Bursa Malaysia • Annual Report 2013

138

Financial Reports

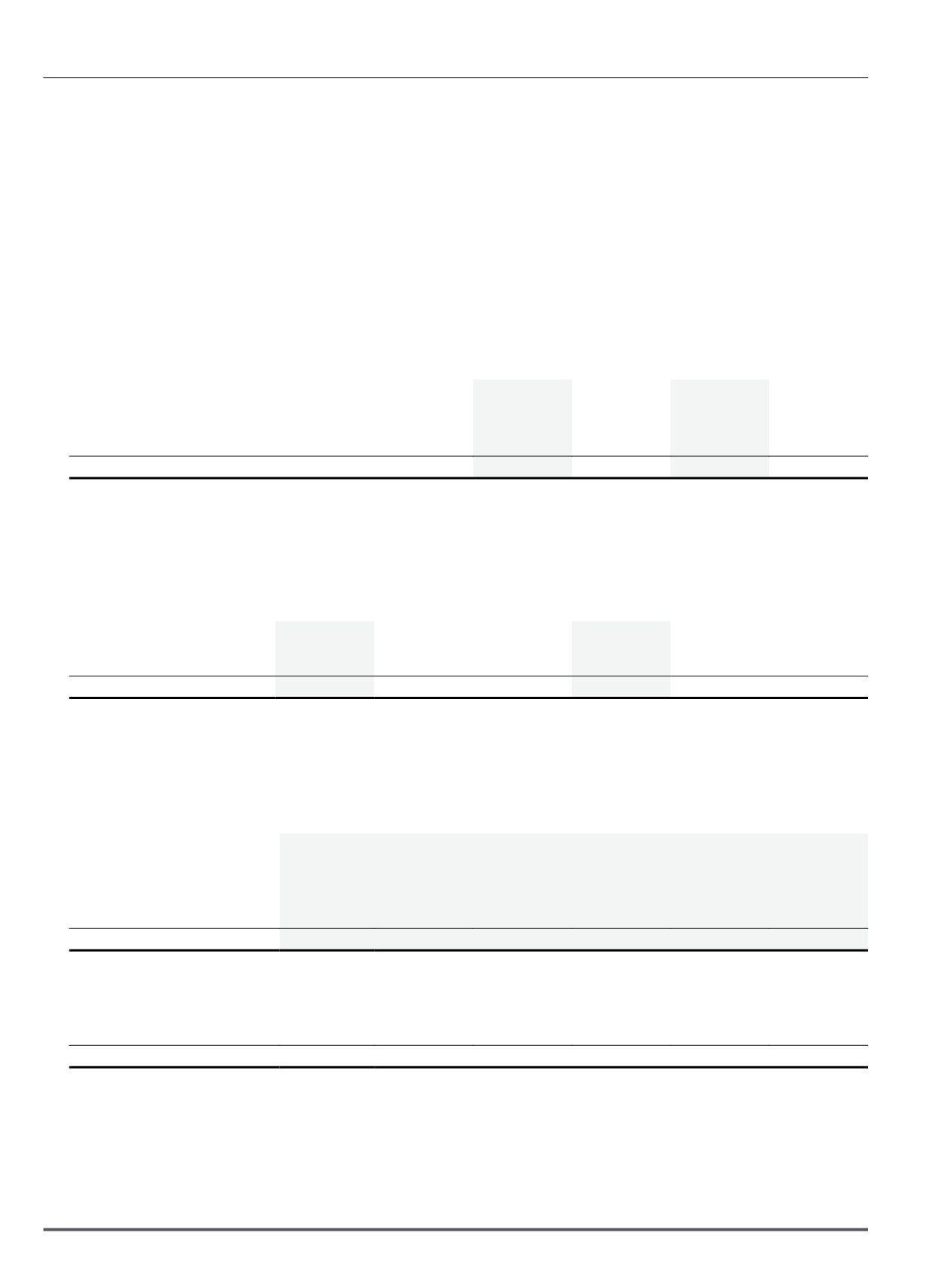

18. Deferred tax assets/(liabilities)

Group

Company

31.12.2013

31.12.2012

31.12.2013

31.12.2012

RM’000

RM’000

RM’000

RM’000

(Restated)

(Restated)

At 1 January

(6,617)

(6,530)

(4,026)

(7,564)

Recognised in income statement (Note 9)

(5,027)

753

(5,688)

4,338

Recognised in other comprehensive income

400

(840)

326

(800)

At 31 December

(11,244)

(6,617)

(9,388)

(4,026)

Presented after appropriate offsetting as follows:

Group

Company

31.12.2013

31.12.2012

1.1.2012

31.12.2013

31.12.2012

1.1.2012

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

(Restated)

(Restated)

(Restated)

(Restated)

Deferred tax assets

1,648

1,278

1,034

-

-

-

Deferred tax liabilities

(12,892)

(7,895)

(7,564)

(9,388)

(4,026)

(7,564)

(11,244)

(6,617)

(6,530)

(9,388)

(4,026)

(7,564)

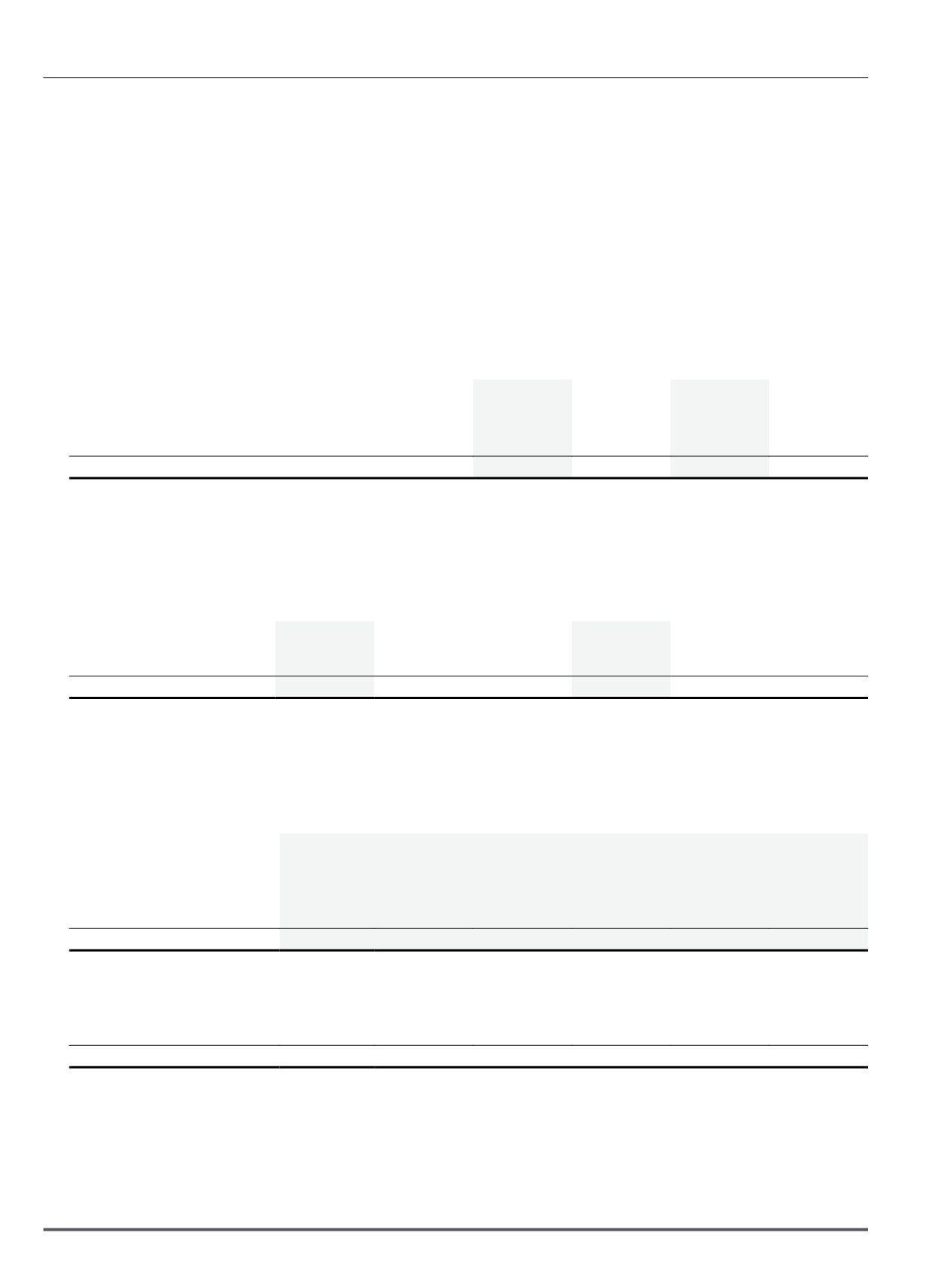

Deferred tax assets of the Group:

Provision for

retirement

benefits

Other

provisions

and payables

Allowance for

impairment of

receivables

Depreciation in

excess of capital

allowances

Unused capital

allowances

Total

RM’000

RM’000

RM’000

RM’000

RM’000

RM’000

At 1 January 2013

7,505

6,705

847

38

-

15,095

Recognised in income statement

(526)

1,696

(837)

4

3,321

3,658

Recognised in other comprehensive

income

257

-

-

-

-

257

At 31 December 2013

7,236

8,401

10

42

3,321

19,010

At 1 January 2012 (Restated)

8,400

6,252

542

13

-

15,207

Recognised in income statement

(41)

453

305

25

-

742

Recognised in other comprehensive

income

(854)

-

-

-

-

(854)

At 31 December 2012 (Restated)

7,505

6,705

847

38

-

15,095

Notes to the Financial Statements

31 December 2013