FINANCIAL REPORTS

190

Bursa Malaysia •

Annual Report 2015

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2015

38. Fair value (cont’d.)

(a) Financial instruments that are carried at fair value (cont’d.)

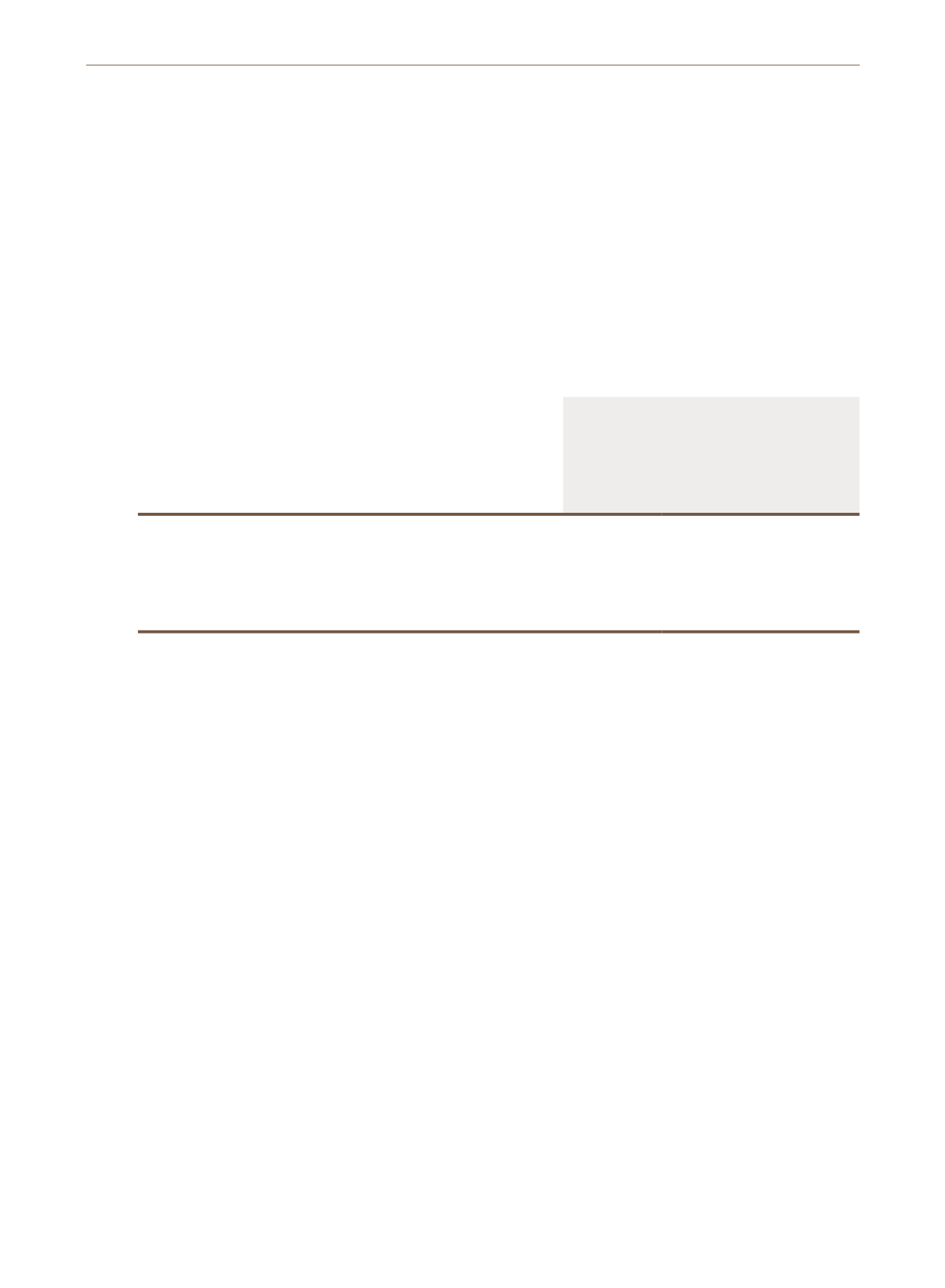

Company

Level 1

Level 2

Total

RM’000

RM’000

RM’000

At 31 December 2015

Asset

AFS financial assets

148,667

-

148,667

At 31 December 2014

Asset

AFS financial assets

118,631

27,026

145,657

There were no transfers between Level 1 and Level 2 during the current and previous financial years.

The Group and the Company do not have any financial liabilities carried at fair value nor any financial liabilities classified as Level 3 as at

31 December 2015 and 31 December 2014.

(b) Financial instruments that are not carried at fair value

Financial instruments classified as HTM investments, loans and receivables and financial liabilities are carried at amortised cost.

The carrying amount of these financial instruments, other than staff loans receivable, are reasonable approximation of their fair values due to

their short-term nature:

Note

HTM investment securities

16

Trade receivables

19

Other receivables which are financial assets (except staff loans receivable within 12 months)

20

Related company balances

21

Cash for trading margins, security deposits and eDividend distributions

22

Cash and bank balances of Clearing Funds

23

Cash and bank balances of the Group and of the Company

24

Trade payables

22

Participants’ contributions to Clearing Funds

23

Other payables which are financial liabilities

30