FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

39

Bursa Malaysia •

Annual Report 2015

CEO’S MESSAGE

AND MANAGEMENT

DISCUSSION AND ANALYSIS

ISLAMIC CAPITAL MARKET

BUILDING SUSTAINABLE COMMUNITIES

2015 was an active year of engagement for ICM as it focused its efforts on

building regional bridges and widening the market base. During the year,

ICM held direct engagements with over 7,000 individual retail investors and

more than 50 institutions including potential issuers, institutional investors

and fund managers, particularly those with Islamic mandates, domestically

and internationally. Our BSAS engagement team reached out to countries

including Jordan, Kuwait, Saudi Arabia, the UAE, Singapore and Brunei,

soliciting new demand in the international market.

We continued to reach out to retail investors through targeted seminars

and events. In 2015, we collaborated with our Islamic brokers to organise

Shariah Investing @ Bursa retail seminars throughout the country. We also

worked together with strategic agencies such as Yayasan Dakwah Islamiah

Malaysia and Bank Rakyat to build greater rapport with the investing public.

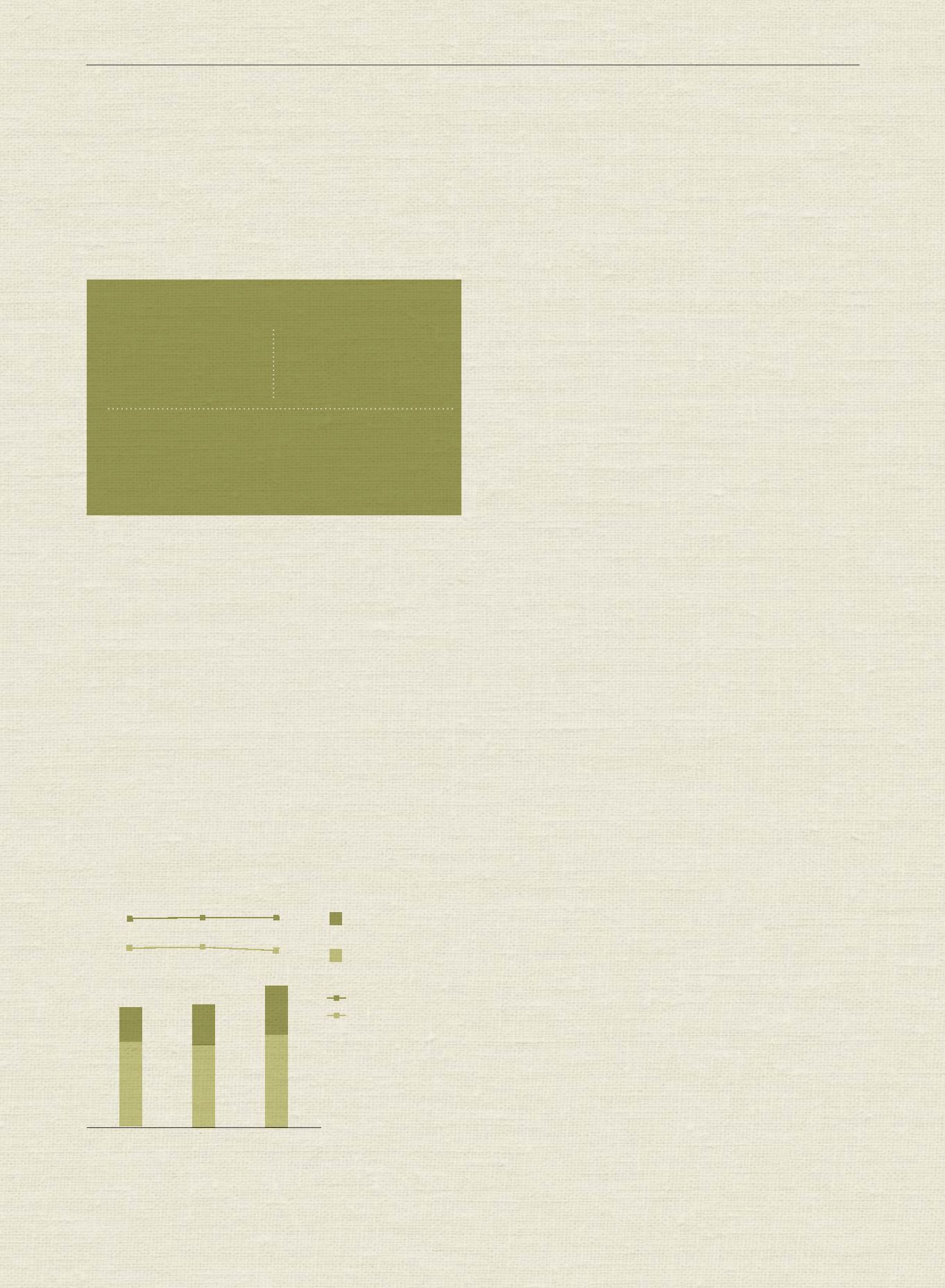

MARKET CAPITALISATION OF LABUAN INTERNATIONAL FINANCIAL

EXCHANGE

STAKEHOLDER ENGAGEMENTS

25

retail

seminars

7,000

retail investors

50

institutions

MARKET DEVELOPMENT INITIATIVES

We have contributed to the development of the Malaysian capital market by

providing an alternative marketplace for fund raising and investments. Our

efforts remain focused on increasing the role of ICM and on increasing the

breadth and depth of its products and services to support the growth of the

Islamic finance industry.

The past year saw the listing of two new Shariah-compliant Exchange

Traded Funds (“ETFs”): the MyETF MSCI SEA Islamic Dividend and MyETF

Thomson Reuters Asia Pacific ex-Japan Islamic Agribusiness. The addition

of these new ETFs provides investors with greater product diversity in the

Islamic space and will appeal to investors looking for index-linked products

and returns. As at end 2015, there were four Shariah-compliant ETFs listed

and traded on Bursa Malaysia.

2015 also saw the listing of a new Shariah-compliant Real Estate Investment

Trust (“REIT”), i.e. the Al-Salam REIT, which gives investors an additional

choice in their investment portfolio that is stable in nature while providing

steady income. The addition of the Al-Salam REIT brought the total number

of Shariah-compliant REITs listed on Bursa Malaysia to four.

In the Sukuk market, Malaysia retained its status as the global leader. In

2015, four Sukuks were listed under the Exempt Regime:

i.

PETRONAS Global Sukuk Ltd

ii. Malaysia Sovereign Sukuk Berhad

iii. Axiata SPV2 Berhad

iv. Hong Kong Sukuk 2015 Limited

As for the Labuan International Financial Exchange (“LFX”), total market

capitalisation continued to grow by 14% to USD27.3 billion in 2015 from

USD23.9 billion a year ago. We also saw an increase in the value of the

listing of both conventional and Shariah-compliant instruments, which grew

9% and 24% respectively.

MOVING FORWARD

ICM has generated considerable growth momentum over the last few years,

and it is our intention to leverage on this momentum to promote Islamic

offerings as an alternative to conventional ones. Favouring this is the fact

that Shariah indices have consistently outperformed the FBM KLCI and its

conventional counterparts over the past five years, thereby making Islamic

investment an attractive source of value for investors.

Moving forward, ICM will continue to look for opportunities to grow and

play a leading role by facilitating cross-border financial activities that will

support the growth of Islamic finance.

16.7

6.8

23.5

23

9

11

11

24

22

16.3

7.6

23.9

17.9

9.4

27.3

Market Capitalisation of

Bonds (USD billion)

Market Capitalisation of

Sukuk (USD billion)

2013

2014

2015

Number of Bond Listing

Number of Sukuk Listing

Over

Over

Over