THE YEAR IN BRIEF

14

Bursa Malaysia •

Annual Report 2015

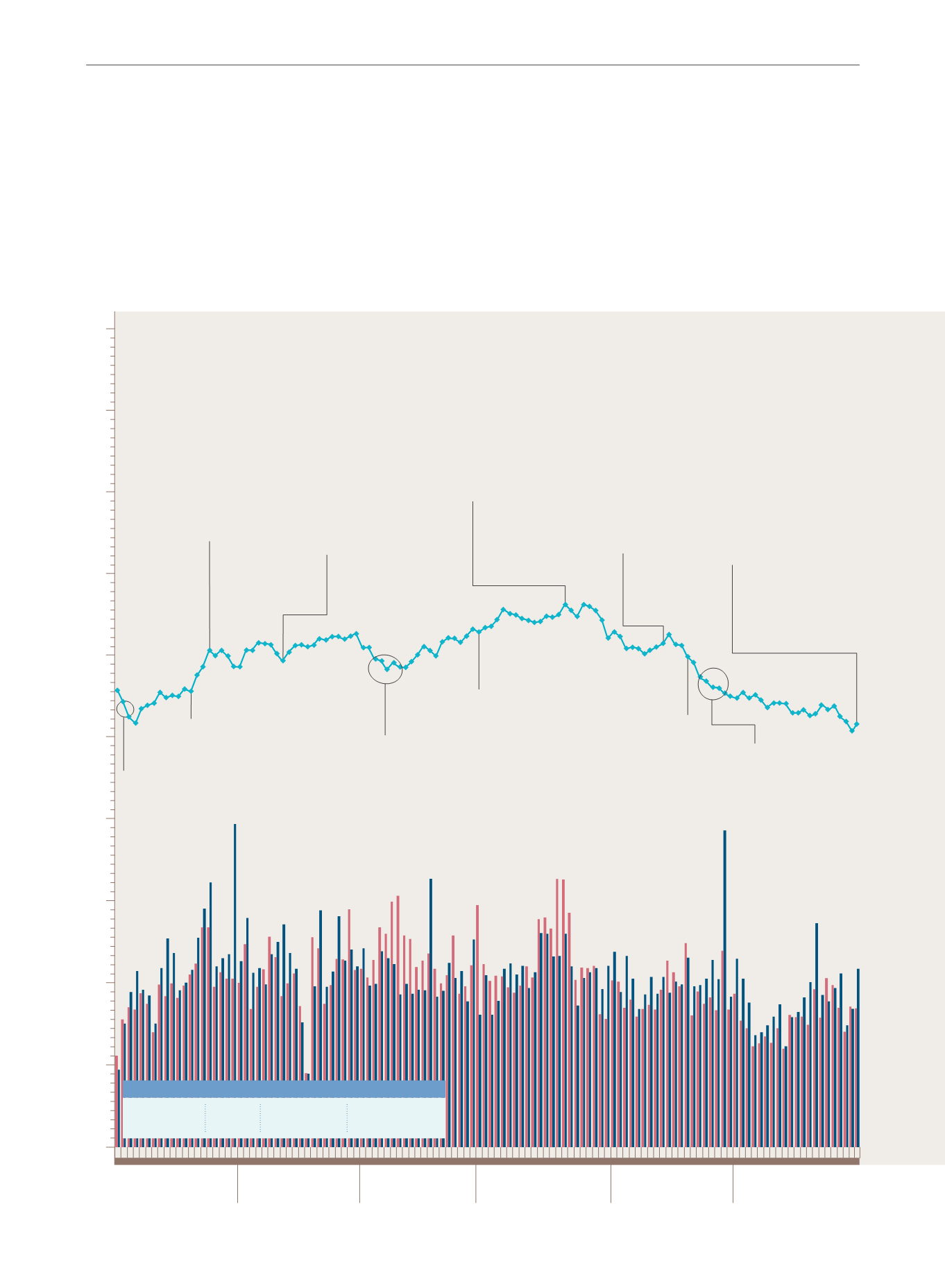

MARKET

PERFORMANCE

JAN

FEB

MAR

APR

MAY

JUN

2,200

2,100

2,000

1,900

1,800

1,700

1,600

1,500

1,400

1,300

1,200

FBM KLCI

(Points)

Note: Both Total Volume and Total Value include odd lot and direct business transactions

Jan 5 to 6

Concerns over

falling crude oil

prices and Greece’s

potential exit from

Eurozone dampen

sentiment

Jan 20

Government revises its 2015

GDP target from 5%-6% to

4.5%-5.5%

Jan 23

Announcement of

European Central

Bank’s bigger-than-

expected economic

stimulus package

boosts sentiment

Feb 12

Bank Negara Malaysia (“BNM”)

announces that Malaysian

economy grew 6% in 2014

(4.7% in 2013)

Mar 9 to 13

Concerns over US

interest rate hike

and falling crude

oil prices dampen

sentiment

Apr 21

FBM KLCI closes at its

highest level for 2015 of

1,862.80 points

Apr 1

Government implements

6% Goods and Services Tax

(“GST”)

May 15

BNM announces

that Malaysian

economy grew

5.6% in 1Q 2015

May 21

Prime Minister unveils

11

th

Malaysia Plan

May 25 to 29

Concerns over weaker

earnings outlook, credit

ratings downgrade,

uncertainty over US

interest rate hike and

possibility of a Greek

debt default dampen

sentiment

June 30

Fitch Ratings revises its

outlook on Malaysia’s

sovereign credit rating

upward to “stable”

from “negative” while

maintaining the country’s

long term foreign currency

issuer default rating at A-

1,752.77

pts

USD56.42

/bbl

RM2,315.00

/MT

FBM KLCI

Brent crude

FCPO

JAN 2

3.5160

USD/RM