Bursa Malaysia • Annual Report 2013

145

Financial Reports

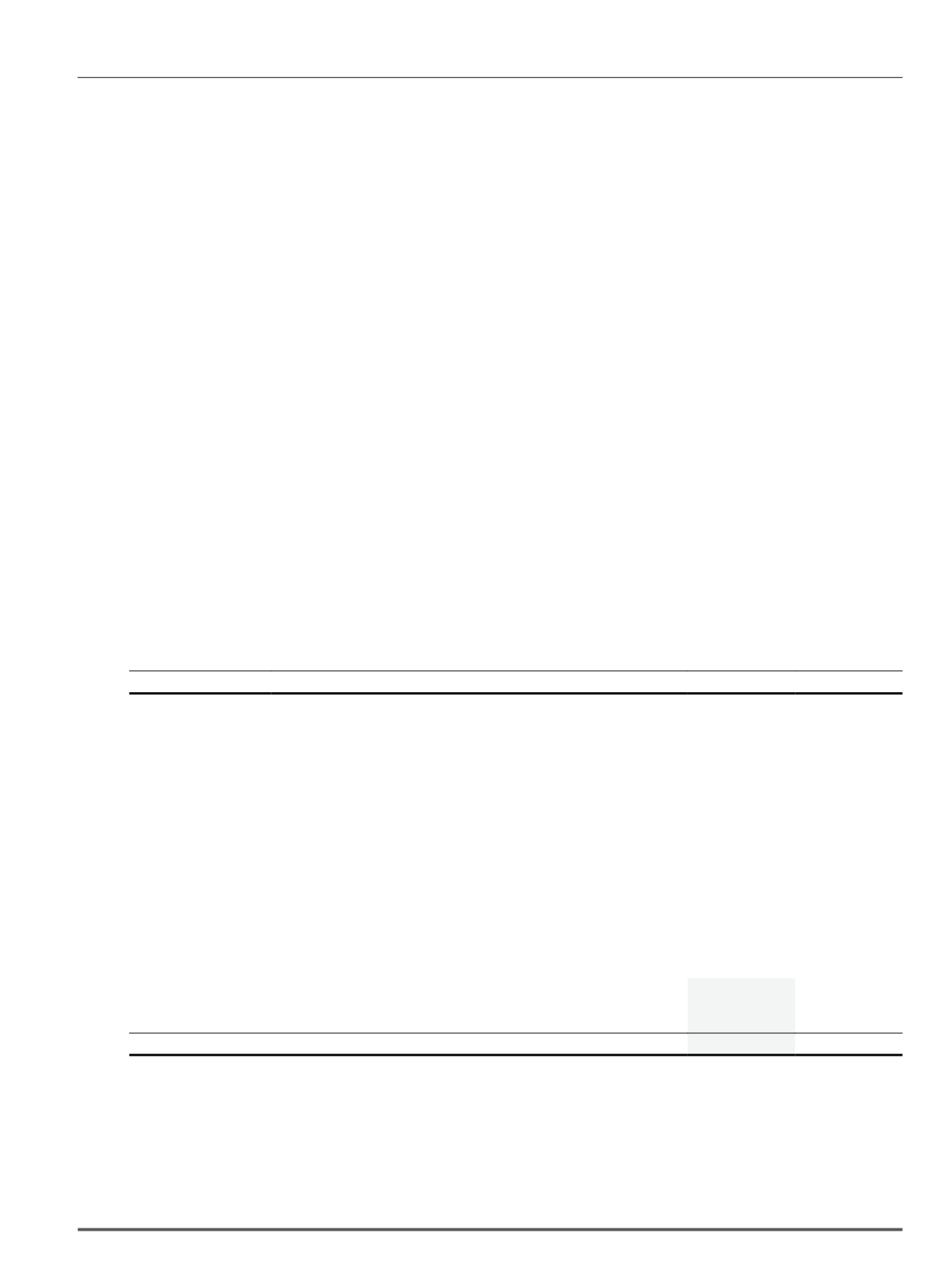

25. Other reserves (cont’d.)

(a) Capital reserve

Capital reserve is in relation to share premium in Bursa Malaysia Derivatives, which arises from “B” and “C” non-cumulative preference shares of

RM1.00 each in Bursa Malaysia Derivatives. The composition of share premium in Bursa Malaysia Derivatives is as follows:

Financial

year of

issue

Type of preference shares

No. of

shares

issued

Share

premium

RM’000

2001

“B” preference shares

16

8,000

2001

“C” preference shares

15

3,000

2002

“C” preference shares

6

1,200

2003

“C” preference shares

1

200

2006

“C” preference shares

1

200

2007

“B” preference shares

1

500

2007

“C” preference shares

2

400

2008

“C” preference shares

1

200

2010

“C” preference shares

1

200

2013

“C” preference shares

1

200

14,100

The share premium arising from the above issues are not refundable to the preference shareholders and thus are treated as a non-distributable capital

reserve. The “B” and “C” preference shares have been accounted for as part of the Group’s non-controlling interest.

During the financial year, Bursa Malaysia Derivatives proposed the revamp of its participantship structure. Further details of the revamp is disclosed in

Note 41.

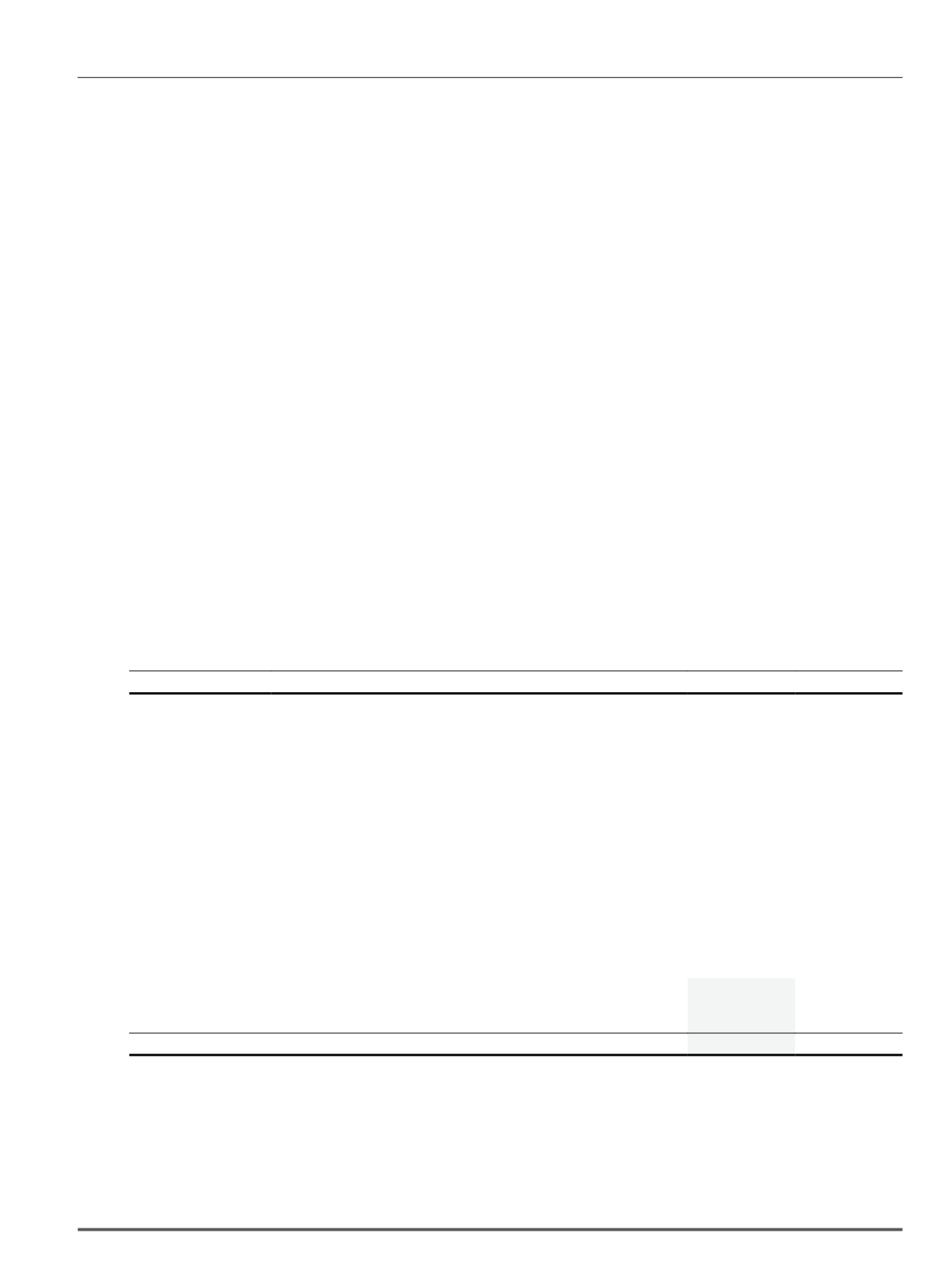

(b) Capital redemption reserve

The capital redemption reserve relates to the capitalisation of retained earnings arising from the redemption of preference shares by the following

subsidiaries:

Group

2013

2012

RM’000

RM’000

Bursa Malaysia Depository

5,000

5,000

Bursa Malaysia Securities

250

250

5,250

5,250

The capital redemption reserve is non-distributable in the form of dividends but may be applied in paying up unissued shares of the subsidiaries to be

issued to the shareholder of the subsidiaries as fully paid bonus shares.

Notes to the Financial Statements

31 December 2013