THE YEAR IN BRIEF

15

Bursa Malaysia •

Annual Report 2015

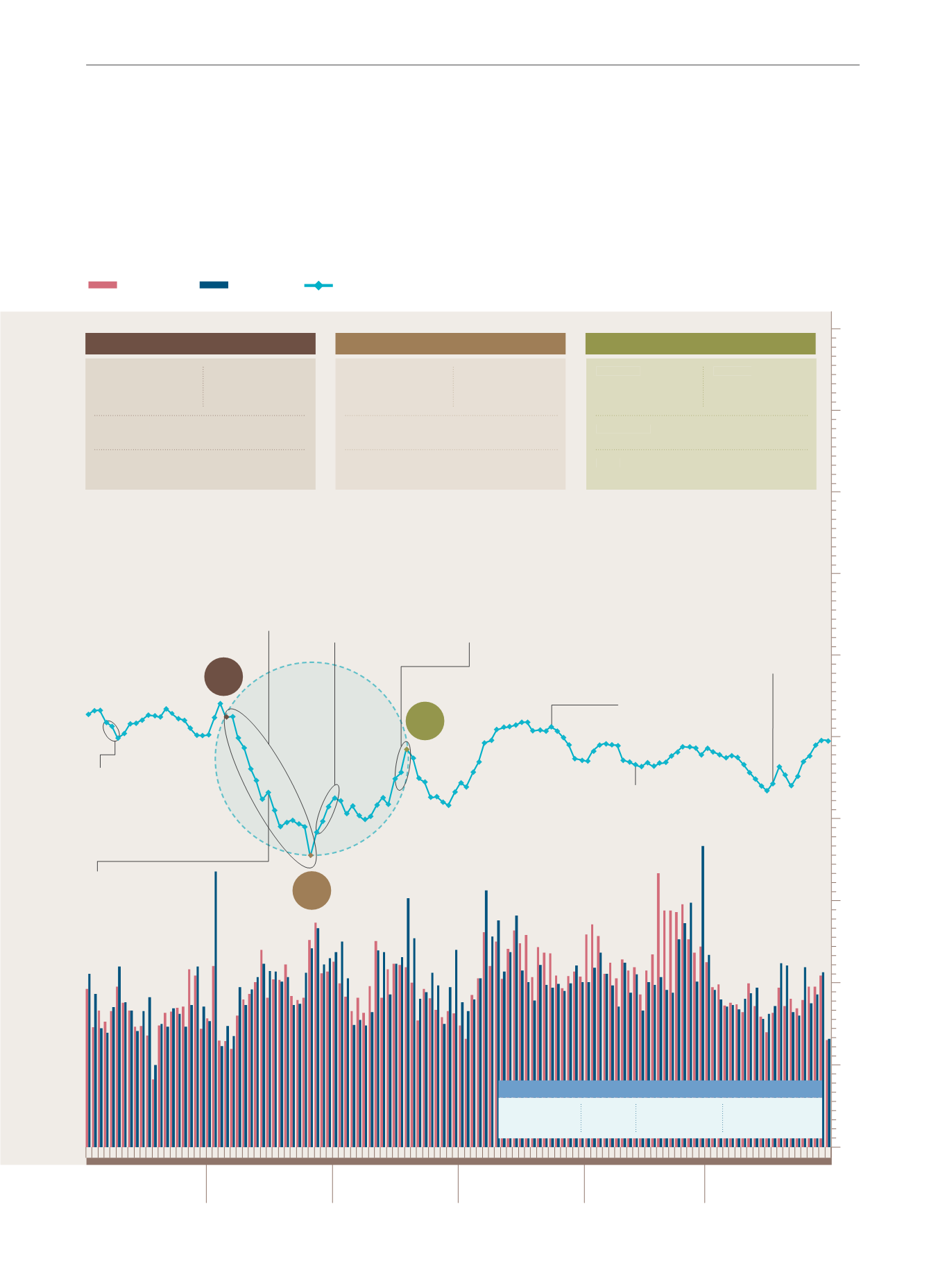

MARKET

PERFORMANCE

JUL

AUG

SEP

OCT

NOV

DEC

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

Total Volume (Units Million)

and Total Value (RM Million)

T

otal Volume

Total Value

FBM KLCI

Dec 16

US Federal Reserve

raises interest rates by

0.25 percentage point

Nov 13

BNM announces that Malaysian

economy grew 4.7% in 3Q 2015

Oct 23

Prime Minister unveils

Malaysia 2016 Budget

Sep 14 to 17

Announcement of stimulus

measures by Government

to strengthen nation’s

economy and US Federal

Reserve’s decision not to

raise interest rates boost

sentiment

Aug 13

BNM announces

that Malaysian

economy grew

4.9% in 2Q 2015

Aug 4 to 24

Devaluation of Chinese Yuan

coupled with continued

depreciation of Malaysian

Ringgit, as well as slumping

crude oil and commodity

prices dampen sentiment

Aug 25 to 28

Sentiment improves

following announcement

of economic stimulus

measures by Chinese

Government and US

Federal Reserve’s decision

to hold interest rates

July 6 to 8

Sentiment dampens

following sharp sell-offs

in China’s markets and

Greek voters’ rejection of

Eurozone’s bailout terms

AUG 4

AUG 24

SEP 17

1,692.51

pts

USD37.28

/bbl

RM2,398.00

/MT

FBM KLCI

Brent crude

FCPO

DEC 31

4.2935

USD/RM

AUG 24

SEP 17

1,723.73

pts

USD49.99

/bbl

RM2,055.00

/MT

3.8535

FBM KLCI

Brent crude

FCPO

USD/RM

AUG 4

1,532.14

pts

USD42.69

/bbl

RM1,844.00

/MT

4.2630

FBM KLCI

Brent crude

FCPO

USD/RM

1,681.54

pts

USD49.08

/bbl

RM2,054.00

/MT

4.2550

FBM KLCI

Brent crude

FCPO

USD/RM

(lowest for 2015)