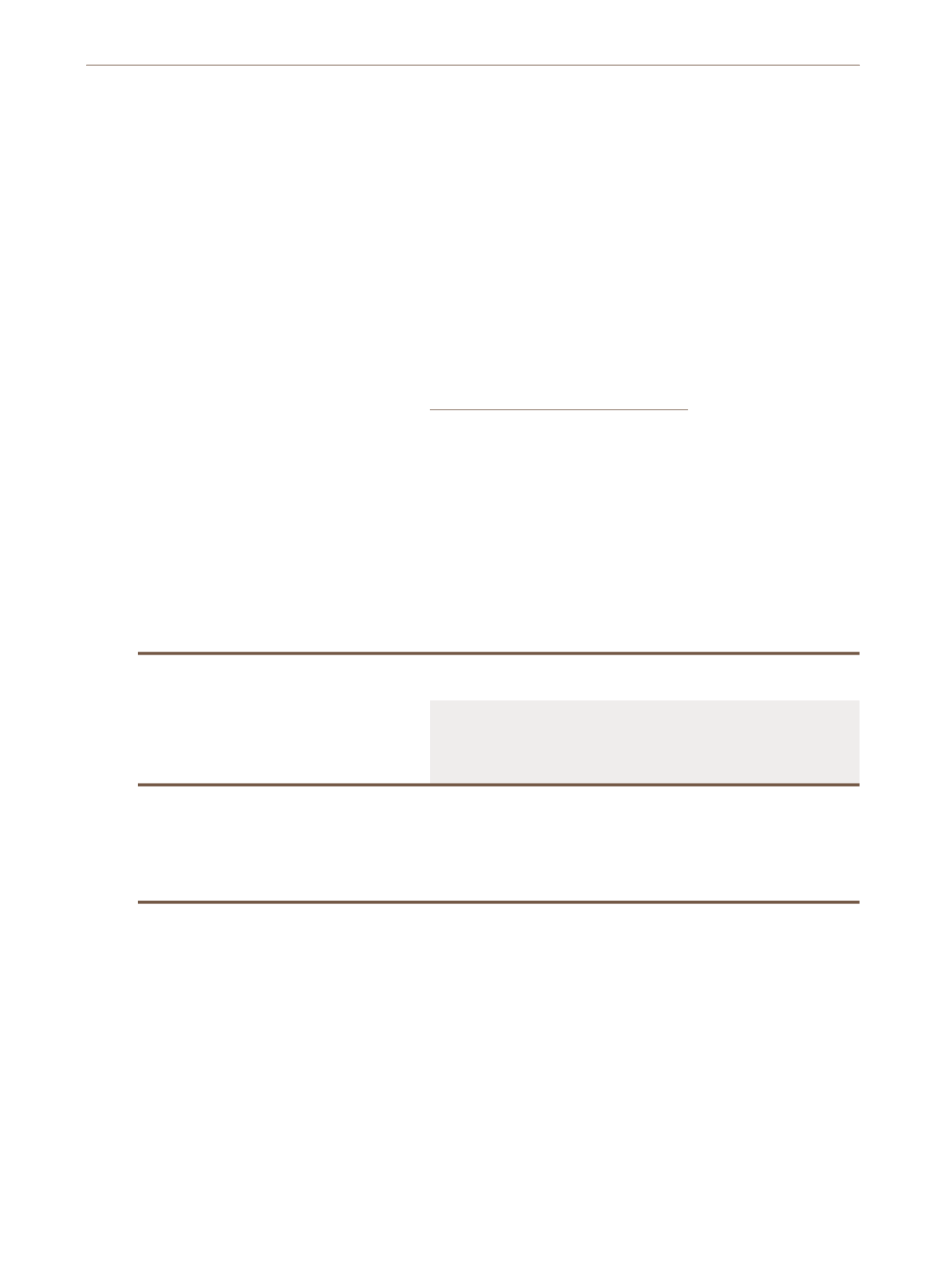

Maturity

Total

Effective

interest

rate

Less than

one year

One to

five years

More than

five years

RM’000

RM’000

RM’000

RM’000

%

Group

At 31 December 2014

Investment securities

14,908

75,055

21,771

111,734

4.58

Deposits with licensed financial institutions:

- Cash set aside by the Group for Clearing Funds

90,000

-

-

90,000

3.88

- Cash and bank balances

210,299

-

-

210,299

3.77

Company

At 31 December 2015

Deposits with licensed financial institutions:

- Cash and bank balances

102,799

-

-

102,799

4.14

At 31 December 2014

Investment securities

4,920

10,222

16,786

31,928

5.08

Deposits with licensed financial institutions:

- Cash and bank balances

56,030

-

-

56,030

3.84

(c) Market risk: Foreign currency risk

Foreign currency risk is the risk that the value of a financial instrument will fluctuate because of changes in foreign exchange rates. The Group

and the Company are exposed to foreign currency risk primarily through the holding of CME Group shares which are denominated in United States

Dollars (“USD”), and transactions in USD.