Directors’ Report

The Directors have pleasure in presenting their report together with the audited financial statements of the Group and of the Company for the financial year ended 31 December 2013.

Principal activities

The Company is an exchange holding company, whose principal activities are treasury management and the provision of management and administrative services to its subsidiaries.

The principal activities of the subsidiaries are to operate the Malaysian securities, derivatives and offshore exchanges and the Shari’ah compliant commodity trading platform, to operate the related depository function and clearing houses, and to disseminate information relating to securities quoted on the exchanges. The principal activities of the subsidiaries are disclosed in Note 15 to the financial statements.

There have been no significant changes in the nature of these principal activities during the financial year.

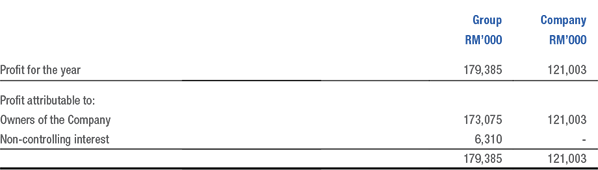

Results

There were no material transfers to or from reserves or provisions during the financial year, other than as disclosed in the statements of changes in equity and Note 2.2 to the financial statements.

In the opinion of the Directors, the results of the operations of the Group and of the Company during the financial year were not substantially affected by any item, transaction or event of a material and unusual nature other than the effects arising from the changes in accounting policies as disclosed in Note 2.2 to the financial statements.

Dividends

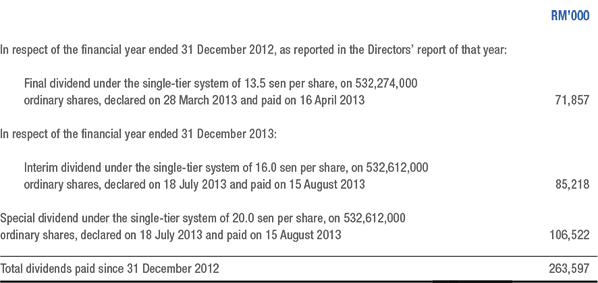

The amount of dividends paid by the Company since 31 December 2012 were as follows:

At the forthcoming Annual General Meeting, a final dividend under the single-tier system in respect of the financial year ended 31 December 2013 of 16.0 sen per share on 532,612,000 ordinary shares, amounting to a dividend payable of approximately RM85,218,000 will be proposed for shareholders’ approval. The financial statements for the current financial year do not reflect this proposed dividend. Such dividend, if approved by the shareholders, will be accounted for in equity as an appropriation of retained earnings in the financial year ending 31 December 2014.

View Pdf