FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

Bursa Malaysia

•

Annual Report 2014

30

CEO’S MESSAGE AND MANAGEMENT DISCUSSION AND ANALYSIS

DEVELOPING CAPABILITIES

Key to our future success and sustainability is the creation of a robust

investing community. From digital media innovations to new market structure

enhancements, our initiatives in 2014 have created value for our stakeholders

while strengthening market integrity and efficiency. These initiatives in 2014

were focused on three core areas:

1. Reaching out and building communities

2. Enhancing our market structure and maintaining fair, orderly and efficient

markets

3. Further enhancing our transformation into a HPO

These achievements have set us upon the right path towards becoming ASEAN’s

Multinational Marketplace and towards long-term sustainability.

REACHING OUT AND BUILDING COMMUNITIES

Just as we have spent the past few years redefining ourselves as a stock

exchange, our activities between 2014 and 2016 will see us make a strong

statement about our value proposition to both regional and global investors—

namely as an interwoven community of our partners, customers, issuers and

investors working together to drive the Malaysian capital market forward.

We made community building a key point in 2014, enabling Bursa Malaysia to

expand its capabilities and reach out to all stakeholders, particularly to new retail

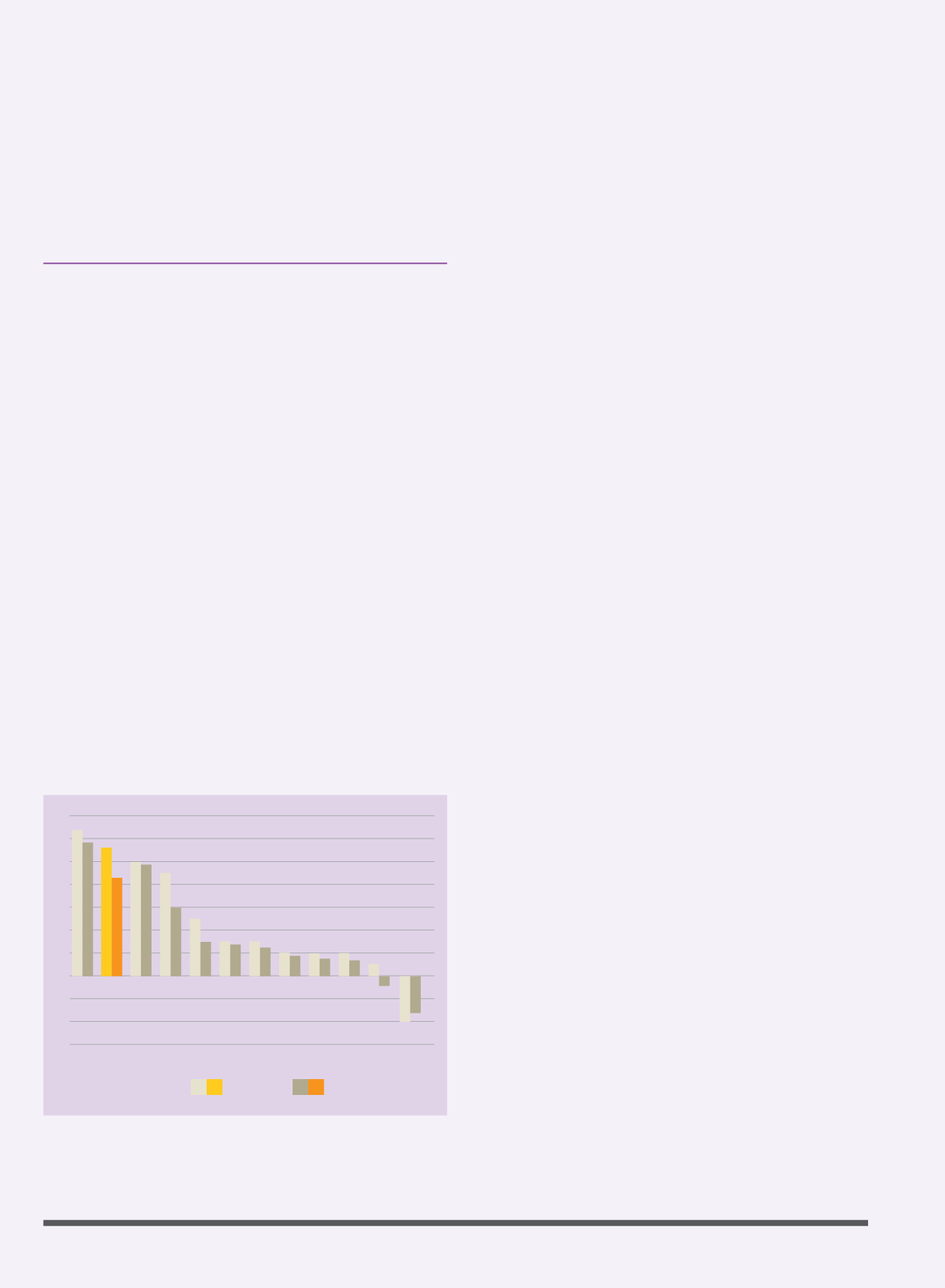

investors and to young working professionals. According to Credit Suisse and the

Malaysian Department of Statistics, Malaysia will have one of the fastest growing

working population in the world between now and 2020. The demographic group

that will be coming into the workforce represents the future core of our retail

investor base, and we must start now to encourage their participation in our

market.

REACHING OUT TO THE DIGITAL GENERATION

The flagship programme under our digital outreach initiative is the BursaMKTPLC,

a one-stop online portal for all traders and investors that we launched on 28

April 2014. BursaMKTPLC is a first-of-its-kind virtual marketplace that creates

a completely unique user experience designed to provide market insights, rich

online pricing information and investor education. Our aim is to create an active

and vibrant eCommunity focusing on enhancing trading and developing financial

literacy.

STEPPING UP INVESTOR EDUCATION AND AWARENESS

In 2014, we conducted a number of education and engagement programmes

via advocacy sessions and workshops to communicate our core messages to

our various stakeholders such as issuers, financial intermediaries and retail

investors. To create awareness of the level and quality of disclosures by listed

issuers in relation to the Malaysia Code of Corporate Governance, we also issued

Findings of Corporate Governance Disclosures in Annual Reports. On the youth

front, we stepped up our engagement with this demographic group through

our Bursa Young Investors' Club (BYIC) and Young Corporate Malaysians (YCM)

programmes. I am grateful to have been given the chance to speak directly to

some of our programme participants and the feedback I received during the

question and answer session has convinced me that we will see continuous

growth in our capital market.

LAUNCHING NEW PRODUCTS AND SERVICES

We continue to expand our range of products and services to offer greater

choice to our existing customers and to attract new customers. While innovation

is a priority for us, we take prudent measures to ensure our new offerings fall

within an acceptable range of risks and that they add value to our role as the

Exchange. We also introduced a host of new trading products for our securities

and derivatives markets. Information on these products and the ESG are detailed

in the respective sections of this annual report.

COLLABORATING WITH EXTERNAL MARKETS

To further extend the reach of our market outside our borders, we signed a

Memorandum of Understanding (MoU) with the Saudi Stock Exchange (Tadawul)

to develop cross-border activities in developing both capital markets. The

MoU will enhance the financial and economic linkages between Malaysia and

Saudi Arabia, whilst facilitating the exchange of knowledge and capital market

expertise.

14

12

10

8

6

4

2

0

-2

-4

-6

PH

MY

IN ID CN AU UK US HK TH SG JP

13

11

10

9

5

3 3

2 2 2

1

-4

Source: Credit Suisse,

Statistics Dept. Malaysia

Growth of New Entrants into the Workforce (%)

2010-2015

2015-2020