FINANCIAL REPORTS

188

Bursa Malaysia •

Annual Report 2015

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2015

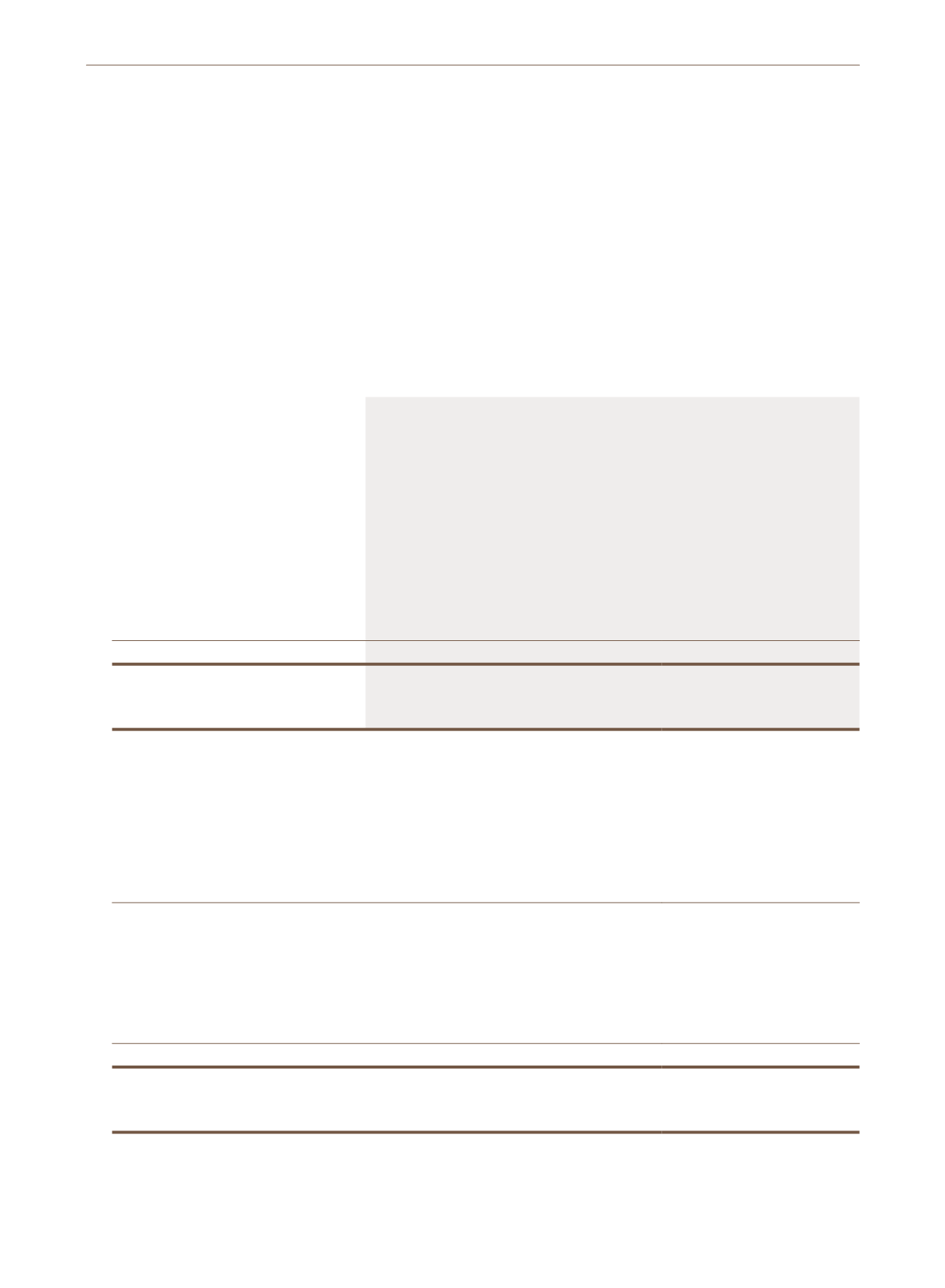

37. Classification of financial instruments (cont’d.)

Company

AFS

HTM

Loans and

receivables

Financial

liabilities at

amortised cost

Total

RM’000

RM’000

RM’000

RM’000

RM’000

At 31 December 2015

Assets

Investment securities

- Shares (quoted equity)

148,667

-

-

-

148,667

Staff loans receivable

-

-

4,486

-

4,486

Trade receivables

-

-

1,760

-

1,760

Other receivables which are financial assets

*

-

-

10,082

-

10,082

Due from subsidiaries

-

-

35,771

-

35,771

Cash and bank balances

-

-

103,811

-

103,811

Total financial assets

148,667

-

155,910

-

304,577

Liability

Other payables which are financial liabilities

**

-

-

-

8,866

8,866

At 31 December 2014

Assets

Investment securities

- Shares (quoted equity)

118,631

-

-

-

118,631

- Bonds

27,026

-

-

-

27,026

- Commercial papers

-

4,902

-

-

4,902

145,657

4,902

-

-

150,559

Staff loans receivable

-

-

6,078

-

6,078

Trade receivables

-

-

938

-

938

Other receivables which are financial assets

*

-

-

5,792

-

5,792

Due from subsidiaries

-

-

32,847

-

32,847

Cash and bank balances

-

-

56,651

-

56,651

Total financial assets

145,657

4,902

102,306

-

252,865

Liability

Other payables which are financial liabilities

**

-

-

-

7,101

7,101

*

Other receivables which are financial assets include deposits, interest receivables and sundry receivables, net of allowance for impairment, as

disclosed in Note 20.

**

Other payables which are financial liabilities include sundry payables as disclosed in Note 30.