FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

32

Bursa Malaysia •

Annual Report 2015

Secu

ri

ti

es tra

di

ng

r

ev

en

ue

fell

on

a

l

ower

t

radi

ng

p

ar

ti

ci

pa

ti

on

b

y

do

m

e

stic

reta

il

a

nd i

ns

titutional

inv

es

to

rs

, bu

t

was cu

shioned partia

ll

y by h

ig

he

r

fo

re

ig

n

pa

rticipat

ion.

M

eanw

hi

le

,

th

er

e

wa

s

grea

te

r

tr

ad

in

g

intere

st

i

n

Cr

ud

e Pa

lm

O

il

F

utures

(“FCP

O”

)

an

d

FTSE

B

ursa M

al

aysi

a

KL

CI

Futur

es

(“FK

LI”) i

n

the

De

ri

vative

s

Ma

rk

et

w

he

re average d

ai

ly

c

on

tracts

(

“A

DC

”)

rose

1

3%

t

o

57,157

c

on

tr

ac

ts

owing

t

o

ma

rk

et vol

at

il

it

y.

B

SA

S si

mi

la

rl

y

sa

w

greate

r

tr

ad

in

g

du

e

ma

in

ly

to

th

e

co

nv

ersion

t

o Mu

ra

ba

hah

co

nt

ract

s

an

d

gr

owing in

te

re

st

i

n

te

nor-

ba

se

d

pr

ic

in

g.

Th

e

ri

se

i

n

contri

bution

s

from

o

ur

non

-s

ec

urit

ie

s ma

rk

et

s

is

a

p

os

it

iv

e

si

gn

t

ha

t

ou

r

effo

rt

s

to

g

row these busine

ss

s

eg

me

nt

s

are

wo

rk

in

g,

a

nd

we

a

re

o

ptimisti

c

that the

y

wi

ll

c

on

ti

nue

to

gro

w th

eir co

nt

ribu

ti

on

s

go

in

g

forwar

d.

OP

ER

AT

ING

EX

PENSES

S

HO

W

CONTROLLED RISE

Bu

rsa

Malays

ia

’s operati

ng e

xpenses ro

se 3

%

to

R

M239

.8 m

i

l

li

on

i

n 20

15

du

e main

ly

t

o

hi

gh

er

s

ta

ff

costs. We

r

em

ain committe

d to a

talent st

ra

tegy

that will see us m

ai

ntai

n

th

e

hi

ghes

t

qual

it

y staff poss

ib

le

a

s

pa

rt

o

f

our

pl

an

to

be

come

a

high

pe

rf

or

mi

ng

org

an

is

at

io

n (“HP

O”).

We

als

o

paid

h

ighe

r

serv

ic

e

fe

es

(

+22%

t

o

RM

22.4 m

il

li

on)

in

2

015

du

e

to

t

he

gre

at

er

n

um

be

r

of derivativ

es

c

on

tr

acts traded and

al

so

the

comparatively weaker val

ue

of the Malaysian

Ri

ng

git ag

ai

ns

t the US

Doll

ar

.

Meanwhile,

w

e

bo

ok

ed

a

l

ower

d

ep

re

ciat

io

n an

d am

or

ti

sa

ti

on c

os

t

in

2

015 as we ha

d

retire

d

ou

r

De

ri

vative

s

Order Management Syste

m

(“

OM

S”

)

in 2014.

O

ther expense items including pro

fe

ssiona

l

fe

es

,

ad

ministra

ti

ve a

nd

m

iscellan

eo

us

exp

en

se

s

ro

se

d

ur

ing th

e

year

as

we

co

ntin

ued to incre

as

e the capa

bi

liti

es of ou

r

mark

et

place.

RE

WA

RD

IN

G

OUR SHAREHOLDERS

In

v

ie

w

of our financ

ia

l pe

rf

ormanc

e

and afte

r

taking

into

considerat

io

n

op

er

ating conditions

a

head

,

Bu

rsa Ma

la

ys

ia

’s

B

oa

rd

o

f Dire

ct

ors

ha

s

re

co

mm

en

ded

a

final

d

iv

id

en

d of

1

8 se

n

per share

to b

e

ap

proved

a

t our

Annual General Meeting to be held in March 2016. If approved, the total

dividends paid by Bursa Malaysia in 2015 will amount to 34.5 sen per

share, representing a dividend yield of 4.1%.

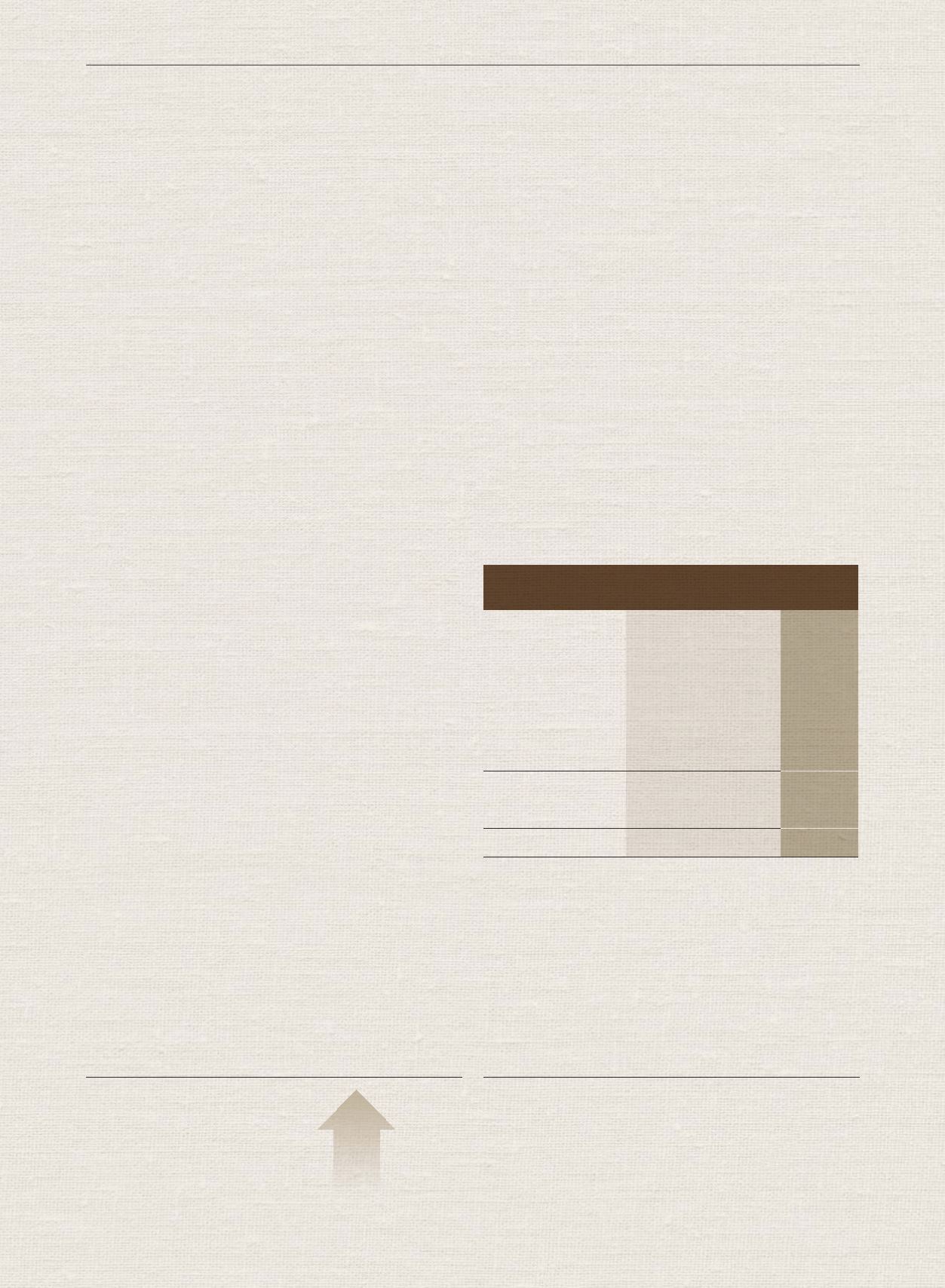

SEGMENTAL PERFORMANCE HIGHLIGHTS

Contributions from our individual markets were mixed in 2015 owing

to volatile market conditions. Although trading in the Securities Market

had decreased during the year, increased activity in the Derivatives and

Islamic Capital Markets had more than made up the difference. The

increase in our non-securities trading revenue is further evidence of the

diversity of our market, as investors and market players can continue

to find value in alternative products and options even when the general

market is on the decline. The following table provides an overview of the

financial performance of our markets:

RM278.8

Profit Before Tax

57,157

ADC rose to

CEO’S MESSAGE

AND MANAGEMENT

DISCUSSION AND ANALYSIS

Se

gm

en

ta

l

Re

vi

ew

2015

RM m

il

li

on

20

14

RM

m

il

li

on

% ch

an

ge

Segm

en

tal

Pr

ofi

t/(L

os

s)

Fr

om

:

Se

cu

ri

ties M

ar

ke

t

28

5.7

29

4.

3

-3

%

De

r

iva

ti

ve

s Mark

et

51

.2

40

.8

+

2

5%

Islamic Ca

pi

ta

l

Ma

rk

et

11

.8

5.4

+1

20

%

Ex

change Hol

di

ng

(8

.9

)

(8.9)

0%

Total

Se

gmenta

l

Pr

ofi

t

339.8

33

1.

6

+2

%

Overhe

ad

s

(6

1.

0

)

(5

9.

8)

+2

%

Profit

Be

fore

Tax

27

8.

8

271.8

+3

%

million

contracts

13%