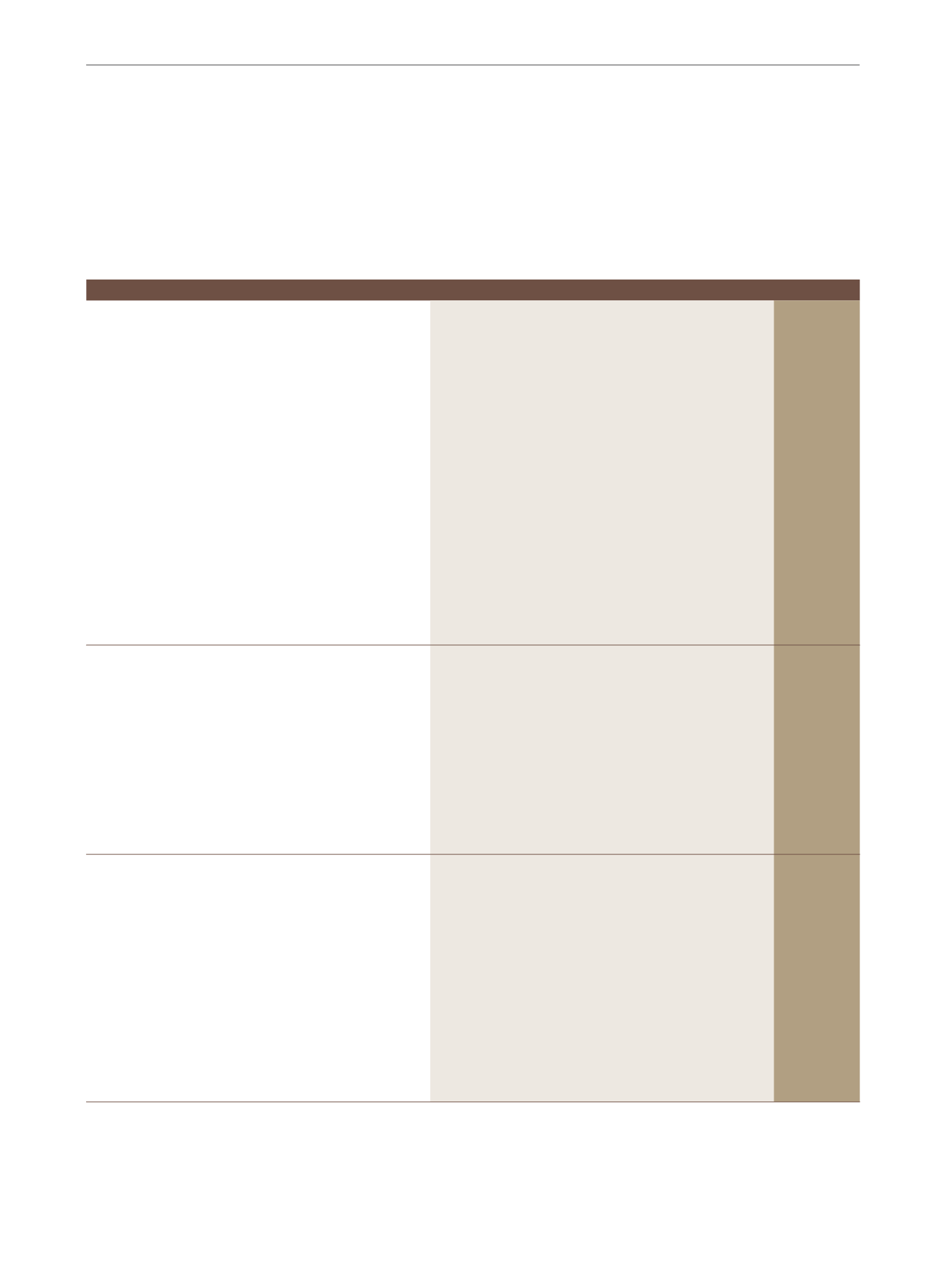

THE YEAR IN BRIEF

12

Bursa Malaysia •

Annual Report 2015

MARKET

HIGHLIGHTS

31 DEC 2011

31 DEC 2012

31 DEC 2013

31 DEC 2014

31 DEC 2015

Securities Market

FBM KLCI

1,530.73

1,688.95

1,866.96

1,761.25

1,692.51

Market Capitalisation (RM billion)

1,285

1,466

1,702

1,651

1,695

Velocity (%)

33

28

30

29

30

Average Daily Trading Volume - OMT & DBT (million shares)

1,344

1,361

1,567

2,157

2,038

Average Daily Trading Volume - OMT (million shares)

1,288

1,294

1,477

2,072

1,966

Average Daily Trading Value - OMT & DBT (RM million)

1,788

1,666

2,137

2,162

2,082

Average Daily Trading Value - OMT (RM million)

1,699

1,573

1,915

2,053

1,991

Total Trading Volume - OMT & DBT (billion shares)

329

334

387

531

501

Total Trading Value - OMT & DBT (billion shares)

438

408

528

532

512

Total Funds Raised (RM billion)

15.0

32.0

22.5

24.3

21.2

Total Listed Counters

1,476

1,640

1,566

1,739

1,739

•

No. of PLCs

941

921

911

906

903

-

No. of New Listings - IPOs (including REITs)

28

17

18

14

11

-

No. of Delistings (including REITs)

43

36

27

21

14

•

No. of Listed REITs

15

16

17

16

17

-

No. of New Listings - REITs

1

1

1

-

1

•

No. of Listed ETFs

5

5

5

6

8

-

No. of New Listings - ETFs

-

-

-

1

2

•

No. of Listed Structured Warrants

304

477

398

527

503

-

No. of New Listings - Structured Warrants

363

551

410

546

644

No. of Rights & Bonus Issue

61

60

54

89

73

No. of New CDS Accounts Opened (Yearly)

164,110

207,393

153,764

136,303

153,140

Total CDS Accounts (million)

1

4.2

4.3

4.4

2.5

2.5

No. of Trading Days

245

245

247

246

246

No. of Participating Organisations of Bursa Malaysia Securities

35

33

31

30

30

Derivatives Market

Open Interest

152,419

214,065

196,493

196,413

230,376

•

Crude Palm Oil Futures (“FCPO”)

112,720

173,649

151,486

166,625

188,888

•

FBM KLCI Futures (“FKLI”)

23,505

30,550

40,473

25,476

37,750

•

Others

16,194

9,866

4,534

4,312

3,738

No. of Contracts Traded:

•

FCPO (million)

5.9

7.5

8.0

10.2

11.0

•

FKLI (million)

2.5

2.1

2.7

2.2

3.0

•

3-Month KLIBOR Futures

92,775

50,946

16,791

13,150

1,271

•

GOLD

2

-

-

24,253

111,844

39,974

•

Other Products (OCPO

3

, OKLI

4

, FPOL

5

, and FMG5

6

)

-

6,314

7,831

5,558

10,762

Average Daily No. of Contracts Traded

34,474

39,387

43,490

50,654

57,157

Total Contracts Traded (million)

8.4

9.6

10.7

12.5

14.1

No. of Trading Days

245

245

247

246

246

No. of Trading Participants of Bursa Malaysia Derivatives

20

20

18

19

18

Islamic Capital Market

% of Shariah Compliant PLCs

89

88

71

74

74

% of Shariah Compliant (by Market Capitalisation)

•

PLCs

63

64

63

63

66

•

ETFs

40

32

30

31

21

•

REITs

18

14

43

42

43

No. of ETBS

-

-

2

3

3

No. of Sukuk Listings on Bursa Malaysia Securities

19

20

20

20

22

Value of Sukuk Listings (USD billion)

28.5

33.7

32.9

34.2

34.6

Bursa Suq Al-Sila’:

•

Average Daily Value Commodity Traded (RM billion)

1.2

2.3

3.9

6.9

15.2

•

Total Accumulated Commodity Trade Value (RM billion)

298.6

563.3

958.9

1,687.9

3,727.7

•

Total No. of Matched Contracts

9,111

20,858

285,547

316,534

350,801

•

No. of Trading Days

245

245

247

246

246

•

No. of BSAS Registered Participants:

Total

55

69

78

93

109

-

Domestic

42

51

60

73

87

-

Foreign

13

18

18

20

22

1

The sharp decline in the number of CDS accounts in 2014 was due to the implementation of automatic closure of dormant CDS accounts that were designated as dormant on or before 2010.This maiden exercise to close such

dormant CDS accounts was performed on 25 August 2014 affecting approximately 2.0 million CDS accounts.

2

Gold Futures Contract was introduced in October 2013

3

OCPO was introduced in July 2012

4

OKLI was relaunched in May 2012

5

FPOL was introduced in June 2014

6

FMG5 was relaunched in December 2014