THE YEAR IN BRIEF

6

Bursa Malaysia •

Annual Report 2015

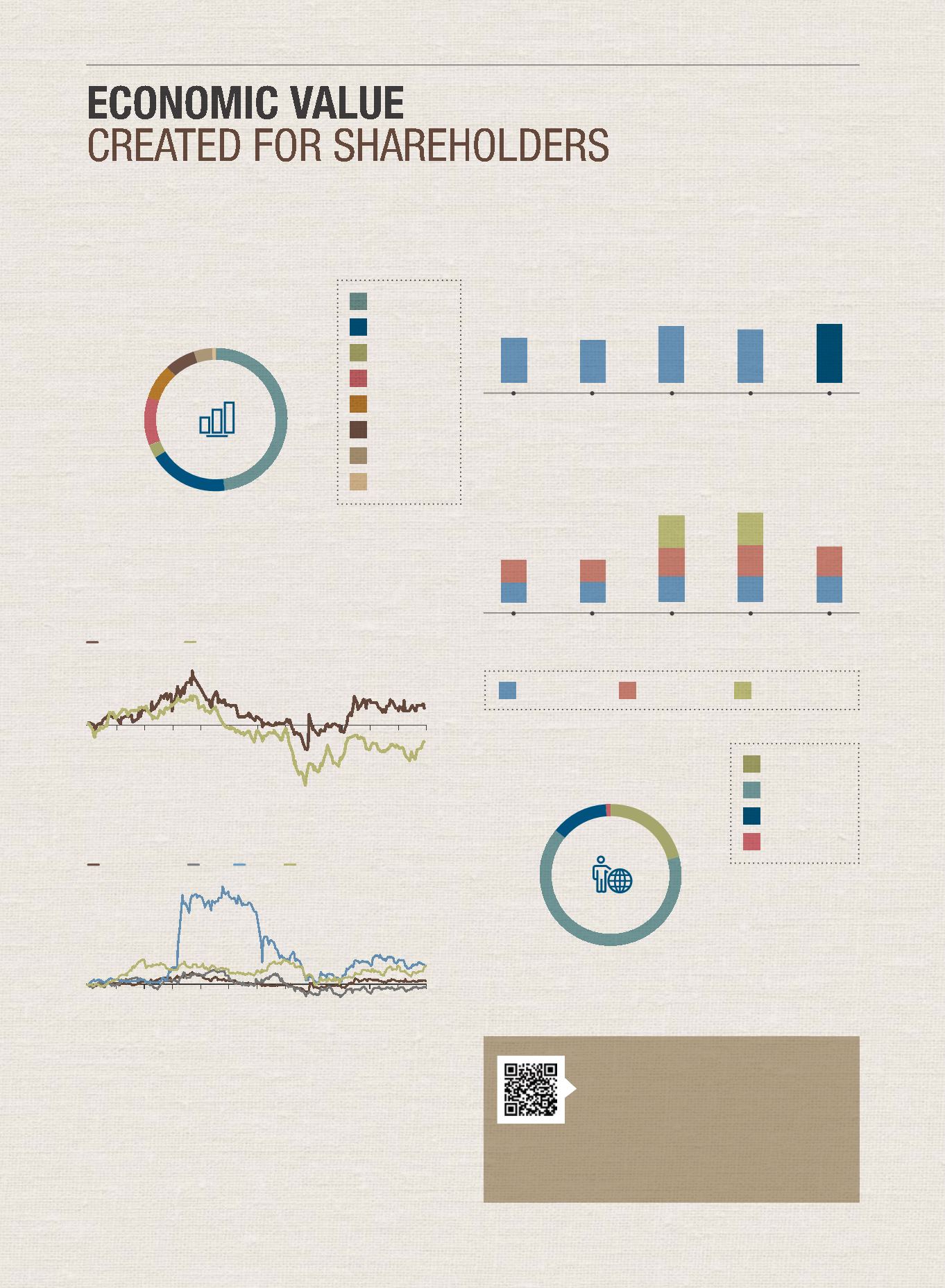

OPERATING REVENUE

(RM million)

1% 4%

7%

8%

11%

3%

18%

48%

5.9

20.8

33.7

38.4

52.9

16.8

86.1

233.1

Depository Services

Market Data

Member Services &

Connectivity

Listing & Issuer

Services

Others

Securities Trading

Derivatives Trading

BSAS Trading

Total operating revenue for 2015 rose 3% to RM487.7 million from

RM471.3 million in 2014.

MARKET CAPITALISATION*

(RM billion)

2011

2012

2013

2014

2015

2011

2012

2013

2014

2015

3.6

3.3

4.4

4.3

4.5

INVESTOR RELATIONS CONTACT

Shareholders and investors may contact the

Investor Relations (“IR”) team directly at

ir@bursamalaysia.comor via the IR section on

our website. You can also subscribe to our alert

list to receive regular Bursa Malaysia updates via

email from our website.

FIVE-YEAR DIVIDEND PAYOUT TO SHAREHOLDERS

* The dividend payout as a percentage of PATAMI, not including special dividend

Interim Dividend (sen)

Final Dividend (sen)

Special Dividend (sen)

SHAREHOLDER MIX

Domestic vs. Foreign Shareholders

Our public shareholding of 61% represents a fair free float of Bursa

Malaysia’s shares and a healthy level of liquidity. As at the end of 2015, we

had a total of 17,702 shareholders.

Domestic Retail

Domestic Institution

Foreign Retail

Foreign Institution

21%

13%

65%

1%

SHARE PRICE PERFORMANCE

Bursa Malaysia Share Price Performance vs. FBM KLCI

BURSA MALAYSIA

FBM KLCI

3%

-4%

Mar

Jan

Jun

Sep

Dec

Bursa Malaysia’s share price increased 3% reflecting its resilience

within volatile market conditions. Starting the year strong at RM8.10,

Bursa Malaysia’s share price traded at its highest level since 2011

at RM9.00 on 24

th

April 2015. The share price closed at RM8.35 on

31

st

December 2015.

In the wider market, the FBM KLCI was weighed down by several factors,

including a weaker Ringgit, depressed commodity prices, a slowdown in China’s

economy and higher interest rates in the US resulting in capital outflows.

Mar

Jan

Jun

Sep

Dec

Bursa Malaysia Share Price Performance vs. Listed Asian Peers

BURSA MALAYSIA

SGX

ASX

HKEx

16%

16%

3%

-1%

* As at 31

st

December

95%

95%

98%*

92%*

93%

13.0

13.0

16.0

16.0

20.0

16.5

18.0

18.0

16.0

20.0

13.5

13.5