FINANCIAL REPORTS

183

Bursa Malaysia •

Annual Report 2015

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2015

36. Financial risk management objectives and policies (cont’d.)

(e) Credit risk (cont’d.)

Receivables

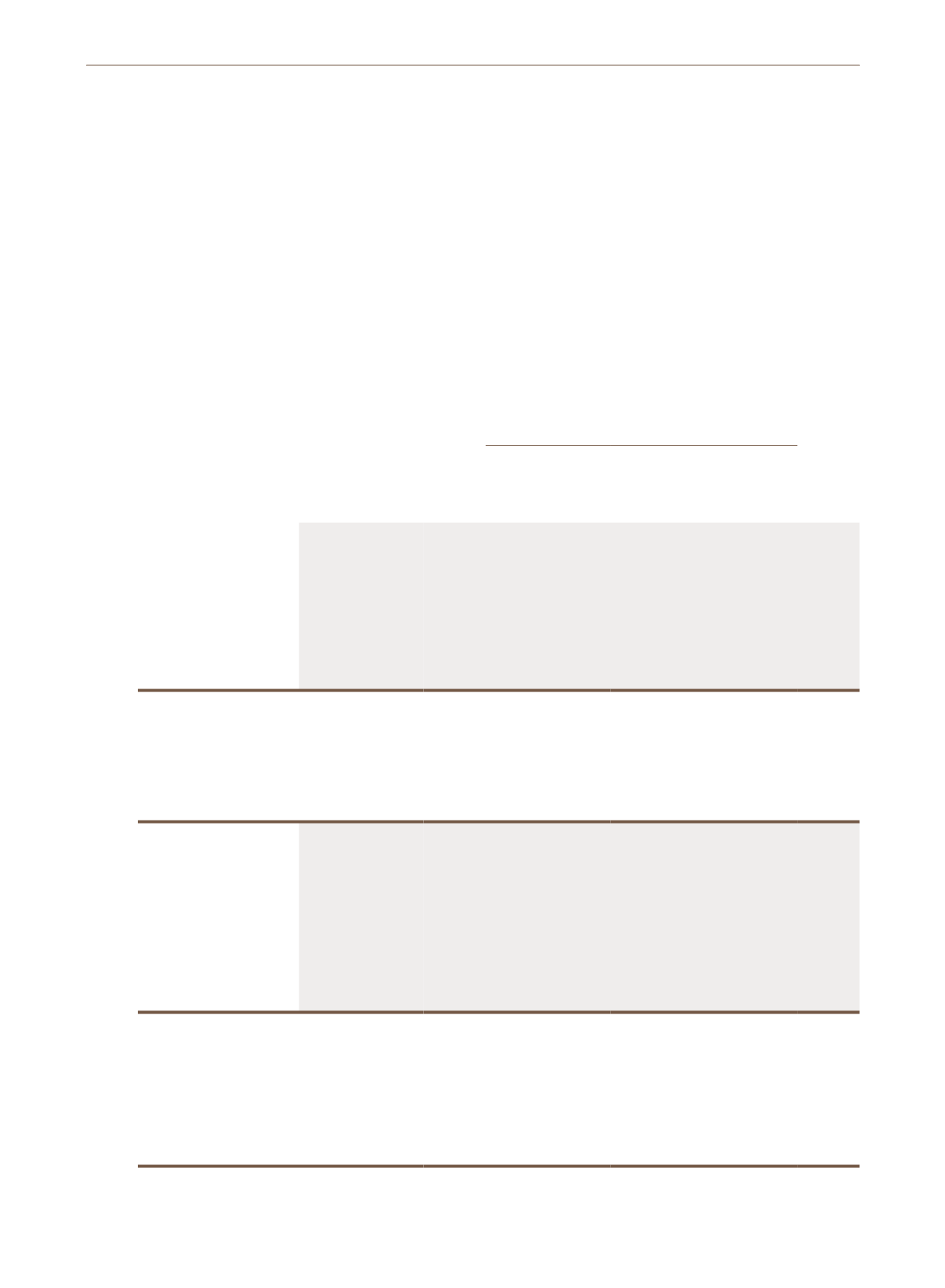

The ageing analysis of the Group’s and the Company’s receivables are as follows:

Note

Total Impaired

Neither

past

due nor

impaired

Past due not impaired

Total

past

due not

impaired

< 30

days

31-60

days

61-90

days

91-180

days

>181

days

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

Group

At 31 December 2015

Staff loans receivable

17

5,026

-

5,026

-

-

-

-

-

-

Trade receivables

19

49,406

732

36,347

3,884

2,747

874

1,815

3,007

12,327

Other receivables which

are financial assets

*

20

20,721

6,059

14,662

-

-

-

-

-

-

At 31 December 2014

Staff loans receivable

17

6,671

-

6,671

-

-

-

-

-

-

Trade receivables

19 41,677

388

32,667

4,426

2,440

346

1,043

367

8,622

Other receivables which

are financial assets

*

20 15,456

6,268

9,188

-

-

-

-

-

-

Company

At 31 December 2015

Staff loans receivable

17

4,486

-

4,486

-

-

-

-

-

-

Trade receivables

19

2,018

258

532

355

177

140

248

308

1,228

Other receivables which

are financial assets

*

20

12,493

2,411

10,082

-

-

-

-

-

-

Due from subsidiaries

21

47,628

11,857

35,771

-

-

-

-

-

-

At 31 December 2014

Staff loans receivable

17

6,078

-

6,078

-

-

-

-

-

-

Trade receivables

19

1,196

258

354

270

83

84

102

45

584

Other receivables which

are financial assets

*

20

8,376

2,584

5,792

-

-

-

-

-

-

Due from subsidiaries

21 44,702

11,855

32,847

-

-

-

-

-

-

*

Other receivables which are financial assets include deposits, interest receivables and sundry receivables, net of allowance for impairment.