Bursa Malaysia • Annual Report 2013

139

Financial Reports

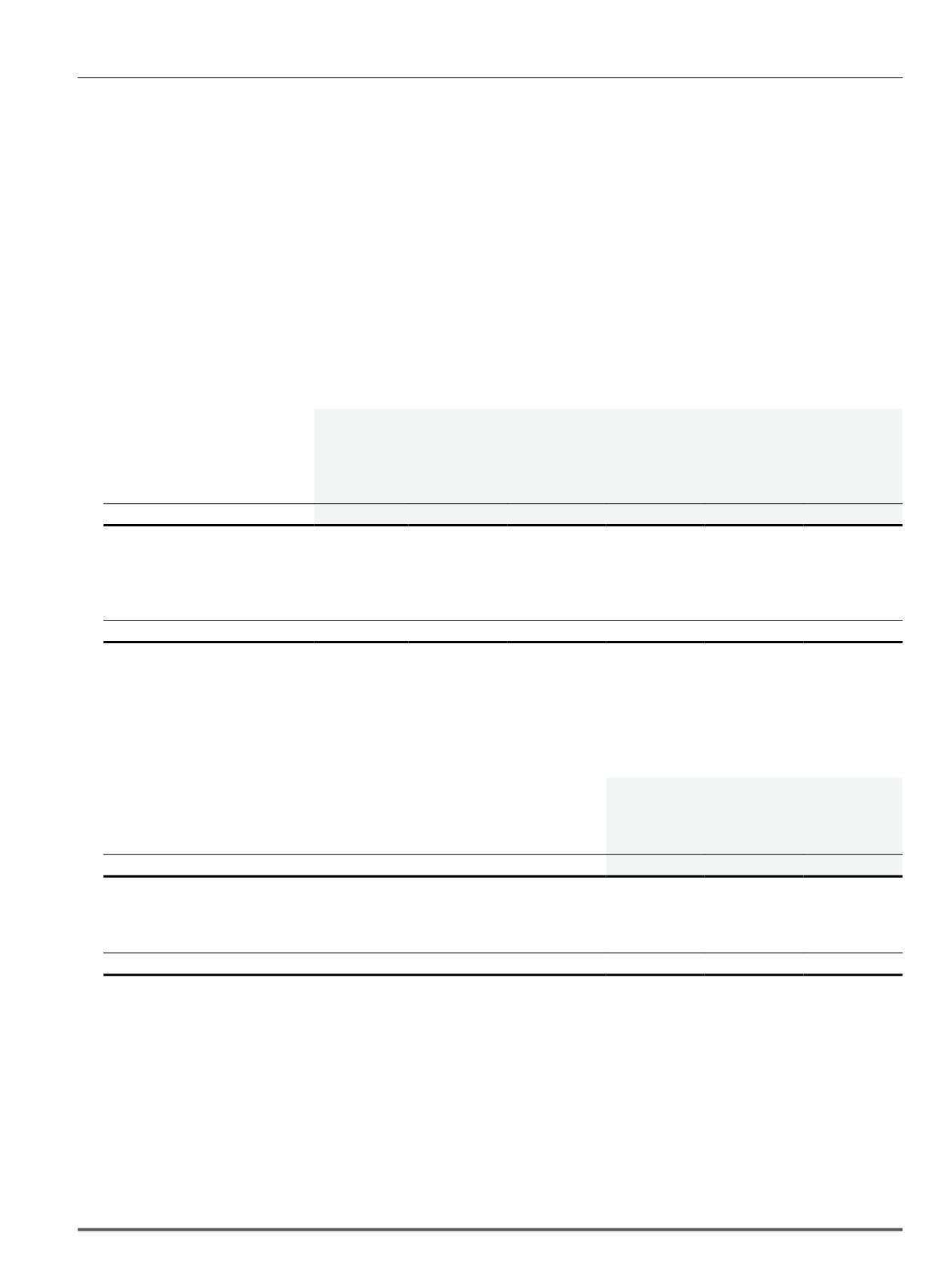

18. Deferred tax assets/(liabilities) (cont’d.)

Deferred tax assets of the Company:

Provision for

retirement

benefits

Other

provisions

and payables

Allowance for

impairment of

receivables

Depreciation in

excess of capital

allowances

Unused capital

allowances

Total

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

At 1 January 2013

7,506

5,286

692

35

-

13,519

Recognised in income statement

(526)

1,185

(681)

2

3,321

3,301

Recognised in other comprehensive

income

257

-

-

-

-

257

At 31 December 2013

7,237

6,471

11

37

3,321

17,077

At 1 January 2012 (Restated)

8,400

4,843

422

11

-

13,676

Recognised in income statement

(40)

443

270

24

-

697

Recognised in other comprehensive

income

(854)

-

-

-

-

(854)

At 31 December 2012 (Restated)

7,506

5,286

692

35

-

13,519

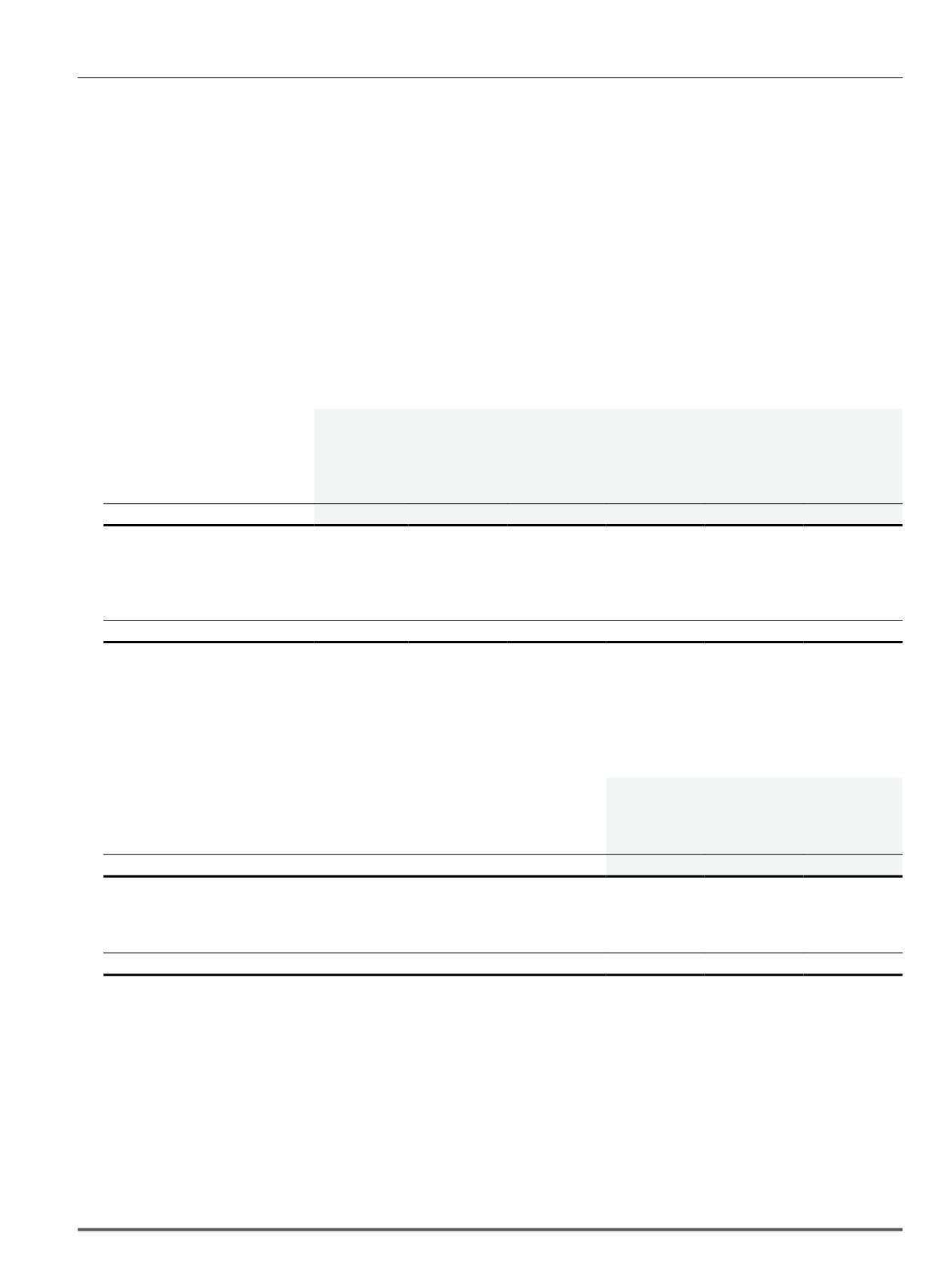

Deferred tax liabilities of the Group:

Accelerated

capital

allowances

AFS

investments

Total

RM’000

RM’000

RM’000

At 1 January 2013

(21,607)

(105)

(21,712)

Recognised in income statement

(8,425)

(260)

(8,685)

Recognised in other comprehensive income

-

143

143

At 31 December 2013

(30,032)

(222)

(30,254)

At 1 January 2012

(21,495)

(242)

(21,737)

Recognised in income statement

(112)

123

11

Recognised in other comprehensive income

-

14

14

At 31 December 2012

(21,607)

(105)

(21,712)

Notes to the Financial Statements

31 December 2013