FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

36

Bursa Malaysia •

Annual Report 2015

CEO’S MESSAGE

AND MANAGEMENT

DISCUSSION AND ANALYSIS

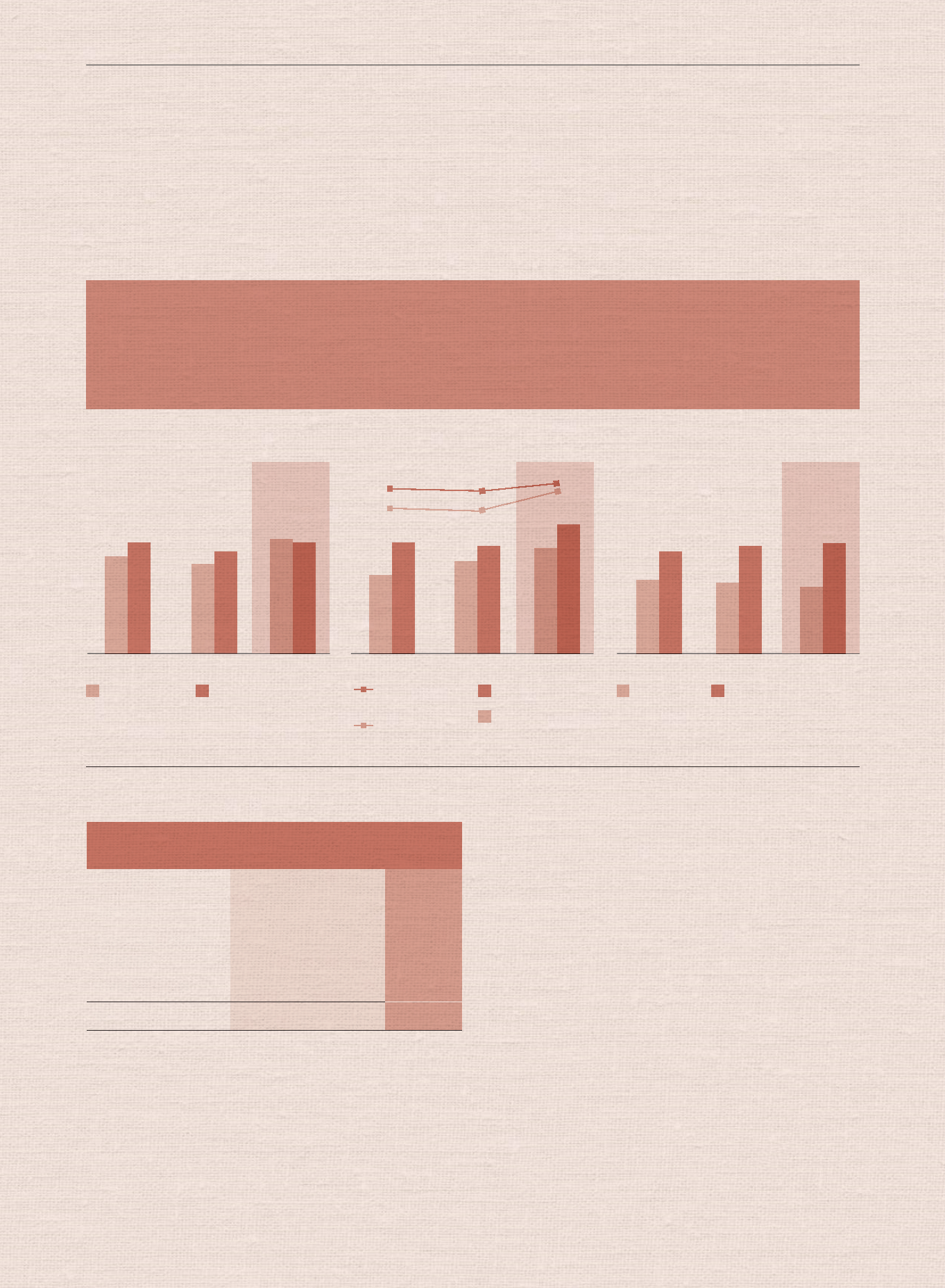

DERIVATIVES MARKET

Trading volumes for all contracts set a new record in 2015 with ADC rising 13% to

57,157 contracts from 50,654 contracts in 2014. The greater trading activity was

driven by fluctuations in the prices of underlying commodities and the FBM KLCI.

SEGMENT PROFIT AND OPERATING MARGIN

FOREIGN AND DOMESTIC PARTICIPATION

40.8

45.7

44.1

50.3

51.2 50.1

43.5

196.5

38

62

42

58

39

61

20

15

RM

m

il

li

on

20

14

RM

m

il

lion

%

ch

an

ge

Trad

ing Revenue

86

.1

70.6

+22%

Market Data

7.

8

7.

1

+1

0%

Me

mber S

er

vi

ce

s

an

d

Co

nn

ectivity

0.

3

1.

9

-8

6%

Co

nf

er

ence

I

nc

om

e

5.

8

6.

2

-5

%

Total

10

0.

0

85

.8

+17%

DERIVATIVES MARKET SEGMENTAL REVENUE

DERIVATIVES TRADING BOLSTERED BY VOLATILE COMMODITY PRICES

The Derivatives Market’s segmental profit grew by 25% to RM51.2 million

from RM40.8 million in 2014, while operating revenue rose 17% to RM100.0

million from RM85.8 million a year ago.

The growth was attributed to higher trading revenue, which saw the volume

of FCPO and FKLI contracts traded grow by 8% to 11.0 million contracts

from 10.2 million contracts, and by 39% to 3.0 million contracts from 2.2

million contracts respectively. Other positive contributors to operating

revenue included higher guarantee and collateral management fees due to

higher margin requirement for FCPO and FKLI, as well as the higher number

of open interest positions.

Conversely, revenue from member services and connectivity fell 86% due

to the cessation of the Derivatives OMS service following the system’s

retirement in December 2014. Since end February 2015, brokers have

migrated to their individual authorised OMS.

50.7

196.4

57.2

230.4

17%

9%

15%

21%

16%

7%

Segment Profit

(RM million)

Operating Margin (%)

ADC (’000)

Open Interest (’000)

Foreign (%)

Domestic (%)

Volatility of Crude

Palm Oil Prices

Volatility of

FBM KLCI

ADC OPEN INTEREST AND VOLATILITY

2013

2013

2013

2014

2014

2014

2015

2015

2015