Bursa Malaysia • Annual Report 2013

140

Financial Reports

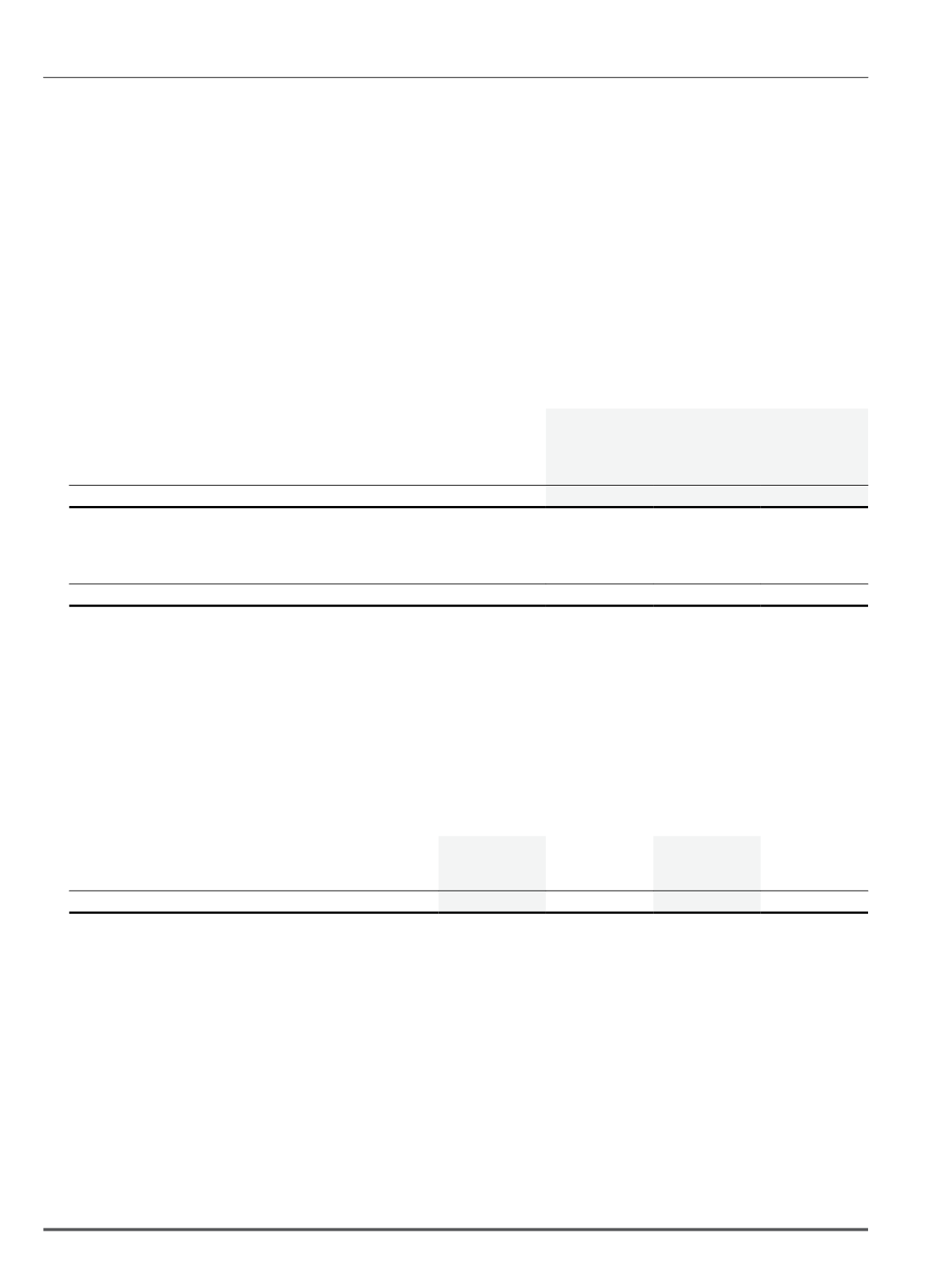

18. Deferred tax assets/(liabilities) (cont’d.)

Deferred tax liabilities of the Company:

Accelerated

capital

allowances

AFS

investments

Total

RM’000

RM’000

RM’000

At 1 January 2013

(17,435)

(110)

(17,545)

Recognised in income statement

(8,943)

(46)

(8,989)

Recognised in other comprehensive income

-

69

69

At 31 December 2013

(26,378)

(87)

(26,465)

At 1 January 2012

(21,072)

(168)

(21,240)

Recognised in income statement

3,637

4

3,641

Recognised in other comprehensive income

-

54

54

At 31 December 2012

(17,435)

(110)

(17,545)

At the financial year end, the Group has tax losses of approximately RM17,485,000 (2012: RM17,131,000) that are available for offset against future

taxable profits of the companies in which the losses arose. No deferred tax asset is recognised on this amount due to uncertainty of its recoverability. The

availability of unused tax losses for offsetting against future taxable profits of the respective subsidiaries in Malaysia are subject to no substantial changes

in shareholdings of those subsidiaries under the Income Tax Act, 1967 and guidelines issued by the tax authority.

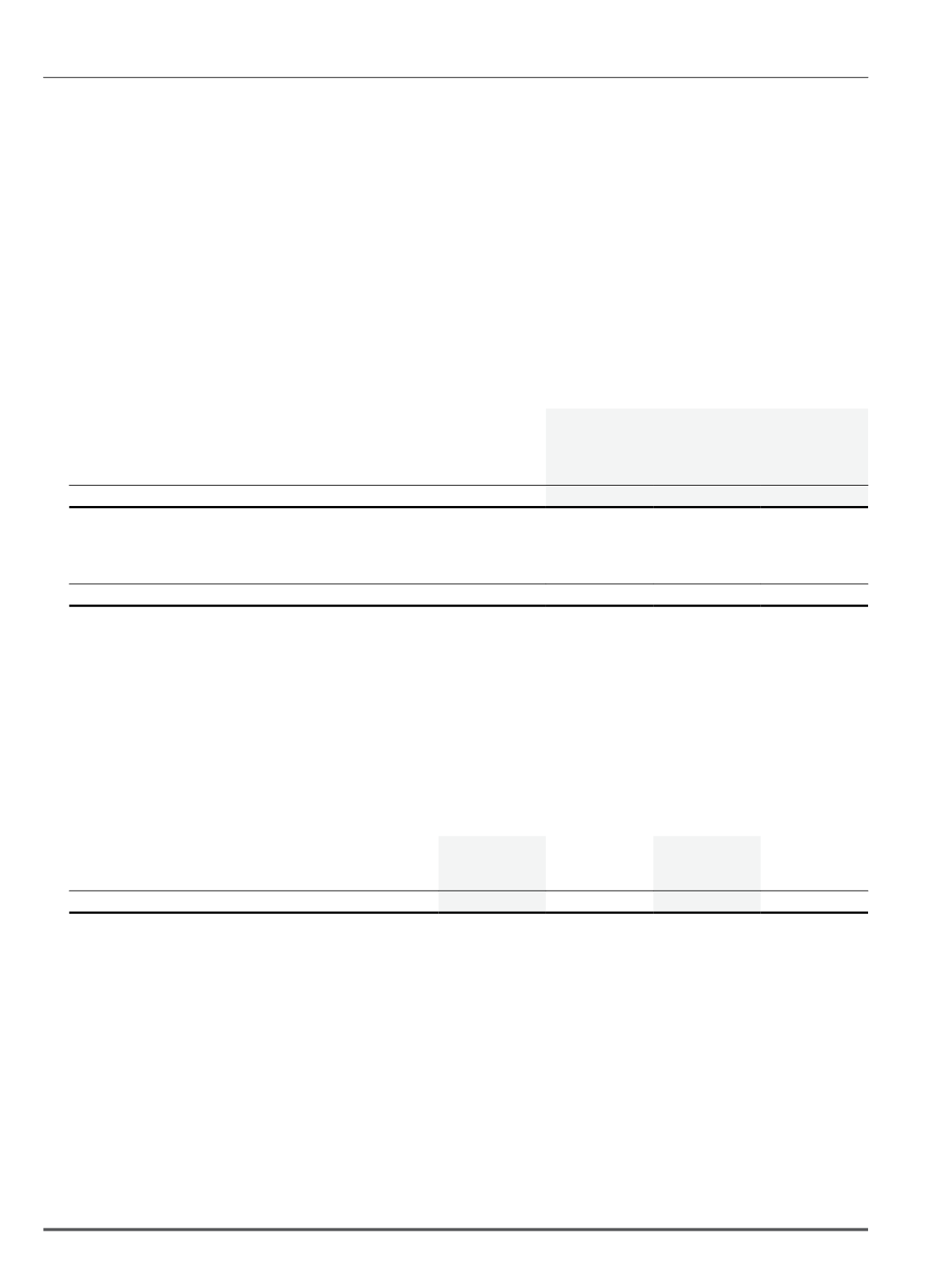

19. Trade receivables

Group

Company

2013

2012

2013

2012

RM’000

RM’000

RM’000

RM’000

Trade receivables

33,234

28,920

1,480

1,581

Less: Allowance for impairment

(501)

(458)

(194)

(206)

32,733

28,462

1,286

1,375

Notes to the Financial Statements

31 December 2013