THE YEAR IN BRIEF

13

Bursa Malaysia •

Annual Report 2015

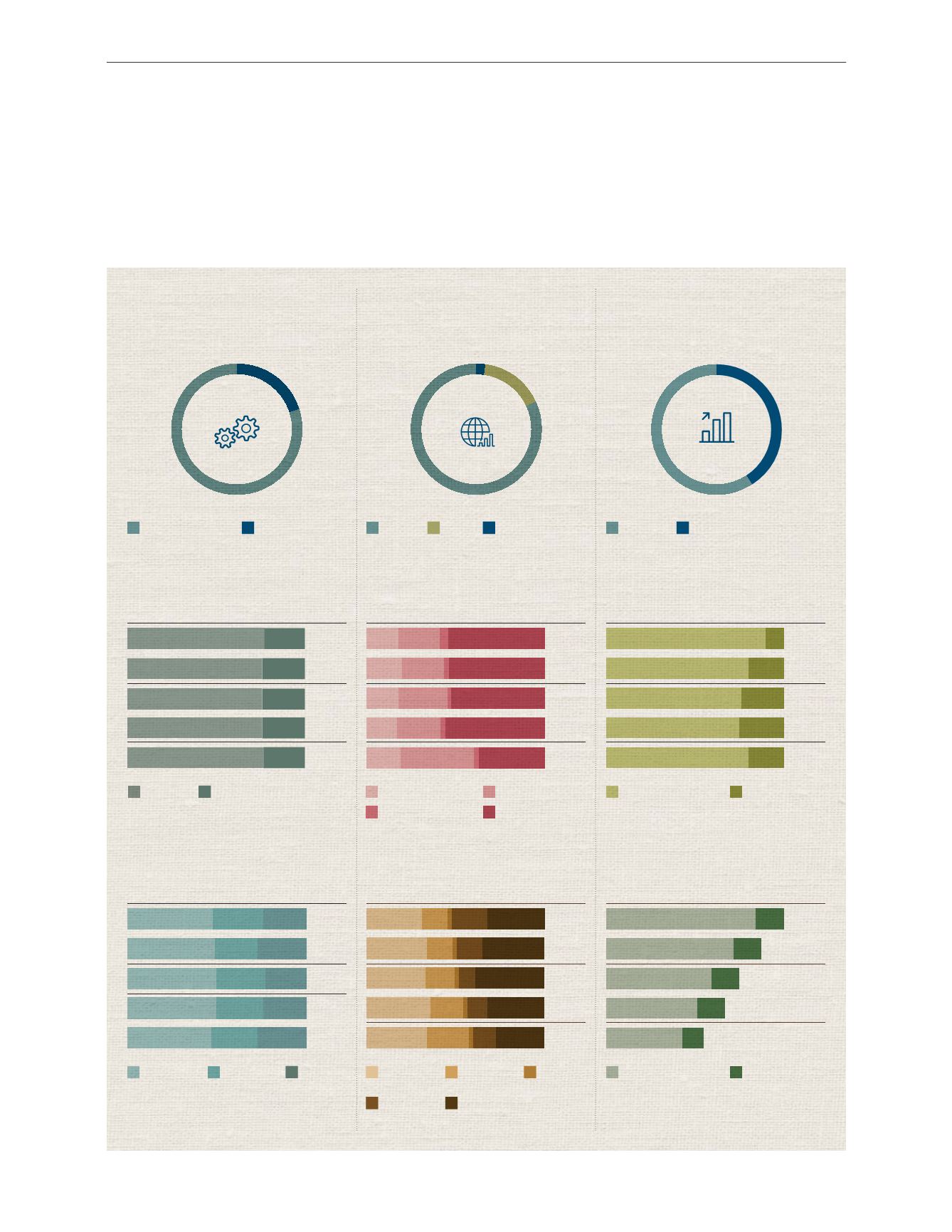

MARKET

HIGHLIGHTS

SECURITIES MARKET

DERIVATIVES MARKET

ISLAMIC CAPITAL MARKET

2%

16%

82%

19%

81%

Demography of BSAS Registered Participants

No. of Trading Participants

109

(2015)

2012

51

18

20

14

73

20

2013

60

18

2011

42

13

20

15

22

87

Market Demography by Trading Value (%)

Total Trading Value

- OMT

RM512 billion

(2015)

20

11

26

25

49

20

12

23

25

52

20

13

22

26

52

20

14

26

23

51

20

15

23

27

50

41%

59%

Market Demography of BSAS Trading Value (%)

Total Commodity

Trading Value

RM3,728 billion

(2015)

20

11

21

79

20

12

32

68

20

13

70

30

20

14

21

79

2015

12

88

11.0 million

(2015)

Market Demography of FCPO Contracts (%)

No. of Contracts Traded

Market Demography of FKLI Contracts (%)

No. of Contracts Traded

3.0 million

(2015)

RM1,695 billion

(31 Dec 2015)

Share Ownership (%)

Market Capitalisation

Funds Raised from New IPOs &

Secondary Market in 2015

Open Interest as at 31 Dec 2015

Value of Listed Sukuk as at 31 Dec 2015

Secondary Market

Foreign

New IPOs

Domestic

FKLI

Others

FCPO

20

14

2

54

24

20

2013

1

53

28

18

20

12

2

56

25

17

20

11

2 37

42

19

20

15

5

55

22

18

20

11

28

131 24

34

20

12

1

32

12

19

36

20

13

1

39

10

33

17

20

14

1

35

15

34

15

2015

32

21

31

15 1

2011

23

77

2012

24

76

2015

78

22

2013

24

76

2014

24

76

Domestic Institution

Local

Foreign Institution

Domestic Retail

Foreign

Retail

Local

Domestic

Institution

Foreign

Institution

Domestic

Retail

Domestic Institution

Foreign Institution

Domestic Institution

Foreign Institution

Domestic

Institution

Foreign

Institution

Retail

Foreign

Domestic