FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

31

Bursa Malaysia •

Annual Report 2015

CEO’S MESSAGE

AND MANAGEMENT

DISCUSSION AND ANALYSIS

RM198.6

PATAMI improved to

RM206.4

PAT grew to

million

million

While sustainability is gradually taking root in our PLCs, we believe that

we must take the sustainability agenda to the next level to secure long-

term viability of our PLCs and our marketplace.

In 2015, we took a four-pronged approach to sustainability:

• Communicating our sustainability vision and goals through our

flagship events, i.e. the ASEAN CAP10 Sustainability Series and

Sustainability Symposium

• Introducing a new Sustainability Reporting Guide and six toolkits for

PLCs to encourage sustainable practices in their operations.

• Committing ourselves to the best sustainability practices by signing

on to the United Nation’s Sustainable Stock Exchange (“UN SSE”)

initiative

• Transforming the way our PLCs operate and report on sustainability

via the FTSE4Good Bursa Malaysia Index and through Environment,

Social and Governance (“ESG”) engagement programmes

We recognise that sustainability is an ongoing conversation rather than

an achievement, and hence we will continue to enhance our sustainability

practices going forward. We are also proud to report that we are the first

exchange in the region to develop a sustainability framework, and we aim

to maintain this competitive advantage.

SUSTAINED FINANCIAL PERFORMANCE

AMIDST CHALLENGING CONDITIONS

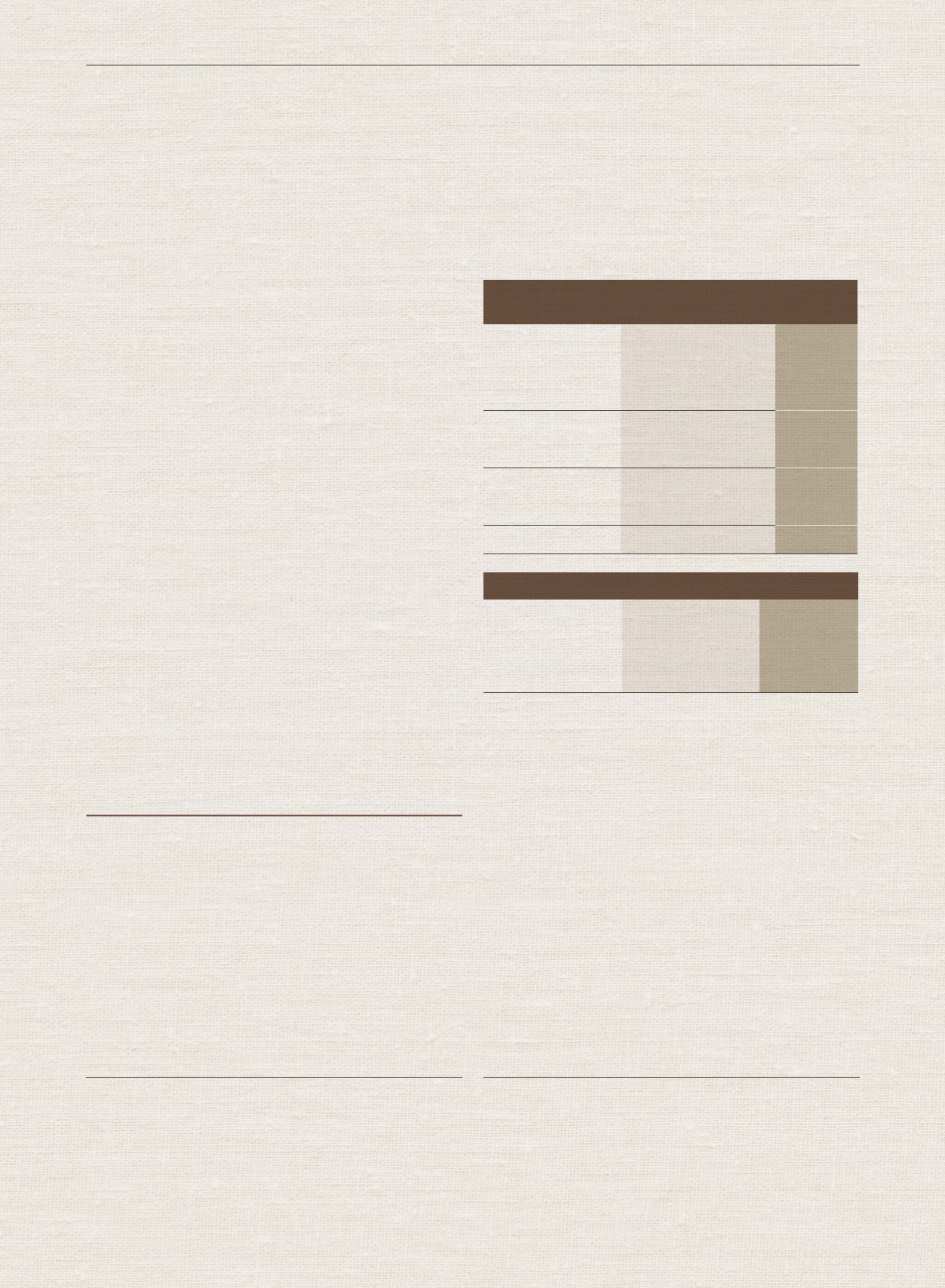

The Exchange improved its financial performance from 2014 with profit

after tax and minority interest (“PATAMI”) of RM198.6 million from

RM198.2 million a year ago. The cost to income ratio was sustained at

46.2% while Return on Equity (“ROE”) improved slightly to 25.6%.

Fi

na

nc

ia

l

Re

su

lt

s

20

15

RM

m

il

li

on

2014

RM

mil

li

on

%

ch

an

ge

Operating

Re

venue

48

7.

7

47

1.

3

+3

%

Other Inco

me

30

.8

32.5

-5

%

Op

er

atin

g

Ex

penses

(239.8

)

(232.0

)

+3

%

Pr

ofit

Before Tax

278.7

27

1.

8

+3

%

Inco

me

T

ax

E

xpen

se

(7

2.

3)

(67.8)

+7

%

Profit

Af

ter Tax

206.

4

20

4.

0

+1%

Mi

no

ri

ty I

nt

er

est

(7.8)

(5.8)

+3

5%

PATAMI

19

8.6

198.2

+0

.2%

Fi

nanc

ia

l

Ra

ti

os

20

15

2014

c

ha

ng

e

Cost

t

o In

come R

at

io

46

.2

%

46.1%

+0

.1

p

er

ce

nt

ag

e

po

in

t

Return

o

n Eq

ui

ty

25

.6

% 25.4%

+0

.2

p

er

ce

nt

ag

e

po

in

t

OPERATING REVENUE GROWTH DRIVEN BY NON-SECURITIES

TRADING REVENUE

Operating revenue rose 3% to RM487.7 million in 2015 from RM471.3

million in 2014. This was due mainly to a significant rise in non-securities

trading revenue as securities trading revenue fell 3% in 2015 to RM233.0

million. Meanwhile, revenue contributions from the Derivatives Market

and the Islamic Capital Market (“ICM”) rose 22% to RM86.1 million and

69% to RM16.8 million respectively.