CEO’S MESSAGE AND MANAGEMENT DISCUSSION AND ANALYSIS

DERIVATIVES MARKET

MARKET AND FINANCIAL HIGHLIGHTS

Trading volumes hit an all-time record high with ADC for all contracts coming in at 50,654 in 2014, registering

a 16% growth from 2013’s 43,490 contracts.

DERIVATIVES MARKET MAINLY NEUTRAL

We recorded a greater domestic and foreign institutional participation in Crude Palm Oil Futures (FCPO)

and higher average daily contracts. Total operating revenue rose marginally by 2% to RM85.8 million from

RM84.4 million in 2013.

Despite strong improvements in trading activity, derivatives trading revenue increased marginally to RM70.6

million from RM70.3 million in 2013 as a result of lower guarantee and collateral management fees. This

resulted from lower margin requirements and higher non-cash collaterals lodged as margin by participants.

OPERATING REVENUE

(RM million)

Trading Revenue

Market Data

Member Services and

Connectivity

Conference Income

70.6 70.3

7.1 6.5

1.9 2.1

6.2 5.6

2014

2013

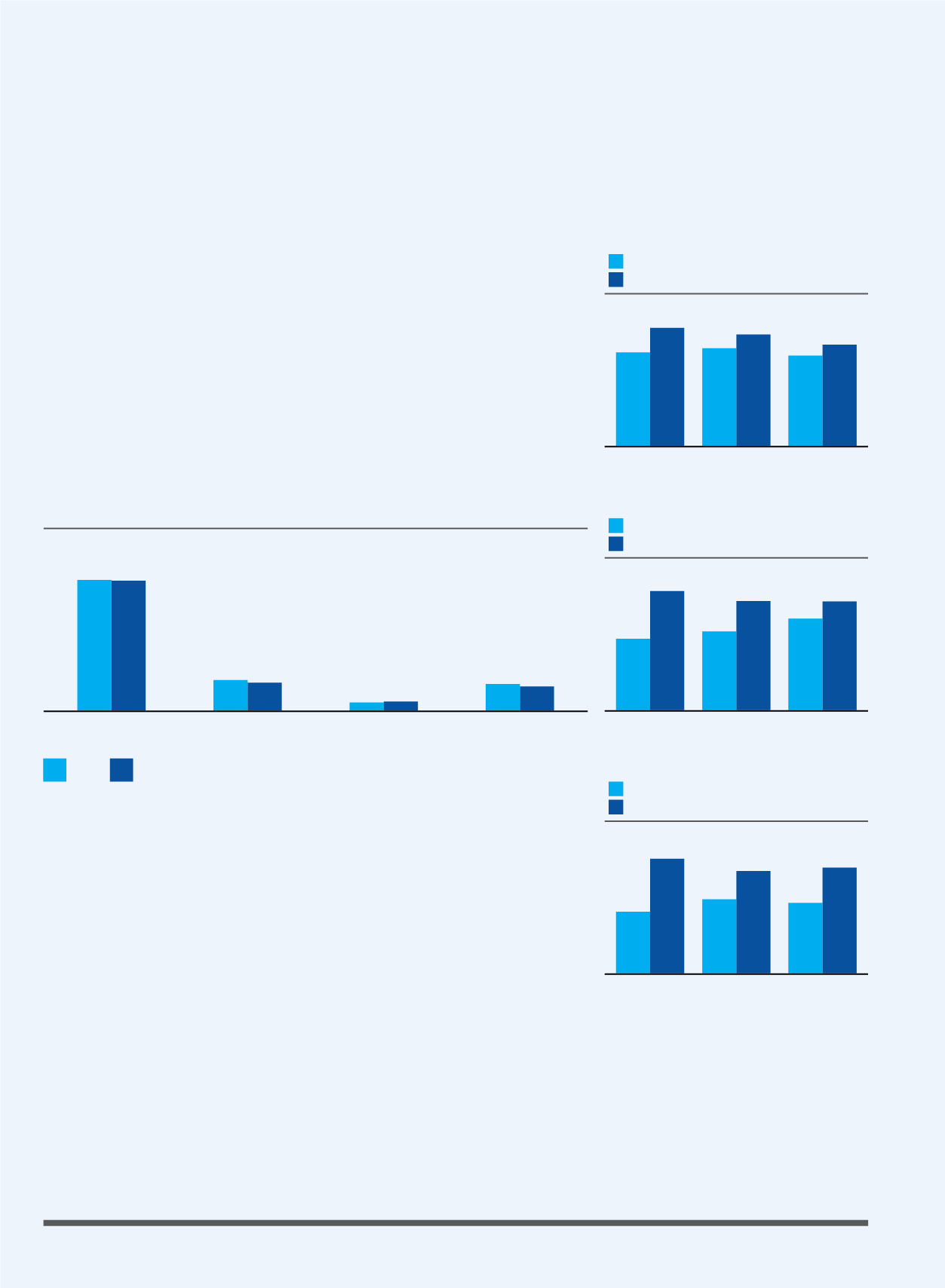

SEGMENT PROFIT AND OPERATING MARGIN

Segment Profit (RM million)

Operating Margin (%)

ADC AND OPEN INTEREST

ADC

Open Interest (’000)

FOREIGN AND DOMESTIC PARTICIPATION

Foreign (%)

Domestic (%)

2012

2013

2014

2012

2013

2014

2012

2013

2014

40.8

44.1

42.2

39,387

36

43,490

42

50,654

39

45.7

50.3

53.3

214,065

64

196,493

58

196,413

61

DERIVATIVES TRADING FUNDAMENTALS SHOW IMPROVEMENT

The marked improvement in trading fundamentals for the Derivatives Market in 2014 is an encouraging sign. The

number of FCPO contracts struck in 2014 rose 27% to 10.2 million from 8.0 million contracts a year ago. However,

the number of FTSE Bursa Malaysia KLCI Futures (FKLI) contracts fell 19% to 2.2 million from 2.7 million in 2013.

Key achievements of the Derivatives Market in 2014 include:

• A historical month high in the traded volume of FCPO contracts which totalled 1,083,141 contracts in

September 2014. The total volume breached the one million contract mark for the first time.

• Open Interest for FCPO rose to an all-time high of 287,859 contracts on 10 September 2014. This also

led to a record high (321,077 contracts) for total open interest for all derivative products on the same

day.

FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

Bursa Malaysia

•

Annual Report 2014

36