FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

38

Bursa Malaysia •

Annual Report 2015

CEO’S MESSAGE

AND MANAGEMENT

DISCUSSION AND ANALYSIS

ISLAMIC CAPITAL MARKET

20

15

RM

milli

on

2014

RM

m

il

li

on

%

change

BSAS T

ra

di

ng Reven

ue

16

.8

10.0

69

%

Ot

he

r

0.6

0.

5

8%

To

ta

l

17

.4

10

.5

65

%

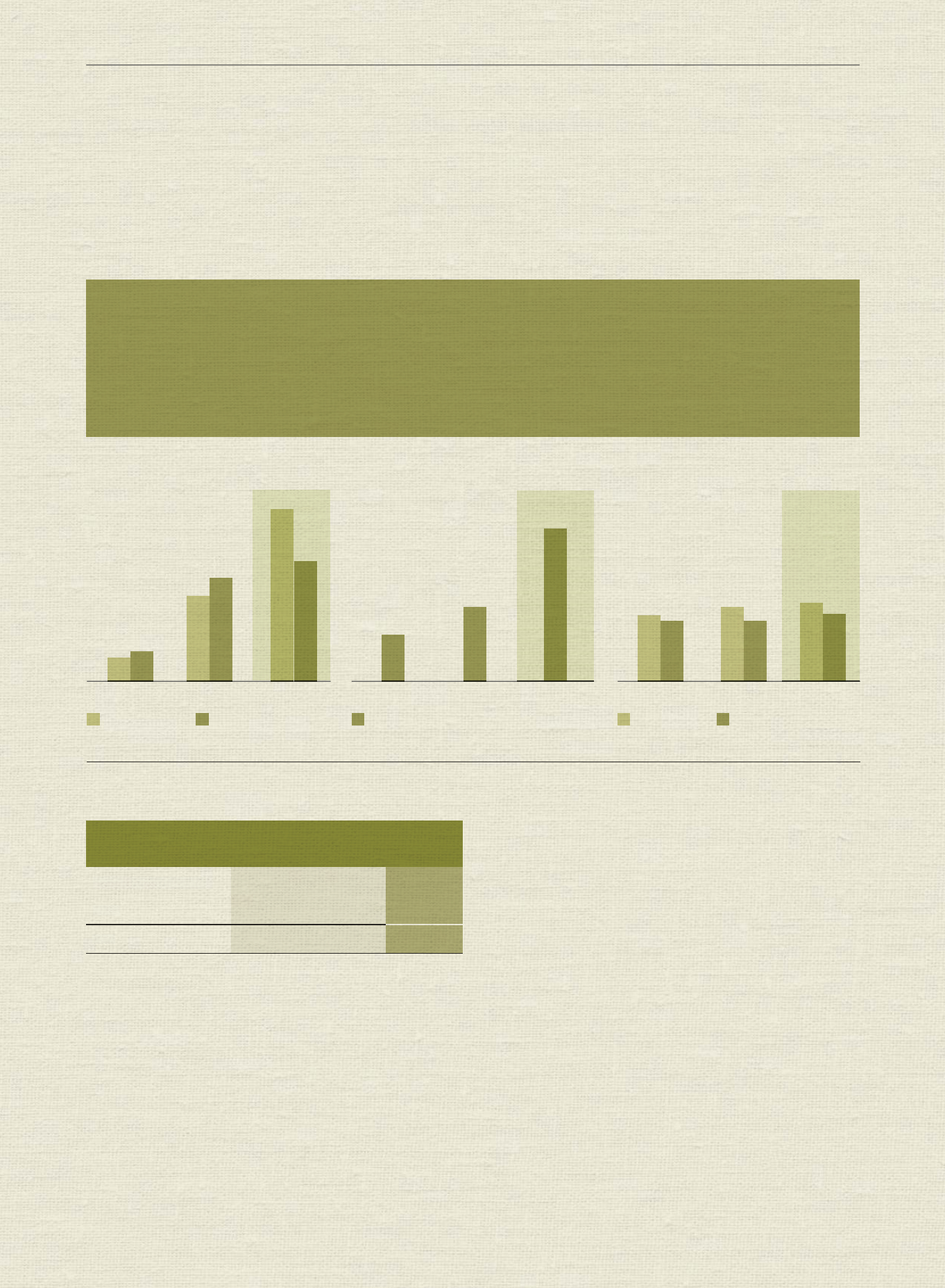

ISLAMIC CAPITAL MARKET SEGMENTAL REVENUE

GROWING ACCEPTANCE OF MURABAHAH AND BSAS PLATFORM

DRIVES PERFORMANCE

Profit contribution from ICM in 2015 increased more than two-fold to

RM11.8 million compared to RM5.4 million in 2014. Operating revenue

rose 65% to RM17.4 million from RM10.5 million in 2014. The primary

driver for the growth in ICM is trading revenue generated on the BSAS

platform, which amounted to RM16.8 million, representing a 69% increase

from the previous year.

The BSAS platform saw ADV grow 121% to RM15.2 billion in 2015. Since its

inception in August 2009, BSAS has recorded a cumulative annualised growth rate

(“CAGR”) of 136%. In 2015, the total commodity trade value on BSAS grew 121% to

RM3.7 trillion from RM1.7 trillion in 2014.

SEGMENT PROFIT AND OPERATING MARGIN BSAS ADV

SUKUK LISTED UNDER EXEMPT REGIME

Segment Profit

(RM million)

ADV (RM billion)

Operating Margin (%)

Sukuk Value

(USD billion)

No. of Sukuk

5.4

50.3

0.9 13.6

11.8

66.5

3.9

15.2

6.9

34.2

20

32.9 20

34.6

22

The strong growth in BSAS trading was mainly driven by the conversion of

bank deposits from Mudharabah to Murabahah contracts and the growing

interest in tenor-based pricing.

Key achievements of BSAS in 2015 included:

• Largest daily trade:

RM30.7 billion on 28 December 2015

• Largest single deal:

RM6.9 billion on 29 January 2015

• Increase in BSAS participants:

The number of market participants

continued to rise with the addition of 16 new participants, bringing the

total to 109 in 2015 (from 93 in 2014). Domestic participants accounted

for 88% of total trades while foreign participants accounted for the

remaining 12%

BSAS’ achievements were recognised by the Global Islamic Finance Awards

2015 which presented the Exchange with the “Best Islamic Exchange 2015”

award and also by the award of “Best Islamic Finance Facilitation Platform

Asia 2015” from the Global Banking & Finance Review. The international

financial community picked BSAS as the “Best Interbroker for Islamic

Transactions” at the 10

th

Islamic Finance News Service Providers Poll 2015.

2013

2013

2013

2014

2014

2014

2015

2015

2015