FINANCIAL REPORTS

187

Bursa Malaysia •

Annual Report 2015

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2015

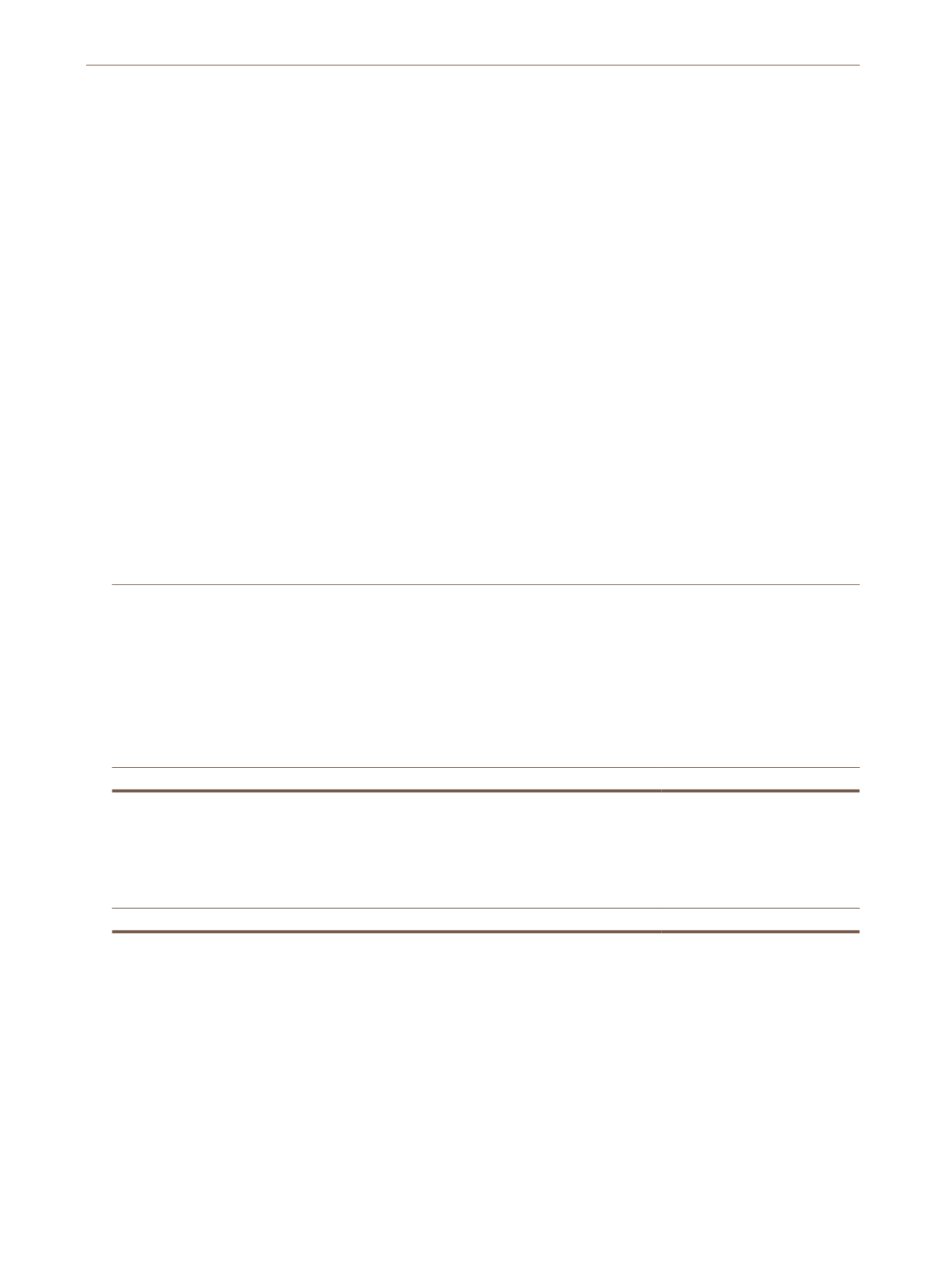

37. Classification of financial instruments (cont’d.)

Group

AFS

HTM

Loans and

receivables

Financial

liabilities at

amortised cost

Total

RM’000

RM’000

RM’000

RM’000

RM’000

At 31 December 2014

Assets

Investment securities

- Shares (quoted equity)

118,631

-

-

-

118,631

- Bonds

106,832

-

-

-

106,832

- Commercial papers

-

4,902

-

-

4,902

225,463

4,902

-

-

230,365

Staff loans receivable

-

-

6,671

-

6,671

Trade receivables

-

-

41,289

-

41,289

Other receivables which are financial assets

*

-

-

9,188

-

9,188

Cash for trading margins, security deposits and

eDividend distributions

-

-

717,133

-

717,133

Cash and bank balances of Clearing Funds

-

-

126,261

-

126,261

Cash and bank balances

-

-

214,367

-

214,367

Total financial assets

225,463

4,902

1,114,909

-

1,345,274

Liabilities

Trade payables

-

-

-

715,815

715,815

Participants’ contributions to Clearing Funds

-

-

-

36,261

36,261

Other payables which are financial liabilities

**

-

-

-

26,309

26,309

Total financial liabilities

-

-

-

778,385

778,385

*

Other receivables which are financial assets include deposits, interest receivables and sundry receivables, net of allowance for impairment, as

disclosed in Note 20.

**

Other payables which are financial liabilities include amount due to Securities Commission and sundry payables as disclosed in Note 30.