17

Bursa Malaysia •

Annual Report 2015

FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

Bursa Mal ysia •

An ual Rep rt

CHAIRMAN’S LETTER

TO SHAREHOLDERS

sen

as at 31

st

December 2015

per share

34.5

Total dividends paid

4.1%

Dividend yield of

Nevertheless, the Malaysian economy and market have proven

themselves resilient against these challenges thanks to their diversity and

robust fundamentals. Bursa Malaysia has drawn on these strengths and

continued to be a source of value for our stakeholders even within this

more challenging operating environment. The confidence of our investors

and issuers is evident from the fact that Bursa Malaysia was again the

largest ASEAN fundraising destination for the second consecutive year.

With numerous signs suggesting that 2016 will remain a challenging year

for market players, the Exchange must remain focused in dispensing its

obligations as both a market regulator and as a value creator. It is from

within this context that we have embarked on our next strategic phase

of development, which calls upon us to accelerate the development of

sustainable communities with our stakeholders to strengthen our practices

in this area.

Over the past 12 months, we launched a number of sustainability

initiatives that will take us to the next phase of our sustainability journey.

These initiatives aim to strengthen our collaboration with our stakeholders

towards shared Economic, Environmental and Social (“EES”) goals to

position the Malaysian marketplace as a regional leader.

We believe that our sustainability initiatives together with our continued

pursuit of operational excellence and innovation will further enhance

the long-term future of our organisation, as well as of the Malaysian

marketplace in general.

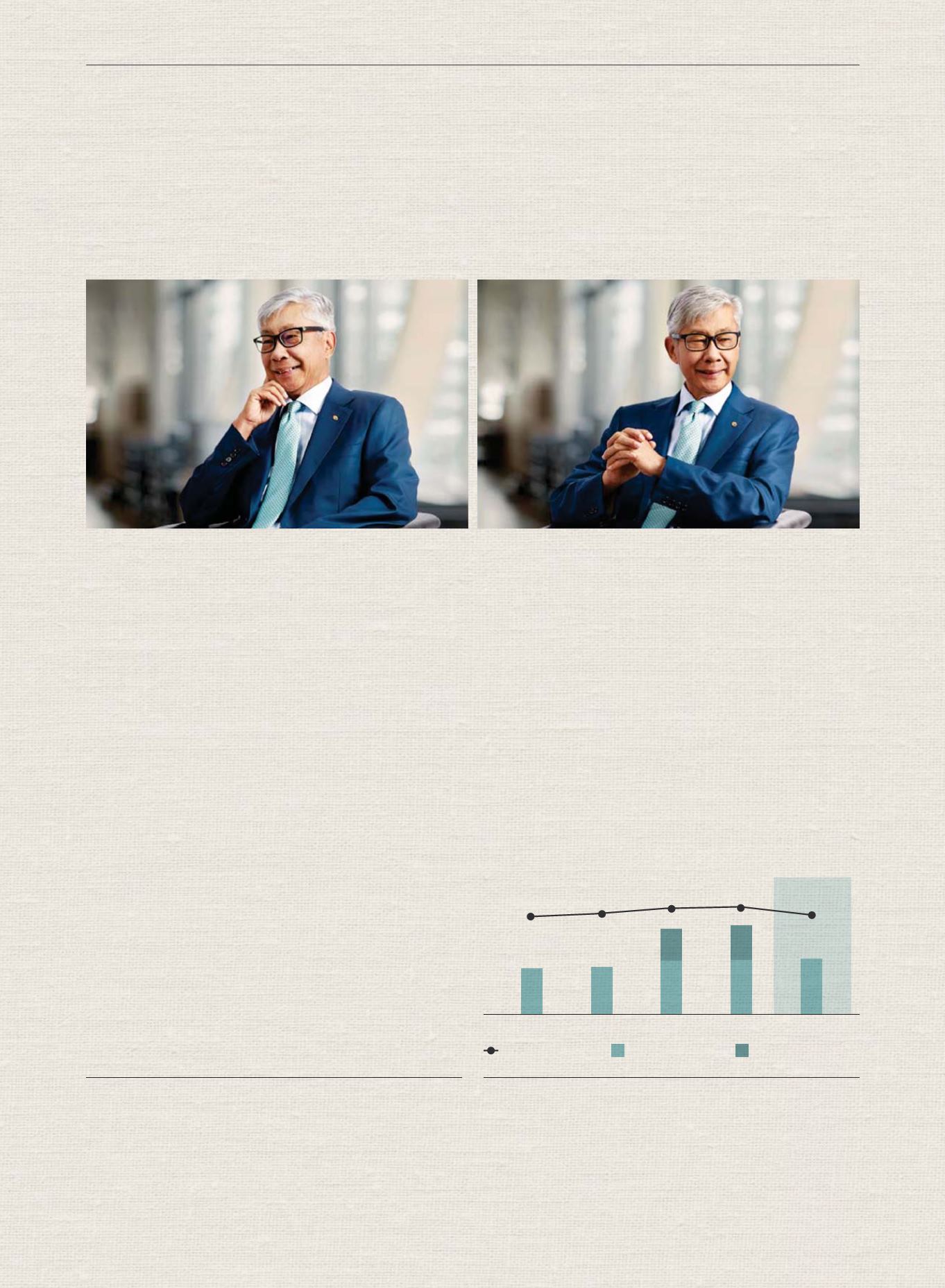

CREATING SHAREHOLDER VALUE

The initiatives implemented over the last several years have contributed

to greater market diversity and resilience, which have protected our

shareholder value in these challenging times. Thus, despite a 3% fall

in the average daily trading value (“ADV”) for on-market trades in our

Securities Market in 2015 to RM2.0 billion from RM2.1 billion a year

ago, we managed to maintain our profitability levels due to the better

performance of our Derivatives and Islamic Capital Markets.

The Exchange posted a Profit after Tax and Minority Interest (“PATAMI”)

of RM198.6 million, a marginal increase from RM198.2 million recorded

a year ago. Earnings per Share (“EPS”) amounted to 37.2 sen during the

same period, translating into an annualised Return on Equity (“ROE”) of

25.6%. Based on this performance, the Board has recommended a final

dividend of 18 sen, bringing our total dividend declared for FY2015 to 34.5 sen,

which represents a yield of 4.1%, and is equivalent to 93% of PATAMI.

2011

2012

20

13

20

14

20

15

26.0

27.0

32.0

34.0

20.0

20.0

3.9

4.3

6.3

6.7

4.1

Dividend Yield (%)

Net Dividend (sen)

Special Dividend (sen)

34.5