CEO’S MESSAGE AND MANAGEMENT DISCUSSION AND ANALYSIS

ISLAMIC AND ALTERNATIVE MARKETS

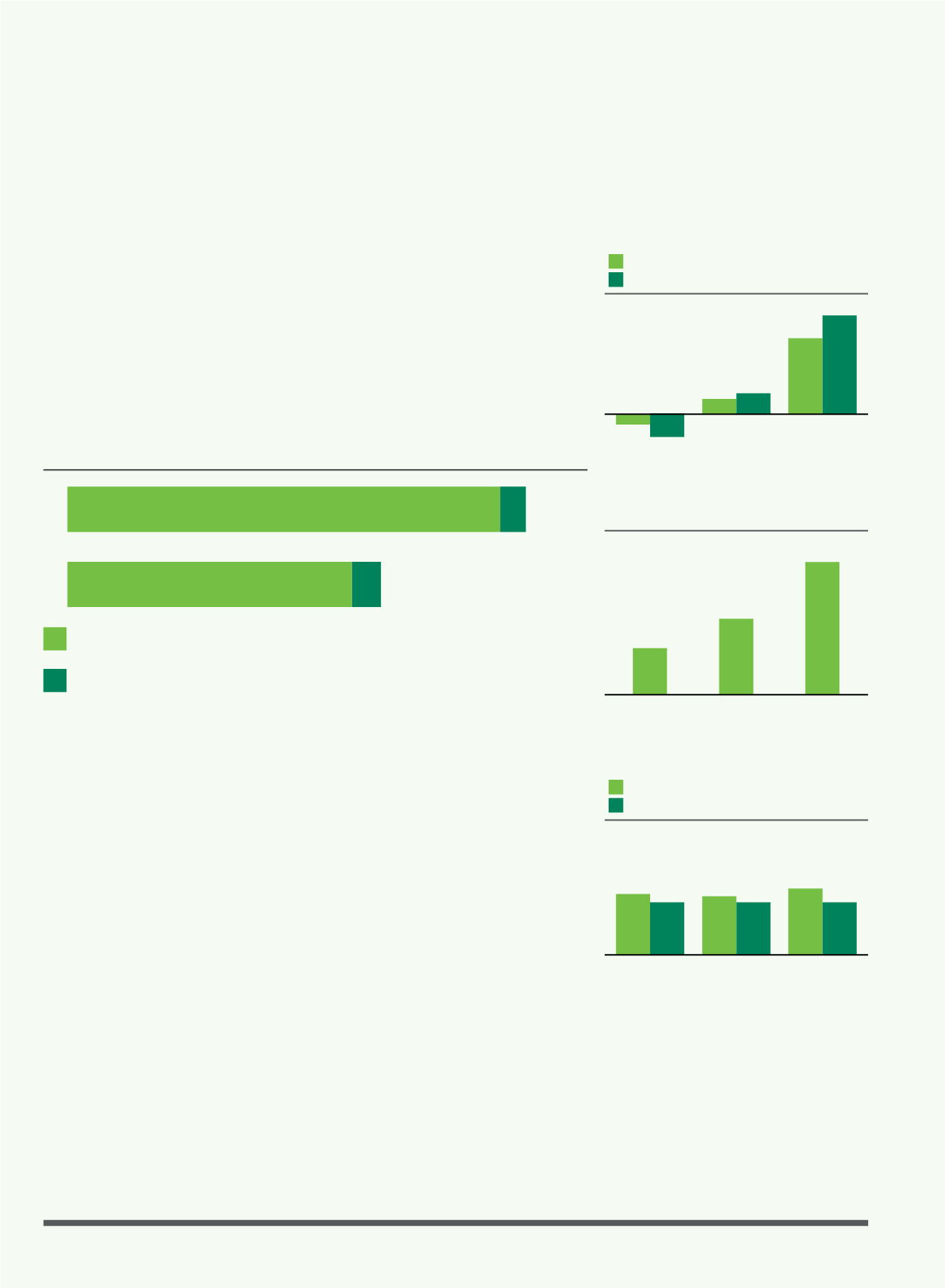

MARKET AND FINANCIAL HIGHLIGHTS

ADV for BSAS trades increased 77% in 2014 to total RM6.9 billion from RM3.9 billion a year ago, which is a

strong endorsement of the market’s growing popularity.

ISLAMIC AND ALTERNATIVE MARKETS EXPANDS REACH

Profit contribution from IAM surged, growing six-fold, contributing RM5.4 million in profits in 2014 compared

to RM0.9 million in 2013. Operating revenue showed strong growth, increasing 64% to RM10.5 million from

RM6.4 million in 2013. Higher revenue from BSAS was the main contributor to this segment, with an increase

of 72% to total RM10.0 million in 2014.

OPERATING REVENUE

(RM million)

2013 2014

10.0

5.8

0.5

0.6

BSAS Trading Revenue

Others

SEGMENT PROFIT AND OPERATING MARGIN

Segment Profit/(Loss) (RM million)

Operating Margin (%)

2012

2013

2014

5.4

0.9

(0.6)

50.3

13.6

(14.2)

SUKUK LISTED ON LABUAN INTERNATIONAL

FINANCIAL EXCHANGE

Sukuk Value (USD billion)

No. of Sukuk

2012

2013

2014

34.2

32.9

33.7

20

20

20

BSAS ADV

(RM billion)

2012

2013

2014

6.9

3.9

2.3

GROWTH DRIVEN BY BETTER RECOGNITION, INTEREST IN ISLAMIC FINANCE

Since BSAS inception in 2009, trades on the platform have recorded annual double-digit growth due to

the growing acceptance of Murabahah and BSAS by domestic banks and sukuk issuers. In 2014, the total

commodity trade value on BSAS was RM1.7 trillion, up 76% from RM958.9 billion in 2013.

The improved trading activity is indicative of growing interest in Islamic investing and finance, which has

grown in stature as a relatively safer avenue of investment post the financial crisis. Malaysia’s reputation as

a leading Islamic finance hub has also been a key lever for the development of IAM to enhance and innovate

our market to better serve the Islamic investing community.

IAM SHOWS IMPROVING FUNDAMENTALS

Key achievements in the IAM:

• Posted largest trade in a day on BSAS of RM16.3 billion on 8 December 2014

• Number of BSAS participants continued to rise with the addition of 15 new participants (from 78 in 2013).

In 2014, domestic participants accounted for 79% of total trades and foreign participants accounted for

the remaining 21%.

FROM THE BOARD OF DIRECTORS AND SENIOR MANAGEMENT

Bursa Malaysia

•

Annual Report 2014

38