Bursa Malaysia • Annual Report 2013

133

Financial Reports

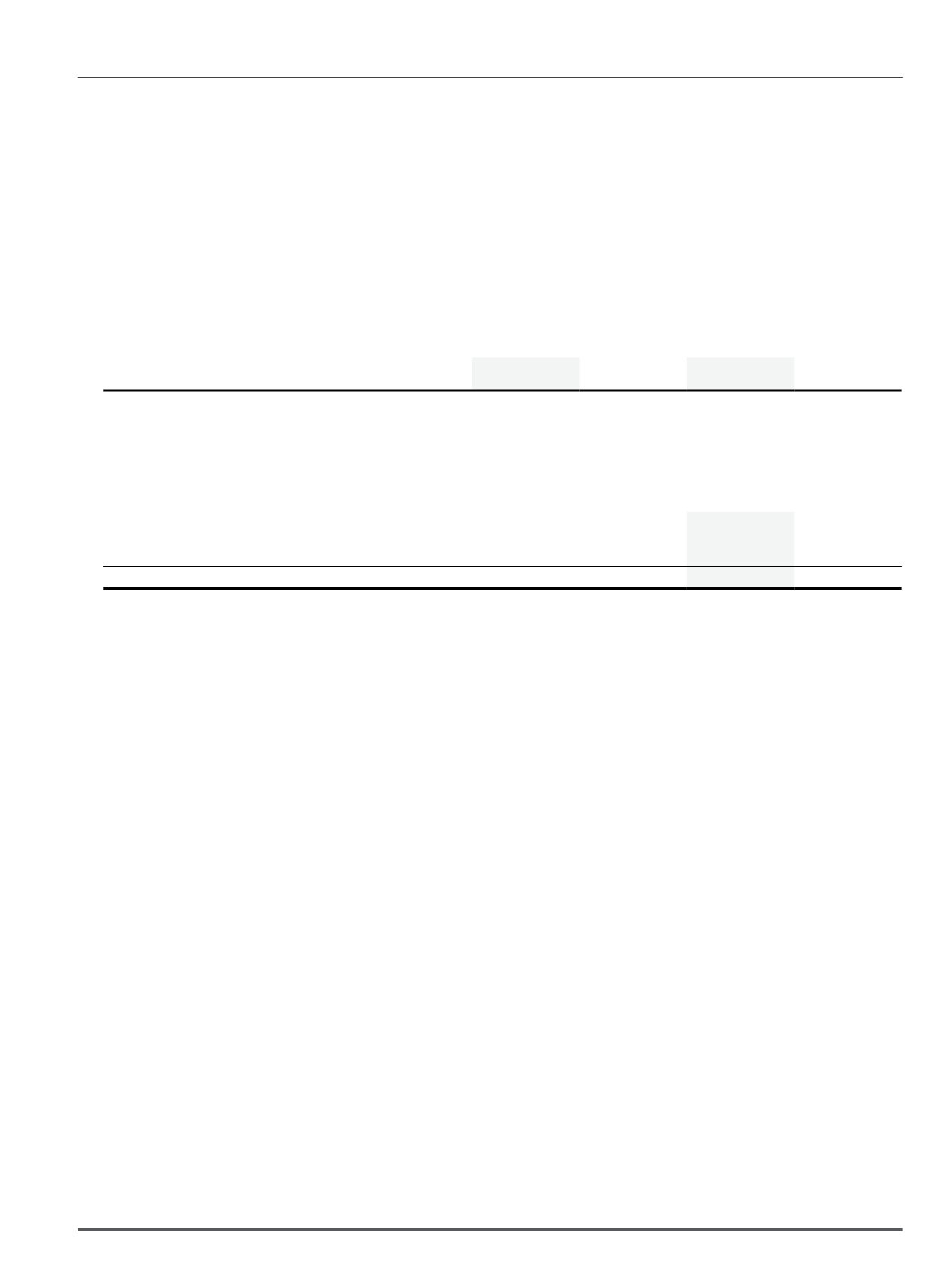

14. Goodwill

Group

Company

2013

2012

2013

2012

RM’000

RM’000

RM’000

RM’000

At 1 January/31 December

42,957

42,957

29,494

29,494

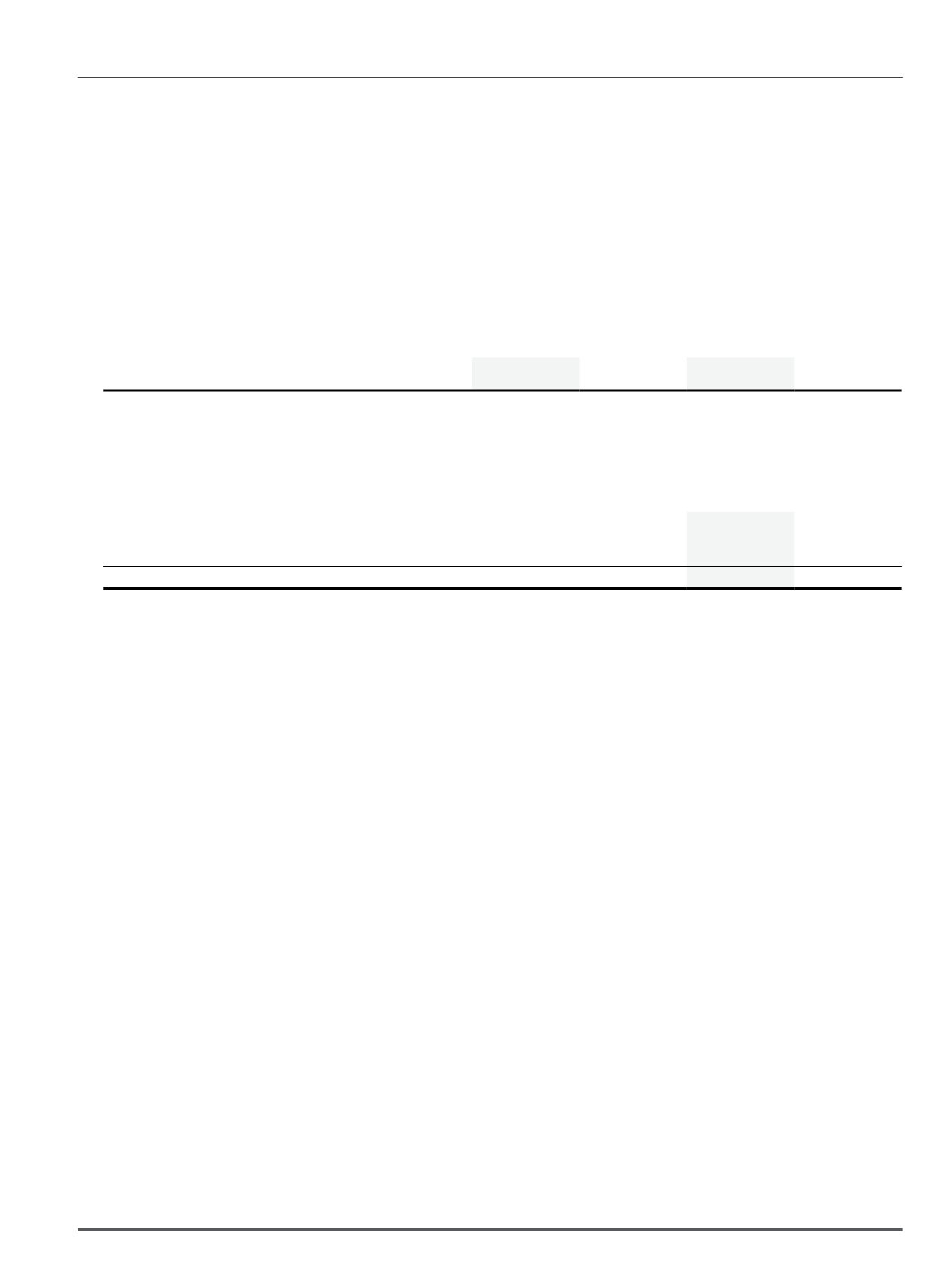

Goodwill is in respect of acquisitions of subsidiaries by the Group and has been allocated to the CGUs in the following market segments:

Group

2013

2012

RM’000

RM’000

Securities market

33,273

33,273

Derivatives market

9,684

9,684

42,957

42,957

Key assumptions used in value-in-use calculations

The following describes the key assumptions on which management has based its cash flow projections to undertake impairment assessment of goodwill:

(i) Securities market

The recoverable amount of this CGU has been determined based on value-in-use calculations using five year financial projections. Revenue growth has

been capped at 5% per annum, while expenses have been assumed to grow at 6% for the first two years and subsequent years at 3% per annum. No

revenue and expense growth was projected from the sixth year to perpetuity.

(ii) Derivatives market

The recoverable amount of this CGU has been determined based on value-in-use calculations using five year financial projections. The anticipated

annual revenue and expenses growth included in the financial projections was between 10% to 25% based on the expected developments over the

next five years. No revenue and expense growth was projected from the sixth year to perpetuity.

(iii) Discount rate

A discount rate of 11% was applied in determining the recoverable amount of the respective CGU. The discount rate was based on the Group’s weighted

average cost of capital.

Sensitivity to changes in assumptions

Management believes that no reasonable possible changes in any of the key assumptions above would cause the carrying values of the CGUs to materially

exceed their recoverable amounts.

Notes to the Financial Statements

31 December 2013