Bursa Malaysia • Annual Report 2013

141

Financial Reports

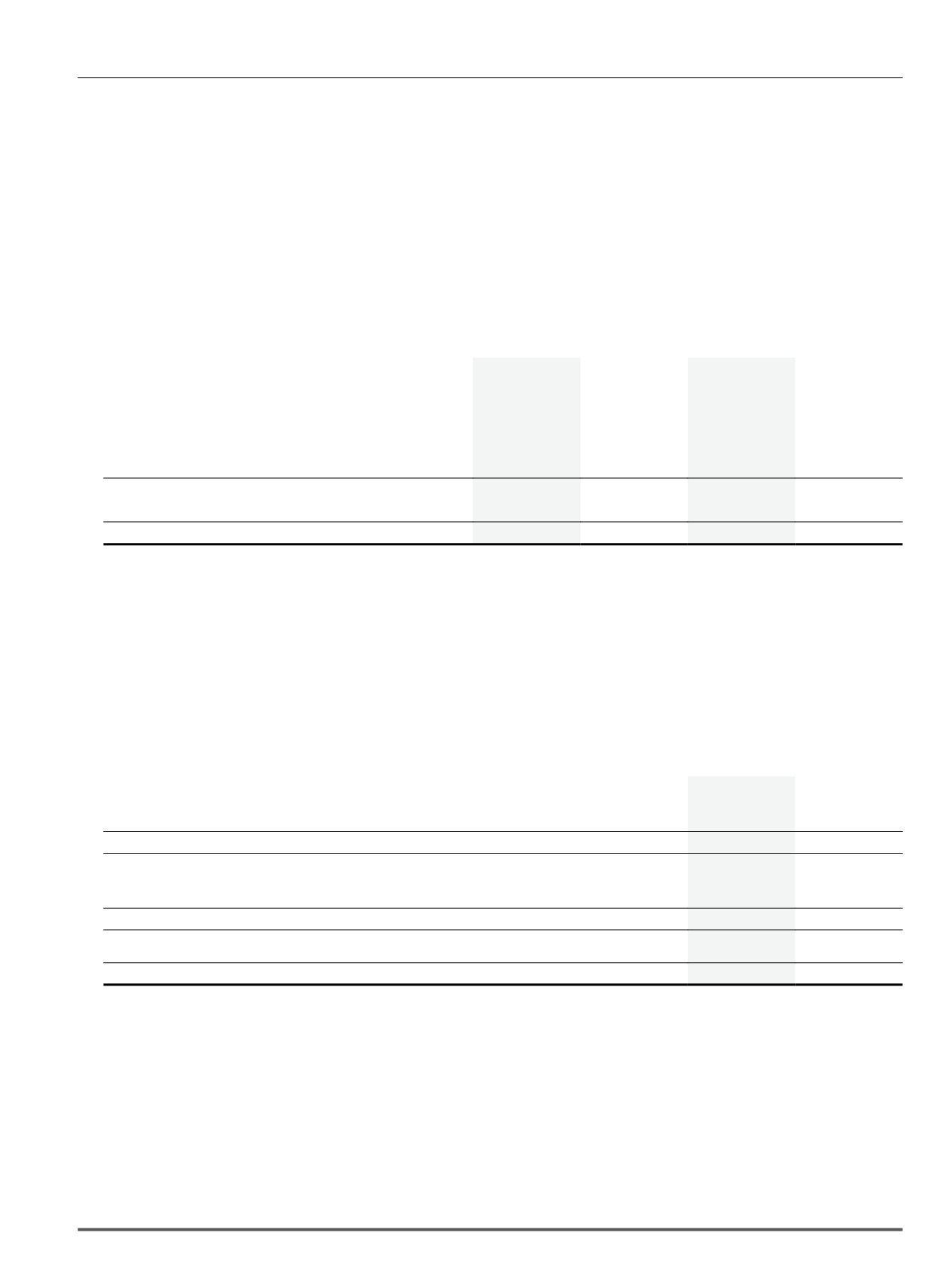

20. Other receivables

Group

Company

2013

2012

2013

2012

RM’000

RM’000

RM’000

RM’000

Deposits

733

816

613

698

Prepayments

5,282

3,727

4,931

3,712

Interest receivables

4,708

5,302

1,593

2,747

Staff loans receivable within 12 months (Note 17)

822

890

745

809

Sundry receivables

11,253

12,370

6,677

5,284

22,798

23,105

14,559

13,250

Less: Allowance for impairment

(7,004)

(7,024)

(2,675)

(2,695)

15,794

16,081

11,884

10,555

21. Related company balances

The amounts due from subsidiaries are unsecured, receivable within 30 days and bear late interest charges of 2% above the prevailing base lending rate.

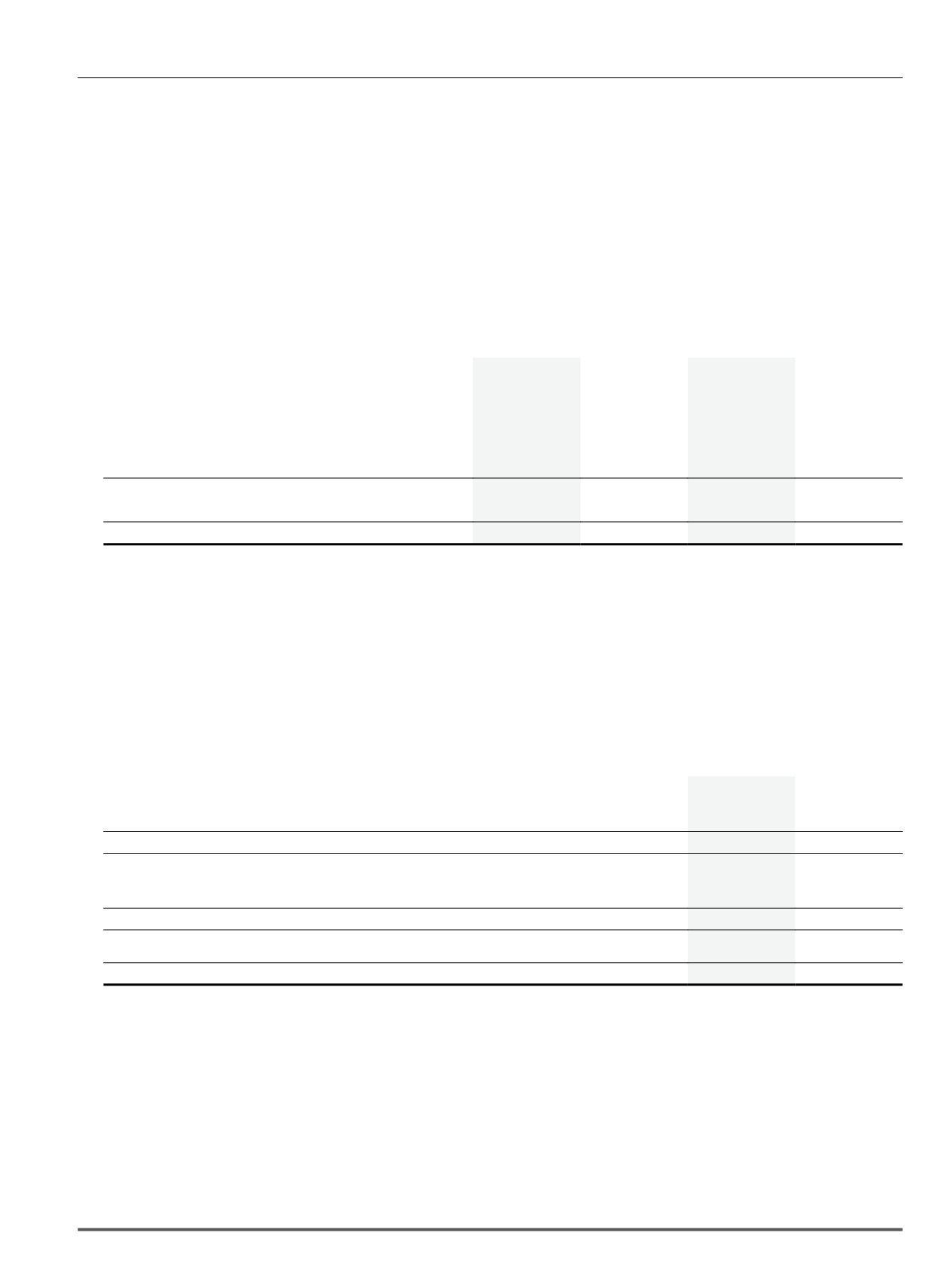

22. Cash and bank balances not belonging to the Group

Group

2013

2012

RM’000

RM’000

Derivatives margins and security deposits

733,601

1,123,660

Securities Borrowing and Lending (SBL) collaterals

717

13,574

Trade payables

734,318

1,137,234

Clearing Guarantee Fund (CGF) (Note 25(e)(i))

13,178

12,361

Derivatives Clearing Fund (DCF) (Note 25(e)(ii))

22,196

23,577

Clearing funds

35,374

35,938

Cash received for eDividend distributions (included within other payables (Note 29))

1,225

1,828

Total cash and bank balances not belonging to the Group

770,917

1,175,000

Notes to the Financial Statements

31 December 2013